With better credit offtake and improving upgrades in credit rating, at PrimeInvestor, we think it may be time to selectively take calls on bonds that compensate well for the risk taken. In this report we cover one such privately placed bond.

Bond recommendation

Svatantra Microfin, a Microfinance Institution (MFI) promoted by Aditya Birla Group, has unsecured, non-convertible debentures (NCDs) in demat form aggregating to Rs.100 crore available through secondary offer. This is a private placement and will be unlisted. We recommend this bond for moderate to high risk investors with short tenure (2 years) and looking for regular cash flows.

Key features

- The NCD is available at present at its coupon rate of 9.5%. Based on the cash flows over these 2 years, the return comes to about 9.83%.

- What is unique about this offer is that the principal is also paid in equal quarterly redemptions with the interest.

- This secondary issuance is available with PhillipCapital (India) Private Limited. The yield may change later at the time of your purchase. You need to write to PhillipCapital (India) to check the present yields. The minimum investment size is Rs 5 lakh, making the bond suitable only for HNIs. Please check further details below.

- To offer privately placed bonds and other traded bonds that are seldom in the radar, we have a non-commercial arrangement with PhillipCapital (India) Private Limited to get details of such bonds. That means we do not earn anything from this nor are we operationally involved. You can read more about this and how we select such bonds here.

- If you have not done it earlier, you need to register with PhillipCapital (India) as a counterparty, with your KYC details to purchase these bonds. This is a one-time process and the details are given here: Investment process for the bond

The company and business

Svatantra Microfin is part of “Aditya Vikram Birla Group (AV Birla Group)” which is one of India’s leading business conglomerates headed by Kumar Mangalam Birla. The MFI has his daughter, Ananyashree Birla, on its helm backed by a professional and experienced management.

Svatantra Microfin is registered with RBI as a Non-deposit taking Systemically Important Non-Banking Finance Company-Microfinance Institution (NBFC – MFI). The AV Birla group’s financial services businesses comprising non-bank lending, asset management and insurance are housed under listed company Aditya Birla Capital with a market capitalisation of Rs 36,000 crore.

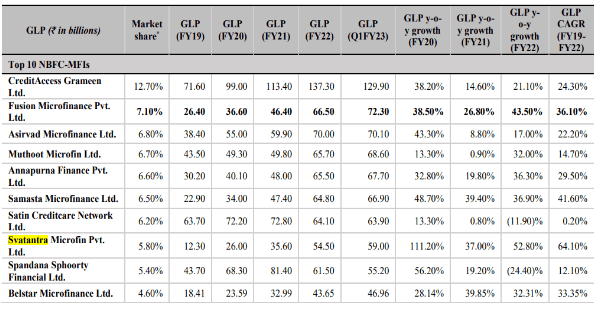

Svatantra Microfin comfortably occupies its slot among the 10 leading standalone MFI in India with a PAN India presence. While CreditAccess Grameen leads the MFI space with double digit market share, the remaining 9 players are placed almost on a similar footing with respect to market share, geographical presence and AUM. Svatantra Microfin has a market share of 5.8% and is growing at a healthy pace.

Among the 9 players aside of Credit Access Graameen, three of them (Asirvad, Muthoot Microfin & Belstar Microfin) are promoted by India’s leading gold loan business groups – Muthoot and Manappuram. To this extent, the standalone MFI space also seems to be heading towards a consolidation - with some strong players backed by stable promoters. Being hit hard in the aftermath of Covid, the space also witnessed a successful IPO of its 3rd largest player, Fusion Microfinance, recently in November 2022.

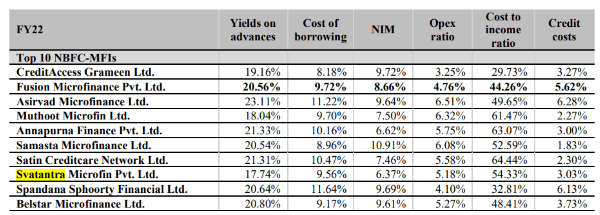

While Svatantra Microfin lags some of its peers on key financial performance metrics such as Yield, NIM and cost to income ratio, it is still within the close vicinity of others.

On the other hand, it impresses on the cost of borrowing (an obvious benefit of a strong promoter back-up) despite being dependent on term loans to the extent of 94% (terms loans account for 65% of borrowings for top player CreditAccess). But there is scope for improvement on this front for Svatantra Microfin.

The fact that Svatantra Microfin has been able to contain its gross NPA within 4% (in-line with leading players) during the turbulent 3 years in the aftermath of Covid is a comforting factor. This apart, the MFI also has a capital adequacy ratio of 20% with further commitment from the promoters.

Below is a glimpse into 5-year financial performance of Svatantra Microfin. The company has been growing its topline at a healthy pace.

Credit rating

Svatantra Microfin has a CRISIL A+/positive rating and CARE AA-/Stable rating for its subordinate debt issue. Its long term debt facilities also carry similar ratings. This is after a recent upgrade by CARE, which is a positive. Leading player, Credit Access Grameen too shares a Ind-RA AA-/stable and Crisil A+(positive)CRISIL is banking on the timely financial support of promoters to Svatantra to meet any incremental capital requirement, as a key factor for its rating. Laying further emphasis on this, CRISIL has also mentioned that reduction in ownership by the AV Birla Group below majority holding will be a rating sensitivity factor.

On the operational side, sound risk management process bolstered by digitization is one of the key positive factors highlighted in the report.

Summary of performance

While industry leading financial performance is always considered key determinant to premium equity valuation, other factors such as promoters, ownership, liquidity, and capital adequacy take precedence when it comes to assessing credit risk, especially on unsecured instruments.

As far as the NCD investors are concerned, the backing of AV Birla Group lends significant comfort in this case and more than offsets the shortfall in some financial metrics. The tenure of the bond and the repayment of principal along with interest also reduces the risk.

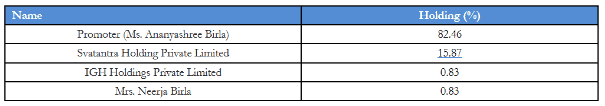

Further, the standalone MFI space offers enough room for a player like Svatantra Microfin to improve, consolidate and grow. It is now a privately held entity with shareholding (as below) with its board comprising of Ananyshree Birla, Kumar Mangalam Birla and his spouse Neeraja Birla.

Suitability

- This bond is suitable only for moderate to high-risk investors. We recommend a buy and hold given the short tenure of 2 years. The bond cannot be traded on the exchanges.

- Since the principal will be repaid along with the interest, you will earn interest only on a depleting corpus (since principal will be steadily repaid with interest). That means your interest component and therefore overall cash flow will reduce (see illustration) While this mode of repayment reduces the risk to your principal, it will not help you earn the same quantum of interest.

- Interest will be taxed at your slab rate and principal will not be taxed.

Below is an illustration of how the cash flows will look like for Rs 100 of investment (please note that the real face value is Rs 5 lakh and this is taken only for illustration purpose), with 9.5% coupon and equal repayment of principal.

If you wish to know more details, you can solicit interest by writing to Phillip Capital (India) in the contact given in this article: https://staging.primeinvestor.in/varsity/investing-in-private-placement-bonds-the-process/

Disclaimers

- PrimeInvestor has a non-commercial partnership with PhillipCapital (India) specifically for receiving information on bond issuances.

- PrimeInvestor does not receive, directly or indirectly, any commission or any other reimbursement in any form – from any of the parties involved in the issuance. We are not brokers nor distributors.

- PrimeInvestor is not involved in the onboarding process nor in the execution of these transactions and as such is not liable for any acts of commission or omission. We will be unable to take on any kind of operational queries regarding these transactions.

- Our responsibility is limited to recommending these products based on information available to the best of our knowledge. Despite best effort on due diligence, there is a risk of default in these instruments.

- PrimeInvestor is a SEBI registered Research Analyst (Registration: INH200008653). The content and reports generated by the entity does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information are provided on an ‘as is’ basis by PrimeInvestor Financial Research Pvt Ltd. Information herein is believed to be reliable but PrimeInvestor Financial Research Pvt Ltd does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The services rendered by PrimeInvestor Financial Research Pvt Ltd are on a best-effort basis. PrimeInvestor Financial Research Pvt Ltd does not assure or guarantee the user any minimum or fixed returns. PrimeInvestor Financial Research Pvt Ltd or any of its officers, directors, partners, employees, agents, subsidiaries, affiliates or business associates will not liable for any losses, cost of damage incurred consequent upon relying on investment information, research opinions or advice or any other material/information whatsoever on the web site, reports, emails or notifications issued by PrimeInvestor Financial Research Pvt Ltd or any other agency appointed/authorised by PrimeInvestor Financial Research Pvt Ltd.

- Use of the above-said information is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. This report is a review of a financial product and should not be construed as advice. Investors would need to take an informed decision about taking on such risk. Such risk is entirely that of the investor. PrimeInvestor absolves itself of any risk of non-payment of interest or principal from the instruments it recommends.

3 thoughts on “Prime Bond recommendation: A privately placed bond for high-risk investors”

Hi,

There is an offer of 9.60% Credit Access Gramin Ltd 2025-Secured Debentures maturing on 23 Nov 2025 at a YTM of 9.50% in the market.

What is your view about investing in this product?

If you are ok with the higher time frame (3 years) then the risk level is the same as the one we covered. Of course Credit Grameen is much larger.

Thanks Vidya

Comments are closed.