ICICI Pru Balanced Advantage Fund(G)

View the direct plan of this scheme

Rs 70.57 0.1(0.142 %) NAV as on 10 Sep 2024

Scheme Objective: To provide capital appreciation and income distribution to the investors by using equity derivatives strategies, arbitrage opportunities and pure equity investments.

Performance (As on 10 Sep 2024)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 10.11 % | 22.09 % | 13.67 % | 14.81 % | 11.67 % |

Portfolio

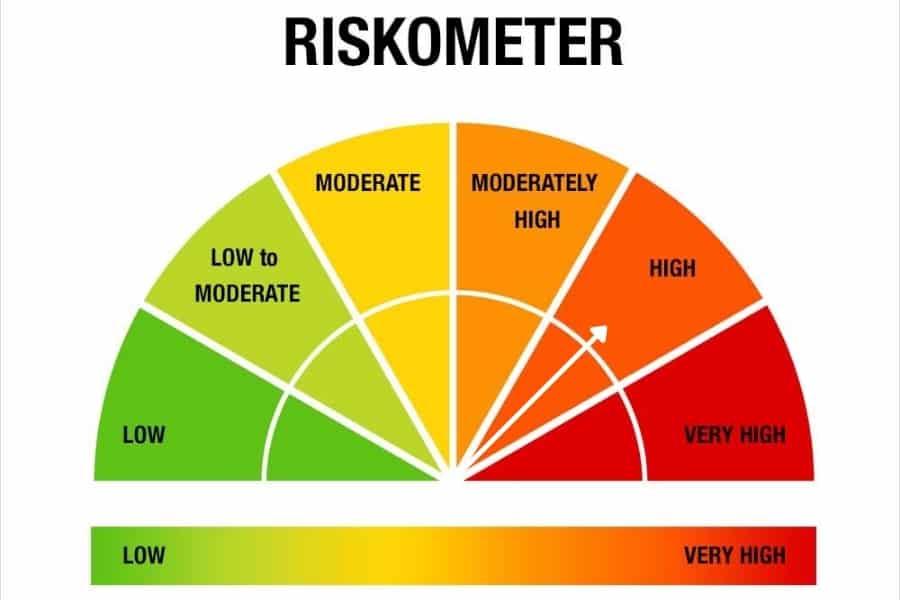

Balanced advantage funds invest in stocks, but hedge part of this exposure through derivatives. They also maintain a portion of their portfolio in debt instruments. These funds shift allocations to equity, derivatives and debt based on market movement and valuations. These funds offer lower-risk participation to equity and are less volatile than even aggressive hybrid funds.

These funds suit all investors, but especially conservative investors who wish for low-volatile equity exposure. These funds need to be held for a minimum of 1.5 years.