PrimeInvestor Recommendation: A passive option to beat other passive and active strategies

Should Nifty 50 be your only choice to play passive? What if a smarter fund can return better than the Nifty 50 or the Nifty

Should Nifty 50 be your only choice to play passive? What if a smarter fund can return better than the Nifty 50 or the Nifty

If the recent events in the debt space brought to light the liquidity risk arising from lower rated papers, you probably haven’t seen the unfolding of various kinds of risk since September 2018. In 2013, when duration became a risk on the back of rate hikes, money flowed copiously to credit risk over the next 5 years. Now, the cycle has turned. Money is moving to duration from credit risk.

The Securities Exchange Bord of India (SEBI) recently came up with a circular that requires AMCs to list schemes that are being wound up. This

Active funds or index funds is a call that continues to remain elusive in the Indian context. While that debate goes on, there is another emerging class of funds – not too active not fully passive. They are quant funds.

Franklin India came out with a communication dt. May 14, 2020 to its investors, on its 6 debt schemes to be wound up. The communication, after apologizing to investors, had the following key points.

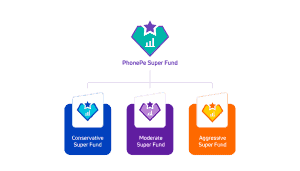

When PhonePe announced last week that they were expanding their mutual funds offering on their app by offering so-called ‘Super Funds’, I was actually quite excited. I was an early adopter of the UPI app, and till date, it is my primary app for money transfers. They probably have the cleanest UX among all UPI apps and I was keenly watching their entry into MF services.

A recent query we received from a customer concerned Aditya Birla Sun Life Frontline Equity. Our MF Review tool throws up a sell on this fund. The questions raised were: Why, since it was a fund that had been delivering returns and was considered among the best funds and was highly rated.

Over the course of the last 2 weeks, following the Franklin debt funds’ fallout, many of you (our subscribers) have written to us seeking answers to a number of questions on the debt funds you hold.

For a long-term investor, is an ETF a better or poorer option compared to index funds? Which is more expensive in the long term? Can one replace your recommendations of index funds (or FoF, like Motilal Oswal Nasdaq 100 FoF) with the corresponding ETF? It’s a little confusing because your Prime Funds and some of your portfolios recommend ICICI Prudential Nifty Next 50 Index fund, but ICICI Prudential Nifty Next 50 ETF is not recommended in Prime ETFs or portfolios. Shouldn’t the performance be same? And what is the impact of tracking error on investor returns?

After the Franklin Templeton debacle, CEOs of asset management companies have been out in big numbers across media to reassure investors that this was an isolated case and that there’s no crisis for the debt fund industry itself.

Kotak Flexicap fund suits any investor with a timeframe of 4 years and above. Here’s why the fund makes a good investment. When stock markets are volatile and there’s uncertainty all around, you need an option that can navigate across markets, that’s steady in strategy, and that is large-cap based.

Question

I have invested some money into Franklin Savings.

I was going through the fund disclosure for the month of March 2020 and saw negative cash balance. Does this mean they have borrowed to honour redemptions?

Legal Disclaimer : PrimeInvestor Financial Research Pvt Ltd (with brand name PrimeInvestor) is an independent research entity offering research services on personal finance products to customers. We are a SEBI registered Research Analyst (Registration: INH200008653). The content and reports generated by the entity does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information are provided on an ‘as is’ basis by PrimeInvestor Financial Research Pvt Ltd. Information herein is believed to be reliable but PrimeInvestor Financial Research Pvt Ltd does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The services rendered by PrimeInvestor Financial Research Pvt Ltd are on a best-effort basis. PrimeInvestor Financial Research Pvt Ltd does not assure or guarantee the user any minimum or fixed returns. PrimeInvestor Financial Research Pvt Ltd or any of its officers, directors, partners, employees, agents, subsidiaries, affiliates or business associates will not liable for any losses, cost of damage incurred consequent upon relying on investment information, research opinions or advice or any other material/information whatsoever on the web site, reports, mails or notifications issued by PrimeInvestor Financial Research Pvt Ltd or any other agency appointed/authorised by PrimeInvestor Financial Research Pvt Ltd. Use of the above-said information is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. All intellectual property rights emerging from this website, blog, and investment solutions are and shall remain with PrimeInvestor Financial Research Pvt Ltd. All material made available is meant for the user’s personal use and such user shall not resell, copy, or redistribute the newsletter or any part of it, or use it for any commercial purpose. PrimeInvestor Financial Research Pvt Ltd, or any of its officers, directors, employees, or subsidiaries have not received any compensation/ benefits whether monetary or in kind, from the AMC, company, government, bank or any other product manufacturer or third party, whose products are the subject of its research or investment information. The performance data quoted represents past performance and does not guarantee future results. Investing in financial products involves risk. Investments are subject to market risk. Please read all related documents carefully. As a condition to accessing the content and website of PrimeInvestor Financial Research Pvt Ltd, you agree to our Terms and Conditions of Use, available here. This service is not directed for access or use by anyone in a country, especially the USA, Canada or the European Union countries, where such use or access is unlawful or which may subject PrimeInvestor Financial Research Pvt Ltd or its affiliates to any registration or licensing requirement.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Compliance Officer Details: Name: Srikanth Meenakshi; Email: contact@primeinvestor.

Grievance Officer Details: Name: Srikanth Meenakshi; Email: contact@primeinvestor.