- Gold was a topper, helped by global pessimism

- In debt, AAA rated/PSU funds delivered while credit funds were battered

- In equities, large-cap and multi-cap funds aced mid and small-cap funds

- Property sales picked up, but inventories weighed on prices

Lady Luck, they say, smiles upon courageous folks who take risks. In 2019 though, she did exactly the opposite with investors. With pessimism being the dominant sentiment both in the Indian and global markets, investors who played it safe were handsomely rewarded, while those who took on risks were beaten black and blue. Here’s how different asset classes fared in 2019.

Gold shines again

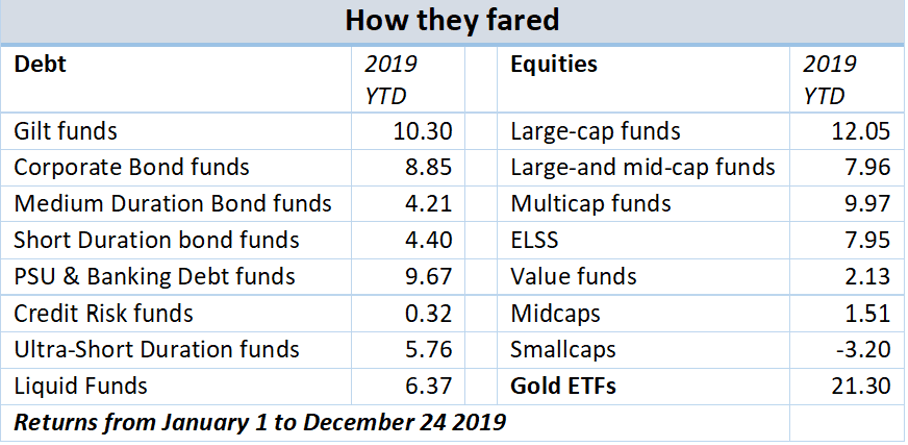

With a loss in 2016, a 2 per cent gain in 2017 and 7 per cent return in 2018, gold had been a frustrating asset class to own for Indian investors in the previous three years. But folks who exited their gold ETFs at the beginning of 2019 would be kicking themselves today. With a 21.3 per cent gain in domestic gold prices (denominated in Rupees), gold ETFs turned out to be the best class of funds to own this year. (All returns in this article are from January 1 to December 24, 2019).

These returns were driven mainly by global bullion prices rebounding by 16 per cent in dollar terms in 2019, while the Rupee depreciated marginally against the dollar. After doing nothing in the first half, bullion received a new lease of life in the second half of 2019 as the US-China trade war warmed up, the US Fed did an about-turn (going from rate hikes to cuts) and revived its bond buying programme. New worries abouta US recession after the yield curve inverted in the second half added to the fear factor. With a return to easy liquidity and money printing, Central banks went on a gold-buying binge in 2019, giving global gold prices a leg up.

These returns were driven mainly by global bullion prices rebounding by 16 per cent in dollar terms in 2019, while the Rupee depreciated marginally against the dollar. After doing nothing in the first half, bullion received a new lease of life in the second half of 2019 as the US-China trade war warmed up, the US Fed did an about-turn (going from rate hikes to cuts) and revived its bond buying programme. New worries abouta US recession after the yield curve inverted in the second half added to the fear factor. With a return to easy liquidity and money printing, Central banks went on a gold-buying binge in 2019, giving global gold prices a leg up.

As we head into 2020, the US Fed is on a rate pause and there’s talk of the trade wars cooling off. But who knows? If there’s one takeaway from gold’s performance in 2019, it is that one never knows when the mood will turn.

Quality pays in bonds

Going by the book, 2019 should have been a good year for Indian bond investors. With the MPC delivering aggressive rate cuts of 135 basis points on the repo rate between January and October, capital gains from rallying bond prices should have propped up their returns. Continuing risk aversion after the IL&FS and DHFL episodes, which kept borrowing rates for corporates elevated should have led to high yields on corporate bond holdings too.

In reality though, the year proved quite a mixed bag for debt fund investors. Gilt funds averaged a decent 10.3 per cent calendar year return, thanks to the g-sec rally. But investors in these funds had to endure a bumpy ride as they saw sharp gains in the first half which partly evaporated in the second half. This was because market yields on g-secs bottomed in July and spiked thereafter.

Compared to gilt funds, medium duration debt funds that invest in corporate bonds put up a lacklustre show with a 4.21 per cent return. A string of defaults, downgrades and haircuts offset a good bit of their returns from high bond yields. Credit risk funds also saw their gains decimated by write-offs, scrounging up a mere 0.3 per cent return. Short-duration bonds funds and ultra-short duration bond funds delivered modest returns of 4.4 per cent and 5.8 per cent respectively. Staid liquid funds beat all of these categories, with a 6.4 per cent return.

Within every debt fund category though, investors who stayed with high quality bonds and played it very safe, took home big gains. Within medium/long duration funds, corporate bond funds that invest mainly in AAA-paper delivered a solid 8.9 per cent return. Within the short-term category, PSU & Banking Funds notched up an impressive 9.7 per cent. Right now, 2020 looks to be equally rocky for debt fund investors, with the easy gains from a fall in rates behind us and the uneasiness about credit risks continuing.

Large-caps all the way in equities

The safety-first theme worked out for investors in equities too, with funds focussed on the bellwether indices and large cap equity fund delivering decent gains, while funds focussed on mid and small caps suffered.

After losses last year, the large-cap equity fund category turned around to average a 12 per cent gain in 2019. Funds still struggled to match the Nifty50 total returns of 13.9 per cent, though. Large-and-Midcap equity funds averaged 7.9 per cent. Multicap funds surprisingly fared better than pure Large-cap rivals, with a 9.9 per cent return. Continuing institutional flows into the index stocks and investor risk aversion aided the large-cap outperformance. Multicap funds, contrary to their labels, mostly huddled in the safety of the large-caps this year, cutting back on both mid-cap and small-cap allocations. ELSS funds followed the same script to deliver 7.9 per cent.

Hit both by selling pressure and liquidity issues, both mid-cap equity funds (1.5 per cent return) and small-cap equity funds (negative 3.2 per cent) disappointed, as the broader market continued to sink lower in sharp contrast to the bellwether stocks. The dichotomy in large-cap versus mid/small-caps prompted both fund managers and investors to gravitate towards the former. With respect to investing styles, with earnings visibility hard to come by, quality and growth stocks aced the markets again, leaving their value counterparts in the dust. Value funds managed a modest return of 2.1 per cent in 2019 after losing 8.1 per cent in 2018.

Given their underperformance in the recent past, both the mid and small-cap segments of the market and the value investing styles are overdue for a rebound. But such a comeback could well be preceded by a nifty correction first. The elevated Nifty valuations and lack of support from corporate earnings make it difficult for the indices to deliver an encore in 2020.

Real estate awaits revival

In 2019, the Indian real estate sector which has been struggling under the burden of unsold inventories, continued to display sluggish price trends. In its year-end review, property consultant Anarock noted that housing prices across the top 7 cities remained more or less stagnant for the year. It noted a modest 1 per cent gain in average residential prices Mumbai, Pune, Bangalore and Hyderabad, Chennai while NCR saw no change and Kolkata registered a 1 per cent drop. That makes the third consecutive sluggish year after the demonetisation year of 2016. Anarock however found that Bangalore, Hyderabad and Pune have seen residential price increases of 6 per cent, 5 per cent and 4 per cent respectively in this three-year period.

A broad-based price revival in Indian residential real estate relies heavily on the liquidation of unsold inventories. JLL India, in its India Market Update, noted that annual sales of residential homes in key cities exceeded new launches for the first time since this slump took hold in 2016. While new launches of residential property dipped by 14 per cent year on year to 1.37 lakh units, sales rose by 6 per cent in 2019 compared to 2018 to 1.44 lakh units. This made a small dent of 2 per cent in the unsold homes stockpile.

But the stockpile itself remained quite large at 4.42 lakh units, three times the annual demand. Overall, a strong revival in this market may remain elusive unless and until residential home prices correct steeply.

The office market however continues to fly high with demand for commercial space jumping 40 per cent in 2019 compared to a 16 per cent growth the previous year. New projects completed zoomed 45 per cent compared to 24 per cent in 2018. This reflected in the strong gains in the only listed Indian REIT – Embassy Office REIT – which has gained 42 per cent over its IPO price after listing in April 2019.