NFO Review: Mirae Asset S&P 500 Top 50 ETF and FOF

Mirae Asset S&P 500 Top 50 ETF and FOF is a new NFO to hit the market, as part of this passive pipeline that will invest in the ETF. Does this index make for a good portfolio addition?

Mirae Asset S&P 500 Top 50 ETF and FOF is a new NFO to hit the market, as part of this passive pipeline that will invest in the ETF. Does this index make for a good portfolio addition?

Balanced Advantage Funds for SWPs – Last week saw the NFO of SBI Balanced Advantage Fund close – and collect a whopping Rs 14,500 crore. That puts it in third place, in terms of size, in the balanced advantage/dynamic asset allocation category. A lot of the attraction here for investors, seeded by the distributors and the fund itself, centered around the scheme’s ability to offer monthly income.

For the first quarter of FY-22 listed steel stocks have generated profits that are already three-fourth that of the full year ending FY-21. The sector has thus stood out for its June quarter earnings, the 2nd wave of Covid lockdown and drop in consumption notwithstanding. Higher prices and export opportunities buttressed earnings despite a drop in domestic sales.

At PrimeInvestor, we did not add any debt fund in the credit risk space when we started out in 2020. And even when a fund we recommended held partial credit risk, we made sure we classified them as high risk-long term. We did not pick any fund from the credit risk category as funds were busy segregating their bad assets.

In the first of our updates in this review cycle, we explained the changes we have made to Prime Funds, our recommended fund list. In this second update, we thought to cover two different aspects: one, changes we made to our MF Review Tool, in the way we call out our recommendations. Two, trends we have observed unfolding over the past couple of quarters that we’re keeping a watch on.

We are living in strange times. No, I am not talking of Covid-19. Your one-year returns of equity funds (across categories), at an average 31% between January to March 22, 2021, zoomed to an average 69% since March 23, 2021. In other words, 1-year returns suddenly doubled from March 23, 2021. If you recall, March 23 2020 was a market low. So, 1-year returns from March 23, 2021, have started looking abnormally high.

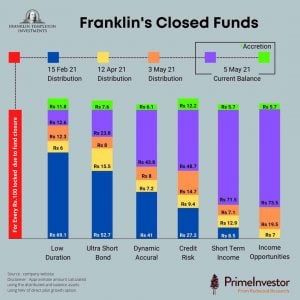

SEBI has come out with its order regarding l’affaire Franklin Templeton debt funds. The 100-page document is categorical in its indictment of the AMC and the ways in which these debt funds were managed. 2 messages are clear from the order: One, investor protection is paramount to the regulator. Two, fund managers and AMCs cannot take their fund management responsibility lightly.

With interest rates being where they are – i.e., stable with no clear signs of a move upwards or downwards – you would wonder where you could hold investments meant for a 2-3 year timeframe. And many of you also wonder if the best option you have is to go for floating rate debt funds as they would have an edge over other debt fund categories.

Updated on 4th Sep, 2023 Franklin Templeton has made another tranche of repayment to investors in its six shuttered funds. Each of the six schemes

There’s another index that gives mid and small-cap funds a good run for their money while housing far bigger names. This is a high return index if highly volatile one, and can be used in long-term portfolios to give returns a boost.

Mirae Asset has come out with a NFO of NYSE FANG+ ETF and a fund of fund (FOF) with the same underlying ETF. This ETF

A recent addendum by Aditya Birla Sun life suggested that investors rollover some of the AMC’s FMPs that are maturing. The reason was that given the low-rate scenario, investors are unlikely to get good interest rates outside once they exit. And that staying invested would provide indexation benefit for capital gains and earn higher returns.

But some investors raised the doubt on whether the FMPs under question were in trouble. We therefore looked at their portfolios. They had high-quality AAA-holdings are unlikely to have had any pressure on repayment. In other words, there does not appear any credit related rollover compulsion.

Legal Disclaimer : PrimeInvestor Financial Research Pvt Ltd (with brand name PrimeInvestor) is an independent research entity offering research services on personal finance products to customers. We are a SEBI registered Research Analyst (Registration: INH200008653). The content and reports generated by the entity does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information are provided on an ‘as is’ basis by PrimeInvestor Financial Research Pvt Ltd. Information herein is believed to be reliable but PrimeInvestor Financial Research Pvt Ltd does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The services rendered by PrimeInvestor Financial Research Pvt Ltd are on a best-effort basis. PrimeInvestor Financial Research Pvt Ltd does not assure or guarantee the user any minimum or fixed returns. PrimeInvestor Financial Research Pvt Ltd or any of its officers, directors, partners, employees, agents, subsidiaries, affiliates or business associates will not liable for any losses, cost of damage incurred consequent upon relying on investment information, research opinions or advice or any other material/information whatsoever on the web site, reports, mails or notifications issued by PrimeInvestor Financial Research Pvt Ltd or any other agency appointed/authorised by PrimeInvestor Financial Research Pvt Ltd. Use of the above-said information is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. All intellectual property rights emerging from this website, blog, and investment solutions are and shall remain with PrimeInvestor Financial Research Pvt Ltd. All material made available is meant for the user’s personal use and such user shall not resell, copy, or redistribute the newsletter or any part of it, or use it for any commercial purpose. PrimeInvestor Financial Research Pvt Ltd, or any of its officers, directors, employees, or subsidiaries have not received any compensation/ benefits whether monetary or in kind, from the AMC, company, government, bank or any other product manufacturer or third party, whose products are the subject of its research or investment information. The performance data quoted represents past performance and does not guarantee future results. Investing in financial products involves risk. Investments are subject to market risk. Please read all related documents carefully. As a condition to accessing the content and website of PrimeInvestor Financial Research Pvt Ltd, you agree to our Terms and Conditions of Use, available here. This service is not directed for access or use by anyone in a country, especially the USA, Canada or the European Union countries, where such use or access is unlawful or which may subject PrimeInvestor Financial Research Pvt Ltd or its affiliates to any registration or licensing requirement.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Compliance Officer Details: Name: Srikanth Meenakshi; Email: contact@primeinvestor.

Grievance Officer Details: Name: Srikanth Meenakshi; Email: contact@primeinvestor.