A few weeks ago, we’d launched a new tool on our platform – the mutual fund overlap tool. This tool shows you how much two funds or three funds have in common between them. But how exactly should you use this overlap information? When is overlap high? What should you do if your funds share a high overlap? Or why is overlap even important?

We’ll answer in three stages:

- In what type of funds does overlap matter

- What defines a high overlap between funds

- What to do if your funds overlap

PS: If you’d prefer to watch a snappy video on mutual fund overlap, watch here ↓

When fund overlap matters

Mutual fund overlap refers to the proportion of the portfolio that is in common between two or more funds – or, in other words, how similar two funds are. Fund overlap, in general, is important because the more similar two funds are, the more they are going to behave similarly and the less the diversification you get in your portfolio. But that said, mutual fund overlap is far more important in some fund categories and less in others.

#1 There is limited overlap concern in debt funds

There are several reasons why overlap between debt funds is not really a useful metric.

- For one, the universe of issuers and debt instruments available for funds to invest in is not very large and most funds will share issuers.

- Two, what matters in debt funds is the coupon on these papers as well as their maturities and this will differ based on the exact bond that the fund holds. A company can have several bond issues running which carry different coupons – two funds could therefore have bonds from the same issuing company but one may have picked it up at a better coupon. Or, a corporate bond fund and a short duration fund could hold bonds from the same issuer but the former may be far longer in maturity than the latter.

- Three, in categories such as gilt, dynamic bonds, long duration funds, or even corporate bond funds to an extent, returns also come from duration strategy – capital appreciation opportunities during rate cut cycles – which primarily come from g-secs. As a result, portfolio overlap could be high, but returns would come from how well each fund manages the rate cycle and gains.

In debt funds, what you can do to circumvent duplication is to avoid too many debt funds from the same AMC in your portfolio and avoid holding multiple funds from the same category. This will be a more useful way to ensure you diversify your portfolio rather than trying to judge overlaps between the funds.

#2 It’s hard to peg overlap in categories that use derivatives

These include the hybrid categories of balanced advantage, equity savings, and arbitrage. Calculating overlap is tricky in these funds, owing to the derivative component.

This apart, the benefit in knowing overlap between such funds is limited. For one thing, it’s hard to gauge the reasoning or intention behind the stock choices. A fund could be picking up a stock for its arbitrage potential rather than its longer-term one, while it could be the other way around for another fund. The fund overlap here does not offer any fresh insight. For another, a good part of performance comes from the extent these funds hedge their portfolios and their derivative strategy and not just from the stocks they hold.

#3 Overlap is the most important only in equity funds

It is equity funds alone that mutual fund overlap is the most important. When two equity funds share a high overlap, both are likely to deliver in the same way. If you hold both funds in your portfolio, correction in these stocks could drag down both funds and amplify the impact on your overall returns. Therefore, owning funds that share a significant part of their portfolio increases the concentration risk in your portfolio.

This apart, holding funds with high similarity also means that you’re not really diversifying your portfolio though you hold multiple funds. A smaller factor is that you would also be inadvertently limiting how well your portfolio is able to pick up different market trends and opportunities.

It is for these reasons that our MF Portfolio Overlap tool has only equity funds. The tool lets you compare the overlap between 2 or 3 equity funds from any equity category.

What is high overlap in mutual funds?

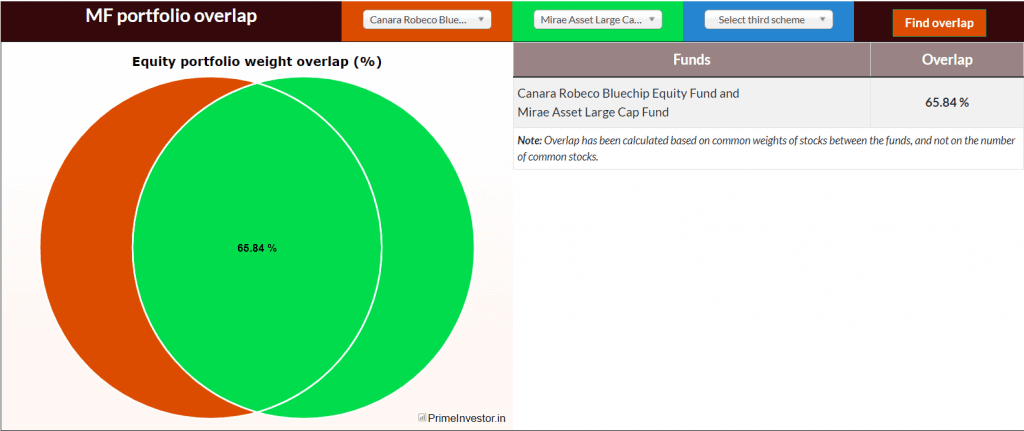

When we talk about overlap, it refers to the weight of the stocks that are common between the funds and not the number of stocks that are common. The weight is the better figure to go by; two funds may have only a few stocks in common but they could both be allocating heavily to these few stocks.

Now, what constitutes a high overlap between funds? There is no hard-and-fast cutoff to this. Broadly, however, funds with over 60-65% of their portfolio in common tend towards a high overlap.

#1 Overlap within a category

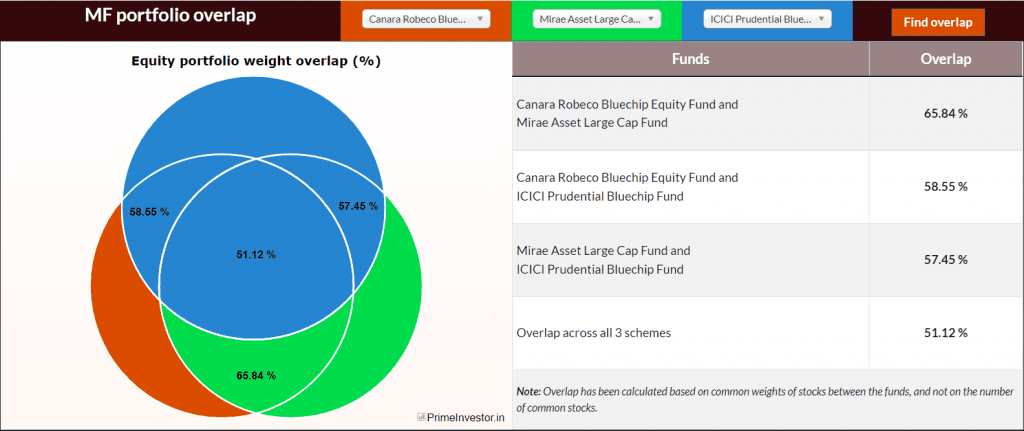

Consider Canara Robeco Bluechip and Mirae Asset Large Cap. As our tool will show you, the two funds have about 66% of their portfolio in common. This comes from heavy weights to top stocks for both funds such as HDFC Bank, ICICI Bank, Infosys, Reliance Industries, TCS, and SBI. That means, based on their current portfolio both funds appear to be making similar bets.

Throw ICICI Pru Bluechip Equity into the mix and you will see that all three funds share a good degree of commonality. The overlap between all three funds stands at 50%. Therefore, holding all three funds in your portfolio is unlikely to offer reasonable diversification.

Also note that in the large cap category, in general, given the limited universe within which funds are mandated to pick stocks, there will be a large degree of overlap.

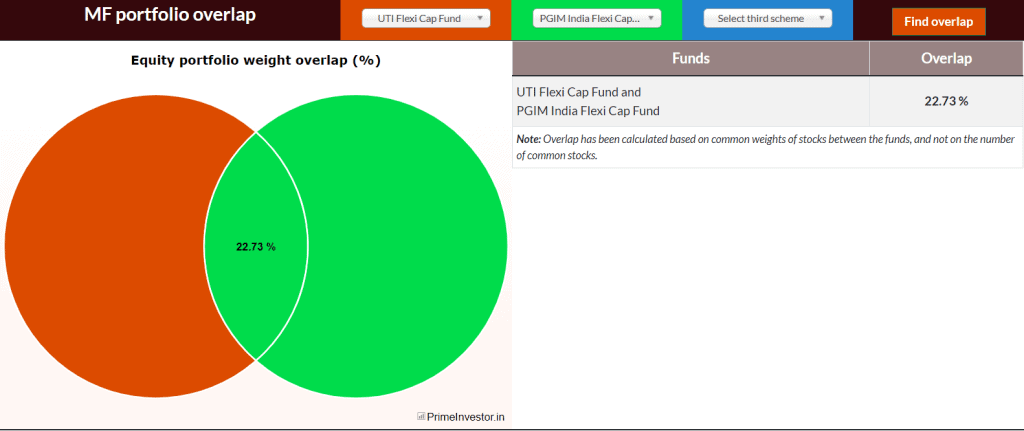

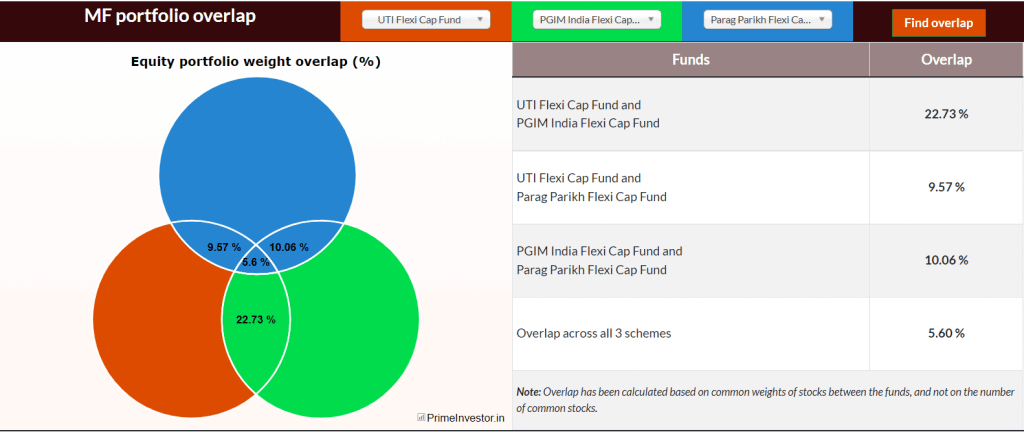

Now, consider the flexicap category. Two of our own recommended Prime Funds from this space are PGIM Flexicap and UTI Flexicap. As you will see, both these funds share little in common.

If you include Parag Parikh Flexicap, also part of Prime Funds, the overlap between the three funds is extremely low. The three funds follow very different strategies, which results in low similarities in their portfolios. Therefore, owning all three funds is unlikely to lead to duplication among your funds.

#2 Overlap across categories

AMCs often tend to have the same overall approach to where market opportunities are, whether in equity or in debt. In equity, an AMC would have a common view on sectors that could outperform or market capitalisation segments that could do well. This view, therefore, is likely to be taken across categories. In addition, multiple categories have a mix of large, mid or small-cap stocks. Both factors together could result in funds within an AMC sharing high overlap even though they belong to different categories.

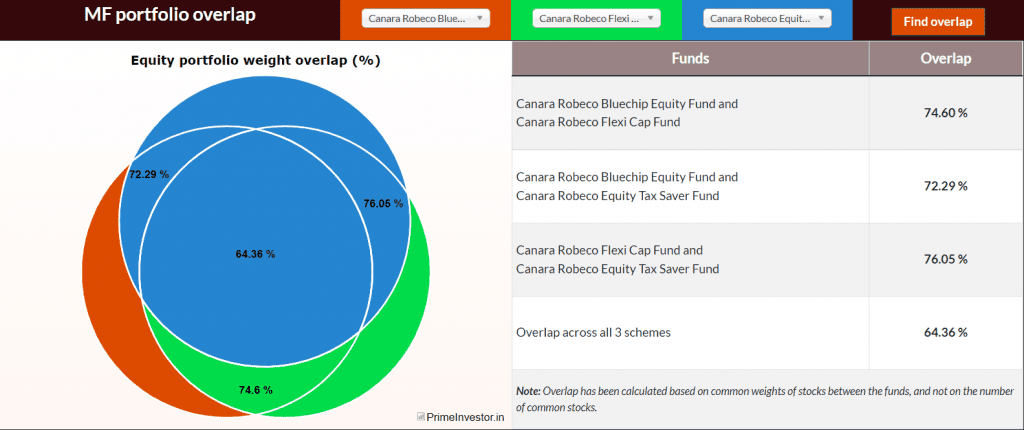

Consider the large cap, flexi cap, and ELSS funds from Canara Robeco AMC. As the image below shows, the three funds share close to 65% of their portfolio and the overlap between each fund pair is upwards of 70%.

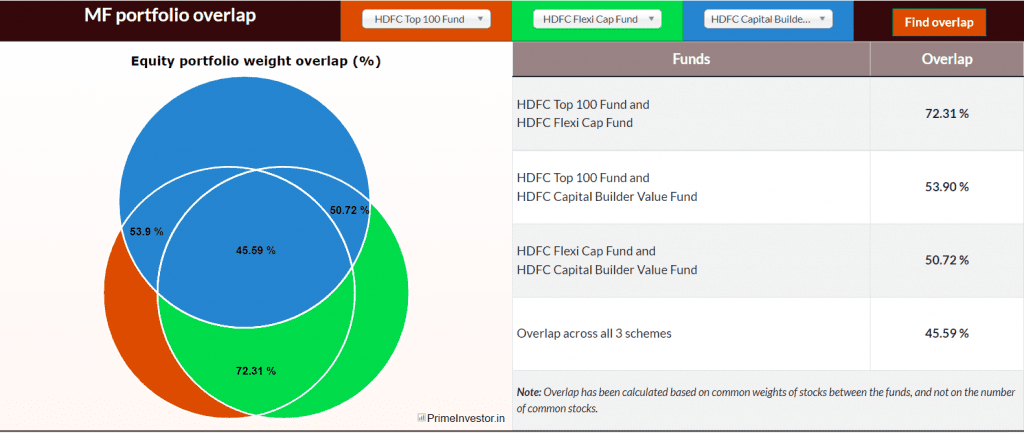

Similarly, HDFC Flexi Cap and HDFC Top 100 sport an overlap of 72%. Add HDFC Tax Saver or HDFC Capital Builder Value and you will see that between the three funds, there is a good amount of overlap.

Other examples include at least 50% overlap between Kotak Flexicap, Kotak India EQ Contra, and Kotak Equity Opportunities. Similarly, the popular Quant Active and Quant Flexicap have about 60% of their portfolios in common.

What to do if fund overlap is high

If you find two funds with high overlap, your immediate reaction would be to keep one and exit the other. But how do you do this? As with every other metric, mutual fund overlap should never be seen in isolation. You can observe whether there is overlap over a 3-4 month period and if it continues, you need to look at other performance metrics to decide which one to keep.

So here’s what you should do if you find a high overlap:

If the overlap is borderline high – say 55% or 65%, for example – remember that the rest of the portfolio is different and influences fund returns. That means, their performance can be quite different, the similarities notwithstanding. Thus, look at the performance metrics to understand whether the two funds have done similarly on aspects such as volatility, consistency in beating peers or benchmark, downsides, risk-adjusted return and so on. This will give you an understanding of whether the funds are likely to deliver in the same manner for you. These key performance metrics are provided in the table below the MF overlap in our tool.

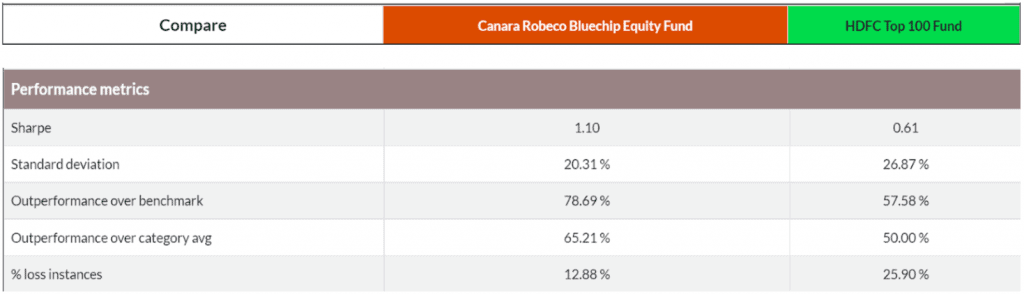

Consider Canara Robeco Bluechip and HDFC Top 100. These two funds have a 62% overlap.

But as you can see, Canara Robeco Bluechip has a far superior performance record. It is less volatile and more consistent a performer. Therefore, between the two, the Canara Robeco fund would be the better option to go with.

Another factor to consider when deciding between two funds is to look at the fund strategy. In our first example, Canara Robeco Bluechip is a more growth-oriented fund while ICICI Pru Bluechip is a more value-driven fund. If your portfolio has more value-based funds, you could go with the Canara fund.

You may also see two funds with high overlap performing equally well – such as Mirae Asset Large Cap and Mirae Asset Emerging Bluechip. In such a case, you could still hold both funds if they belong to different categories.

If the overlap is very high at 70-75% or above, it’s best to go with only one of the funds and avoid holding both the funds in your portfolio. The small part of the portfolio that is unique to each fund is unlikely to influence returns by much. You can use the performance metrics to pick the better one. If these metrics are very close to each other, you can also choose to decide based on the proportion each fund accounts for in your portfolio.

To summarise:

- If the overlap is not too high, you can assess whether the funds have different performance metrics and decide to keep both if one performs well on the upside and the other on the downside.

- If the overlap is very high, then use the performance metrics to eliminate the one with less favourable metrics.

- If the overlap and performance are close to each other, decide based on what proportion these funds account for in your portfolio. You can remove the one with insignificant holding.

Of course, as a PrimeInvestor subscriber, you can also go by the Prime Call (also provided in the table below the overlap data) to know if the fund is a buy, hold or sell.

So go ahead and try the MF Portfolio Overlap tool out to know if your portfolio needs any change in terms of duplication!

22 thoughts on “How to identify mutual fund overlap in your portfolio”

one should compare over lap across categories or within category ? or if done both ways how one should interprete results?

Ideally, compare within categories that share similarities or where stocks are more likely to be common. For example, you can compare a flexi cap along with value/contra or even large-cap. You can compare midcap with multicap or large-and-midcap. However, comparing very different categories like largecap with smallcap will not be useful. The article explains how to look at overlap results. – thanks, Bhavana

DO we get to see Hybrid funds added in this tool in the near future?

At this time, no we don’t plan to add hybrid funds. As explained in the post, overlap is not very useful in these funds. – thanks, Bhavana

Excellent analysis and a very useful tool. Perhaps, it’s first of its kind by any Mutual Fund Research service.

🙏 yes, it is unique sir 🙂 thanks, Vidya

Thanks Bhavana.

Providing Weightage based overlap is indeed a welcome feature. It really helps in making right choices.

I was delighted seeing less than 2 % overlap in my Core Portfolio of PPFAS Flexicap, Axis Growth Opp and Mirae Emerging Equity.

It really validated my original thesis of choosing those funds.

Thanks a lot

Keyur

Thanks!

This is something I would do manually before investing in any fund….This feature simplifies the process a lot!

Kudos to the PI team for this new feature.

Thanks!

Simply outstanding feature! You are giving us more power to choose the MFs to rebalance and eliminate the duplication! Thank you!!

Thanks!

Thank you, Bhavana for covering the topic in such greater detail and the best practices related to it with a specific number. Even though these are high-level numbers and guidelines but it helps with the strategy.

Can Mirae Asset Large Cap Fund and Canara Rob Flexi Cap be part of a portfolio? Both are Prime Funds.

Thanks, sir. Given the way large-cap funds have been performing and the overall trend, it would better to have one large-cap active fund and the Nifty 50/ Nifty 100 index fund rather than multiple large-cap funds. – thanks, Bhavana

Thank you for your reply. Canara Rob Flexi Cap currently has a large cap bias but falls into the Flexi cap category and has an overlap of 59% with Mirae large cap. Would you suggest not having both in a portfolio due to the overlap and large-cap bias?

Some flexi-cap funds tend to have a very high large-cap bias and can in fact be the large-cap allocation in a portfolio; the Canara Robeco fund has had a steady large-cap holding. You can avoid holding both in your portfolio. – thanks, Bhavana

Thanks Bhavana for the write up. Useful tool indeed.

However, it would be helpful if this feature is incorporated in the ‘saved portfolio’ section also.

Thanks and Good day.

Thanks, sir. Didn’t quite understand your suggestion, though. The tool provides the overlap between 2-3 funds…not a portfolio as a whole. Do you mean save the overlap data for your selected funds? – thanks, Bhavana

My query was how to check my portfolio overlap, if my portfolio has say 15-18 funds.

Checking overlap between 15 funds is not really feasible and won’t tell you much. We are, however, planning to overhaul the MF Review Tool to provide more insights on a portfolio (not right away!). This will help address your concern on the stocks you hold across your funds. – thanks, Bhavana

Thanks. Will wait🙂

Terrific!! The MF overlap tool is fabulous and I am delighted. Excellent tool for MF portfolio rebalancing. Thanks a ton!!

Comments are closed.