Please note that Canara Robeco Equity Diversified fund has since been renamed as Canara Robeco Flexi Cap fund.

When uncertainty is the name of the game today, investing in an equity fund may not be at the top of your to-do list. But for long-term investors, markets like these offer good buying opportunities. For such investors, a multi-cap fund that uses a core of large-cap stocks and adds returns by selectively picking mid-cap and small-cap stocks will serve well.

Canara Robeco Equity Diversified is one such fund and is part of our Prime Funds recommendations list. Here are four key reasons why the fund features in our list.

#1 Performance places it well above others

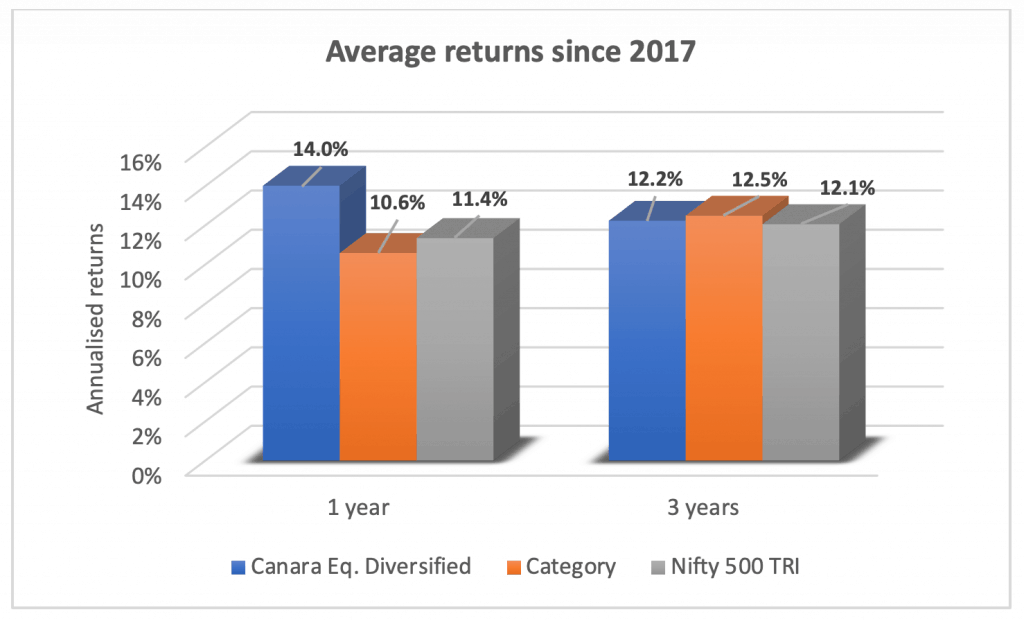

Canara Robeco Equity Diversified (Canara Equity Diversified) has steadily ticked ahead of the broad-market Nifty 500 TRI from around mid-2017 and onwards. Against peers too, the fund has shone in the past three years. On a 1-year rolling return basis since 2017, the fund has beaten the Nifty 500 TRI 84% of the time. That compares favourably with the average of 42% that funds investing across market capitalisations have managed. This improvement in Canara Equity Diversified’s performance has come about from a strategy change in 2016 that saw it become more structured and focused in stock-picking.

On risk-adjusted returns measured by the Sharpe ratio, the fund beats almost all peers save for a few such as Parag Parikh Long Term Equity. This is in part due to the fund’s ability to both participate on market upsides as well as contain downsides, while keeping volatility under control. The fund’s upside capture, considering different 1-year periods, is in the top quartile of funds in its category. Deviation in the fund’s 1-year returns is much below category average.

#2 Strategy can help it stay ahead across market cycles

The fund’s strategy involves using quality, steady, long-term growth companies as the basis of the portfolio. With most such stocks obviously not coming at low valuations, the fund is primarily growth-oriented.

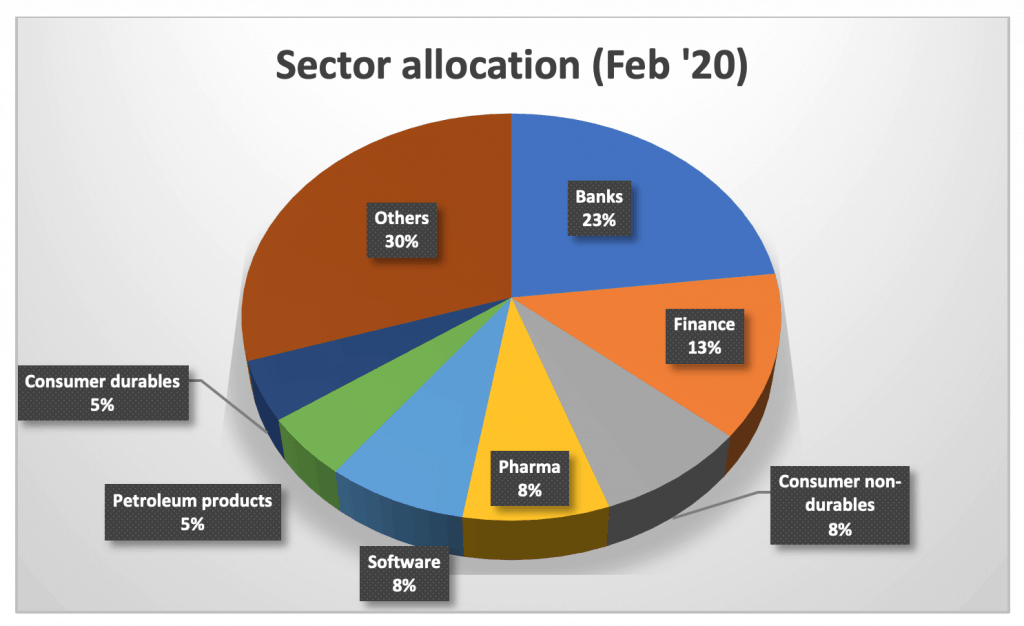

Top stocks in the fund’s portfolio feature names such as HDFC Bank, Reliance Industries, Kotak Mahindra Bank, Bajaj Finance, and Hindustan Unilever. In the polarised market of the past two years, these stocks have helped the fund beat the index where other funds have faltered. These stocks, along with other holdings such as Infosys, TCS, ICICI Bank, Divis Labs, and Abbott India are also up quite sharply from lows hit in the ongoing market correction. This has helped the fund keep losses in check. The top stocks in the fund’s portfolio additionally tend to be concentrated accounting for about 40-45% of the portfolio, with individual stock weights going up to 7-9%.

However, given that opportunities do exist in value-based or cyclical plays, the fund puts around 25-35% of its portfolio in such stocks. This allocation serves to push returns as a rapid recovery in a company’s fundamentals can lead to a valuation re-rating. Here, the fund goes for companies that can see a jump in earnings growth over the next couple of years, triggered by factors such as a performance turnaround, broader improvement in a sector’s trajectory, an economic uptick and so on. For instance, stocks such as Larsen & Toubro, Honeywell Automation, and Ultra Tech Cement form part of the fund’s portfolio.

A clear growth-value blend such as this can help performance stay steady across market cycles. It helps the fund participate, whether markets are rewarding quality companies or picking up the low-valuation stocks.

This approach also serves well in the current market. If the depth of the Covid-19 economic impact is extremely severe or prolonged, markets may continue to prefer quality companies with low debt, stable earnings, and better return on capital. At the same time, should recovery come in quicker, cyclical stocks that markets have dumped in this correction can bounce back. Combining quality and value stocks can help tick both opportunities.

The second factor that can keep returns sustained is the fund’s deft profit booking. In stocks that have run up, especially those that fall into its shorter-term plays (turnaround stories that have delivered), the fund either pares holding to capture part of the gains or can even exit. While this increases overall portfolio churn – the fund’s portfolio turnover is often the highest in its category – it enables the fund to realise gains made and mitigate effects of any stock slides.

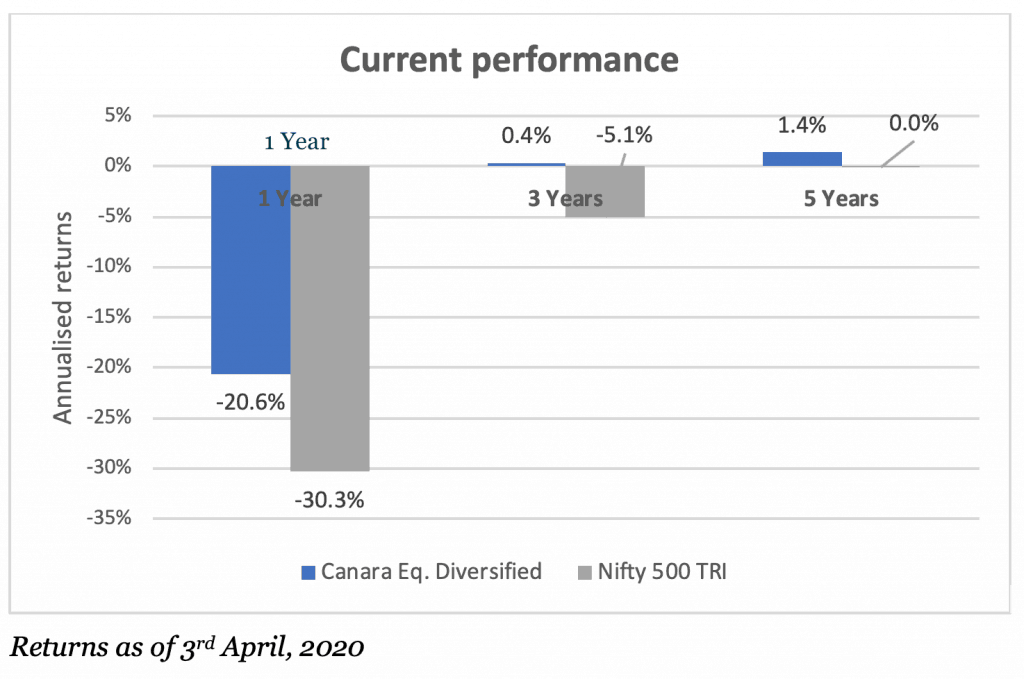

#3 Ability to contain downsides

This strategy of Canara Equity Diversified, to pick up stable companies and to book profits or exit from time to time, allows the fund to contain downsides. Measured by the downside capture ratio, the fund captures about 73% of a market fall. That means the fund has lost far lesser than the benchmark. This is well below the 90% that the category averages.

From the peak this January, the Nifty 500 TRI has tanked 33%. In contrast, Canara Equity Diversified has lost 25.3%. Containing downsides is a key positive, as such funds are quicker to recover. This apart, such funds do not require a big market rally to make up for the losses.

#4 Provides a good blend of large-cap and mid-cap stocks

With several pure large-cap funds still struggling to beat the index, taking a moderate-risk multi-cap fund can serve better. This apart, multi-cap funds can participate in a mid-cap rally without taking the risk of a pure mid-cap fund.

Canara Equity Diversified has maintained about 65-75% of its portfolio in large-cap stocks with the rest mostly in mid-caps. This is similar to other quality multi-cap funds such as Kotak Standard Multicap. Canara Equity Diversified is able to hold its own against this fund, beating it about 53% of the time on a rolling 1-year basis in a 4-year period. It fares similarly when compared to other large-cap based funds such as Mirae Asset Large Cap.

Suitability of this equity fund

Canara Equity Diversified suits moderate and high-risk investors with at least a 5-year investment horizon. It can be used along with a more value-based fund for a balanced portfolio. Aggressive investors can also add a mid-cap or small-cap fund along with this fund.

The fund’s managers are Shridatta Bhanwaldar and Miyush Gandhi. The fund’s AUM stands at Rs 1765 crore at end-February.

Also Read : Prime Recommendation – A Nifty Midcap Index Fund

8 thoughts on “Prime Recommendation: Canara Robeco Flexi Cap fund”

Thanks for the clarification regarding the fund manager change.

Hello Sir,

This is Vikas Kapoor..

I’m keen to know more about Mutual-Funds and tax savings!

Hello sir,

Please refer to the tax-saving funds section in Prime Funds. Tax-saving mutual funds qualify for deductions under Section 80C of the IT Act. You can refer to this article for general understanding on how to use section 80C under the old tax regime. If you’re opting for the new tax regime, then you will not need to make any tax-saving investments.

Thanks,

Bhavana

5 yr. returns fund 1.41% & index 1.31%

Your comment.

Hello sir,

Not quite sure whether you’re referring to the returns or the fund’s performance. Markets have collapsed 20-30% in the space of a month, so it would negate a lot of the gains. As far as the fund goes, as mentioned in the analysis, it has picked up only recently. When we look at funds, we also consider those that haven’t always been good but show promise of delivering well – so that we pick up newer ones and we don’t wait for full performance to show up.

Thanks,

Bhavana

Hi,

Could you please share your thoughts on how you factor in fund manager changes into your recommendation? I see that this fund has a new fund manager since Oct’19.

Thanks.

Hello sir,

The fund has an additional fund manager from Oct 19. The other fund manager (Mr Shridatta Bhandwaldar) has been managing the fund from July 2016. So there’s no fund manager change recently. Funds often have additional managers, to make it easier to manage or a de-risking to ensure smooth functioning of the fund, or to bring up newer managers and so on.

Generally speaking, however, the effect of a fund manager change depends on the fund, the old manager, and the new manager. If a quality fund has a structure and process in place, then a change may not be a problem. If it’s a mid-cap or small-cap fund, then we’d be more wary of a change. If the fund manager alone changes, while the overall equity head and team is in place, then again a change may not be hard.

Where a fund manager changes, we may not recommend fresh investments in the fund, but we wouldn’t recommend a sell in the fund. A wait-and-watch approach would always be the best course to follow for investments already made in the fund.

Thanks,

Bhavana

Hello,

We do take into account fund manager changes and observe portfolio churn and ask for fund manager calls to understand change in strategies. In this case, Shridatta, who was the primary fund manager continues to remain as the co-fund manager. There is no change. thanks.

Comments are closed.