There is no dearth of stock market stories about the next HDFC bank or the next Page Industries or the next Dixon Technologies. In the recent IPO boom, this comparison went to the next level – comparing Indian companies with global giants.

But this kind of chasing the next big multi bagger, has seldom yielded rich dividends for investors. This is because it is not easy to understand what market rewards a stock for. Is it for being in a booming industry or for its superior financial performance? We will try to find answers to these questions in this article.

We will take stock examples to highlight how markets believed that some emerging companies will emulate pioneers and winners and what happened next.

#1 Chasing the next HDFC bank

Whenever a new bank comes into the market with few quarters of stellar growth or a high growth strategy, a comparison starts to shape up with multi decade compounders like HDFC Bank.

Banks that were touted as the next HDFC bank include DCB bank (Development Credit Bank), RBL Bank (Ratnakar Bank), Yes bank and IDFC First Bank. One of the things that led to this perception was the re-shaping and re-branding of some of these old institutions under a new leadership of CEOs from global or international financial institutions.

So, a fresh lease of energy and new strategy from high-profile CEOs was expected. This combined with a strong growth take-off in early years further built the perception of new winners. Hence, valuations moved up sharply, close to that of HDFC bank, in terms of price to book, leading to more investors jumping in. But the end results in these cases – a series of disappointments.

So, let’s go back to our question of what do markets reward a stock for? In this case, let us first get into the core economics of a banking business. Banking is not a lucrative business when it comes to capital requirement and return on equity (RoE). It needs a lot of capital for growth while there is a limit to the RoE the business can generate (highly fragmented deposit pool, low market shares) unlike consumer companies.

In the below table, we can see that the peak RoE is around 20% for some and that too for a short period. Otherwise, it has hovered around 15-18% for the best ones while some of the others saw a sharp dip in bad years. Consider this with the cost of capital of 10-12% – essentially, the wealth creation for investors lies in a narrow band.

So, in this business, the only way for wealth creation is not to lose moneywhen the potential to enhance RoE is limited. This is where HDFC bank stands as an exception – it made money without losing money across time frames, as reflected from the NPA chart below for the last 15 years.

Banking as a cyclical business is attractive only during growth cycles, which is characterised by growing loan book, declining NPA, expanding RoA and expanding valuation (price to book value).

On the other hand, the downcycle is characterised by higher NPA, declining loan growth, fresh capital raising to compensate for NPA write-offs and declining valuation.

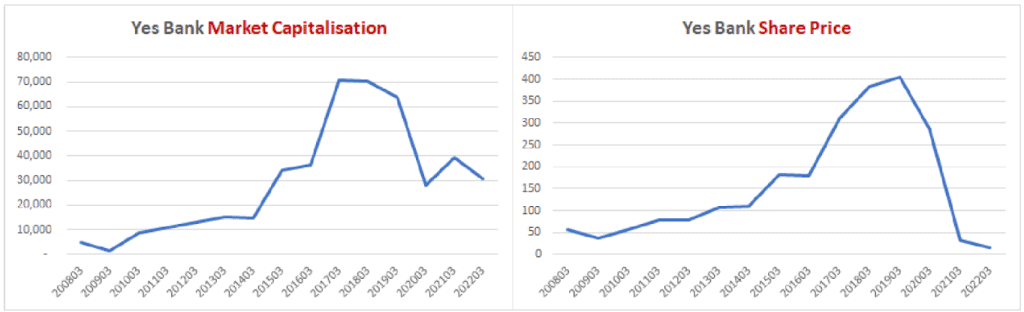

If any one of these go wrong for a financial stock, it hurts the investor and the Yes bank episode is a reminder of this. The bank had to raise additional share capital to write-off the losses and in this process, the share capital went up over 10 times as shown in the table below.

What did the above mean to Yes Bank shareholders? While market capitalisation fell only by 50-55%, the share price crashed 95% to life time low as 10 times additional share capital came in.

This explains the magnitude of disaster that can happen with financial stocks. YES, DCB and RBL lost their market charm!

The bottom line is that every stock deserves to be valued based on its own performance and lending discipline. Comparison with the successful stories may result in wrong signals and if that does not transpire, the loss can be painful. This is especially true in a business with limited RoE potential.

#2 Chasing the next L&T

In the height of the infrastructure boom during 2007-08, one of the most echoed sentiments was to find out the next L&T. Infrastructure sector was seen as a sun-rise sector and so investors wanted to grab a share of every stock that could become the next L&T. Orders were pouring in for new companies and stocks were hitting new highs every month.

But, as we look back after a decade, many of the popular companies either don’t exist or have shrunk to the size of penny stocks. Even worse,other than L&T, there is only one other stock (GMR Airport Infra) that managed to enter the space of the top 250 companies by market-cap (which are large caps and mid-caps). Others have just shrunk to small caps or even penny stocks.

If you have a question on how GMR survived, it is one of the few companies that managed to sell non-profitable assets and retain its relatively better assets – airports. Others like J P Associates and GVK got rid of their most profitable assets such as cement plants and airports to reduce their debt and were eventually left with non-profitable assets. A popular stock, touted to become the next L&T was Punj Lloyd. It is a penny stock now.

What exactly went wrong here? The market was valuing the infrastructure companies on the perception that every order they win would get executed and after every execution, payment would be received.

But neither of these things happened. Stuck projects due to regulatory issues, payment delays and arbitrations led to ballooning of debt and eventual collapse of these companies. Only a handful of small companies like KNR Constructions and Ahluwalia Contracts managed to survive for longer periods without landing into much trouble, although they still remain small caps.

L&T still stands tall and lone with a market cap of Rs.2.5 lakh crore as the next L&T just didn’t happen. Thanks to its successful IT business comprising LTIMindtree and LTTS that were also adding meaningfully to market cap.

This sector may be a pointer to the worst experience of chasing the next L&T for investors without understanding the risks involved in a less understood order book and high debt driven business.

#3 Chasing the next Page Industries

Page Industries, the franchise for Jockey in India, was another fascinating stock listing (in hindsight) that happened in the last 15 years. It has become over a 100 bagger ever since its IPO at Rs 395 in early 2007.

The stellar performance of Page Industries has time and again caught the attention of investors to find out the next Page Industries. Investors started looking at companies in similar lines of businesses with the same optimism and opportunity.

Again, let’s go back to the basic question of what do markets reward a stock for? In the case of Page Industries, it delivered one of the best return ratios in the listed space, during the last 15 years, since listing.

Below is a comparison of RoCE and RoE of some of the best-known quality listed companies with that of Page Industries.

Page Industries clearly demonstrated that the market rewards a company for its superior financial performance, in the long run, and not for being part of any sector or group or an industry. It would likely have delivered the same returns with similar financial metrics had it been in some other business also.

While we may be seeing some of its peers doing reasonably well of late with good financial metrics, sustaining it over a longer period of time will be key to wealth creation.

One of its peers, Lux Industries, after a sharp rally in 2021, took a hit in its share price on governance issues.

So the next Page Industries is yet to happen for well over a decade and a half now! All its peers remain below Rs.5,000 crore in market capitalisation compared to Rs.52,000 crores market capitalisation for Page Industries!

#4 Chasing the next Dixon

One of the latest episodes of chasing the next big stock has been that of Dixon technologies vs. Amber enterprises. While both the companies came into the market at a similar time through IPO in late 2017 and early 2018, with similar levels of optimism, they are poles apart on stock price returns now.

While Dixon delivered 13X returns in the last 4 years, Amber barely doubled since listing. But the stocks have been bucketed in a similar category of “electronics manufacturing” and those who missed Dixon were chasing Amber as there are few stocks to play this manufacturing opportunity.

But what led to outperformance of one over other can be explained by the superior financial metrics of Dixon as seen in the Du Pont Analysis below.

Here, you can see that both the companies have similar net profit margin (PAT/Sales) and leverage (Assets/Equity), but there is a material difference in the Assets Turnover (Sales/Assets). This is the key reason behind superior financial metrics of Dixon as elaborated further in the graph below.

In our article on 3 ratios to pick winning stocks in manufacturing space, we have emphasised on the key things to look out for and the factors leading to superior RoCE

From the Du Pont Analysis, it is clear from the time of IPO itself that these two companies showed distinct financial metrics (Asset turnover and RoE) while both were getting similar investor attention for being in the same industry. Eventually, it showed up in the returns with one significantly out-performing the other.

While Dixon had its own challenges during the last two years due to Covid and the complex supply chain mainly comprising of imports, the company has managed to come back on earnings while demonstrating significant scalability in revenues. From Rs 2,500 crore in FY17, revenue surpassed Rs.10,000 crore in FY22. The management remains optimistic of RoCE expansion, beyond the current levels 30%, in the next few years as majority of capacity expansion is done with.

On the other hand, Amber has been struggling with financial performance while its stock price has halved in a year even as the scalability gap is widening with Dixon.

The next Dixon may or may not happen and the daunting task for anyone would be to achieve the level of scalability in this low margin business that Dixon has achieved.

Starting from Xiaomi as its client in LED TV, lesser known Gionee in mobiles and Godrej in washing machines, it has expanded its clientele to comprise of Samsung, Panasonic, Motorola, Nokia, Acer, Lenovo, Bosch, Panasonic, Havells, Phillips, JIO, Croma, etc as its clients across different verticals.

Coming to our key question on what markets reward a company for, this is another case of how markets reward a company with superior financial performance over the other despite being in the same industry.

#5 New-age IPOs – Going beyond boundaries

The most recent example of chasing a stock has been the new age start-ups. The comparison now has gone beyond boundaries to look at the valuations of US and Chinese tech companies in this space.

The fact that all new-age technology companies performed well globally until 2021 also gave a feeling that fin-tech, food delivery and e-commerce are the businesses of the future and investors wanted to lap up the Indian counterparts of such globally popular businesses. But in 2022, they all fell down – together.

How markets reward stocks

There are some key takeaways for investors when they try to chase the next big stock.

- Don’t take a prejudicial approach to investing with an eye on the ‘next X stock’. Each company will be rewarded by the market for its own financial performance and there will be only a very few outlier stocks in the market.

- It makes sense to look at every company from its own ability to deliver financial performance and what valuation market is likely to give it for such a performance. Superior performance will result in superior valuation given by the market.

- It is even more important to understand the risks and challenges involved in every business and whether the management is capable of navigating those risks. Sometimes, the ‘rising tide lifts all boats’ phenomenon lifts all stocks in a particular sector, but that will not sustain. As Benjamin Graham said - In the short run, the market is a voting machine but in the long run, it is a weighing machine.

- To know what are the key attributes of a multi bagger and how to identify them read our article: The magic formula to identify multi-baggers. We also recently published two articles on Smallcap investing where we have highlighted the odds of scaling up of companies from small to mid and large caps.

While the 100th company is only Rs. 48,000 crore in market cap, only very few companies that started as mid-caps or small-caps in the last 15 years have graduated to become large-caps such as Avenue Supermarts (D-mart), L&T Infoteh, Mindtree, Page industries and Varun beverages (Pepsico franchisee). At the same time, the retail sector from which D mart comes from is also well known for big failures such as Subhiksha and Future Retail. This also throws up the limited probability of success by chasing a stock because there was a success story in that sector.

NOTE: The stocks mentioned here are not recommendations. These stocks may also be priced to perfection 😊. In such stocks, the only possible approach , where you decide to make an entry, is to do so during market declines with lower initial allocation and build up over time. Even then, you need to make sure that such companies still address the huge opportunity size, growth and in-turn the potential to generate compounded returns of 15-20% over other reasonably valued stocks in the market.

4 thoughts on “Are you looking for the next HDFC Bank?”

Are you looking for the next HDFC Bank,

It seems conclusion incomplete or missed.

The article seeks to highlight what markets look for in a stock, by using different examples of what worked and what didn’t work. The intention is not to give a stock recommendation. – thanks, Bhavana

Really a nice article.

Thanks

kannan.

Superb Article .Great NVC- well researched and well written.. Ideal article for students of Finance ( MBA , ACA or ACMA , CFA) .

Good learning for all Investors in Stock Market looking for Multi-baggers.

RAVINDRAN

Comments are closed.