One of the many lessons that the pandemic has taught is that despite having a health cover, you can still be very badly out-of-pocket when it comes to covering hospital bills and all the ancillary expenses that come with it. Could LIC’s newly launched ‘Arogya Rakshak’ (launched in July 2021), which is a new and improved version of its ‘Jeevan Arogya Plan’ that has been withdrawn, address this? If you are thinking it’s just old wine in a new bottle, here is a closer look to see if it can find a place in your protection portfolio.

The LIC Arogya Rakshak falls somewhere in between a hospital daily-cash policy and a critical illness cover. It is an individual health insurance plan from a life insurer that provides a definite benefit unlike indemnity health covers that only reimburse hospital expenses. It can be taken either on an individual or a family floater basis, with one member being the Principal Insured (PI).

Minimum age at entry for the principal insured, spouse and parents is 18 years and the maximum is 65 with cover until age 80. For children, the age at entry has to be between 91 days and 20 years, with coverage possible only until they turn 25.

Unlike other health or critical illness policies where you choose a Sum Assured, Arogya Rakshak works based on an ‘Applicable Daily Benefit (ADB)’ amount that you choose at the start of the policy. The initial ADB you choose is called the Initial Daily Benefit or IDB. It starts at Rs. 2,500 and can go up to Rs. 10,000 in multiples of Rs.500 based on your choice (used to be only up to 4,000 under Jeevan Arogya). The ADB you choose along with other factors such as age and other underwriting guidelines, decides the premium payable. There is a rebate on premium for policies with Hospital Cash Benefit over Rs. 4,000 which may make it more attractive to opt for a higher cover. The different types of benefits you can get from the policy are a factor of the ADB chosen by you.

Pros

#1 Predetermined benefit with generous caps, higher than Jeevan Arogya

The most attractive aspect of this product is that it offers a predetermined cash benefit in case of one of the over 260 specified surgeries, irrespective of how much is actually spent. (Jeevan Arogya covered only 140 specified surgeries). Further, the hospital cash benefit provides the insured with the benefits of a hospital daily-cash plan, providing a fixed allowance for each day spent in hospital as long as the stay exceeds 24 hours. A brief summary of the benefits based on your chosen ADB can be seen in the table below.

In an automatic protection against healthcare inflation, Arogya Rakshak offers an auto-step up benefit that incrementally adds 15% of the IDB to the ADB every three years (used to be annual increments under Jeevan Arogya) until the ADB reaches 1.5 times the IDB. It also comes with an optional term assurance rider and an accident benefit rider.

As Arogya Rakshak offers a defined benefit like a critical illness cover, it is comparable to such plans too. A critical illness cover makes only one payout in a lifetime - on the diagnosis of one of the listed critical illnesses, subject to the insured surviving a minimum time period after diagnosis. Arogya Rakshak makes multiple benefit payments as long as the policy is in force and subject to the limits set out in the table above. It does not come with a survival period requirement either.

# 2 LIC is the largest life insurer in the country and has a favourable claims settlement history.

#3 Additional sweeteners

A no claim bonus in the form of 5% of the IDB will be added to the ADB for every three claim free policy years. The policyholder also gets his / her health check-up bill reimbursed once every three years, subject to a maximum of half of the ADB.

#4 Quick cash facility

If the insured is undergoing any of the eligible surgeries in any of the listed network hospitals, the insured will have the option to avail of a cash advance amounting to 50% of the eligible surgical benefit amount which will be credited to the bank account instead of waiting until the claim is filed after the event.

#5 Auto health cover

Perhaps one of the most significant additions to Jeevan Arogya, resulting in its new avatar is the Auto Health Cover. In case of death of the original Principal Insured, the policy shall continue with a new Principal Insured (insured spouse or parent) along with other eligible surviving insured(s) without any payment of premium for a further period of 15 years or up to specified age in respect of each of the insured whichever is earlier. (For insured children, the AHC period will be either 15 years or until they turn 25 whichever is sooner and for the spouse / parents it is 15 years or till the age of 70 whichever is sooner.

Cons

#1 Insufficient cover

Given that every benefit under Arogya Rakshak is capped at a multiple of ADB, the hospital cover can be grossly insufficient in the event of a major surgery. Several expensive procedures are now done as day care procedures. But even with the maximum IDB of Rs. 10,000, your eligibility for such procedures will only be Rs. 50,000. Another important aspect of health coverage namely, home-care especially in recent times that have seen many having to set up ‘ICU’ like facilities at home, is not covered under Arogya Rakshak.

For similar reasons, Arogya Rakshak cannot entirely substitute a critical illness cover either. With critical illness plans, you can make them count by going in for a generous cover (For e.g. Aditya Birla Health Insurance offers a critical illness cover where the sum assured can go up to 12 times your gross income) which is not possible with Arogya Rakshak where benefits are based on ADB. While critical illness covers are based on diagnosis of one of the listed critical illnesses (HDFC Ergo lists the following in its Silver Plan: Heart Attack, Multiple Sclerosis, Stroke, Cancer, Major Organ Transplantation, Coronary Artery Bypass Surgery, Paralysis and Kidney Failure), Arogya Rakshak is based on treatments for specified health conditions, major surgical procedures, day care procedures and hospitalisation, even though it comes with a similar waiting period and exclusion of pre-existing conditions unless accepted by the insurer.

#2 Premium revisions

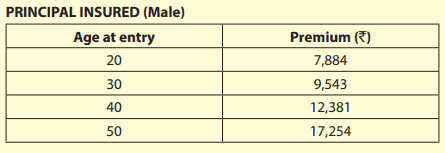

You cannot lock into premiums in this policy. Premiums are only guaranteed for 3 years at a time, after which LIC reserves the right to revise the premium. Thereafter, it will remain fixed at that level for a further period of 3 years. Of course at the time of premium revision, the insured has the option to cancel the policy. Below is the indicative annual premium for an IDB of Rs. 5,000.

Source: Arogya Rakshak sales brochure

Further, while Arogya Rakshak cannot be compared to an indemnity health cover or your critical illness cover or a hospital daily cash policy, depending on the IDB chosen by you, it can command a higher premium.

#3 Not portable

Being issued by LIC, it does not come under the purview of the portability norms issued by IRDAI and hence will not be portable to another insurer.

# 4 Waiting Period & Exclusions

Like other health insurance products, Arogya Rakshak comes with a general waiting period of 90 days for hospitalization or surgery due to sickness. This general waiting period is not applicable in the case of accidental injury. There is also a waiting period of 2 years for a list of specified treatments including treatment for cataract, gallstones, hernia, knee or joint replacement (other than those caused) by accident etc.

The exclusions too are not unlike other health policies (hospitalization outside India, surgeries done for the purpose of diagnosis, purely cosmetic procedures that are not medically necessary, anything arising out of attempted suicide, anything related to pregnancy and childbirth etc.) and need to be read carefully before to see how it affects one’s specific medical history before making a decision.

Our Take

The primary objective of taking health insurance is to protect your finances against health emergencies. LIC’s Arogya Rakshak may not serve this purpose due to its cap on the payouts linked to the ADB. While the benefits may seem generous, a realistic look at surgery and recovery costs based on medical and family history may tell you that your costs in case of major surgeries may not get fully covered. Though Arogya Rakshak is positioned as a supplement to your indemnity health-plan, there are better ways to achieve. We think that a super top-up plan on top of your Mediclaim policy, a generous critical illness cover and an emergency fund to take care of spillover costs will cover your bases better. Earlier articles on ‘Why you don’t need a Rs. 1 crore health policy’ and ‘Critical checks to make on critical illness covers’ offer pointers on this.

10 thoughts on “LIC Arogya Rakshak – should you go for it?”

After reading this and your ‘critical illness covers’ article, i would like to have some clarification and guidance:

I am thinkling of taking a supplementary insurance and divided between choosing LIC arogya rakshak or a critical illness cover.

Any critical illness may most likely involve surgery, so in this regard, arogya rakshak seems to have a much wider coverage of surgery than a critical illness plan would. Not to mention several other coverageoffered by arogya rakshak (i understand while both are different products, there is also huge overap in features).

The only advantage i can see for a critical illness cover is that it offers a much larger amount than arogya rakshak.

I have a very large mediclaim policy and my family wouldn’t suffer if i stopped earning. Consiering this, i feel going for arogya rakshak makes more sense, what do you think?

Also you mentioned in ‘critical illness covers’ article that insurers only make payouts for cancers of specific severity and not just if it is critical illness. So iam wondering if any such distinction applies to arogya rakshak?

Thanks,

Vikram

Hello Sir,

To answer your queries:

Critical illness cover can provide a larger cover, payable only once, for a narrow set of causes, meanwhile LIC Arogya rakshak coverage could be low, payable multiple times, for a wider set of causes.

In case of LIC Arogya rakshak, the payout for major surgical procedures could vary from Rs 2 lakh to Rs 10 lakh for maximum ‘Applicable daily benefit’ of Rs 10,000. Please see https://licindia.in/getattachment/Products/Health-Plans/LIC-s-Arogya-Rakshak-(Plan-No-906,-UIN-512N318V01)/Arogya-Rakshak_-Web.pdf.aspx page 37 for details.

In general, to have higher coverage and to compensate for loss of income in case of a critical illness; a combination of super top-up policy and a critical illness cover (along with a base policy) is recommended.

As a special case, if higher coverage and compensation for loss of income is not a requirement, then from just a diversification perspective, LIC arogya rakshak, being a defined benefit plan can be used along with an indemnity plan. Note that this combination of policies may not provide a high enough coverage for the total premium paid, considering alternate options available.

About the list of procedures that qualify for a payout from LIC arogya rakshak; there is no specific severity mentioned in the policy prospectus.

Hope that answers your queries.

Please comment LIC Arogya Rakshak benifits with existing Mediclaim policy. Can one get hospital expenses not covered in the Medicliam policy, availing LIC Arogya Rakshak

Thank you for your comment Sir. Yes, because it pays fixed benefits, one can get hospital expenses not covered in a Mediclaim policy by going in for LIC’s Arogya Rakshak. However, we believe that there are better ways to supplement your mediclaim policy (through a super top up, critical illness cover or emergency fund).

Most of us would be having an existing Health insurance , based on the first /second agent who met us and presented a “very good product” in those times . And staying with that product for over a decade , I am worried to change as due to entry age revising premiums . Can you give is a relative rating / checklists based on the available products, so that we know we are paying premiums to relative well balanced product ?

Sir,

We will be presenting a rating of health insurance plans shortly so kindly wait for that.

Thank you.

Good Article. Thankyou.

Thank you Sir.

THANKS FOR INFORMING ABOUT POLICY. GOOD ARTICLE.

Thank you Sir.

Comments are closed.