UTI Nifty 50 Index Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 172.9562 0.7221(0.419 %) NAV as on 10 Sep 2024

Scheme Objective: The principal investment objective of the scheme is to invest in stocks of companies comprising Nifty 50 Index and endeavor to achieve return equivalent to Nifty 50 Index by u201cpassiveu201d investment. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

Performance (As on 10 Sep 2024)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 12.08 % | 27.50 % | 14.02 % | 18.88 % | 14.05 % |

| NIFTY 50 | 11.33 % | 26.13 % | 12.94 % | 17.84 % | N/A |

Portfolio

Index funds aim to mimic a specific index. It could be the Nifty 50, or the Nifty Next 50, the Sensex and so on. These funds invest in the stocks that make up that index, in the exact same weights. An index fundu2019s performance moves in line with the index. However, there may be deviation in returns on account of expenses, cash kept to meet redemption requirements, and difficulty in buying and selling stocks in the index. Depending on the index, some can beat actively managed funds.

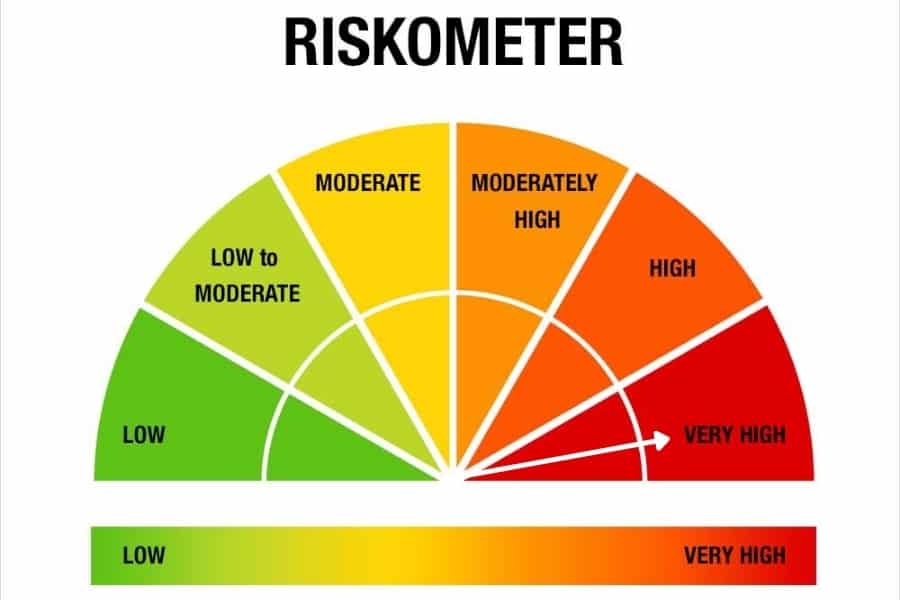

Index funds suit investors who simply want a passive strategy with no fund-management risks. Depending on the index, risk appetite required may be conservative to high. The minimum period for which these funds need to be held is 5 years.