In recent times, you may have read about stories of equity indices or equity mutual funds struggling to deliver double digit returns even over 3 and 5-year periods. If many of you had expectations of say 12% return or a 15% returns these numbers are indeed disappointing.

But here’s a question: how did you form your return expectation? I posed this question to some friends. Their response can broadly be categorized into two: one, they either read or were told that equity markets can deliver 15-20% returns. Two, at some point in the past, some of the stocks they held had delivered this return and it naturally became the ‘best return to expect’. Just hold this point for now.

Real returns

In 2016, former Reserve Bank governor Raghuram Rajan said that he wanted real returns of 1.5-2 percentage points for savers. Real return is the return adjusting for price rise (inflation) in the economy. He wanted the RBI to monitor and keep inflation under check and protect savers. Now let’s take some cues from this.

Mr Rajan wanted a fixed income product to deliver 1.5-2 percentage points over inflation so that an investor’s savings don’t shrink as a result of price rise. Now if that is for a fixed income product, a market-linked product like equity should obviously beat inflation and by a higher margin (given the higher risk). So, the first point is that you should be linking your return expectation to inflation, rather than an arbitrary number. Let us look at some of the past data on inflation and market returns to know what they say.

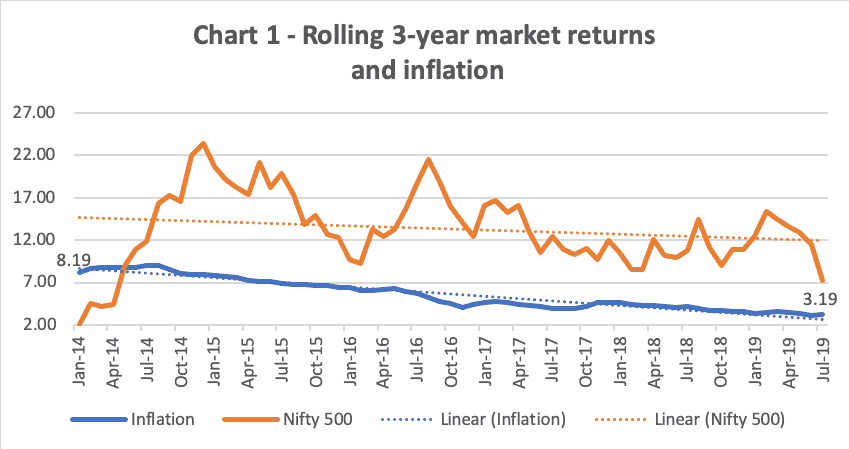

The rolling 3-year returns graph in chart 1 will tell you that the return following:

- The market (represented by the Nifty 500 index) has beaten the consumer price inflation (CPI) almost all times for any 3-year period between 2011-2019; barring a short period until May 2014 when markets returned lower than inflation.

- The more important point to note here is that inflation has over this period reduced from 8.2% to 3.2% – a good 5 percentage point reduction. That essentially means you do not have to earn as high a return as earlier to stay ahead of price rise.

- In other words, your return expectations must moderate compared with 4 years ago as inflation is on a clearly downward trajectory.

Inflation, economy, and returns

The margin by which the market has delivered returns over inflation has varied, also seen in Chart 1. This is partly to do with inflation and the growth of the economy. While a very high inflation is not conducive (3 years ending January 2014) for the economy and stock markets to outperform, a very low inflation (3 years ending July 2019) doesn’t help either. The table below will tell you that the margin of outperformance by the market has steadily come down post 2015 with inflation moving south.

| 3-year returns rolled monthly in… | Avg. 3-year CPI (%) | Avg. 3-year Nifty 500 returns (%) | Real market returns (%) |

| 2014 | 8.5 | 11.8 | 3.3 |

| 2015 | 7.1 | 17.0 | 9.9 |

| 2016 | 5.5 | 14.6 | 9.1 |

| 2017 | 4.4 | 12.8 | 8.4 |

| 2018 | 4.1 | 10.6 | 6.5 |

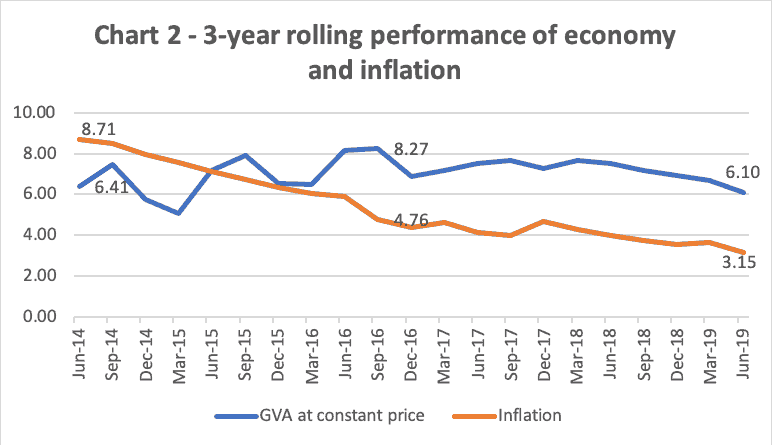

The shrinking outperformance of the equity market is attributable to the lower growth in the economy. Chart 2 clearly shows how the economy’s growth engine has slowed. While lower inflation is one of the reasons, other internal and external factors (starting from demonetization to new bank code to a new tax regime and external trade wars) also contributed to the economy’s slowdown.

What does this mean to you? While you want ‘inflation + X’ as returns, this ‘X’ can vary based on how the economy is performing.

Tweak your return expectation

What am I trying to convey here? Just that your return expectation are high and you need to tone it down:

- Your current return expectations must be tapered down in line with lower inflation as you do not need a ‘high return’ to beat ‘low inflation’.

- A high market return is also not possible in a steadily low inflation and lowering economic growth scenario. To this extent too, be prepared for lower margin of outperformance.

- Periods of non-double digit returns in equity market does not necessarily mean that equity as an asset class is nonperforming.

An inflation of 3-5% plus the real growth of the economy can be your expectation over 3-5-year periods or more. If a simple FD can give you 1.5-2 percentage points more than inflation, then expect 3-4 percentage points more than inflation in the long term from a riskier asset class called equity.

So, what should be your return expectation? There is a low chance of India hitting the high inflation phases experienced pre-2013 as the RBI is now constantly monitoring and managing it with monetary tools, and is tasked with keeping inflation at around 4%, +/- two percentage points.

An inflation of 3-5% plus the real growth of the economy can be your expectation over 3-5-year periods or more. If a simple FD can give you 1.5-2 percentage points more than inflation, then expect 3-4 percentage points more than inflation in the long term from a riskier asset class called equity. For example, for the 3-years ending 2018 the average consumer inflation was 4.1%. The 3-year deposit rate, had you locked into it in end 2015/beginning of 2016 was 7.5% and the average market returns over those 3 years was 10.6%. Essentially, your deposit generated 3.4% real return while the equity market generated 6.5% excess return.

Please note that individual stocks may continue to outperform well beyond these expectations. But as a portfolio, they cannot be totally cut off from the averages of the market. To this extent, a diversified basket of stocks will largely reflect market returns plus or minus some points based on the fund manager’s ability.

Why return expectation is important

Having a realistic return expectation is important for 2 reasons. One, wrong expectations would primarily mean setting your financial goals and savings wrongly. For example, you might expect 20% annualized return on your portfolio and have a goal of say Rs 35 lakh in 10 years. You would save Rs 10,000 a month thinking your returns will be delivered. If you end with say 12% return, then do you know what will be your shortfall? About Rs 12 lakh!

Second, when your high return expectation does not transpire, you lose faith in equities and move to FD for good, not realizing the reason for lower returns. You miss the fact that it would still be better than an FD rate or other fixed income options. This may lead to a sub-optimal wealth building strategy.