Deposits, bonds and debt funds are great ways to diversify one’s portfolio. But the taxation on these instruments can decide whether an option is attractive or unattractive on a post-tax basis. Taxation, though varies across instruments and can be quite complex. The fact that not all debt instruments are taxed in the same way compounds the decision making dilemma on which option to choose. This write-up will break down the taxation aspect of popular debt instruments for resident individuals.

Income and gain from debt instruments

Investing in debt instruments is akin to lending money to an entity. In return for this loan, the borrowing entity provides periodic interest payments (coupon). The loan will be repaid at the end of the tenure (at maturity). Usually, debt instruments provide returns to the lender in two ways:

- Interest payments and

- Capital gains if the debt has been bought and sold (this is dependent on how long the instrument has been held by you. The Income Tax Act, 1961 lays down the duration of holding for various instruments for this purpose.

Now let us move on to various instruments and how their interest and capital gains (if any) are taxed.

Fixed deposits

Fixed deposits (FD) or term deposits find a place in many households. A deposit of money is placed with a bank or an entity authorized to accept deposits, for a fixed period of time and will earn interest at a predetermined rate. Interest is the only income stream from an FD and it can be periodically paid out or can be accumulated and paid out at maturity. FDs can take one of the following forms.

#1 Bank FD

Often called one of India’s favourite ways to save, the Bank FD, allows you to place money with banks for a specified tenure at a predetermined rate of interest (with slightly higher rates for senior citizens). What makes it attractive is the safety of the capital or investment amount although this is largely dependent on which bank the deposit is placed with. Our Bank FD Tool will help you assess the financial health of a bank before you place your deposits with them.

In addition, bank FDs offer flexibility in terms of allowing premature closure and also providing for loans against the deposit. Interest Income is periodically credited to the bank account of the deposit holder.

- This interest income is taxable at your tax slab rate.

- The bank will also deduct tax at source at the rate of 10% on the interest payable to a deposit holder if the interest is above a certain threshold. (Rs. 40,000 per annum and Rs. 50,000 per annum in the case of senior citizens). Do note that TDS will be deducted every year even if your deposit is a cumulative one.

- The scenarios in which tax will not be deducted is if the depositor has submitted form 15G or 15H or if the interest income at that bank for that deposit holder falls below the threshold limit.

#2 Tax Saving FD

These deposits are just like regular bank FDs and usually even carry the same interest rate except, they come with a 5-year lock-in. Section 80C of the Income Tax Act, 1961, allows you to deduct some eligible investments and expenses (up to a total of Rs. 1.5 lakhs) from your taxable income, thereby reducing the tax. One of the eligible investments here is the tax saving FD.

- In the year that the tax saving deposit is placed, the deposit holder can get a deduction for the same under section 80C.

- Apart from this benefit however, the interest income from this deposit is taxable just the same as a regular bank FD. Tax will also be deducted on the interest in the same way as it is done for a regular bank FD.

#3 Company deposits

Apart from banks, some NBFCs and companies that have a license to do so from RBI, will accept fixed deposits. These deposits usually carry a slightly higher rate of interest than bank deposits. In these deposits too, the income stream is from the interest alone.

- Here too, the interest income is fully taxable at your applicable slab rate.

- Tax will also be deducted at source if the interest per annum is above a threshold. In the case of company deposits, the threshold is Rs. 5,000 including for senior citizens unless form 15G or 15H has been submitted.

#4 National Savings Time Deposit (Post Office Time Deposit)

The Post Office Time Deposit, works much like a bank FD and can be placed for tenures of 1 to 5 years with the 5-year deposit being eligible for a deduction under section 80C. The interest rate on this deposit will change periodically and is compound quarterly but paid annually.

- The principal amount on a 5-year deposit only is eligible for deduction from total income.

- The interest on this deposit is always taxable as per the deposit holder’s tax slab.

- TDS is applicable subject to the same limits as a bank deposit.

Do take a look at our curated list of FDs at Prime Deposits to see which deposits make the cut.

Small Savings Schemes

The Government of India mobilises small savings and uses the same for its funding requirements via the schemes run by the National Savings Institute. These schemes are run through post offices and designated banks and include tax saving favourites such as the PPF, Senior Citizens Savings Scheme and the Post Office Time deposit (covered above). The interest rates for these schemes are periodically updated by the Government.

#1 National Savings Monthly Income Account

The Monthly Income Account allows a depositor to deposit a maximum of Rs. 4.5 lakhs in an account or Rs. 9 lakhs in a joint account and matures in 5 years. It allows for premature closure subject to some conditions.

- The amount deposited in this account does not qualify for a benefit under section 80C.

- Interest payouts are made monthly and these are taxable at the slab rate applicable to the depositor.

- However, tax is not deducted at source.

#2 Senior Citizens Savings Scheme

The SCSS allows for the deposit of an amount from Rs. 1,000 upwards and subject to a maximum of Rs. 15 lakhs (Rs. 30 lakhs from FY 24). This scheme is open to individuals aged 60 and above (50 / 55 if some criteria are met) and makes quarterly interest payouts. After the expiry of 5 years, the account can be closed or extended for a further 3 years. Premature closure of the account is allowed subject to some conditions being met.

- The deposits made in this account will fetch you a deduction under section 80C of the Income Tax Act.

- However, the interest is taxable based on your tax slab.

- Tax will be deducted at source @ 10% on the interest if total interest payable across all SCSS accounts in a financial year is over Rs. 40,000 (or Rs. 50,000 for those over 60 years of age).

No tax will be deducted if form 15G or form 15H has been submitted. More details on this scheme details can be found here.

#3 NSC VIIIth issue

The NSC VIIIth issue, matures in 5 years and comes with no maximum limit on the deposit amount. This scheme does not allow you to close the account before the end of the 5-year term. The interest amount on NSC is compounded annually but not paid out. Instead this is reinvested each year and paid out at maturity.

- The amount invested in NSC is eligible for deduction under section 80C and in subsequent years, the interest amount that gets reinvested is also eligible for deduction under section 80C.

- While tax is not deducted at source, the interest income is taxable in the hands of the depositor at the applicable slab rate. But because such interest is also considered as reinvestment under Section 80C, you effectively end up paying tax only in the final year. However, the interest income must be disclosed.

#4 Kisan Vikas Patra

The KVP scheme requires a minimum investment of Rs. 1,000 and comes with no maximum limit. This scheme compounds interest annually and doubles a one-time deposit at the end of 124 months but does not fetch any tax benefits.

- The amount invested does not qualify for deductions under section 80C.

- The interest earned is taxable in the hands of the depositor.

- Tax is however not deducted at source when a payout is made at the time of maturity.

#5 PPF Account

The hugely popular PPF account that allows you to deposit a maximum of up to Rs. 1,50,000 in a year, comes with a maturity term of 15 years. However, it allows for withdrawals from the 7th financial year and loan facilities from the 3rd to the 6th financial years. The interest on a PPF account is computed monthly but compounded and credited to the account annually. Our article on ‘PPF interest rate history’ will tell you more about the PPF scheme.

- What makes the PPF attractive is that not only are the investments in PPF eligible for deduction under section 80C but, the interest on a PPF account is tax free as well.

If you would like to know how to fit PPF into your debt portfolio, our article, ‘PPF as part of debt portfolio and other FAQs’ will come in handy.

#6 Sukanya Samriddhi Account

The Sukanya Samriddhi account allows you to open an account in the name of a girl child under the age of 10 and matures on completion of 21 years of opening the account. You can only open one account in India in the name of a girl and deposits up to a maximum of Rs. 1,50,000 per annum are allowed. Interest is computed and compounded annually.

- This deposits to this account qualify for deduction under section 80C and;

- The interest earned on this account is tax free.

Debt Mutual Funds

For those looking to take their debt portfolio to the next level without getting their hands dirty, debt mutual funds are the route to take. Debt mutual fund schemes primarily invest in listed and unlisted fixed income instruments. As per SEBI’s ‘Categorisation and Rationalisation of Mutual Fund Schemes’ there are sixteen categories of debt funds. This can be mind boggling for some of us and if you would like these categories to be demystified for you, our article, ‘How to use each debt fund category in your portfolio’ will be of use. What will make your decision making even easier is our shortlist of mutual funds that can be found at Prime Funds. Income from debt mutual funds comes in two ways:

- IDCW - When you invest in a mutual fund scheme, you get to choose between the ‘growth’ option or the ‘IDCW’ option. Under the growth option, the gains made by the scheme (by way of interest / coupon payments received and capital gains on sale of instruments) are put back into the scheme. Under the IDCW (Income Distribution cum Capital Withdrawal or the erstwhile ‘dividend’) option periodic distributions are made, out of the NAV of the fund.

To know more about IDCW, do take a look at our article, ‘What is IDCW in mutual funds?’. This IDCW payout is taxable in the hands of the investor at the slab rate applicable to her. Tax will also be deducted at source on IDCW @10% if IDCW exceeds Rs. 5,000 per annum in respect of the units in a mutual fund. - Capital gains - Apart from the IDCW payouts, when you invest in a debt mutual fund, you will make a capital gain or loss on the investment when you redeem it. If redemption occurs after holding the fund for 3 years, the resulting gain would be classified as long term capital gains and would therefore be taxed at 20% after indexation. In the case of redemption before 36 months, the gains would be short term capital gains and these would be taxed at the slab rate applicable to you.

'Please note that taxation of debt funds has undergone a change. Indexation benefits will not be available for investments made from April 1, 2023 onwards. You can read all about this change in our article ‘Tax changes in mutual funds: How to manage your investments now‘.

Bonds

Bonds are instruments used by firms to borrow from investors who are compensated by way of periodic interest repayments until maturity when the loan is repaid. These bonds could come with options to payout interest (at different frequencies) or with a cumulative option. They could also come with a call option (where the borrower chooses to repay the loan ahead of the maturity).

The tenures can range from a few weeks to 40 years. If it is a perpetual bond, technically, the tenure can stretch endlessly until the bank exercises its call option. You can read more about perpetual bonds in our article, ‘What they didn’t tell you about perpetual bonds’. With all of the different options, tenures and credit ratings, it can seem like an ocean of options as far as bonds go.

The following are the key points that drive taxation of bonds:

- Despite the various types of bonds that are available, for taxation purposes, bonds can be classified into ‘Listed’ - bonds that are traded on an exchange and ‘unlisted’ – these bonds are less liquid.

- For listed debt instruments, the minimum holding period for classifying capital gains as long term is 12 months. In the case of unlisted securities however, this is 36 months.

- Zero coupon bonds (bonds that are issued at a discount and pay out the face value at maturity with no coupon payments in the interim) are always considered long term capital assets if they are held for over 12 months (even if they are not listed).

- Indexation benefit is only available to Sovereign Gold Bonds and Capital Indexed Bonds issued by the Government as per section 48 of the Income Tax Act.

- Short term capital gains will be included in the total income and taxed at applicable rates.

- Long term capital gains are taxed at 10% without indexation or 20% with indexation (where applicable).

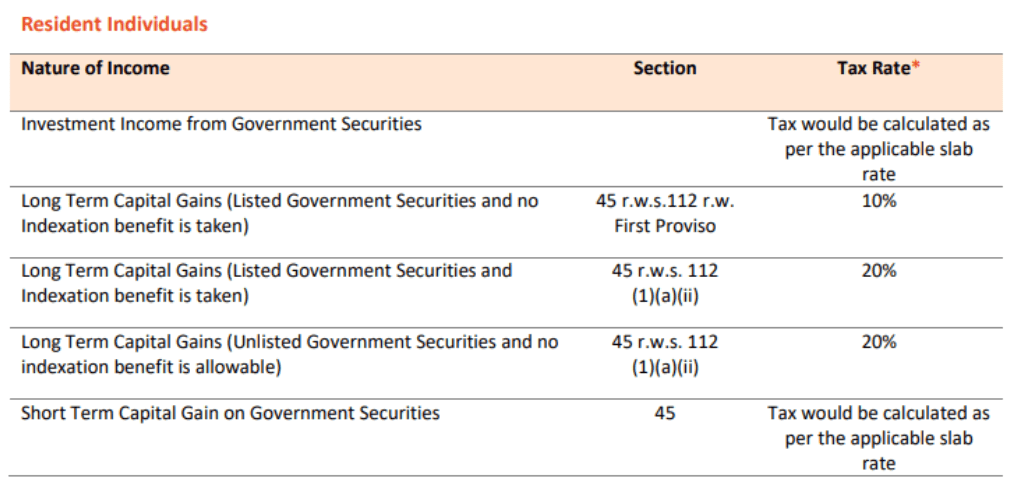

Listed Government Securities

Government securities are issued by the Central and State Governments for various maturities. While most obviously, they meet the funding requirements of the Government, these securities also set the tone for the overall debt market by being a benchmark and representing the risk free rate due to the sovereign guarantee that they come with. The RBI Retail Direct Platform (you can read our write up here) launched in December 2021, gives retail investors a way to get a piece of the action in the Government securities space.

A few key points to note with regard to taxation of listed Government securities are:

- TDS is not applicable on Government Securities as per the Income Tax Act.

- Interest is usually paid half yearly and does not come with a cumulative option.

- Holding period for long term capital gains is over 12 months for listed Government securities.

- Long term capital gains taxed at 10% with no indexation benefit (indexation is only applicable to some Government bonds).

The following are the four types of Government securities that retail investors can invest in via the RBI Retail Direct platform and how they are taxed.

- T-Bills usually have maturities of less than a year. These bonds make no coupon payouts but are issued at a discount (zero coupon bonds). At maturity, the investor will be paid back the face value of the bond. The difference between the purchase price and the redemption value would be short term capital gains since T-bills are for tenures of less than 12 months (currently, T-bills have maturities of 91 days, 182 days and 364 days) and this would be taxed as per the tax slab applicable.

- G-secs or dated securities have tenures ranging from 1 year to 40 years.

- The coupon / interest payouts made (half yearly with no cumulative option) are clubbed with the investor’s income and taxed as per his / her applicable slab rate. Tax is not deducted at source.

- If the bond was purchased at face value in the primary market and held to maturity, the question of capital gains would not arise.

- However, if the bond has been bought and / or sold on the secondary market, the difference between the sale price and the purchase price would be capital gains. Long term capital gains (holding period over 12 months) would be taxed at 10% with no indexation benefit.

- Short term capital gains are however taxed at the slab rate applicable to the investor.

- State Development Loans (SDL) represent borrowings of the State Governments and Union Territories. These are issued for tenures of 1 year to 40 years. While SDLs don’t come with an explicit sovereign guarantee that T-bills and G-secs come with, they are the next best thing and you can read more about SDLs here.

- Like G-secs, SDLs too make half yearly coupon payments with no cumulative option. These coupon payments are taxable at the slab rate applicable to you. However, tax will not be deducted at source.

- Capital gains would be taxed in the same was as G-secs.

- Sovereign Gold Bonds (SGB), a way to invest in gold minus the hassles of physical storage were launched in 2015 and come with a tenure of 8 years. Investors are allowed an early redemption from the 5th year onwards. Issue and redemption prices of these bonds are linked to prevailing gold prices. If held in demat form, these bonds are tradeable on an exchange. The bonds can also be transferred to another investor subject to some eligibility criteria. A detailed FAQ on SGBs can be found on the RBI website here.

- SGBs make half yearly interest payouts (fixed rate which is currently 2.5%) and this is taxable at the hands of the investor based on the slab rates applicable. Tax will not be deducted on this interest payout.

- The capital gains arising at redemption of these bonds have been exempt from tax.

- In the case of transfer of these bonds, the resulting long term capital gains are allowed to be reduced via indexation benefits before being taxed at 20%. Short term capital gains will be taxed at the slab rate applicable to the investor.

Source: Taxation_of_Government_Securities.pdf (nseindia.com)

Listed Corporate Bonds

Fixed income instruments issued by corporations and are traded fall under this category. These would carry a higher rate of interest than Government securities to compensate for the relatively higher risk they carry. These bonds could come with fixed or variable coupon rates. While there are several variants of listed corporate bonds, the interest income and capital gains arising out of them are taxed as follows:

- The interest on listed corporate bonds is taxable in the hands of the bond holder at the slab rate applicable. While section 193(ix) of the Income Tax Act used to grant an exemption of TDS on interest payments where the bonds are listed and held in demat form, this exemption will be removed from April 1, 2023 (Budget 2023). This means that TDS will now be applicable.

- The exception to this are tax free bonds that were usually issued by PSUs like REC, PFC, NHAI and HUDCO. The interest on these tax free bonds are tax free under section 10 of the Income Tax Act and hence there is no TDS on the interest payouts either. These bonds are limited in availability and are available on the secondary market for their residual maturities. Capital gains on these bonds are however, taxable (as below).

- Capital gains listed corporate bonds are taxable. Since these are listed securities, a holding period greater than 12 months would mean the gains are long term capital gains. These are taxed at 10% without indexation benefit.

- Short term capital gains are taxed as per the investor’s applicable slab rate.

Unlisted Bonds

While the interest income on bonds that are not listed on an exchange would be taxed in the same way (at the slab rate applicable to the investor), capital gains tax differs on account of a longer holding period requirement for classification as long term capital gains for unlisted securities. If the holding period is less than 36 months, the gains would be short term capital gains that are taxed at the investor’s slab rate. If the holding period was over 36 months, the gains would be taxed at 20% without indexation benefits.

Non-transferable bonds

- 54 EC Bonds, popularly known as capital gains bonds are used to set off long term capital gains against the investment in these bonds. Certain bonds (issued by REC, NHAI, PFC and IRFC) are earmarked as eligible under section 54EC of the Income Tax for this purpose. These bonds come with a lock-in of 5 years and are not transferable. Therefore, the only income stream from these bonds is by way of interest. This is fully taxable as per the applicable slab rates. However, no tax will be deducted at source on the interest payouts.

- RBI Floating Rate Savings Bonds 2020 are a floating rate debt instrument issued by the Government and comes with a sovereign guarantee. The rate of interest is reset every six months and is tied to the NSC rate + a markup of 35 basis points. The interest is paid out half yearly. These bonds come with a 7-year lock in with early redemption being allowed for senior citizens. You can read more about these bonds in our earlier article here. Since these bonds are not traded or transferable, the question of capital gains does not arise. The interest on these bonds is taxable as per the applicable slab rate and tax will be deducted at source on the same at 10%.

Market Linked Debentures or MLDs are a category of debt products that are structured in a way where the instrument does not make periodic payouts but one final payout at maturity which is usually linked to an index. Therefore, not only do MLDs not have periodic interest payouts that are typical of debt instruments but they also don’t payout a predetermined amount at maturity. MLDs are listed securities.

Currently, these instruments are taxed similar to listed corporate bonds (LTCG for holding period greater than 12 months) but that is set to change on April 1, 2023. Budget 2023 has proposed that all gains on MLDs, irrespective of holding period, be taxed like short term capital gains on debt, i.e. at the slab rate applicable to you.

Prime Bonds will take you to our recommended list of Government and Private issues if you would like to fit any of these into your debt portfolio. Prime Deposits will tell you which are the good deposits to invest in now.

6 thoughts on “How are deposits, bonds and debt funds taxed?”

Request you to kindly do an article on GSEC STRIPS.Many financial Advisors are recommending as it is tax efficient.What Is Primeinvetor’s opinion

1.Kindly confirm the holding period of SGB for LTCG, whether it is 1 yr or 3yrs.

2.If one buys SGB from secondary market from NSE and sells in market will one still get the benefit of indexation for LTCG

3.If one buys from NSE and redeems to RBI after say 5 yrs will benefit of indexation available on LTCG

You may kindly read this: https://www.financialexpress.com/money/income-tax/how-are-sovereign-gold-bonds-taxed-tds-interest-income-early-redemption-explained/2455545/

Thanks for the prompt reply.As per the Primeinvestor article holding period of SGB is 1 yr for LTCG,and as per financial express article it is 3yrs.Kindly clarify which one is correct.

Are G-Sec coupon STRIPS LTCG also after 1 yr holding period ? are they taxed at 10% flat or 20% with indexation 0r whichever is lower?

We received this query through a ticket as well. It is best that you consult a tax expert on this. thanks, Vidya

Comments are closed.