What’s a corporate action? They include bonuses, stock-splits and buy-backs and are some of the most welcomed corporate actions. Bonus shares are considered as a reward in the form of free shares. Stock splits are generally taken to be a measure to increase the liquidity in a stock. Buy-backs generally happen at a mature stage in the life-cycle of companies when they want to return excess cash.

Corporate action news is invariably met with stock price movement. So, what should you read into a company’s bonus, stock split or buy-back? Can these moves give you an idea about a company’s growth?

Bonus – a reward with some meaning

In a bonus issue, shareholders are given additional free shares as a proportion of the shares they hold. For example, a 2:1 bonus issue means every shareholder will get 2 additional shares for every one share held.

Of-course the stock price will get adjusted to the increase in number of shares and do not provide any additional price appreciation due to the event. So how are bonuses viewed?

The bonus impact

Conventionally, it is viewed by investors as confidence in a company’s management in the growth of the business. For one, as the company needs to pay a dividend on enhanced equity capital, it is perceived that only companies that are confident of the same issue bonus shares. Two, it creates a perception of a larger size and signals a sense of confidence in a company’s ability to continue growing. Three, it enhances a stock’s trading liquidity.

Bonus issues in general don’t really ‘reward’ investors as such, since price automatically adjusts to the bonus. But if such companies dole out more bonuses with enhanced dividends over time, they become money machines in the long run. A few such examples are below.

When companies issue bonuses

Bonus shares are more likely in companies with high free reserves, faster accumulation of these reserves and generating a higher level of free cash. Generally, liberal bonus issues come from companies that demand lower capital intensity, are less cyclical in their business and are growing at a steady pace. Such companies may be debt-free, and so they need to service only equity shareholders with their profits.

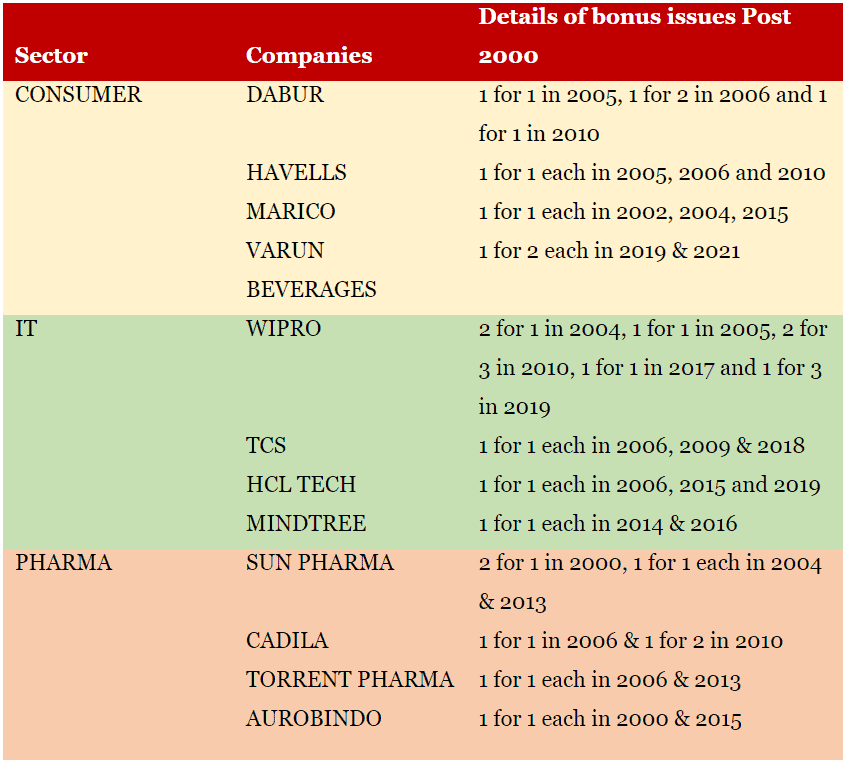

In the past, companies from sectors like FMCG, IT services, or pharmaceuticals have made generous bonus issues. A few examples are listed below.

There are capital-efficient companies in other sectors as well, such as two- wheeler automobile manufacturers, consumer electronics/electrical companies, top-tier engineering/capital goods companies, etc. that have issued bonus shares in the past.

On the other hand, bonus issues have been few from sectors such as banking or NBFCs, where capital requirement is typically high. High capital requirement and cyclicality deter their ability to payout liberally. Their RoEs are also moderate, leading to lesser accumulation of free reserves as compared to capital-efficient companies from other sectors. These businesses also carry the risk of write-offs that eat into their reserves in bad times.

The few cases where companies in such sectors did dole out bonuses include ACC & Ambuja Cements, from the cement sector, Tata Steel & Hindalco from metals, in the pre-2000 period. Kotak Bank has been known for liberal bonus issues until 2005, when it was a fast-growing financial services Co before it converted into a bank.

What to watch out for

However, it’s not always a positive outcome, nor is it necessary that it’s only a stable, growth company that issues such bonuses. Reliance Power issued bonus shares in the ratio of 3:5 in 2008. That could be the first major case to point out where a company that was yet to start earning from business issued bonus shares. Many other companies followed suit such as HDIL (2008), JP Associates (2009), Hindustan Construction (2010), IVRCL Infra (2010) , Va-Tech Wabag (2015).

Beware of such things in future too. Remember that a bonus issue is more a sentiment driver than a real, tangible addition to your returns. Therefore, do your check on management quality, growth prospects, quality of balance sheet (debt free status), free cash flow generation, visible cash accumulation and dividend payment track-record if you are interested in bonus candidates.

Stock split - nothing much on future

In a stock split, a company reduces the face value of each stock to increase the number of stocks. In simpler words, one stock is split into more stocks. For example, a Rs 10 face value stock can be split into 2 stocks with a face value of Rs 5 each. The stock’s price is also adjusted for the split.

Stock splits don’t offer much insight into the future of the company. The common notion and aim behind a stock split is that it increases liquidity in a stock. On the other hand, it may lead to excessive speculation also in such stocks.

When stock splits happen

Stock splits are generally followed after a huge rally in stock prices, especially in a bull market, and also where dividend payouts are smaller. These rallies can result in a very high absolute price (not valuations), which reduces liquidity, can increase impact costs, and make it harder for investors to invest.

Companies thus undertake stock splits to accommodate a larger investor interest and enhance liquidity. But what a split also serves is to influence the behavioral side of investors by attracting them to these stocks.

While tech/e-commerce players like IRCTC and Affle India have recently announced stock splits, others that went up multi-fold in the recent past and underwent a stock split include Dixon Technologies and IEX.

What to watch for

Because stock splits lead to a spike in interest and activity in a stock, beware of companies affecting splits for NO purpose other than lifting stock price and enticing retail investors into speculation. Always run your regular checks on company growth and quality, and don’t use stock splits as the only reason to enter a stock.

Buybacks – worth putting on watch

Buyback is a process where companies use cash on their balance sheet to buy back equity shares from the shareholders. The process extinguishes the number of available shares to the extent of the buyback. Companies use this route when they want to return excess cash to shareholders.

If bonuses and stock splits are more sentiment drivers than an actual shareholder reward, a buyback is different. A buyback increases the EPS and Return on Equity (RoE) due to reduction in equity. Buybacks are usually at prices higher than prevailing market prices as well.

Thus, it is considered as a corporate action that enhances value for existing shareholders. Most buybacks are priced above prevailing market prices, which is an added advantage.

As per SEBI regulations, a company is allowed to buy only up to 25% of the share capital in a buyback. Generally, most buybacks are less than 10% and there have only been few cases where companies bought back as much as 20% of the capital.

When companies may buyback

Companies generally use buybacks when they are in a low growth phase, or when they are sitting on sizable reserves with limited avenues of redeployment into expanding business (or when funding such expansion can still be done with the size of the reserves). It can also happen when there is significant pressure from investors for returns or utilization of cash. This exercise of optimizing the capital structure gives some leg up to returns.

The IT sector is a great example. Almost all the top-tier IT companies, which were generating colossal cash flows, returned this cash to shareholders through buybacks between FY-17 and FY-21. Due to reduction in share capital and free reserves pursuant to buy-back, it has an effect of increasing the EPS and RoE of these companies.

There were some under-appreciated buybacks as well in the recent past from PSU metal companies such as NALCO and NMDC. Such buybacks were of unbelievable magnitude in terms of the percentage of shares bought back. Buybacks to the extent of 20-25% of share capital have been rare in India. Such cases throw insight on the extent of undervaluation in these stocks.

NALCO’s buyback took place in 2017 at Rs.44 per share. NMDC’s buyback was in 2017 at Rs.94 per share. NMDC and NALCO have paid cumulative dividends of Rs. 8,200 crore (Rs.28 per share) and Rs. 3,500 crore (Rs. 19.25 per share) respectively in the last 5 years and are still cash-rich.

In the case of commodity companies, if they are not incurring losses at the bottom of the cycle and have enough cash for buybacks, that’s something to be noticed. These companies have also seen significant revival of fortunes with rise in commodity prices.

De-Jargonizer - Acceptance Ratio in buybacks

Acceptance ratio is the number of shares accepted in a buyback offer as compared to the total number of shares tendered. A lower ratio means that one will have a smaller share of their holdings being successfully bought back, leaving a larger number of shares remaining with them. As per Sebi norms, 15% of the total buyback size is reserved for small investors with holdings of up to Rs 2 lakh in the company. For those with holding value above Rs. 2 lakh, the acceptance ratio will be in the same proportion as offered in the buyback.

Consequently, in the case of companies with high promoter holding, the acceptance ratio can be high for small investors in the buyback. Of late, small investors have been buying shares of companies offering buyback on the promise of high acceptance ratios, which has the opposite effect and lowers the acceptance ratio (since there are a greater number of shares being tendered for the buyback). The result is a greater number of shares left with the investor. Of course, the ratio will be known only after the buyback process.

What to watch for

A buyback is generally appreciated by investors. But it is also a lure for gullible investors. Why? Because buybacks are often misused by companies to support falling stock prices and improve market sentiment.

In the past, there have been several companies that undertook buybacks with the intention to support falling stock prices and trapped investors who couldn’t judge this corporate action as being such. Examples include DLF (2008), Reliance Infra (2011), McLeod Russel (2018), DB Corp (2018), PC Jeweller (2018, but later withdrawn), and HEG (2019).

But how do investors get trapped in poor stocks due to buybacks? As buybacks are usually viewed favourably, there can be two scenarios – one, investors assume that it signals better long-term growth and improved metrics for the remaining investors. Two, investors buy into the stock in order to participate in the buyback, but still get stuck with shares as an investor’s entire holding may not always be accepted in the buyback (see box on acceptance ratio).

Those who are buying only to take short term price advantage need to check the acceptance ratio. Even so, given that one might yet be saddled with unsold shares, it’s best to check the company.

Therefore, whether short or long-term, the intention and genuineness of the buyback matters if you are looking to buy a stock based on its buyback announcement. Here are four pointers:

- If buyback is used as a means to return cash to save dividend tax, then check for buyback of at least 3-5% of outstanding shares unless they are paying dividends.

- If buyback is just used to return excess cash on a one-time basis, check for a better reward, say buyback of 5-10% of outstanding shares.

- Also check the balance sheet to ensure that the companies are debt free and are having enough cash on their balance sheet.

- While regulations allow even debt-ridden companies to undertake a buyback (the rule is that the post buy-back debt equity ratio needs to be below 2:1), such cases are not worth considering in a high interest rate economy and in companies where cash flows are not stable.

In conclusion, bonuses and stock splits are more sentiment influencers among corporate actions. Buybacks, on the other hand, when done well can enhance real value for shareholders.