We’ve flagged off our reviews of critical illness plans in the right earnest and have been putting all the products in the market through the key filters we mentioned earlier on critical checks to make on critical illness covers. We covered the first one last month, on Aditya Birla Health’s Activ Secure Critical Illness Plan.

Today, we review the second plan, one from Bajaj Allianz General Insurance. This insurance player has not one but two critical illness covers on offer – the ‘Critical Illness Insurance Policy’ and the more recently launched ‘Criti Care Policy’.

The former is a plain vanilla product that covers 10 critical illnesses and comes with the standard initial waiting period of 90 days and survival period of 30 days. The sum insured can go up to Rs. 50 lakh if the insured is up to 60 years old. After this, it is capped at Rs. 5 lakh even though it offers lifetime renewability.

However, while it ticks the boxes for simplicity and affordable premiums, we think that the limited list of illnesses covered and curb on sum insured for the 60+ category, work against it (full details on this product can be found in the brochure and policy wordings). The latter of the two policies mentioned above – the Criti Care policy launched in April 2021 – addresses some of the shortcomings of the ‘Critical Illness Policy’. Here’s our take on it.

Key Features of the Criti Care Policy

First, a brief on the main features that this critical care policy offers.

- This policy has 5 sections – Cancer Care, Cardiovascular Care, Kidney Care, Neuro Care and Transplants Care & Sensory Organ Care. It covers 43 illnesses across these sections. Each section includes some early-stage illnesses (category A) and advanced illnesses (category B).

- You can choose to opt for one or more sections under this policy. The sum insured (SI) under each section is separate and can go from Rs. 1 lakh to Rs. 50 lakh. This is capped at Rs. 10 lakhs per section if age at entry is 61-65 years. The total sum insured for an insured across all sections is capped at Rs. 2 crore.

- Category A illnesses are eligible for 25% of SI payout and category B illnesses are eligible for 100%. The maximum payout under each section is limited to 100% of the SI under that section. An insured is allowed one category A and one category B claim under each section. Once 100% of the SI has been paid out under any section, the cover for that section ceases and cannot be renewed. The cover for the other sections however, will continue.

- Family members can be covered under this policy and each person will have an individual sum insured. However, the SI of dependents cannot be greater than that of the primary insured.

- The entry age for adults is 18 years to 65 years and for children, it is 3 months to 30 years.

- The policy allows lifetime renewability. However, renewals from age 70-80 years can only be for a maximum SI of Rs. 5 lakhs per section. This is further capped at Rs. 2 lakh for renewals over the age of 80 years.

- The initial waiting period can be 120 or 180 days and the survival period can also be 0, 7 or 15 days, as opted for.

- Accepted pre-existing diseases are covered with loading on premium. Pre-policy medicals may be required.

- Opting for 2 and 3-year tenures will fetch discounts of 4% and 8% respectively. A discount of 5% can be availed if certain ‘wellness’ parameters are met. Policies bought online or directly can fetch a 5% discount.

- The policy is available for Indian nationals, but NRIs can go for it too, provided premium is paid in Indian currency.

What we like

#1 Multiple claims possible

The split of the policy into five sections with independent SI, allows a customer to buy 5 mini policies. Hence, if an insured has opted for all five sections, technically, he / she would be able to make five major critical illness claims (as unlikely as this maybe) with each section limited to a maximum sum insured of Rs. 50 lakhs and an overall sum insured of Rs. 2 crores.

#2 Total sum insured up to Rs. 2 crore

The policy allows for a sum insured of up to Rs. 50 lakh per section and up to Rs. 2 crores in total. To use your cover wisely and minimize premiums it may be best to identify which CIs you are prone to by virtue of your family and medical history and to choose the relevant sections alone. While the maximum payout for a single major critical illness can only be Rs. 50 lakhs, the product allows for more than one major critical illness claim (under different sections) subject to a total SI of up to Rs. 2 crore.

#3 Coverage of early-stage illnesses

Usually, critical illness covers kick in when the illness is advanced. But Criti Care allows claims at early-stages too. This can be useful to reduce out-of-pocket expenses and immediately compensate you for any loss of income. Out of the 43 illnesses covered by this policy, 18 are early stage and include illnesses like early-stage cancer, carcinoma in situ and angioplasty that are usually excluded in critical illness covers. These attract a 25% SI payout and do not result in the cover for that section ceasing.

#4 Shorter survival period

Most critical illness covers require a 30-day survival period in order to make a payout but this policy requires a shorter survival period of 0, 7 or 15 days and allows you to pick one of these in exchange for a higher / lower premium. The base case is 7 days. A 0-day survival period can be got in exchange for 5% loading whereas opting for a 15-day survival period will fetch you a 3% discount.

As we stated in our earlier article, a critical illness cover is intended to help one cope with the myriad ways in which one’s life changes after being hit by and surviving a critical illness (as against life insurance) and hence the survival period requirement. We think the base case 7-day survival period is itself attractive compared to the 30-day survival period required by most other policies. Therefore, unless there is a specific concern, one need not pay extra to shorten this to 0 days. Further, since the premiums are also affordable, there is no reason to extend the survival period in exchange for a discount.

#5 Affordable premium

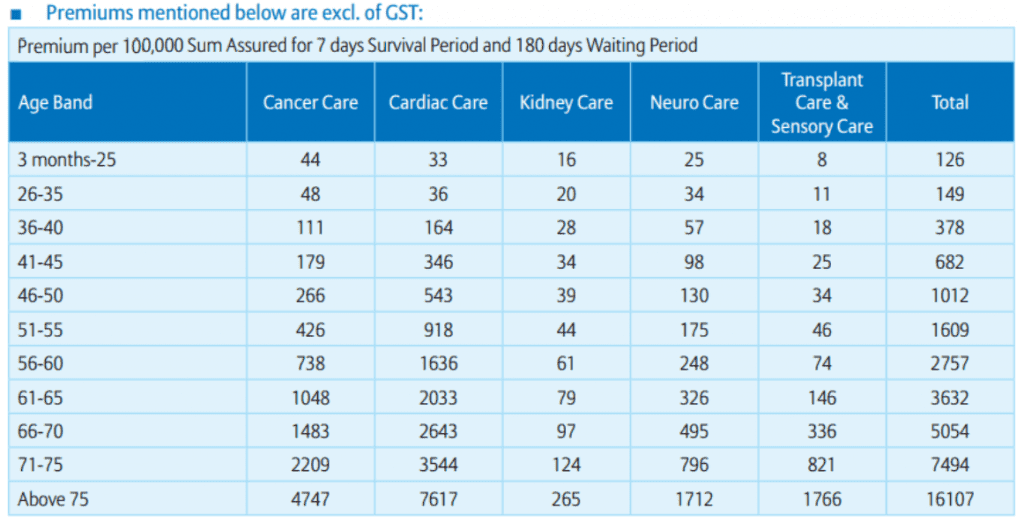

The design of the policy into sections that also cover early-stage illnesses, with individual SI and premiums, means that one cannot really make an ‘apples to apples’ comparison based on the tariff alone as far as Criti Care is concerned.

Source: Tariff details from Criti Care brochure

However, based on the tariff information above, if one were to opt for a cover of Rs. 10 lakhs and opt for all 5 sections, the premium for a 26-35 year-old could be about Rs. 1,490 and about Rs. 3,780 for a 36-40 year-old.

Below is how much a Rs.10 lakh cover under some of the available critical illness products would cost (excluding taxes):

- Bajaj Allianz’ Critical Illness Policy that covers 10 critical illnesses charges ~Rs. 3,000 for a 26-35-year old and Rs. 5,500 for a 36-40 year-old.

- Iffco TOKIO’s Critical Illness Benefit Plan that covers 25 critical illnesses, charges a premium of ~ Rs. 3,256 for a 25-35 year-old and Rs. 4,219 for a 36-40 year-old.

- Kotak Secure Shield that covers 18 critical illnesses, charges a premium of ~ Rs. 2,975 for a 26-30 year-old, Rs. 3,651 for a 31-35 year-old and Rs. 4,230 for a 36-40 year-old.

- HDFC ERGO’s Platinum option that covers 15 critical illnesses, charges a premium of ~ Rs. 3,500 for a 26-30 year-old and Rs. 4,000 for a 31-35-year-old.

- National Insurance Company’s critical illness plan comes at ~Rs 6,455 (including GST) for a 31 – 35-year old, under plan B covering 37 critical illnesses.

- Aditya Birla Health Insurance’s Activ Secure Critical Illness cover, under the plan that covers 50 critical illnesses, charges Rs. 2,826 for a 30 year-old and Rs. 6,186 for a 40 year-old.

- Oriental Insurance Critical Illness Policy’s Plan B that covers 22 critical illnesses comes at a premium of Rs. 3,341 for a 26-30 year-old and Rs. 3,544 for a 31-35 year-old and Rs. 5,533 for a 36- 40 year-old.

Thus, Bajaj Criti Care is attractively priced.

#6 Additional benefits

Depending on the section under which a claim is accepted, the insured gets some additional benefits such as benefit for cancer reconstructive surgery, cardiac nursing, dialysis care, physiotherapy care and sensory care under the policy. These benefits range between 5% and 10% of the SI and are subject to maximum limits but are over and above the SI payout.

The cons

While Bajaj Criti Care has some good features and comes at a reasonable cost, we think the following points could be a drag and need to be carefully considered.

- Complexity: The biggest factor that works against this policy is the complexity. With the 5 sections, and the categorization into ‘A’ and ‘B’ attracting different payouts means this product requires careful reading and maybe clarifications to fully understand what the coverage means for you. You may need to be very specific about what illnesses you expect to get cover for.

- Coverage: Out of the 43 illnesses covered, 18 fall under category A. In effect therefore, only 25 big critical illnesses are being covered. Further, this list does not include illnesses such as Alzheimer’s and Parkinson’s which could be significant risks to both your career and finances if you are elderly.

- Longer initial waiting period: Most critical illness covers come with a standard 90-day initial waiting period. Criti Care comes with a longer 180-day waiting period. This can be shortened to 120 days in exchange for a 5% loading. However, this means that this plan will take quite a long time to kick in.

About the Insurer

Bajaj Allianz General Insurance Company Limited, a joint venture between Allianz SE and Bajaj Finserv Limited, is one of the large private sector general insurers in India and has been operating for just over 20 years. For the 9 months ending in December 2021, Bajaj Allianz boasts of a claim settlement ratio by value 89.9% and 90.44% by number. It also has a claim settlement efficiency ratio 99.55%. These are reasonably good metrics. Our article, ‘Which insurers settle your claims the best’ will tell you what these numbers mean for you when shopping for a health insurance product.

Suitability

Given this policy’s section-based approach to critical illnesses, it may not be everyone’s cup of tea. But if you tick the following boxes, Bajaj Criti Care could be a candidate for your critical illness protection:

- You know fairly specifically what type of illnesses you want to cover and those fall under this policy’s ambit.

- You want to be able to make more than one major critical illness claim.

- You are keen to cover the early-stage illnesses.

- You are able to build a corpus to supplement the maximum Rs. 50 lakh SI per section under this policy

The previous critical illness cover we reviewed, Aditya Birla’s Activ Secure Critical Illness plan, offers a longer list of illnesses covered under Plans 2 and 3. While, like Criti Care, it offers the benefit of a shorter survival period, it comes with a sum insured that can go up to Rs. 1 crore depending on your income.

The main advantage of Criti Care over Activ Secure is the possibility to make more than one major critical illness claim, albeit from a shorter list of covered illnesses and a lower sum insured per section. While one critical illness event per lifetime may be fairly common, five may be a bit of a stretch. The likelihood of one benefitting from the section-wise sum insured structure of Criti Care should be evaluated in the light of one’s individual and family medical history. In order to truly benefit from Criti Care’s section-wise cover, one should choose the sections wisely and opt for 2 to 3 sections to make them count.

As always and like with any insurance product, do go through the fine print in the policy wordings, if possible with your doctor, to see if there is anything that could work against you (in view of your personal medical history). Do also carefully consider the exclusions and various criteria to be met under each critical illness in order for a claim payout to be made.

Important documents relating to this policy: Policy brochure, Tariff, Customer Information Sheet and Policy Wordings.

Disclaimer: Please note that the above is only a review of the plan and not a recommendation. Please make a decision based on your requirements.

2 thoughts on “Insurance Review: Criti Care Policy by Bajaj Allianz General Insurance”

Thanks for the informative write up. I have an HDFC Health On base policy (erstwhile Apollo Munich Optima Restore) and My Health Medisure super top up family floater. I understand that this takes care of critical illness also. Is there a need for a separate critical illness policy? I know that in critical illness policies, the insured sum is paid upfront as opposed to regular policies.Apart from that is there anything else to be considered?

Will be thankful for your views.

Thanks and Good Day..

Hello Sir,

Thanks for the comment. Yes – as you mentioned, a critical illness policy is a benefit plan where the payout is not linked to what has been spent. Please have a look at our earlier article here . This will tell you all about critical illness covers, including why you need them, how much cover you may need and what to look for when shopping for one.

Comments are closed.