Axis Treasury Advantage Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 3038.997 0.485(0.016 %) NAV as on 10 Sep 2024

Scheme Objective: The investment objective is to provide optimal returns and liquidity to the investors by investing primarily in a mix of money market and short term debt instruments which results in a portfolio having marginally higher maturity as compared to a liquid fund at the same time maintaining a balance between safety and liquidity. However, there can be no assurance that the investment objective of the scheme will be achieved.

Performance (As on 10 Sep 2024)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.12 % | 1.94 % | 4.01 % | 7.65 % | 6.21 % | 6.31 % | 7.69 % | >

Portfolio

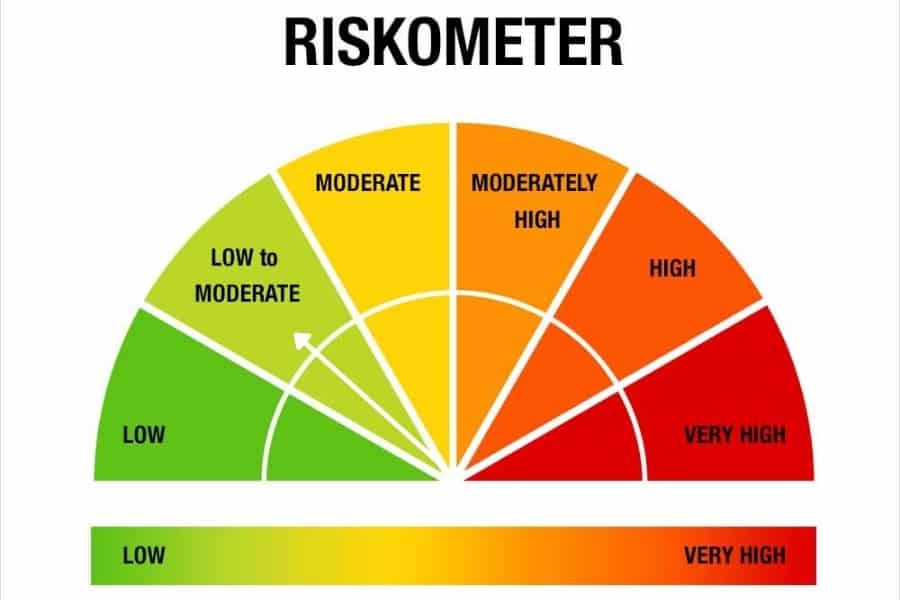

Low duration debt funds invest in debt instruments such as commercial paper, certificate of deposits, treasury bills and other money market instruments. They maintain an average portfolio maturity of around 1 year. These funds may deliver losses on a day-to-day basis but are generally low volatile. While most funds pick instruments that have a high credit rating, some can go into papers with lower credit ratings in order to deliver higher return.

These funds suit any investor with investment horizons of 6 months to a year. Ensure that funds do not have a high share of low-rated debt. These funds can also be used to maintain emergency money as well.