Kotak Dynamic Bond Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 38.4246 0.0342(0.089 %) NAV as on 10 Sep 2024

Scheme Objective: The investment objective of the Scheme is to maximize returns through an active management of a portfolio of debt and money market securities.

Performance (As on 10 Sep 2024)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.43 % | 3.57 % | 5.10 % | 10.60 % | 6.71 % | 7.49 % | 8.89 % | >

Portfolio

Dynamic bond debt funds actively change their strategy and portfolio based on the interest rate cycle and opportunities in the debt market. When the direction of interest rates is headed downward, these funds get aggressive and move into long-duration government debt to make gains off bond price appreciation. At other times, the funds stick to other corporate and bank bonds and earn the interest on these bonds. These funds tend to be volatile in the short term as they adapt their portfolios to market movements; their 1-year returns can be range from the high double-digit to losses based on their strategy and debt market movements. Returns even out over longer periods and need to be held for the long term.

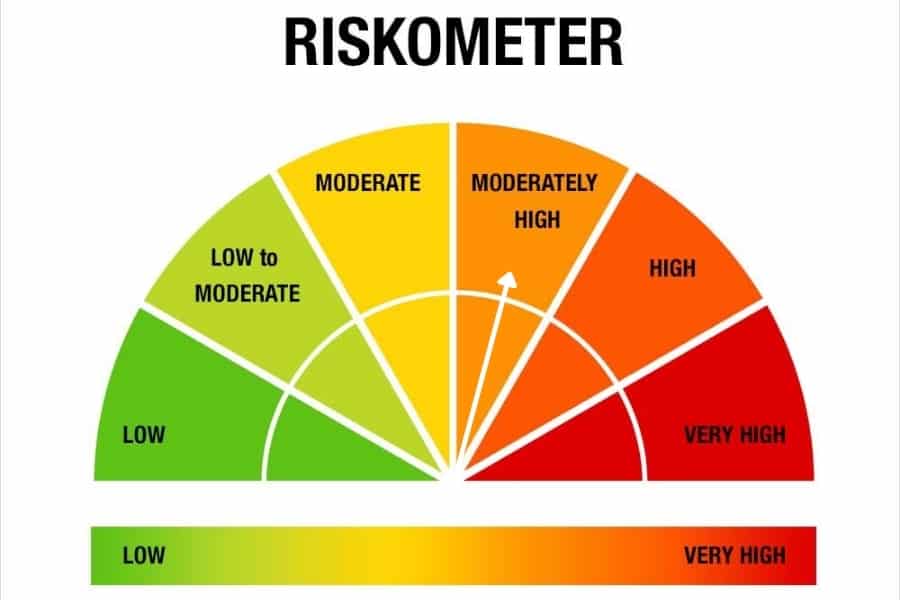

These funds investors with investment horizons above 3 years and who can take short-term volatility in their debt funds.