You may have missed the whopping 123% return of the Nifty Realty Index in the last one year. But it certainly caught the attention of AMCs. And hence comes the New Fund Offer (NFO) from HDFC AMC – called the HDFC Nifty Realty Index Fund.

The HFC Nifty Realty Index fund is an open-ended passive fund that will simply replicate the Nifty Realty Index. The NFO will close on March 21, 2024, and will then be available for regular investments after the NFO period.

The Nifty Realty Index

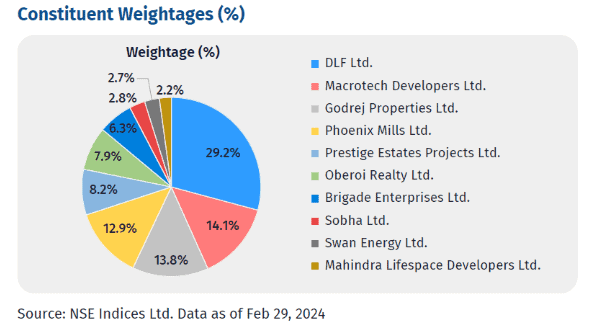

The Nifty Realty Index is a free-float market-cap based index that will invest in the 10 largest real estate companies listed in the Indian bourses. The individual stock weight of this index is capped at 33% and the index is rebalanced semi-annually.

The Nifty Realty index differentiates itself from the S&P BSE Housing Index by sticking only to realty companies. As opposed to this, the S&P BSE Housing Index (there are 2 passive funds from UTI and Kotak based on this) is a more diversified fund with exposure to construction materials, durables (for example Voltas, Crompton Greaves, Havells India) and even industrial products and finance.

The above data will tell you that the Nifty Realty TRI is neck and shoulders above both active housing funds as well as the S&P BSE Housing Index (the 2 passive funds based on the S&P BSE Housing have not crossed a year yet, but the index returns is representative of their performance).

Active housing funds, too, diversify themselves well across sectors allied to real estate. For example, the active housing fund from HDFC has about a fourth of its AUM in financial companies, 20% in construction companies, 15% in construction materials and just about 11% in real estate companies themselves.

What is evident is that such diversification by the active funds has not helped capitalize on the real estate boom, although during down markets (which last for a good proportion of time) the active funds have shown far less volatility than the Nifty Realty Index fund.

However, given that you do not hold a sector fund to contain the downside but to participate more on the upside, participating in a pure play does seem to work better than a diversified approach. Realising this, it appears that HDFC AMC has launched this passive fund, after its own active fund in this theme did not deliver well over the years.

Performance of Nifty Realty Index

If you are enticed by the point-to-point returns in the table in the above, you need to know that the Nifty Realty Index has been on a long downturn before it saw the light of day. Given below is the 10-year rolling return of the index since inception, along with the Nifty 50 index.

You will see from the data above that the Nifty Realty Index’ 1,3,5-year returns came from the upmove post March 2023 after a very prolonged down phase. The 10-year rolling return data also suggests the following:

- The Nifty Realty index beat the Nifty 50 just 3.2% of the time over 10-year rolling periods, since its launch.

- The average 10-year rolling return of the Nifty Realty Index since its launch in 2006 was -0.48% annualized versus 11.7% annualized for the Nifty 50.

- The worst 10-year return was -16% for the Realty index and 5 percent for the Nifty 50.

To sum up, the data clearly points to the highly cyclical nature of the sector and that returns come by in very short spurts – trying to make up for years of underperformance.

In its own presentation (data below), HDFC AMC takes note of the fact that the outperformance of this sector is erratic, although the margin of outperformance is high.

The sector’s fortunes

Mutual funds have been trying many ways to play the realty space, without much success. The chronology of launches goes like this:

- In 2017, HDFC launched as a closed-end housing fund with 1440 days lock in and turned open-ended in 2021, after negative returns since launch. The fund’s performance continues to be below the Nifty Realty Index.

- In 2021, PGIM launched a global real estate FoF that invested in a parent fund (which invests in REIT and realty players globally). Its returns have been far from inspiring thus far.

- In 2022, ICICI Pru and Tata launched housing funds when there was a spike in the sector returns. They were more diversified but did not beat the Nifty Realty or the BSE Housing index.

- In 2023, Seeing that active strategy did not help, Kotak and UTI came up with passive funds that mirror the S&P BSE Housing index. These funds do not have a track record to assess but the Housing index trails the Nifty Realty Index over 1,3- and 5-year periods (back data as the Housing Index waslaunched in 2022 only).

- In 2024, now, with these learnings, HDFC AMC has launched the Nifty Realty Index.

If mutual funds have not had much luck in these launches, then whether the present NFO would make sense would depend on just two questions:

- Is it different now? In other words, has anything fundamentally changed over the last several years in the sector?

- Is this a good entry point? - considering that the cyclical nature of this sector necessitates timing it right.

#1 What is different

There have been changes in the sector over the past decade both regulatorily and fundamentally. Some of them are listed below:

- The Real Estate (Regulation and Development) Act, 2016 or RERA has provided the necessary impetus to the sector in terms of improved transparency and measures (such as separate escrow account, redressal mechanisms for buyer) to improve confidence of residential home buyer.

- Consolidation in the sector (with many smaller players also folding) and strengthening of balance sheets over the past few years is also a visible change. Data below will show that most companies in the Nifty Realty index have reduced their debt equity ratio.

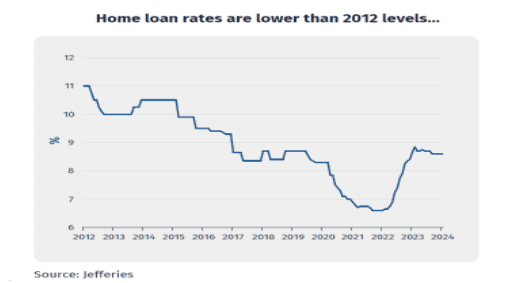

- Interest rate cycles are not hurting the home buyer as they used to in the past (image below). With rate cycles not expected to move northwards now, this scenario can remain steady. However, on the flip side, the tax incentives on buying more than one home and the quantum of relief have come down. The New Tax Regime does not also provide any deductions for principal repayments and interest deduction is restricted to let-out property. Still, thanks to the premiumization story playing out in various consumer segments as well as the pent-up demand post Covid, in FY23, residential property sales in India hit an all-time high with a 48% YoY increase to Rs 3.4 lakh crore.

Source: HDFC AMC Presentation

- The Covid-19 phase, although highly detrimental to the sector, has also helped realty companies in the post-Covid period. An overall demand uptick has been visible across residential, commercial, and retail space from FY-23. While it is strongest in the residential space, the commercial space occupancy rate has been slowly going up post Covid (with global capability centres taking shape in India) and data from Jeffries suggests that mall space demand has recently surpassed the supply.

#2 Is it a good entry point?

Strong uptick in the economy along with favourable rate scenarios have in the past buttressed a rally in the real estate listed segment and it is evident that the same is playing out now. As most AMCs have failed to catch rallies in the past in a timely manner, it appears that HDFC AMC has remained cautious and entered a rally that is at its mid-cycle.

The returns below of the Nifty Realty constituents will tell you that there has already been a swift rally.

This means that valuations are not cheap. The Nifty Realty Index’ P/E ratio (according to the presentation) is at 57 times (as of February 2024) as opposed to 24.4 times for the Nifty 500 and 22.7 times for the Nifty 50. Earnings growth of the 10 Nifty Realty constituents, for the nine months ending December 2023, was over 42% YoY compared with similar period. This growth will have to keep pace or move up further to create upside. Specifically companies like DLF and Macrotech have to deliver to sustain the returns of this index.

Is the HDFC Nifty Realty Index fund suitable for you?

The above points will make it amply clear that Nifty Realty is a more volatile, unpredictable, and high-risk space than many other sectors. You will need to note the following points to make your decision:

- Unpredictable regional demand, corporate governance and regulatory issues besides the working capital-intensive nature of the sector make it a high-risk play. So, more than other themes, this sector necessarily needs you to time your entry and exit.

- Since this is a market-cap weighted index, not all the stocks in the index will pass all quality filters. This means some of them can go wrong (large companies do fail in the realty space. Example – Unitech).

- There is not much merit in holding this index for the long term as there can be opportunity loss in periods it does not perform.

Essentially, you need to be on top of this sector, tracking it to make the best of this sector. To be honest, we have never managed it simply because the dynamics of each company (whether into residential, commercial or retail and the region they are in) are exceedingly unique and varied 😊 We might at best look at stock opportunities if valuation provides comfort.

But if you think you can manage this feat, timing wise, this is not a bad time for an entry (provided you know when to exit). But if you plan to track the sector that closely, picking 1-2 realty stocks would be a better idea than the index itself. After all, by picking this sector, the writing is that you will take on the risks with it.

Whether you want it with 10 stocks of an index or 1-2 is the call. We don’t see the risks reducing significantly with a 10-stock portfolio giving that downside risks play out alike across the sector. A diversified housing/realty based active fund, as explained above, is not a preferable option to play the space either.

Needless to say, any exposure over 5% (outer limit) is not worth the risk it adds to your portfolio. Please note that this is only a review and we have not ventured into giving a call on this fund.