Kotak Bond Short Term Fund(G)

View the direct plan of this scheme

Rs 48.879 0.0064(0.013 %) NAV as on 10 Sep 2024

Scheme Objective: The investment objective of the Scheme is to provide reasonable returns and reasonably high levels of liquidity by investing in debt instruments such as bonds, debentures and Government securities; and money market instruments such as treasury bills, commercial papers, certificates of deposit, including repos in permitted securities of different maturities, so as to spread the risk across different kinds of issuers in the debt markets.

Performance (As on 10 Sep 2024)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.13 % | 2.22 % | 3.94 % | 7.36 % | 5.19 % | 6.04 % | 7.35 % | >

Portfolio

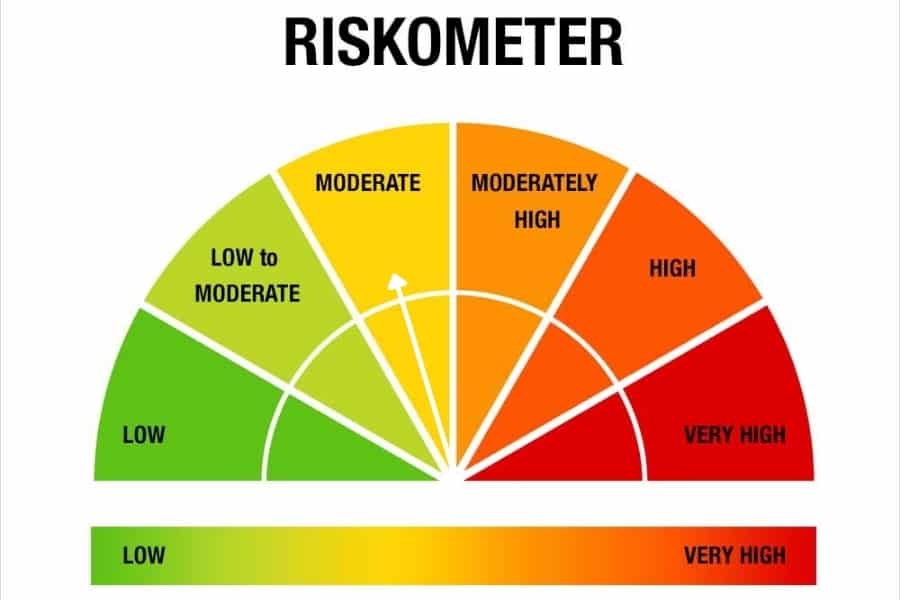

Short duration debt funds invest in debt instruments ranging from money market instruments to corporate and bank bonds and government papers. Average maturities for these funds hold below 2-3 years. These funds can be volatile in the very short term as bond prices react to potential interest rate changes, but this volatility is usually contained and evens out. Funds can pick instruments across the credit rating spectrum. Therefore, some can be far riskier than others.

These funds suit any investor with a minimum investment horizons of 1.5 to 3 years but can be held for longer periods as well. Ensure that funds do not have a high share of low-rated debt if holding for the short term.