Prime Stock Screeners help you narrow your stock choices by applying meaningful filters. If you are not sure what filters will help, our Premium screeners (see the second tab from the right on the above Screener link) – which are nothing but readymade screeners – will help you narrow your filter choices to specific parameters.

These Premium screeners are available for all our Growth subscribers.

In today’s article we will take you through some of the premium screeners that will be useful to narrow your stock choices.

#1 52-week highs and lows

This is a simple but highly useful screener that will help you know the stocks that are nearing their 52-week high or 52-week low. This can give you a good sense of the market breadth. Seen with other fundamental parameters, this will tell you if your stock is nearing an attractive zone in pricing or or whether a stock hitting new highs is an indicator of a fresh rally. At this time of writing this article, 399 NSE listed companies were nearing 52-week lows while only 84 were nearing 52 week highs.

This Premium Screener can be used every day to understand market breadth, especially in bear-hit markets such as the present one.

#2 Debt reduction

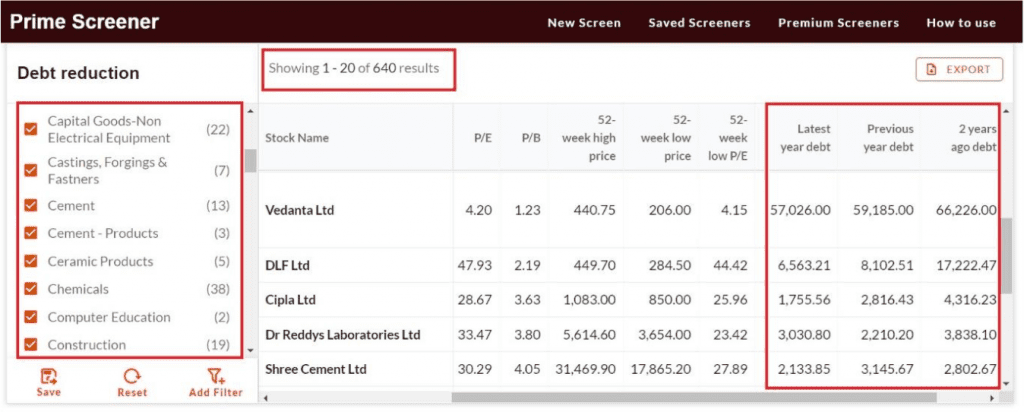

In India, deleveraged balance sheets or in other words, balance sheets that are freed up from debt, are considered a big positive. So, if you wish to narrow your stock universe to those stocks or sectors that are undergoing de-leveraging, we have a readymade screener that will provide you with such a list. If you select the Debt Reduction Premium Screener now, it will show 640 NSE listed companies that have reduced debt in the last 3 years as shown below. But these stocks belong to different sectors (the left menu will show the sectors and also the number of stocks from each sector).

You can use this screener in sectors such as steel, cement, infrastructure, pharmaceuticals and manufacturing where companies tend to have high debt and deleveraging can often lead to re-rating of the stock.

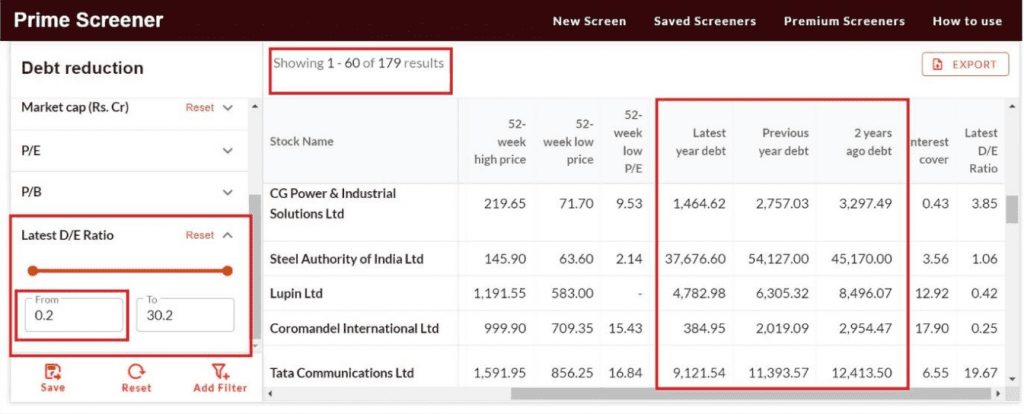

This list further be filtered by using the market cap range or use the debt equity ratio to eliminate companies that anyway had negligible debt in the first place (input 0.1 or 0.2 at the lower end to eliminate companies with negligible debt).

Doing this exercise, the list narrows to 179 NSE listed stocks with market cap above Rs.1,000 crore that have reduced debt in the last 3 years (screenshot below).

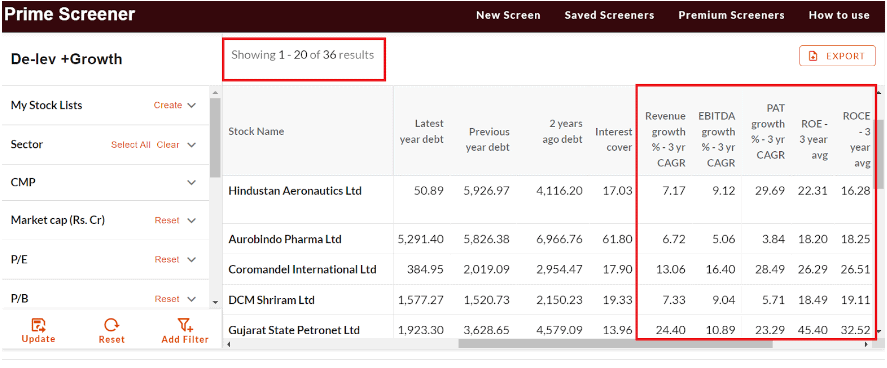

Can you improvise on this further? Yes, of course! This Premium Screener can be further narrowed to filter companies that are not only undertaking debt reduction, but also growing their sales and profits with respectable RoE and RoCE (as shown below) by applying our growth, quality and valuation filters.

In other words, our Premium Screener can a be starting point for you to narrow an initial screening further, with regular fundamental filters to make the list more meaningful and investment worthy.

#3 Expanding EBIDTA Margins

This Premium Screener assumes significance at this point of time as plenty of companies or sectors are going through a phase of margin contraction due to high input cost prices. By using this Premium Screener, you can buck the trend and find out companies that are expanding margins during these tough times.

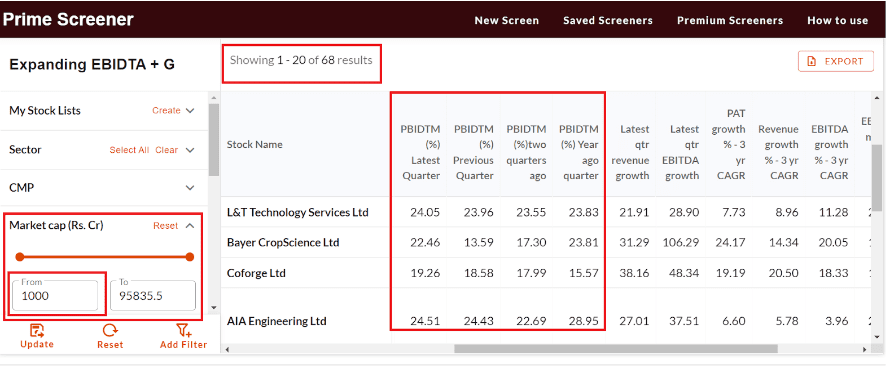

If you just run this Expanding EBIDTA Margin Premium Screener now, it will throw out about 493 companies that have expanded their EBIDTA margins in the last 1 year. The list can be further narrowed down to exclude very small companies below Rs.1,000 crore market cap, if needed, using the Market Cap filter.

So, this Premium Screener helps discover outliers with an ability to maintain margins or it could also throw candidates that are turning around.

You can again shortlist this further. If we apply our growth, quality and valuation filters, as explained for growth stocks, to the output of this Premium Screener, we will get a shortlist of companies that are growing with expanding margins and respectable quality metrics, as shown below.

From the initial output of 493 stocks, we have filtered out 68 stocks by applying growth, quality and valuation filters.

#4 Steady earnings growth

This is another useful and easy to use screener to find out Outliers when companies are going through margin pressure and earnings contraction.

This Premium Screener will throw you companies that have delivered growth in profits for the last 4 consecutive quarters. While many companies have been facing either cost related pressure or tough business environment related challenges, this Premium Screener will bring out the resilient ones.

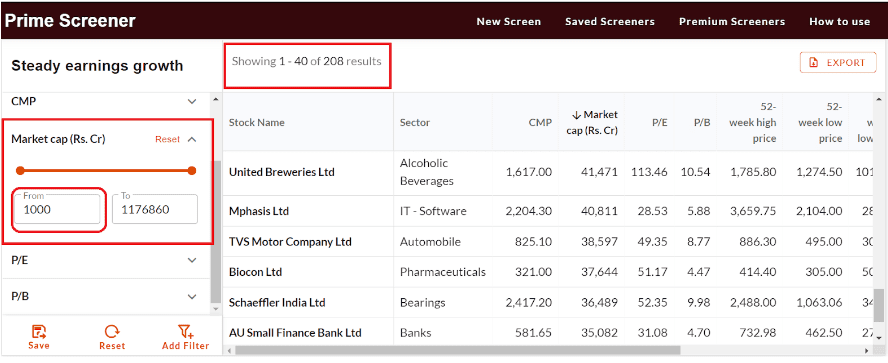

If you run this screener now, you will get 304 companies with increasing profits in the last 4 consecutive quarters. In case you want to weed out the small cap ones, apply the market cap filter and you will end up with 208 companies as shown below.

#5 Steady cash flow positive

The most important financial item to check in any business is cash flows. Small wonder they say, revenue is vanity, profit is sanity and cash flow is reality 😊

This is an interesting Premium Screener that will give you companies churning out positive cash flows in the last 3 consecutive financial years. If you run this Premium Screener now, you will come up with 1,094 companies out of 1,879 NSE listed companies.

The ideal way to use this Premium Screener is to use it along with the criteria to pick growth stocks. We have discussed how to pick growth stocks in our earlier article.

If you run this Premium Screener before applying the growth filters in the article mentioned above, you will get a great combination of growth stocks that are cash flow positive – a combination that is not easy to discover!

You can also watch the video below to see how to use this Premium Screener in conjunction with growth, quality and valuation filters to pick growth stocks.

#6 Rising RoE

This is a quality metric whose importance cannot be understated as it helps check the efficiency of utilising shareholder’s capital. You will find about 290 NSE listed companies where RoEs have been expanding for the last 3 years, if you run our Premium Screener now.

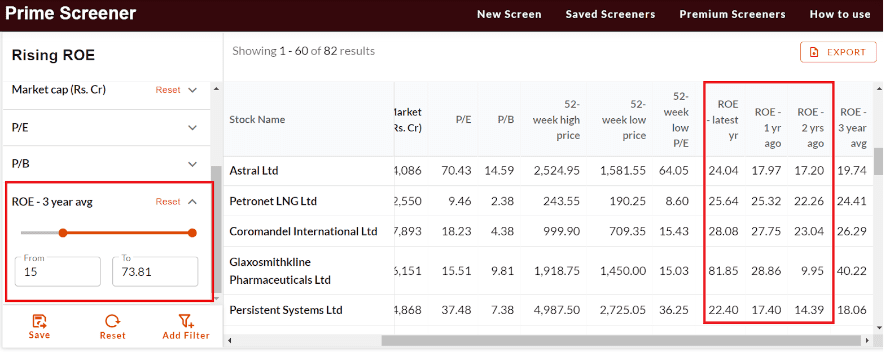

You can further use the RoE filter from the Quality filter to input the RoE range. If you pick companies with market cap above Rs.1,000 crore and also had RoE above 15% during the last three years with increasing RoE trend, the list narrows down to just 82 stocks as shown below:

These are but just some of the ways in which you can use our Premium Screeners along with other filters to narrow the choice of stocks based on your own thesis.

And there are Premium Screeners like “nearing 52 week high” and “nearing 52 low” that can be used daily to understand the breadth of the market and also get an understanding of the sectors and stocks that are doing well or badly in a certain market situation.

Please use Prime Screeners and let us know what you shortlisted or whether you would like us to deal with any specific segments of these through webinars. Prime Stock Screener has made your choices easier than any other tool out there, Subscribe today to PrimeInvestor if you are not a member.

12 thoughts on “Why these 6 Prime Stock Screeners make you an equity pro!”

Good day sir, I am looking for Intraday unidirectional stock selection pre market. Can you help?

Thank you for your interest. However, our tools and recommendations are designed for long-term stock investors and making fundamental calls. – thanks, Bhavana

Hi,

I have been using Screeners for some time now, but this article makes it more clear to use it quite effectively and productively. Check for few possibilities –

1) When you select more number of filters, the columns go off screen to right side. Can we make it possible to drag a selected column and bring it on screen, so that one can rearrange screen.

2) When we download it in Excel, it gets downloaded as a dump. If we can download it with basic formating displays, it will be more useful.

Hello Sir, thanks for your feedback.

1. At this point it is difficult. We will however explore.

2. Whatever is in the screen gets downloaded in a proper excel format. Can you please tell us what formatting is missing?

thanks

Vidya

Is there any way to combine premium screeners themselves.

For instance,

Premium Screener X

AND

Premium Screener Y

OR

Premium Screener Z

Hello Sir, At this point, no 🙂 You can run them seprately and you have to ‘V-look up’ your way on the excel 🙂 thanks, Vidya

Steady Cash flow premium screener – Latest year OCF column is blank for all the stocks in the results. Perhaps ZERO is considered positive, since it is not negative !!

Thank you for bringing it to our notice there was a small bug in our back-end the display of OCF values seems fine now.

I AM PREMIUM MEMBER.

HOW CAN I ADD RISING ROE PLUS THE NEWER FEATURES TO MY SCREEN MAKING IT A NEW SCREEN.

PLEASE GUIDE

I AM SENIOR CITIZEN

Welcome your query sir

There is a menu in our stock screener called “premium screeners”

Under that, “Rising RoE” screener is there. Just click that and the companies with rising RoE will appear there

Can export this to excel using the option on upper right corner – “export”

Thank you

When I save a list of filters, and try to switch the premium screeners, I do not see an option to add the saved filters. is there a way to do that ?

Thanks

Welcome your query sir

You have to first select the premium screeners and then apply the filters

Thank you

Comments are closed.