A theme that makes a good addition at this time, in long-term portfolios, is the consumer theme. Consumption as a theme covers any sector that directly relates to people spending on necessities, leisure, entertainment and even health. That brings up a wide range of potential sectors that consumer thematic funds can choose from.

But while choices may be plenty, the overall consumption theme has been patchy with some pockets doing well while others have not. However, there are now green shoots of a more broad-based pickup in consumer spends across sectors:

- Hibernating rural demand is returning in key sectors such as FMCG and will, if sustained, eventually spill over into more discretionary spending. Microfinance lending also suggests returning demand in the rural market.

- Meanwhile, urban demand continues to hold up especially with the premium end showing strong growth.

- Inflation squeezing consumer spends is cooling off – companies in sectors such as FMCG or QSR have indicated that the worst of the demand slump is now past. Indicators such as the RBI’s Consumer Confidence Survey and credit card spends are also showing revival.

- Lower inflationary pressures also help margin recovery for companies, as well as allowing them room to play on prices to boost demand.

Along with this, the consumption theme itself lends to a long-term play, with economic growth and rising income pointing to strong consumer spending.

Our recommendation in this theme is Nippon India Consumption fund, which is already part of Prime Funds. The fund is among the steadiest performers in the consumption theme, and has typically done far better than the Nifty Consumption index.

Consumption recovery

Consumer demand can be seen in different ways.

- One, the behaviour of rural and urban demand.

- Two, the price spectrum of value versus premium.

- Three, the nature of spends between staples, leisure, health and so on.

The consumption theme has been firing on some of these, and subdued on others.

Take rural demand – this has been a drag on overall consumption spending, and the high-inflation scenario especially over 2022 took a toll on this key consumer segment. FMCG demand, the staple for households, was a clear example of this with rural demand shrinking over all quarters in the 2022 calendar. Entry-level 2-wheeler sales, another good indicator of rural spends, is still well below the pre-Covid peak.

However, the March 2023 quarter indicated a turnaround. For FMCG companies, rural demand growth crept out of the negative zone. Urban volume growth has steadily increased. Going by Nielsen reports, the sector moved from a shrink in overall volumes to a 3% growth in the March ’23 quarter. In addition, the non-food categories saw value growth steadily pick up.

Management commentary for companies such as Hindustan Unilever and Jubilant Foodworks for the recent June 23 quarter also indicate that the worst of the demand slump, along with peak inflation, is now behind. Lower input inflation will also aid in companies potentially cutting product prices to boost demand. Companies like Marico plans to use the gains in gross margins to boost the ad spends to drive consumption. FMCG players are also finding themselves in a sweet spot now to acquire digital first brands that have won consumers’ minds in niche and fast-growing categories such as healthy foods, wellness, male grooming, nutraceuticals, etc to expand and build premium portfolio.

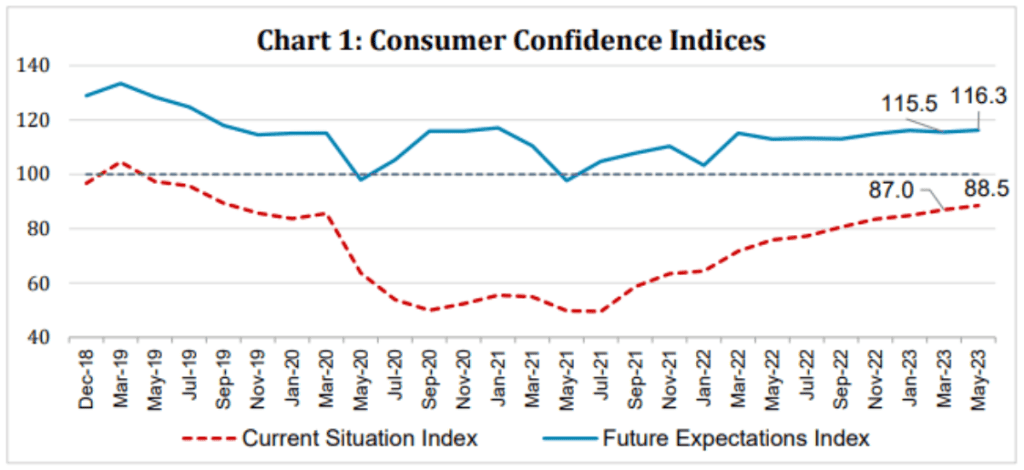

The RBI’s Consumer Confidence Indices also signal more positivity on multiple indicators. For example, household perceptions of spending on essentials and non-essentials, both current and 1-year ahead expectation have markedly improved since January 2023. Perceptions of income growth have similarly improved. The chard below shows the movement in the Consumer Confidence Index for the current scenario and future expectations – the good recovery seen in the Current situation index bodes well for nearer-term demand recovery.

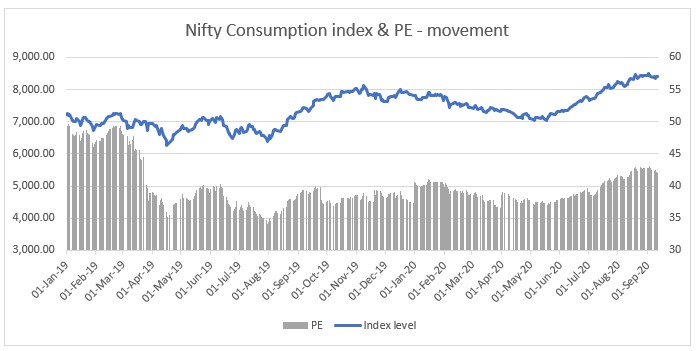

While the recovery is yet to fully firm up, markets have already been factoring in a better spending scenario. The Nifty Consumption index has returned 11.5% since January 2023, against the Nifty 50’s 8.6%. In terms of valuations, the consumption basket has never been a low PE one. However, from 2019 to date, the PE multiple has marginally shrunk even as markets overall rallied.

Therefore, while there has not been a PE correction, the flat returns of the consumption basket along with some earnings improvement has helped current valuations remain within averages. The chart below shows the 5-year movement in the Nifty Consumption index and the PE over the past 5 years.

Longer-term potential

Private final consumption expenditure already accounts for about 61% of GDP. The consumption theme as a whole can be a long-term one as well, going by the trends unfolding in consumer spending behaviour and income growth.

- Expansion plans by retail chains and restaurant chains serve to improve penetration and tap into demand in smaller towns and cities.

- Across sectors – foods, personal care, home care, automobiles, apparel, travel etc – the premium end of the spectrum is seeing strong demand. This premiumisation trend is important for two reasons – one, it shows a general shift in consumption behaviour, better household incomes, and more sustained spending. Two, it will help improve product mix for consumer companies, aiding better margins.

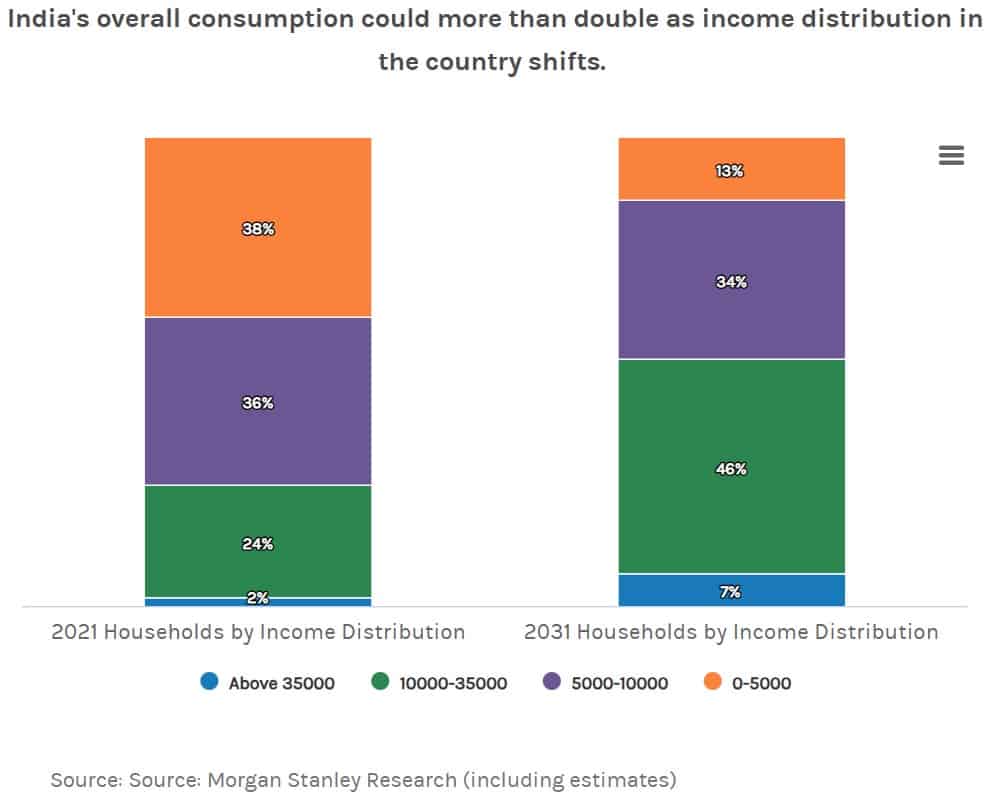

- Various reports and estimates point to a leap in per-capita income; a recent Standard Chartered Bank report, for example, estimated that per capita income could grow to USD 4,000 by FY-30 from the USD 2,450 it is currently. A Morgan Stanley report expects a boom in discretionary spending, driven by a rise in household income and a bigger share of higher-income households. As per these estimates, discretionary spending can move up to 79% of overall spending by FY-32 compared to the 74% in FY-22. This will aid the premiumisation trend in the point above.

This apart, the range of sectors within the consumption theme is vast, offering funds investing in this theme a variety of choices. Apart from the standard FMCG basket, sectors will include those such as jewellery, paints, hotels & restaurants, apparel, footwear, retail chains, consumer durables, auto, and even financials. The universe, thus, blends both more defensive plays such as FMCG along with more tactical plays such as auto, leisure and so on. To this extent, funds will be better able to contain downsides during corrections compared to other themes.

Recommendation – Nippon India Consumption fund

Of the consumer funds there are, our pick is Nippon India Consumption fund. The fund is part of Prime Funds, in the Strategy & Thematic section.

Nippon Consumption has been adept at juggling stocks in its portfolio, booking profits and exiting where warranted. It invests across market capitalisations; its June’23 portfolio has about half in large caps with midcaps at 19% and small caps at 24%. The small-cap exposure is among the highest in the consumer funds basket.

Our recommendation on Nippon India Consumption is based both on its performance and portfolio. For one, this fund is the most consistent at returning better than the Nifty Consumption index; on a rolling 1-year return over the past 3 years, the fund beat the index all the time. On a rolling 3-year return, it beat the index over 90% of the time by an average margin of 5 percentage points. On the consistency front, Nippon Consumption is better than current chart-toppers such as SBI Consumption, ICICI Pru FMCG, and Mirae Asset Great Consumer.

Two, Nippon Consumption also tends to stay within the top quartile of consumer funds. It delivers less flashy returns than peers, but is far steadier. This characteristic fits well for a longer-term play. For example, considering the same 1-year returns as above, Nippon Consumption’s lowest return was 0.14%. All other funds delivered losses ranging from 2-15%.

Three, Nippon Consumption’s current portfolio is a tad more diversified than other consumer funds. For example, its exposure to autos, which has rapidly run up, is less concentrated than those such as SBI, Mirae, UTI or BNP Paribas. It also holds very marginal exposure to banking & finance, another segment that seen a sharp rally. It has a stronger presence in durables, retail, and leisure all of which play on the strong urban demand and rely less on rural demand recovery.

Suitability & portfolio exposure

The fund requires a high-risk appetite. While the theme is relatively less cyclical than others, it still is a focused play on consumer sectors and with many such opportunities more in the mid-cap and small-cap space. Ideally, invest through lumpsum. However, if you are keen on SIPs, you can do so but do not allow SIPs to run for more than 6 months.

This can be the only sector fund in your long-term portfolio or you can use it with more tactical thematic funds for a good all-round sector exposure. Keep total exposure to all sector funds to 15-20% of your portfolio.

12 thoughts on “Prime Recommendation: A thematic fund to add in long-term portfolios”

Thanks Bhavna for the insights .. .can it be used for long term horizon – 10 yrs+ ; my overall portfolio does not have any thematic funds and this will be the first

Yes you can. Keep exposure limited. Vidya

Hi

Thanks for the article.

In comparison with SBI Consumption Opportunities Fund and Canara Robeco Consumer Trends Fund, which one of these three is better?

Regards

Kaustubh

As explained in the article, our recommendation in the consumer themed funds is Nippon Consumption. The fund is less volatile a performer and is more consistent; SBI for example, tends to swing high and fall sharply. Returns therefore tend to be better on an average, and given that this is a longer-term thematic call, we’d prefer more consistent funds. – thanks, Bhavana

Normally when I have surplus, I feel like investing that amount to Parag Parikh Flexi Cap since they have a such good track record of performing well over a time period, do you think I should continue that or there can be an additional return possible with this fund?

A fund that has a ‘buy’ call from us can be used at any point in time. We remove it when we see no potential or when performance suffers prolonged. thanks Vidya

If someone is fully invested in equity as per their asset allocation, do you suggest they redeem some other fund and invest in this (or any new thematic or sectoral fund that is recommended), or add this if and when they have a fresh lumpsum available?

No, don’t redeem funds and invest. When we highlight these opportunities, or issue strategies, it’s always for investing additionally – using any surplus. Generally speaking, our suggestion is that one keeps some amount in surplus (in bank/liquid) over and above regular investments and use that to utilise any tactical opportunity. You can, at best, redirect some SIP instalments to this if you’re keen on it. Else, invest when you have surplus. As explained, the theme will hold good for longer term as well. – thanks, Bhavana

Hi Bhavana,

Thanks for the recommendation, I am bit confused on the number of thematic recommendations that are currently active.

Transport/Banking/Healthcare/Commodities/Consumption – Can we have an additional column in the prime funds under thematic section stating the current status. (i.e. Can be added on dips / Hold/ Lumpsum addition etc.), with a quarterly updation. This can help someone taking a fresh look at any point of time.

All funds in Prime Funds are active calls. If we change our stance on any theme, we issue both an alert on this and remove it from the list. – thanks, Bhavana

Well elucidated, makes lot of sense to invest in this theme. The Horizontal Blue bars under “Recent Returns – Nippon India Fund” – what do these Bars represent.? Did not seen any narration. Kindly clarify

Sorry about that, didn’t notice the legend wasn’t there. Updated the table now, thanks! – regards, Bhavana

Comments are closed.