HDFC Liquid Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 4896.0891 0.8681(0.018 %) NAV as on 10 Sep 2024

Scheme Objective: To generate income through a portfolio comprising money market and debt instruments. There is no assurance that the investment objective of the Scheme will be realized.

Performance (As on 10 Sep 2024)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.13 % | 1.77 % | 3.68 % | 7.37 % | 6.04 % | 5.25 % | 6.81 % | >

| Nifty 1D Rate Index | 0.12 % | 1.67 % | 3.37 % | 6.83 % | 5.74 % | 4.88 % | N/A |

Portfolio

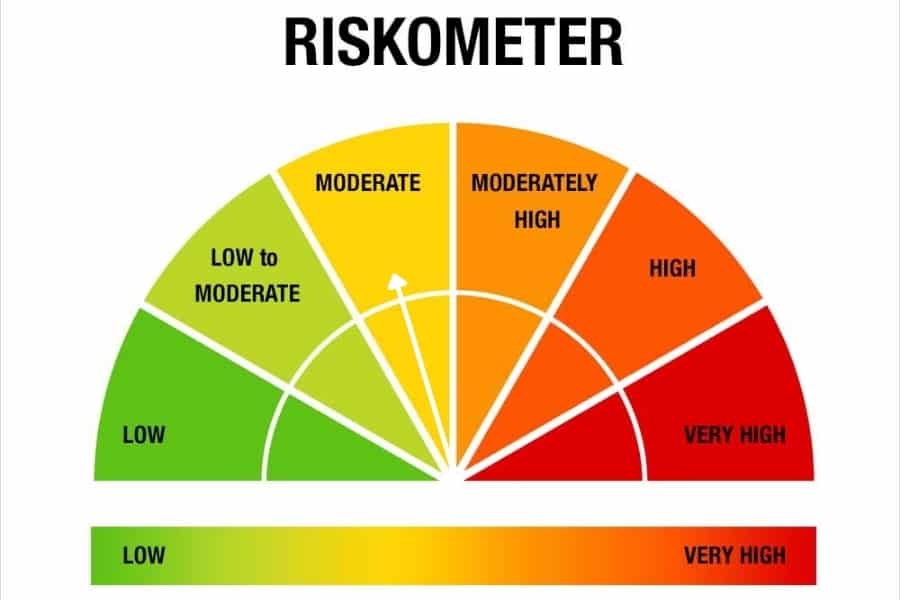

Liquid debt funds that invest in debt instruments whose maturities are less than 60 days. These instruments are typically government treasury bills, commercial paper, and bank certificates of deposits. Funds stick to papers that have the highest credit rating. Because of the nature of instruments, these funds are extremely low risk and generally do not deliver even 1-day losses.

These funds suit any investor with a very short term investment horizon of a few days to 6 months. These funds can also be used to maintain emergency money.