Despite accounting for a chunk of the bellwether index, the banking sector has not been that rewarding for investors in FY24 as unexpected challenges emerged after a bumper FY23. This apart, the performance of individual stocks has been mixed, leaving investors confused.

The bank index also delivered much lower returns of 15% in the last one-year Vs the Nifty 50’s 25%. It is unusual for the bank index to underperform the Nifty 50 by such a wide margin.

You could have made better returns in banking stocks only with the right choices. Going passive with the index or sticking to old favourites would have helped.

Here’s a quick look at the 1-and3-year absolute returns of top private and PSU banks.

In this article, we will dive deep into the earnings performance of banks, the key drivers, challenges, valuation and what lies ahead in FY25.

Earnings performance for banking stocks

After 2 years of stellar growth between FY21 and FY23, the earnings growth rate moderated in FY24 as unexpected challenge came in the form of deposit mobilisation and the rising cost of such mobilisation. While banks enjoyed the benefit of interest rate pass through to borrowers immediately throughout FY23 (as a large chunk of loan portfolio is linked to repo), the deposit mobilisation challenge started to hurt their margins later in FY24.

Below is a snapshot of the profitability growth of a representative sample of banks taken across market cap and advance size for the period FY21-FY24.

The data tells you that the earnings momentum remained strong between FY21-FY23 while it moderated through FY24. It has further moderated in Q4FY24 due to strong base effect.

If we analyse the numbers in detail, the strong growth between FY21-FY24 has come on the back of best-in-class Net Interest Margin (NIM), continuously improving asset quality (lower NPA) and improving Return on Assets (RoA).

The asset quality (NPA) continued to improve through FY24 as well while the NIM expansion has plateaued out in the wake of rising deposit cost.

Let us look into the key metrics in detail to gauge the earnings performance.

NIMs peak out

Last few years of low interest rates and robust deposit growth helped banks garner significant low-cost deposits while the new system of repo-linked lending rates allowed banks to pass on the interest rate hike by RBI to borrowers quickly. As a result, NIMs kept expanding until the end of FY23 while the cost of deposits started to hurt margins with a lag in FY24.

Here’s a quick glimpse in to the movement of NIM in the last 5 years.

To throw more light on NIM trajectory, ICICI bank ended FY24 with 4.4% NIM while it reported 4.9% NIM in Q4FY23, leading to a contraction of 50bps.

In general, banks saw a 15 to 50 bps contraction in NIM during FY24 due to rising cost of deposits while some mitigated it by focusing on higher yielding loans.

The good news is that banks have still not given up much of the gains, making NIM as one of the core drivers of RoA.

Asset quality (NPA) continues to improve

Another important factor aiding profitability was the continuous fall in NPAs which peaked out during FY17 -FY18 for most of the banks.

It continued to improve through FY24 as well with most banks reporting fall in NPAs further, be it private of PSU.

As we can see from the graph, banks across the board reported their highest NPAs during the FY17-FY18 period and declined since (barring IndusInd Bank, which landed into crisis in FY19 post IL&FS crisis). It is interesting to note that the net NPA for private banks, in general, has converged to 0.5-0.7% levels from varying levels 5 years ago.

They have now reached NPA levels that are normal (or the best they can) for the business of banking. If we were to benchmark this number against any reliable data, the average net NPA of HDFC bank has hovered between 0.2-0.5% for the last 15 years.

Even PSU banks like Canara Bank managed to significantly bring down its NPA while regional banks like Federal also staged a strong comeback.

This declining NPA trend continue to boost profits and in turn RoA despite the headwinds from rising deposit costs.

Return on Assets (RoA) remain superior

As NIM expanded and asset quality improved significantly, profitability shot up leading to significant improvement in RoA. Top private banks seem to have conquered the best levels of RoA in the 2-2.5% band while PSU banks are also inching up to their best levels, at 1-1.5%.

While top banks like ICICI Bank and Axis Bank have already reached high RoA levels, there may be a bit of room for the likes of Indusind Bank as well as PSU and old private sector banks to catch-up.

A 3.5-4% NIM and 1.75-2% RoA is a mark of good performance for any bank and can in turn can lead to RoE of 15-20%, provided the asset quality is also under control.

Even though the tailwind from NIM expansion disappeared in FY24, fall in NPAs supported the banks to continue to generate superior RoA.

Rising deposit cost and CD ratio, the key challenge

While a benign deposit mobilisation environment flushed money into the banking system with low cost deposits post Covid, things changed fast in FY24 with banks competing for deposits as credit growth also took off in double digits in the last two years.

Meanwhile, RBI also seem to have asked individual banks to maintain healthy credit-deposit ratio (see the box below on what credit is to deposit ratio) which made the deposit mobilisation environment even more competitive. HDFC bank was the hardest hit after the merger of HDFC into itself as it had to significantly bring down its credit-to deposit ratio, that shot up far beyond the desirable levels of 85-90%. This much needed adjustment is hurting its credit growth and in turn overall profit growth and valuations.

Credit-to-deposit ratio: In the banking system,for every Rs.100 deposit received by a bank, banks have to keep Rs. 4.5 as cash reserve ratio (CRR) with RBI and Rs.18 to buy Govt securities to keep statutory liquidity ratio (SLR). After this, only Rs.77.5 is available for lending. Of course banks have their own share capital plus reserves and they can also do market borrowings. But deposits form their key source of funds at attractive cost.

In an environment where deposit rates go up quickly, the banks with very high credit-to-deposit ratio (beyond 85%) will find it difficult to grow unless they are able to mobilise deposits at the same pace of credit growth. They may have to offer higher rates on deposits or resort to market borrowings. Consequently, this can put pressure on NIM as well as pace of growth.

At the same time, the repricing of deposits is likely to be fully done within in the next two quarters and may give a relief to banks. With rate cut expectations now pushing beyond FY25, banks can take even more breather on any further threat on their NIMs.

Despite all these challenges, one good thing to note was that most of the banks have been able to grow their deposits in FY24 while maintaining a decent CASA ratio. Even more appreciable is the fact that some of them managed to make their credit-deposit ratio even more healthy in this challenging environment post such discussions from the regulator.

Valuation re-rating done, a new order has emerged

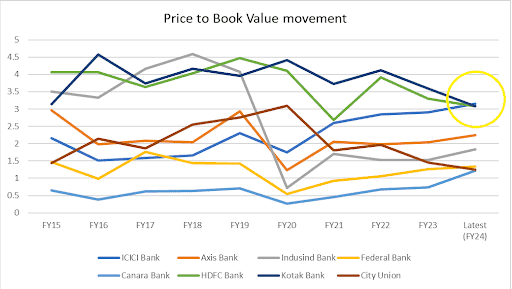

In the last 2-3 years, a lot of changes have happened in the valuation in the banking sector and a new order seems to be emerging in the private sector.

ICICI Bank has snatched the prime spot from HDFC Bank as the latter has been facing growth challenges, pulled down by deposit mobilisation challenges post-merger of HDFC with itself. Apart from HDFC Bank, the ones that went against the tide include Kotak Mahindra Bank and City Union Bank where valuation contraction has happened.

Below is a glimpse into how valuations in terms of price to book value movement (consolidated price to book value).

While we have discussed only a representative sample of banks above, performance of most of the other banks from respective categories follow a similar trend barring few exceptions.

From the historical valuation trends shown in the graph, it appears that the best price to book multiple enjoyed by retail focused banks at their good times was close to 4.5 times, which banks such as HDFC Bank, Kotak Mahindra Bank and Indusind Bank enjoyed. Interestingly, all these banks had less share of low yielding home loan book at that point of time and even today Kotak and Indusind have very low share of this lending segment in their advances.

While there may be some room left in some of the banks, much of the valuation re-rating seem to be done.

What’s ahead for the sector in FY25?

In FY24 the market celebrated the FY23 earnings performance of banks so much that it underscored the challenges going into FY24. The banking index also delivered 25% returns in FY23. Even the stock of HDFC bank saw a big spike after it announced merger of HDFC with itself while it fell ~20% in the 3 months following that as challenges started to emerge on the deposit mobilisation front.

We believe the divergent trend of divergent performance in stock returns within the sector in FY24 can continue into FY 25 as well.

While the valuation re-rating seems mostly fully don, there may be some leg-up for few players. Even if not to their historical levels, the growth opportunity is robust for the banking sector. So, the returns from hereon could mirror credit growth plus any further re-rating, if left.

The overall credit growth in the sector for FY25 is expected to be 14-15% while a strong in private capex, as expected, could potentially take it further higher. This is also a structural tailwind as a pick-up in private capex cycle could provide long runway for growth for banks.

The large and even some of the mid-sized banks are equally well equipped with both strong balance sheet and technology to cater to a large pool of retail, corporate and SME customers. Some of them could be raising fresh equity as well to fund growth and strengthen their balance sheets as valuations are good to raise money at a significant premium to book value.

Those banks facing challenges may take time to overcome those challenges while those banks that are not dealing with any kind of balance sheet or technology related issues may be on track to deliver healthy returns.

- Risk averse investors can look to accumulate using a more passive route we recommended while waiting for correction opportunities in individual banking stocks.

- You can check our recommendation in this space in Prime Stocks. You can still invest in them as long as they remain in our buy list.

- If you are an aggressive investor and want to take a broader bet, then check out our Finance Squared smallcase.

6 thoughts on “Should you bank on banking stocks? Earnings review and more”

Thanks for the article 🤗

Am hoping we all make good returns from this sector, considering current economic and market situation over the two – three years 👍🏼

Hello Sir,

What are your views on Bank of Baroda and how will the recent RBI draft guidelines on project financing impact the PSU lender.

Thanks

Tarak Mehta

Welcome your query sir,

I may not be able to provide a specific view on BoB as I m not aware of its overall project fin. book. We may have to wait for its results and mgmt. clarification in concall. It is on May 10th

In general, this is negative, if banks will have to set aside such huge provisions. Especially when PSU banks are majorly involved in project funding.

At this stage, it seems to be a draft proposal and the final outcome need to be seen.

RBI may be taking cues from previous cycle based on the overall NPA reported by banks from across the projects such as cement, steel, power, infrastructure, etc

A majority of them were a fall-out of global cycle as well while banks almost recovered fully in cement and steel projects as existing bigger players drove the consolidation.

So, the overall write-offs after such a big fall-out may be 5-6% only in the system.

So, this provisioning requirement looks very high even based on past cycle and driving up interest costs for projects may not be a desirable thing.

Hope the draft may not get implemented, otherwise it is really negative for banks engaged in project financing.

Thank you

Thanks Chandra for this informative article. What’s your opinion on NBFC like Bajaj Finance which is trading at decadal low P/B value and growing PAT at 25% ?

Welcome your query sir,

It is a difficult question. Bcoz in its early days as an auto financier, the stock traded at lower multiple as well while over time, it got re-rated to the top among NBFCs and now giving up a bit.

Having ruled consumer financing for long, it has been scaling up home finance and now venturing into car, tractor and microfinance. These are segments where we have seen Cos doing poorly than Bajaj Finance despite their strong foothold.

Some of these are backed by competition, lower yields, longer tenures, cyclicality, higher cyclical NPAs etc as well.

So, it would be difficult for me to think of a re-rating from hereon. But so long as it maintains this growth + RoA combo, this price to book may hold.

It is encouraging to see that Chola is sustaining 5X price to book as well .

So, growth + RoA is an inevitable combo. that it needs to deliver to maintain this valuation despite entering into new lending areas (where others may be the leaders).

So, if they are still entering 14-15% lending yield segments (one thing to watch) and can maintain their asset quality discipline (unless that segment has that bad track record like micro-fin), it would be OK. So, micro-fin going beyond 10% may not be a desirable outcome in the long term.

So, you may have to involve a bit in tracking the Co’s evolving portfolo mix while entering at this valuation.

In housing finance, management itself has told that it will be a low RoA and RoE biz.

Hope it helps, though I can’t give a conclusive bullish view

Thank you

Thanks Chandra for the detailed reply.

Comments are closed.