The balanced advantage category (called the balanced advantage/dynamic asset allocation category or BA/DAA) has received a lot of attention, after a whopping collection of Rs 12,000 crore by SBI Balanced Advantage during its recent NFO. This category is mostly seen as one that delivers equity returns with less risk or one that can be used as an income generation option – neither of which are quite right. In this report we get into detail about one of our already recommended funds in this space, while also explaining when and how to use a fund in this category. See Prime Funds for other recommended funds.

About the balanced advantage category

The BA/DAA category seeks to dynamically manage the equity and debt allocation in a fund based on the AMC’s assessment of whether the market is overpriced or underpriced. To assess this, different fund houses use different models.

The equity held by these funds can range from 10-90% based on what their model says. An ideal model should allocate more to equities when markets correct and go significantly low on equities when markets peak. What this peak is, is the tricky part and that is where different funds behave differently.

These models have their own set of rules and filters and therefore unlike other categories, the outcome of the model can be vastly different. Not every fund house clearly spells out the details of its model. Instead, AMCs throw out a lot of jargon such as ‘pro cyclical’ or sentiment indicators with earnings drivers and so on. Hence, it is not easy for an investor to understand the differences between funds.

Still, you need to, at the very core, be aware of the following key characteristics when it comes to the BA/DAA segment.

- Most schemes in this space use a combination of fundamentals and sometimes technical indicators to decide how much net equity to hold at what point. Some like Edelweiss AMC for example, used more technical indicators both short and long term to assess the market trend while others are more fundamentally driven. In effect – no two funds are alike. If you see vast difference in the returns of the funds, it could merely be due to a model that favors higher exposure to equity than another that is more conservative to equity. Hence, returns alone cannot be a metric to identifying a poor performing fund.

- When we say a fund can reduce equity to even 10%, how does it manage to stay as an equity fund? That is where the role of derivatives come in. Derivatives are used to ensure the minimum average of 65% (net equity plus derivatives) is held to retain equity fund status for tax purposes. Derivative holdings are considered as part of equity holdings. In the derivatives allocation, a fund tends to look for arbitrage opportunities. When the model is bearish, the arbitrage exposure can increase. Conversely, when the model is very bullish, then the fund may not even hedge its equity position and hold completely unhedged equities.

- The balancing figure is held in debt. Debt holdings in these funds, per se, do not have any stated duration or accrual strategies. But that does not mean their papers are all high quality. A few can have some risky papers as well.

- Since there is a proportion of equity that is left unhedged, they are subject to the vagaries of the equity market. These funds have delivered negative returns even over 1-year periods. This makes them highly unsuitable for 1-year holding periods or for immediate income generation. Read our article for more details on whether you can use this category for income generation.

Purpose of the BA/DAA category

At PrimeInvestor, we see the purpose of this category and its use as follows:

- We think the primary job of this category of funds should be to reduce the volatility that comes with pure equity funds and still benefit from holding equity. These funds, by their very model, cannot deliver high returns like pure equity funds over the long term. If you see them delivering high returns, it is more an aberration than a norm. If you expect higher returns, then other pure equity fund categories would suit better.

- We think these funds are suitable for those who are particular about tax efficiency and want to hold equity funds for shorter duration (like 2-3 years) or want debt plus returns for shorter duration.

- We also think that these funds have limited use for a long-term equity portfolio. A combination of equity and debt should do the job. But if you are someone averse to pure equity and are happy with lower than equity returns, then no harm holding them for the long term.

Our call in the category

We have 2 fund recommendations in this space in our Prime Funds. Of the two, we think DSP Dynamic Asset Allocation stays closest to the purpose that we have defined for this category – low volatility, low downside and deliver debt-plus returns. The other fund, we would say, has a marginally higher element of risk and meant for those who can take volatility. Therefore, you will see that in Prime Funds, this fund is bucketed as ‘Hybrid equity – low risk’ while the other fund is in the ‘Hybrid – moderate risk’ category.

DSP Dynamic Asset Allocation uses a combination of price earnings ratio and price to book ratio to arrive at what it calls as its ‘core equity allocation’. These valuation ratios are considered in relation to historical averages, to determine whether market is relatively cheap or expensive. However, so as not to lose out on market momentum, the model has a ‘add-on’ metric using technical indicators to capture uptrends. This may add up to another 10% in equity and is useful when fundamentals look expensive but the market rallies on strong momentum. But it remains primarily a fundamental-driven model.

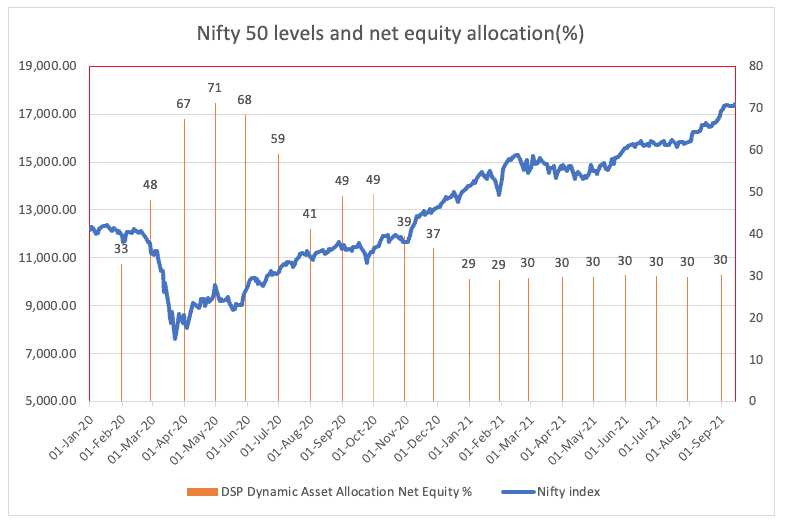

The image below will illustrate how the net equity allocation moved as the markets corrected or moved higher. The image below shows that the fund has steadily reduced its exposure to equity since the beginning of 2021 as valuations surged ahead of long-term averages.

We have mentioned in various other articles on this subject, on how the net equity allocation varies across funds. At present, the more popular ones such as Edelweiss Balanced Advantage holds about 60% in equities while ICICI Balanced Advantage 38% – as opposed to 30.2% by DSP Dynamic Asset Allocation.

(You will soon be able to check such allocation details, as well as many other useful analyzed data using our MF Screener that is in works).

The model used by DSP is clearly more reliant on fundamentals than technical as it captures less of the market momentum than peers like Edelweiss. We view this as being more conservative, and in keeping with the purpose of the category, than a limitation.

Performance and portfolio

DSP Dynamic Asset Allocation beat its category average on a rolling 1-year return basis (rolled for 3 years) 74% of the times as against category average of 56%. This performance largely stems from its steady trait of being low on volatility. Some of these numbers below will speak of its low volatility characteristic compared with popular peers.

Needless to say, if you were to pick funds from this category based on 1,3- or 5-year returns, the peers above will score over DSP Dynamic Asset Allocation. As mentioned earlier, our call on this fund is based on what we think is the key purpose of holding this category. And so, the best fund in this category is not the top-returning fund.

The one-year return trends for DSP Dynamic Asset Allocation in the current year has been trailing the category average, but that has been due to lowered equity allocation compared with most peers. We think such allocation appears prudent at current market levels.

DSP Dynamic Asset Allocation held over 80% in large caps and had large portfolio of about 120 stocks as of August 2021. It was underweight financials as well as technology. In debt, it held government papers that expire in the next one year besides treasury bills and AAA-rated NCDs. Debt holding was under 30% as of August 2021.

For 5-year periods, if you can handle volatility then diversified equity funds with debt for asset allocation can serve you better.

The fund is managed by Atul Bhole, Abhishek Ghosh and Laukik Bhagwe.

25 thoughts on “Prime Recommendation: The best fund in the balanced advantage category”

Hi Vidya, is there an article on the basics of derivatives/arbitrage/hedging so I can understand the concepts better there by helping make better investment decisions? Thanks.

We don’t have one yet. We will consider. thanks, Vidya

Comments are closed.