Indexation benefit does not apply for investments made from April 1, 2023 onwards. You can read all about the tax change for mutual funds that kicked in on April 1, 2023, in our article, ‘Tax changes in mutual funds: How to manage your investments now‘

If there is one thing that has dominated the new fund offer space, and your collective interest, it is target maturity funds. Over the past year, the debt market has dealt with a swift rise in interest rates and we have issued multiple strategies to alert you on opportunities that presented themselves.

In our previous strategy recommendations, we had mentioned that for those who have a short-term timeframe and want to lock into yields, target maturity funds are a good option. In this strategy, we want to specifically alert you on the yield opportunity in short-term debt, through target maturity funds for three reasons:

- The upward movement in the short-term yields, owing to a clutch of reasons

- The ability to lock into prevailing yields with target maturity funds, which offers more predictable returns and time frame

- The current timing (before end of FY-23) which offers an additional year of indexation benefits, for a shorter-term timeframe – thus providing superior tax efficiency

Short-term opportunity

Let’s quickly explain with why debt markets have opened up several opportunities in the past few months. For a prolonged period, interest rates were at all-time lows, as a measure to encourage growth and lending during the pandemic. This came after a period where rates remained stagnant.

We are, therefore, seeing a persistent cycle of rising rates after a gap of several years and a shift in the rate cycle always opens up different opportunities. Not just that, it is at a time when central banks around the world are similarly dealing with spiralling inflation and hiking rates. Remember that yields move both in anticipation of rate action by central banks as well as the actual action. Therefore, new developments – such as a suddenly higher inflation print, which we saw in January, or commentary by the US Fed – can cause changes in yields.

This also means that we need to be on our toes to spot the different strategies that could help better returns, since it’s not often that debt markets throw up an array of opportunities!

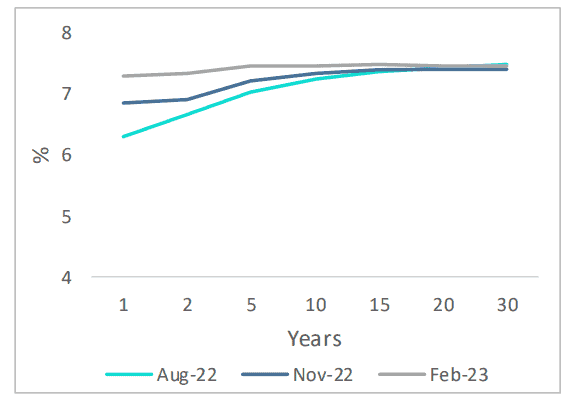

Now, yield movements in the shorter end of the tenor range have been far sharper than the longer end. See the chart below, sourced from Care Ratings. It shows the yield curve (yields mapped across different tenors) in three different months. As you will see, the yield difference between the short- and long-term periods has narrowed by February 2023 compared to August 2022.

A key factor, of course, is that the interest rate hikes that began last year have reflected far quicker in the short-term yields. Longer-term debt tends to react earlier to rate changes, and 10-year bond yields started factoring in rate hikes well ahead of the actual hikes. For the past few months, the long-term yields have also stayed put as expectations are largely built in.

But apart from this, another key factor that has sent short-term yields higher is liquidity. Along with rate hikes, the Reserve Bank also began to reduce the liquidity in the system – both to normalise after the Covid-driven excess, and to also enable pass-through of rate action. Therefore, from a heavy surplus, liquidity has now moved to the neutral zone especially in recent months. System liquidity has a bigger impact on the shorter-tenor yields than longer-tenor which is more influenced by inflation, government borrowings, and so on. Other smaller factors that could be working at this time include money outflow to meet advance tax payments that can keep yields higher.

Which target maturity funds

We have specifically picked target maturity funds to play this specific opportunity in short-term yields for a few reasons:

- One, these funds allow locking into current yields – similar to getting in on fixed deposits when rates are attractive.

- The indexation benefit that these funds provide make them superior to FDs, at a time when FDs are also offering high interest rates.

- These funds also offer better predictability in terms of returns (please note that this does not necessarily mean superior returns) and also the average maturity, than other debt fund categories.

The target maturity funds currently available span a wide maturity range from 2023 to 2036. In this, we think the 2025, 2026 and 2027 maturities offer the best yield trade off at present. Yields on the longer maturity funds are similar or even lower than the yields in these three buckets.

The table below shows the list of target maturity funds we are recommending. We have gone with funds for which we data on portfolio yields, as well as considered AUMs and expense ratios.

Note the following:

- Choose funds based on your timeframe. This call is primarily a buy and hold call. Kindly do not compare it with the longer duration funds we have recommended earlier for capital appreciation when rates fall.

- Any combination is fine: You can invest in any or a combination of these fund/funds. You will need to hold the fund to maturity to earn returns close to the yields. There may be price volatility in the interim, but the idea is not to exit before maturity.

- Indexation alert: If you are investing in the funds, make sure you do so before March 31st in order to earn an extra year's indexation benefits. But do note that the 2025 funds will not come with indexation benefits as the holding period is less than 3 years.

- Tracking error not known: We do not know the tracking error for these funds. For one, we don’t have underlying index data (not available) to calculate tracking. Secondly, most funds are new and have limited performance history. We have mostly opted for larger-sized funds in the hope that these would find it easier to keep errors low.

- Yields mentioned not the latest: The yields above are not current yields. Current yields are marginally lower; the Bharat Bond 2025, for example, is 7.65% now while the Axis 2027 SDL fund is at 7.66%. Most AMCs do not offer current yield data.

Suitability and your other debt funds

The question that most of you would ask is if you should hang on to your current debt funds or exit and reinvest in these target maturity funds.

The answer is - do not exit from your current holdings 😊

This opportunity to get into superior yields offered by target maturity funds is suitable in the following circumstances:

- You have fresh surplus to invest and you’re looking for opportunities to earn better returns in debt.

- You’re attracted by high interest rates bank FDs are currently willing to pay out and you’re wondering if you should go for them instead of debt funds.

- You have a specific timeframe for investment and you’re looking for low-risk options that are still decent in terms of returns.

- You’re keen on adding target maturity funds to your portfolio and unsure on which one to go for.

These funds can be avoided when you’re simply using debt funds as part of the debt allocation in your portfolio. Here, your existing debt funds will continue to be eminently suitable; yields across debt funds have markedly gone up over the past 6-8 months.

It is not that good returns lie in target maturity funds alone – debt funds from other categories are also perfectly capable of delivering well! And in fact, in the event of a rate fall, medium duration funds (apart from long duration ones) can benefit well from a price rally, thus providing capital appreciation, apart from the coupon income. It is simply the return predictability of target maturity funds that makes them more suitable for specific goals (listed above). With other active debt funds, the active management of the portfolio can keep the returns and maturity a moving target.

To sum up, retain existing investments in your debt funds and don’t exit unless they are below-average performers. Use our MF Review Tool to know if your fund is a Sell. Invest any such exited money or fresh sums in the strategy explained here.

29 thoughts on “Debt funds for double indexation and high returns”

I have a small query around Edelweiss Nifty PSU Bond Plus SDL Apr 2026 50:50 Index Fund. In the table above, YTM for this fund is 7.74%. On Edelweiss website, the YTM for this fund (as on 22nd March) is 7.62%.

In less than a month, the YTM has reduced. Is it a negative indicator for the fund?

Also, the Tracking Error for this fund (as mention on Edelweiss site) is 1.16. How should we interpret it? Is it too high?

Thank you,

Rajan

No, it is not a negative. We have considered the current YTMs for funds where available before we issued this call; not all AMCs declare latest YTMs, but we checked those that do to gauge what yields will be. As far as tracking error goes, as explained in the post, we can’t really judge what’s high and what’s low because we don’t have the underlying index data and we can’t compare between funds. As such 1.16% is on the higher side, compared to equity funds – but this may well be par for the course in debt index funds. – thanks, Bhavana

Hi

I don’t understand what you mean by saying that these funds can be avoided when you are simply using debt funds as part of debt allocation in your portfolio. Can you please enlighten me?. Regards

If you hold and/or are investing in debt funds in your portfolio as part of the debt component in that portfolio – like short duration funds, corporate bond funds etc – then these target maturity funds can be avoided. These funds are useful only for the purposes outlined in the recommendation above. – thanks, Bhavana

My only goal is wealth creation and I have long investing horizon. If only for diversification purpose, I am investing in debt, should I make some allocation to TMFs or should continue with Corporate bond funds/ Dynamic bond funds only?

No, there’s no need to invest in TMFs in your case. Continue with the corporate bond funds you have. You can also add short duration funds, if you have money you want to invest now. – thanks, Bhavana

My earlier comment has not been published yet. It was as below –

Thanks for another well timed article.

Will Bharat bond 2025 fund be treated as LTCG when it matures in April 25, if it is bought before 31st March? It actually completes only 2.1 years by then and not 3 years, hence the confusion.

We have responded. But please note that our responses to blog comments can take time or be delayed. If you need specific clarifications, please raise a support ticket with us here. We are generally more time-bound there 🙂 – thanks, Bhavana

Comments are closed.