Axis Banking & PSU Debt Fund-Reg(G)

View the direct plan of this scheme

Rs 2466.8228 0.2593(0.011 %) NAV as on 10 Sep 2024

Scheme Objective: To generate stable returns by investing predominantly in debt & money market instruments issued by Banks, Public Sector Units (PSUs) & Public Financial Institutions (PFIs).The scheme shall endeavor to generate optimum returns with low credit risk.

Performance (As on 10 Sep 2024)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.11 % | 2.05 % | 3.81 % | 7.13 % | 5.41 % | 6.13 % | 7.64 % | >

Portfolio

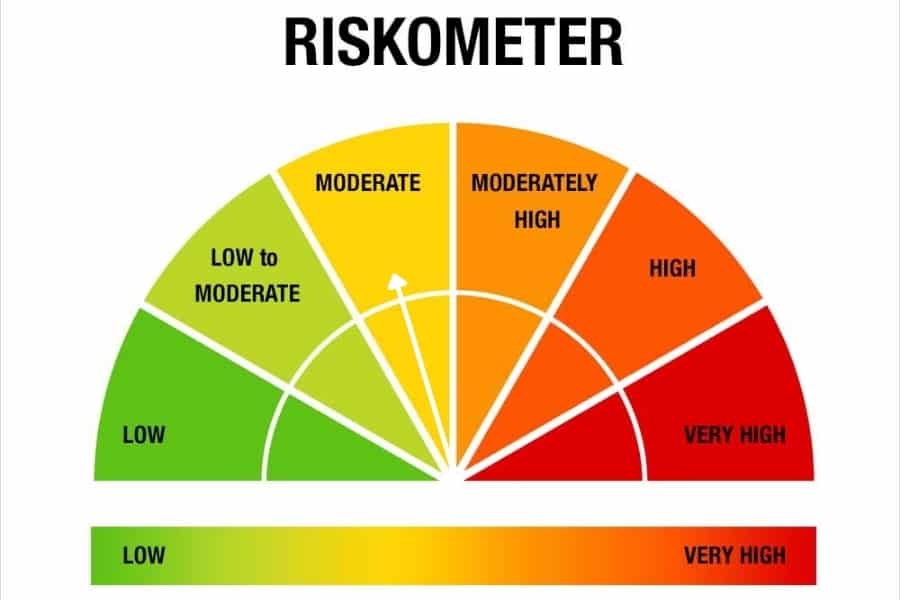

Banking and PSU debt funds invest in instruments issued by banks, such as bonds and certificate of deposits and debt papers of PSU companies. These funds make returns from the interest accrued on papers as well as price appreciation on the PSU bonds during downward rate cycles. Average maturities for these funds change based on interest rate cycles. These funds typically carry low credit risk as they restrict themselves to PSU companies and banks.

These funds suit any investor with investment horizons above 3 years. Some funds may be riskier than others, so a check on portfolio will be prudent.