MF Switch Tax Calculator

Know what Mutual Fund Switch Tax Calculator can do

Mutual fund switch tax

A switch from one mutual fund into another may seem like the right thing to do when you are holding an underperforming fund or one which carries a SELL recommendation. But you could have invested a large amount in such a fund, and the absolute tax outgo that you will have to bear when you exit the fund may have you hesitating. Your new investment has to make up for the tax outgo and deliver better than your current fund, too.

Therefore, you are left with the following dilemma:

Should you cash out of your current fund and switch into a new one? Or should you continue to hold on to your underperforming fund, save the taxes, and hope that it eventually picks up?

Our Mutual Fund Switch Tax calculator makes it easy for you to resolve this dilemma by quantifying the impact of the mutual fund switch tax. With this interactive calculator, you will know:

- Just how much additional returns your new fund will have to generate in order to make up for the tax cost you’re bearing.

- Whether or not you should switch from your current fund to a new fund

How to use the Mutual Fund Switch Tax Calculator

The Mutual Fund Switch Tax calculator needs 3 inputs from you, in order to quantify the tax impact of mutual fund switch and to help you understand whether you should undertake the mutual fund switch.

- Your current mutual fund details: This refers to your underperforming or ‘Sell’ fund that you want to switch out of. Enter your current mutual fund details – the original invested value, the duration you held this investment for and the current value. If the fund is a debt fund, mention whether it is a debt fund bought before April 1, 2023.

- Expected returns: Enter information about the returns you expect from the old fund and the potential new fund you’re considering. Be realistic about the returns you expect. A reasonable assumption is that your new fund should deliver more than your current fund, but avoid going too overboard on return assumptions.

- Capital gains details: Input details regarding the current exemption available for capital gains, current tax rate for your fund, and what you expect this rate to be in future when you sell the fund (old or new).

- Holding timeframe: This is the period for which you will hold your investment (whether you continue with the existing fund or switch to a new fund and hold that)

How does the Mutual Fund Switch Tax Calculator help?

The Mutual Fund Switch Tax Calculator takes in the inputs you provide. It calculates the outcome of staying in the existing fund versus switching to a new fund, after accounting for key factors like capital gains taxes, tax exemption limits, and the compounding effect of returns.

The Mutual Fund Switch Calculator helps you arrive at the financial implications of switching versus not switching. It tells you the final investment value post tax in two scenarios:

- Staying with the current fund and paying taxes only at the end

- Switching to a new fund and paying taxes now at redemption, and later at the end of the period

This empowers you to make a holistic assessment and determine whether switching makes financial sense for your unique situation. The goal is to arrive at an assessment like, “For this switch to be beneficial for me, the new fund would likely need to outperform the old fund by at least XX% per year.” This is what the mutual fund switch tax calculator will help you do.

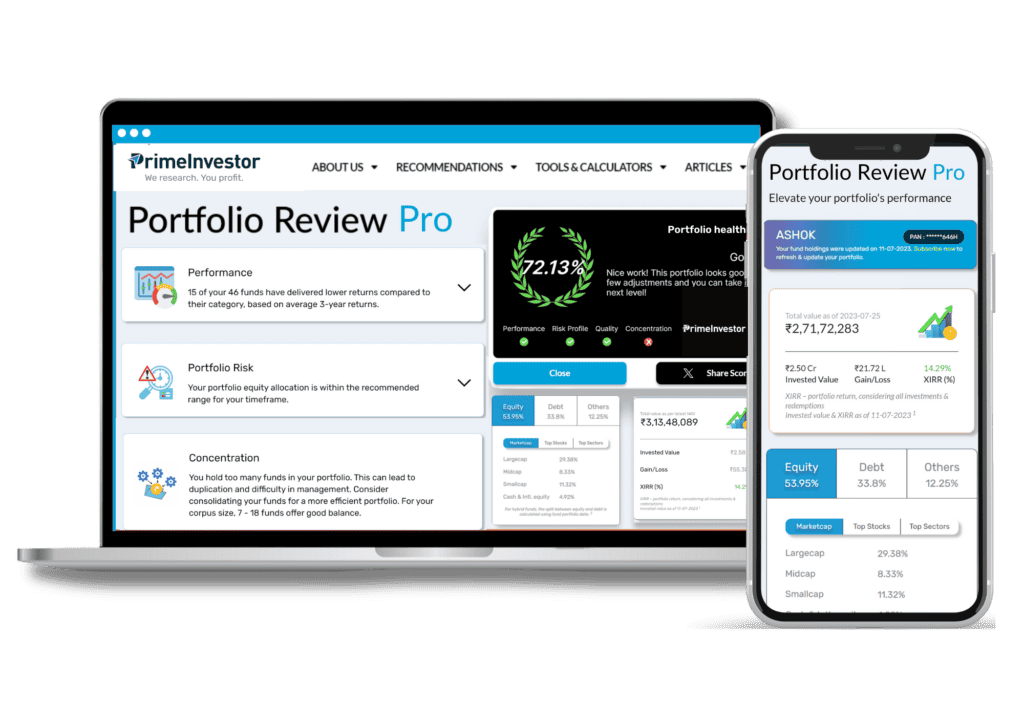

Review your mutual fund portfolio now !

FAQ