The Bharat Bond ETF will open on December 12 and close on the 20th. Most of you would have read about the ETF in the news. PrimeInvestor had briefly covered it last week, where we discussed the emergence of a new class of debt ETF. With all the details about the Bharat Bond ETF now out, let us move to specifics about the Bharat Bond ETF from Edelweiss AMC.

You can get your basic questions on the bond ETF answered here.

We’d like to focus on lesser known/published facts about the index and ETF before we get into looking at its suitability for you.

Are my returns fixed?

Bharat Bond ETF and the Bharat Bond FOF (fund-of-fund) have fixed maturities and not fixed returns. What do we mean by this? The product presentation says, at present (December 5, 2019), the 2023 Bond index has a yield of 6.69% and the 2030 index has a yield of 7.58%. This means if you buy the ETF now and hold them till maturity (the underlying bonds have maturity close to that of the ETF) your return will roughly be the same as the yields mentioned.

So, what happens if you buy the ETF or the FOF later? You may not get the same yield!

For example, if interest rates further fall, the price of the bonds (and therefore the ETF) may go up. If this happens, you will be buying at a higher price thus lowering your yield. The converse is true if interest rates go up. In essence, your yield is determined by the time of your entry (assuming you hold to maturity). So, is there a risk if you buy later? There certainly is. We’ll discuss on how to get over this in our last section.

If I lock at current yield, will that be my actual return?

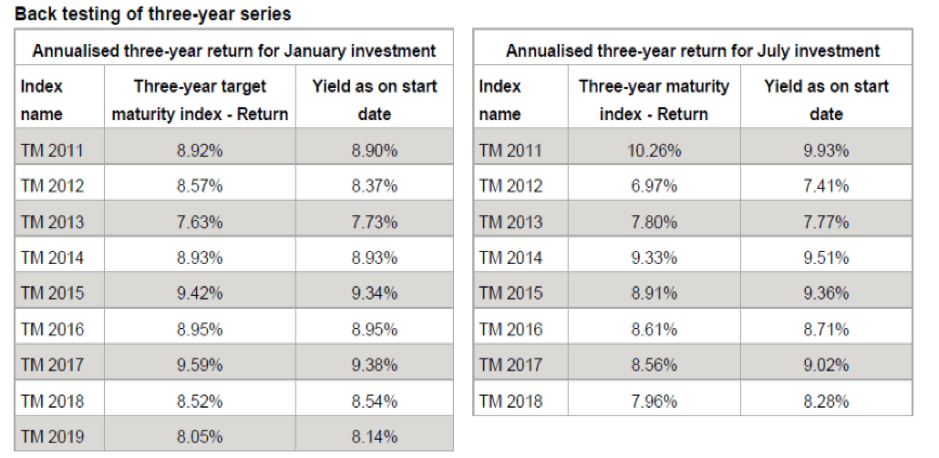

Your return will hover around the yield, if no severe incidents like sharp downgrades happen. This holds if you buy in the NFO and hold till maturity. A CRISIL report throws some light on how bond yields and actual returns on maturity turned out to be. For this purpose, it built a model portfolio with bonds, took 2 different investment dates every year and calculated the returns 3 years hence. You can see from the table that the returns are not way off from the yields The slight variation happens based on how the yield curve itself behaves and due to the entry and exit of investors at different stages of the interest rate cycle. Suffice to know the return may not exactly match the yields, but will still be very close.

Is the current yield good enough for me to invest?

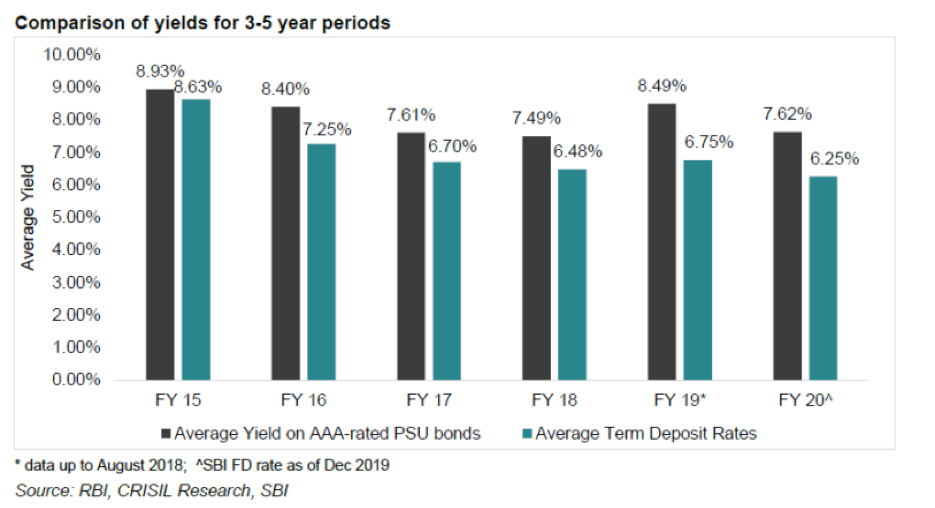

If you go by the 6.25% interest rate on SBI deposits, the yield of both the 2023 and 2030 bond indices looks better. CRISIL’s data on comparison of deposit interest rate with the yields of such bonds with a tenure of 3-5 years says it is good enough. Here’s CRISIL’s data. And remember this is pre-taxation. Since you get indexation benefit for any period over 3 years, the post-tax is certainly beneficial – at least for most investors. We discuss this again in our last section.

The bonds are AAA-rated and considered safe. But what if they are downgraded or if the government sells those companies?

If a bond’s rating goes below AAA (and still investment grade), the index will exclude it in the next rebalancing (quarterly) date. If the bond goes below investment grade, the bonds will be excluded by rebalancing within the next 5 days. Of course, the ETF will also have to act with the same alacrity or will have to borrow time if it is unable to do so. Either way, the index constituents are meant to remain high quality. But here’s the risk – If a downgrade happens, the ETF cannot be immune to the mark down, especially if it goes below investment grade. Yes, such a risk is very low but not nil.

As for disinvestment, PSUs that have a disinvestment plan when the index is launched have been excluded. If they come under such a plan later, they shall be excluded once disinvestment is complete.

To summarize, the ETF will remain invested in bonds of PSUs To this extent, it seeks to be a high-quality portfolio.

Will there really be liquidity for these ETFs? Can I buy or sell them when I want to?

The AMC is appointing a market maker which will essentially create or suck liquidity as needed, to ensure that the market price of the ETF is closer to NAV and. This can be expected make it easier for you to also buy and sell. While we will know the real state of liquidity only when the ETFs are listed for a few months, having an active market maker can help ensure liquidity.

This ETF also plans to force most buyers/sellers to make their transactions through the exchanges by restricting direct access (unit creation or redemption) through AMC to over Rs 25 crore. That means unlike other ETFs where investors can approach the AMC for a few lakhs, such transactions will be aided by market makers and this can be expected to provide liquidity.

But if you simply want to own debt as an asset class for the long term, the 10-year 2030 ETF is a great option. It helps you lock into decent yields (7.58%) and provides significant indexation benefit over a 10-year period.

One other factor to consider is the liquidity of the underlying bonds. This is important because the index plans to do a quarterly rebalancing. This can be done with ease as an index is, well, just a theoretical construct. But will the ETFs have enough liquidity in their underlying bond holdings to do this? According to data from CRISIL, all the underlying issuances had 100% liquidity (this classification is based on number of trades and spreads) for the past 5 years barring just one instrument that was semi-liquid for about 3 months in the 5-year period considered. In other words, the current constituents appear to be liquid going by past data. But there can be newer issuers, whose liquidity we may not know. And that’s the next point.

Will the bonds mentioned in the index now remain through the 3/10 years?

No, the same bonds may not remain. Fresh eligible issues may come in (as long as their maturity and yields are reflective of the index’s) and some may need to be exited (like those downgraded or where the government has divested). Besides, the ETF may not always be able to get the same bond that the index has. They would be allowed other issuances of same quality, yield and maturity (within the permitted universe), subject to some element of deviation.

Ok, I’ve patiently read this! Should I invest or not?

Thanks for your patience! Here it is ?. Different strokes for different folks.

- For regular income – not the best option: This ETF is not meant to generate regular income as there will be price volatility and you can’t automate exits in an ETF unless your broker has a way to provide the same. If you still wish to hold it, opt for the 10-year fund-of-fund and go for a systematic withdrawal plan. Do not withdraw over 4-5% of your corpus annually and be prepared for dips in the corpus during your holding tenure due to price volatility.

- For long term for those in the lowest tax bracket: We think the Post Office time deposit offers a better rate for you, even post tax. The RBI taxable bond, too, is good.

- For those in the 20-30% tax bracket: If you want to align investment to any 3-year goals, a safe, low risk short duration or ultra-short debt fund should serve your purpose. Our analysis of 3-year returns rolled daily for the past 5 years shows that ultra short funds (including low duration, money market and floater) delivered over 7% returns 91% of the times. Short duration (and banking & PSU debt funds) delivered the same 89% of the times. This probability is good enough, even after considering the severe hit that funds took in the past year. But if you simply want to own debt as an asset class for the long term, the 10-year 2030 ETF is a great option. It helps you lock into decent yields (7.58%) and provides significant indexation benefit over a 10-year period. Go for it now and hold till maturity if you are a passive retail investor. If you are keen to test waters only for 3 years, reduce your duration risk by re-investing in longer duration debt ETFs available then when the 3-year matures.

- If you wish to invest later: Like we discussed earlier, buying in the market entails price risk. Your yield will be higher if you buy at a price lower than now and vice versa. Essentially it is about timing it right. To avoid this, one option is to go for a SIP in the 10-year fund-of-fund and average it (continue SIP) for a 3-5-year period to reduce the risk of timing it wrong over rate cycles.

- Senior citizens: Senior Citizens Scheme, Pradhan Mantri Vaya Vandana Yojana, RBI bonds and bank deposits should be your options before this ETF or fund-of-fund.

- For NRIs: Go with your NRE deposits for 3 years. If you want a 10-year debt product or want to actively play the bond market, this (10-year) can be a good start.

And for all those who buy and hold the ETF or FOF, please note that price volatility is inevitable in any traded security. Expect the same here and don’t get spooked.

Last question: Should I necessarily hold this till maturity?

If you hold the ETF till maturity, your price risk will be lower. But if you know your ETF has delivered well and you need the money, please go ahead and exit especially if you’ve crossed 3 years. Also, some day, if PSUs issue attractive tax-free bonds in large numbers and your ETF has delivered reasonably, you could decide to move out. Minimum investment in the ETF and FoF is Rs 1,000. You can invest in the ETF through your demat account and in the FoF directly through Bharat Bond or through any online or offline platform/advisor. Happy investing!

3 thoughts on “Bharat Bond ETF – facts to know before you invest”

Beautiful and thorough analysis as usual. I liked the parts which cover the market maker aspects of the units and the implications of people trying to sell before maturity.

Please keep such good stuff coming along.

Sir, Thank you for the very kind words and encouragement. regards, Vidya

Nicely summed up. Unbiased recommendation. True to your commitment.

Regards,

Comments are closed.