In these reviews, we pick stocks that have rallied, or where businesses are interesting or changing, or where companies may be relatively unknown and so on. We present an analysis of these stocks, covering what has driven them, business prospects, threats and more. These reviews are meant to give you an understanding of a stock. They are not our recommendations.

RITES Limited, is a public sector undertaking (PSU) specializing in consultancy work in the fields of transport, infrastructure and related technologies. Established under the aegis of Indian Railways, this Miniratna (Category I) Schedule A PSU, was established in 1974 and was listed in the stock exchanges in July 2018. The Ministry of Railways owns 72.02% of the shares in RITES Limited. Starting out as an infrastructure consultant, the company evolved itself to offer both consulting and turnkey execution of engineering projects, leasing services and exports for the Indian Railways.

The RITES stock is not among the stock market favourites but had a sharp rally between May and mid-June, in the run up to the results announcement. Here is an attempt to understand this lesser-known company, its business, and potential risks.

External Environment

The cyclical infrastructure sector depends to a large extent on Government spending and the state of the economy. An event such as the present Covid-19 pandemic can be a dampener to such infrastructure-dependent businesses. Still, infrastructure remains an area of focus for the Government as it is the primary driver of economic growth. Following are some of the key medium-long term initiatives that are at the root of this optimism.

- Target to make India a $5 trillion economy by 2025

- The National Infrastructure Pipeline with a capital outlay of Rs. 111 trillion between 2020 and 2025 (18% in Roads and 12% in Railways)

- National Rail Plan 2030 (including Vision 2024 which targets 100 % electrification of broad gauge)

- Rise in infrastructure spending to Rs.5.5 lakh crore in FY 22 focusing on building infrastructure to drive GDP growth in Budget 2021

- Budget emphasis on asset monetization (InvITs, FII participation etc.) to raise funds; setting up of a new Development Finance Institution (DFI) to provide debts to infrastructure sector; Intention to privatize PSUs and move to bare minimum presence in core areas

- Initiatives such as Bharatmala (Highways) and Sagarmala (logistics – waterways and coastlines)

Given the current environment, even if only a part of the above initiatives materialise, RITES will still stand to benefit, given its direct relationship with the Indian Railways and its long track record.

What makes RITES tick

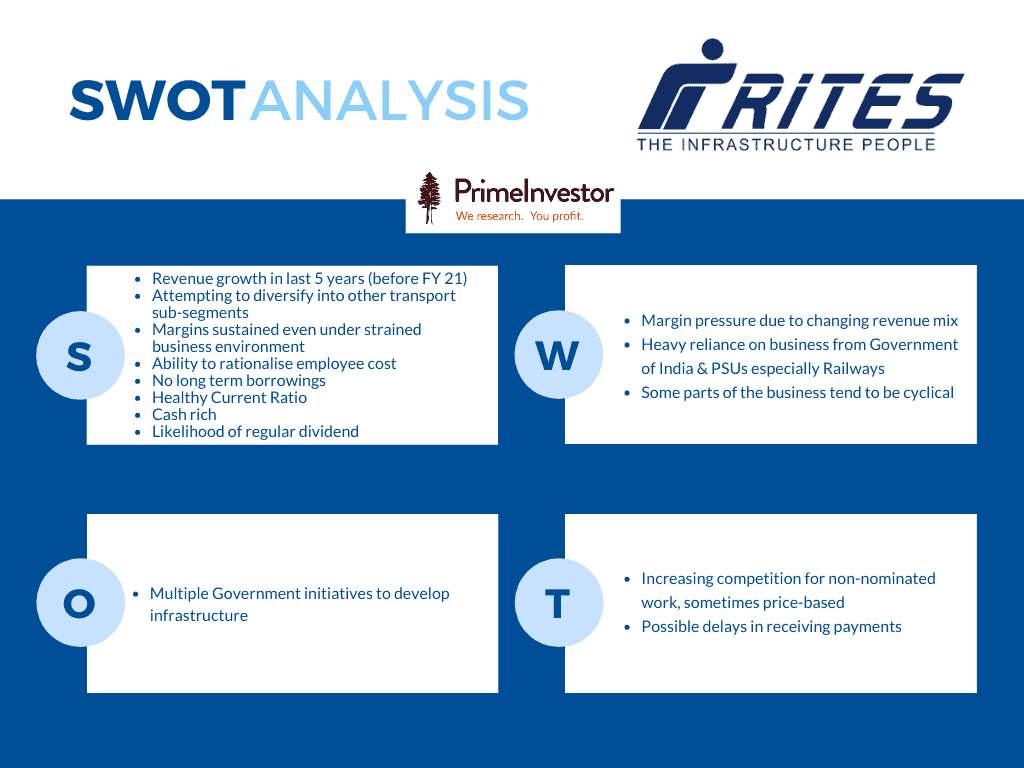

#1 Revenue Growth (pre-pandemic) & Sustained Margins

RITES more than doubled its operating revenue in the five years from FY 2015 t0 FY 2020 with FY 2020 showing a 22% growth over the previous year and also recording the highest ever total standalone revenue. Top Line growth, especially from 2018 onwards, has largely been led by exports and the low margin - high volume turnkey business. FY 2021 however, took a beating with revenue dropping by 25% to Rs. 1,797 crore, as the pandemic impacted the business on many fronts (disruptions in supply chain, restrictions and delays). Exports in particular took a hit with the company not being able to ship orders that were ready due to non-availability of ships and other supply chain disruptions. These are expected to take place in FY 2022.

The PBT margin, which sustained at 31% in FY 2018, FY 2019 and FY 2020 (despite a drop in share of the higher margin consulting business in total revenue during these years), saw a marginal drop to 29% in FY 21. EBITDA margin, likewise dropped 31% after staying steady at 33% for the previous three financial years. EBITDA margin however, remained higher than that of peers, Engineers India Limited (just over 12% in the latest fiscal), also an engineering consulting company but with a focus on the hydrocarbon space. What has protected the margins from a steeper fall is a higher proportion of high margin consultancy business (margins over 40%) and cost optimization measures, especially manpower rationalization.

#2 Diversified order book

The order book remained flat with a respectable Rs. 6,277 crore (3.5 times operating revenue of FY 2021) as on March 31, 2020. Despite the fact that it is barely higher (less than 1% higher) than the order position as on March 31, 2020 (Rs 6,223 crore, which was a record high then), the management is confident that this provides revenue visibility for the next 2 to 3 years. 71% of the order book is derived from Government & PSU clients. In line with RITES’ diversification measures and in response to requirements for end-to-end solutions, 35% of the order book comes from the lower margin turnkey business segment. However, as long as consulting remains the bread and butter of the company, it will continue to buttress the margins. Despite the pandemic, management remains optimistic and managed to bag several new orders in FY2021.

Encouragingly, RITES Limited continues to diversify into other transport sub-segments in addition to its strong suite – railways, and projects in Metros, High Speed Rail, DFC and Highways spaces are also being eyed for future business. This could, over time, see revenues get more broad-based rather than being primarily railways-driven.

Through its subsidiaries and JVs (REMCL and SAIL-RITES), RITES Limited participates in the renewable energy and wagon manufacturing spaces.

- Railway Energy Management Company Limited (REMCL), a JV between Indian Railways and RITES Limited (51%), has been tasked with handling power procurement under open access for Indian Railways in addition to planning and executing renewable energy and renewable energy projects. Currently, REMCL handles 1,400 MW purchase of power for Indian Railways but if 100% electrification occurs by December 2023, then this would move up to 4,000 MW. Revenue of REMCL dropped from Rs. 81 crore in FY 20 to Rs. 69 crore in FY 21 owing to less traction power demand during the pandemic and especially during the lockdown.

- SAIL-RITES Bengal Wagon Industry Pvt. Ltd, a JV between Steel Authority of India Limited and RITES (50%), manufactures wagons for domestic and international customers.

#3 Ability to Optimise Employee Costs & Productivity

Being a largely consulting organization, RITES Limited is asset-light and employees are key to the organization and employee costs are a very significant line item in the Profit and Loss Statement. This cost stood at 22% of operating revenue for FY 2020 and rose to 27% in FY 21 despite manpower optimization measures. Bearing in mind that FY 21 was an unusual year, employee cost as a percentage of operating revenue has steadily declined from the 31-32% seen in 2015 and 2016. This decline coincides with a shift in the revenue mix to a larger percentage from Turnkey projects which has in turn seen the revenue per employee climb up from what it was in 2015-16.

RITES employs manpower using a combination of regular employment, deputation, contract basis and retirees re-employed for expertise. This model has helped them be flexible when needed and has contributed to revenue / employee not dropping below FY 2019 levels despite a fall in revenue.

#4 Healthy Cash Position and Balance Sheet

RITES Limited (Standalone) has always had a healthy cash position in its balance sheet with owned cash and bank balances amounting to 22% of current assets and covering 38% of current liabilities in March 2020. Even though this dropped to 19% of current assets and 29% of current liabilities in March 2021, it stood at Rs. 889 crores. With a healthy cash balance, the expectation is that some of it would flow to the shareholders in the form of dividends and buybacks and this is what happened in November 2020 when RITES completed a buyback of 96,98,113 shares at an average buyback price of Rs. 265 per share utilizing Rs. 257 crores.

The current ratio too has always stood at above 1.5 with the ratio at March 2021 being 1.54.

In addition, RITES Limited (standalone) has no long term borrowings apart from its lease obligations.

#5 Likelihood of Steady Dividend

A dividend declaration of Rs.4 per share now takes the total dividend for FY 2021 to Rs. 13 per share. With a dividend payout ratio of over 60% in the last three financial years and a dividend yield of 4.8% (pushed down by a rising stock price in recent times), investors have the comfort of expecting a steady income. A recent advisory from Department of Investment and Public Asset Management (DIPAM) in November 2020 advocates for a quarterly dividend, which if followed will make dividend income even more steady and reliable for investors.

Areas of concern

#1 Margin pressure

Shift in Revenue-mix: A large part of RITES’ Limited’s business is derived from Indian Railways and more recently, RITES Limited has also diversified into many non-railway (highways and MRTS) consultancy projects. Further, in recent years, RITES has responded to a preference for end-to-end solutions and has participated in providing turnkey solutions for the Indian Railways in addition to leasing and export of locomotives. While the traditional consultancy business segment fetches a margin of over 40%, the turnkey business, while high in volume, only fetches between 2.5% to 3% margin.

The above diversification is clearly visible in the revenue mix that shows high volume turnkey business accounting for a greater proportion of revenue than it used to 5 years ago. Consulting business now accounts for a lower share of total operating revenue than it used to. While this may augur well for the topline, it has put pressure on the margins.

Additionally, export of rolling stock is cyclical in nature and dependent on provision of Line of Credit by the Government.

This trend in the revenue mix can be expected to continue as it is seen in the mix in the order book as well with turnkey business accounting for 35% and consulting for 40%. Management too intends to pursue diversified business segments focusing on various transport sub-segments, expanding its export business, strengthening its EPC / turnkey business especially electrification and its operations in the power procurement and renewable energy sector through its subsidiary REMCL but maintains that consulting will be the mainstay for RITES Limited.

Price based competition: Another factor that could exert pressure on the margins is that management expects, in future, work from Indian Railways and other Government agencies could be awarded based on competition / tendering process as against nomination which happens now. The management is confident that even if this were to be made competitive, business will still be won. However, the participation of private and foreign players could result in price based competition and put additional pressure on margins.

Client Mix: Currently, RITES gets approximately 2/3 of its work on nomination basis and a significant chunk of it comes from Government and PSU clients (71% of order book) especially the Indian Railways. This reliance on the Indian Railways could mean that impacts of policy changes and priorities would be amplified on RITES’ margins.

#2 Debtors

RITES Limited had improved its Receivable days which was above 150 in FY 2016 but in FY 2020 stood at 107 days. Correspondingly, the cash conversion cycle has overall improved from FY 2016 when it was over a 100 days to FY 2020 when it stood at a little over 80 days. This is likely in no small part due to the greater share of Turnkey business in total revenue where there is little to no working capital requirement. Turnkey business, which at this point is done only for Indian Railways, sees payments being received in advance in batches and being replenished periodically as against consulting where payments usually take 3-4 months / 100 days. When we adjust the receivable days to exclude revenue from turnkey (assuming all of the receivable does not include any amount from Turnkey revenue), the receivable days have in fact gone up in the last 3 years. This is based on the assumption that receivables pertain only to Consulting, Leasing and Exports. What could offset this concern is the fact that RITES derives a large part of its revenue from Government and PSU clients.

Working capital parameters have been adversely affected in FY 21 with receivable days rising to 141 (taking average debtors and not year-end). Inventories at the end of FY 21 too stood at Rs.286.16 crore as against just Rs. 10.67 crore in the previous year and Rs. 104. 93 crores at the end of FY 19.

Market Moves and Valuation

The performance of the RITES Limited stock has not been stellar, yielding negative 6-month and 1-year returns until very recently, reflecting the concerns investors have with regard to execution capabilities in a pandemic driven ‘normal’. The latest daily P/E stands at a little over 15 (Engineers India Limited is at a little over 13).

Bonus shares (1:4) were issued in August 2019. Further a buyback of 96,98,113 shares at an average buyback price of Rs. 265 per share utilizing Rs. 257 crore was completed in Nov 2020.

RITES Limited has not been a high beta stock and dividend yield stands at 4.9% (2.5% for Engineers India Limited). While a favourable balance sheet and dividend has worked in its favour, mediocre order book size at present and concerns over margins have pulled the stock down.

SWOT Analysis

3 thoughts on “Stock Review: RITES – A quality play on railway transport”

Simply Superrbbb

Hi, Good one, what I see many topics do not close with summary or a conclusive data. Thanks Siva

Hello sir, thanks. Our stock reviews would not have a call..so will not be conclusive. Vidya

Comments are closed.