Kotak Credit Risk Fund(G)

View the direct plan of this scheme

Rs 27.9335 0.0116(0.042 %) NAV as on 10 Sep 2024

Scheme Objective: The investment objective of the scheme is to generate income by investing in debt /and money market securities across the yield curve and predominantly in AA rated and below corporatesecurities. The scheme would also seek to maintain reasonable liquidity within the fund.

Performance (As on 10 Sep 2024)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.34 % | 2.73 % | 4.46 % | 8.94 % | 4.96 % | 5.70 % | 7.42 % | >

Portfolio

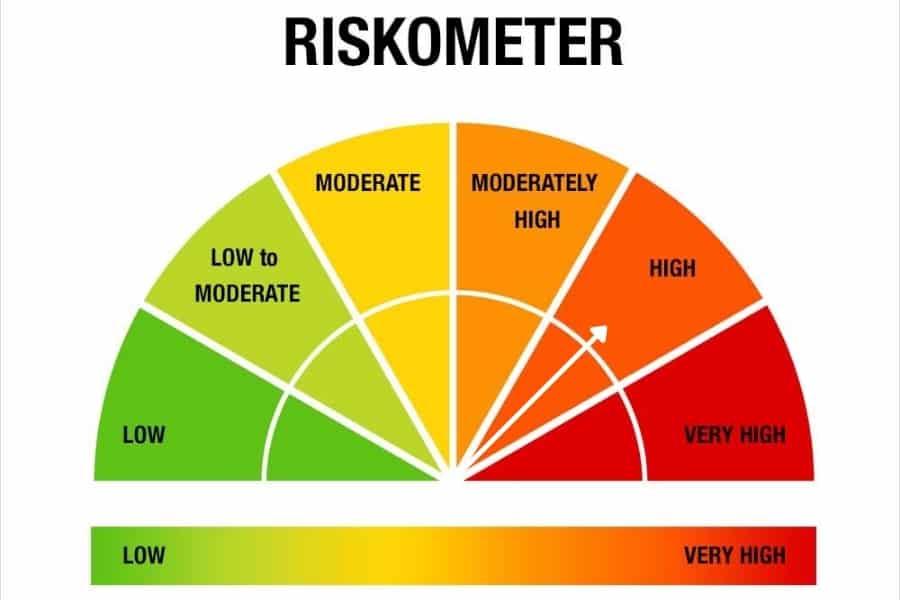

Credit risk debt funds invest at least 65% of their portfolio in debt instruments rated below AA+. As such instruments carry higher coupons, returns from these funds are generally higher than other debt categories. These funds, however, carry very high risk. While returns may not be volatile, as low-rated instruments are seldom traded, the risk comes from write-offs due to downgrades in the debt papers or defaults in repayment. Average maturities for these funds may be short at around 2 years but may go higher. Even so, these funds need to be held only with a long horizon as this gives a buffer in the event losses due to downgrades and defaults.

These funds suit high-risk investors with at least a 3-year holding period. Investors need to be able absorb shocks of losses. They are not alternatives for fixed deposits and fit only long-term portfolios.