In early June, we gave a ‘BUY’ call on an API maker as we were and still are convinced that many of the challenges facing the sector may be abating and that the time is right to carefully select players that are well positioned in this space. We narrowed down on a player that operates in the commoditized API space and still managed to churn out a steady performance despite it being a volumes game where margins are usually modest.

The stock has run up 30% since our call.

The stock in question is Aarti Drugs and our first ‘BUY’ report can be found here.

Our original ‘BUY’ recommendation price was Rs. 468 (26 times TTM PE). The stock has since run up significantly on July 24, 2023, touching a high of Rs. 612.45, and currently trades at Rs. 605.5 (31 times TTM PE).

The stock shot up recently post a buyback announcement. It’s long-term prospects not withstanding, we think this sharp price rise, triggered by the buyback news is temporary and only provides an opportunity to take off some profits. We are recommending a book profit and moving the stock to a HOLD.

Let us understand the buyback news first.

Buyback announcement

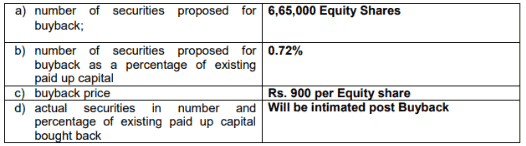

On July 21, 2023, the company approved a buyback and the key details of the same can be found below.

While on the face of it, a buyback price of Rs. 900 is very attractive given the premium over the current market price, we do not believe that the buyback really offers shareholders an opportunity to offload shares. This is because the number of securities proposed for buyback as a percentage of existing paid up capital is less than 1%. Roughly this translates to a shareholder who owns 100 shares being able to offload just 1 share at the buyback price of Rs. 900. That essentially means you cannot meaningfully take advantage of the attractive buyback offer price.

What to do now

While you may not be able to take advantage of the buyback, we believe this spike in price offers an opportunity for subscribers who entered the stock at our ‘BUY’ price of Rs. 468 or thereabouts (even if 5-10% more), an opportunity to partially book profits. We are now recommending a book profit and moving the stock to a ‘HOLD’.

That means you can partially sell your holdings and hold the rest (how much to sell would depend on your holding size).

Long-term growth prospects for the company as detailed in our original recommendation report are still intact. These are:s

- Its position of strength with respect to key products with newer launches such as salicylic acid (an import substitute in dermatology) getting closer,

- a capex program which will be completed in the current FY and that provides better rate of growth beyond FY24 (at the conference call on July 24th management has provided information that this is to the tune of Rs 4,500 to 5,000 crore by FY 26-27),

- a strong foundation at the group level itself in the chemicals space

- a conducive external environment.

However, current valuations do not justify making fresh purchases of the stock at its current price despite the long-term prospects and hence the ‘HOLD’ call.

Results of Q1 FY24 – good but not unexpected

While the YoY growth in topline and margins are encouraging, they are not entirely unexpected given that input costs pressures were already abating at the time of our ‘BUY’ call coupled with the company’s efforts at working capital management.

Given that the positive results were not unexpected, we believe that would have already been factored into the price and that the buyback announcement is the key driver of the spike in stock price post the result.

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (hereinafter referred to as the Regulations).

1. PrimeInvestor Financial Research Pvt Ltd is a SEBI-Registered Research Analyst having SEBI registration number INH200008653. PrimeInvestor Financial Research Pvt Ltd, the research entity, is engaged in providing research services and information on personal financial products. This Research Report (called Report) is prepared and distributed by PrimeInvestor Financial Research Pvt Ltd with brand name PrimeInvestor.

2. PrimeInvestor Financial Research Pvt Ltd, its partners, employees, directors or agents, do not have any material adverse disciplinary history as on the date of publication of this report.

3. I, Pavithra Jaivant, author/s and the name/s in this report, hereby certify that all of the views expressed in this research report accurately reflect my/our views about the subject issuer(s) or securities. I/We also certify that no part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any financial interest in the subject company.

I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any material conflict of interest. I/we have not served as director / officer, etc. in the subject company in the last 12-month period.

4. I, Pavithra Jaivant, do not hold this stock as part of my investment portfolio. I/analysts in the Company have not traded in the subject stock thirty days preceding this research report and will not trade within five days of publication of the research report as required by regulations.

5. PrimeInvestor Financial Research Pvt Ltd has not received any compensation from the subject company in the past twelve months. PrimeInvestor Financial Research Pvt Ltd has not been engaged in market making activity for the subject company.

6. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report, PrimeInvestor Financial Research Pvt Ltd has not received compensation or other benefits from the subject company of this research report or any other third-party in connection with this report.

1 thought on “Book profits and HOLD stocks of this API maker”

Kudos to PI Team,

Appreciate your timely update on the exit, was inclined to sell given the run-up of stock. Somehow the buy back at a huge premium (and insignificant volumes) did not reflect very well on moral/ethical compass. Outright felt like move was intended to spur the share price. btw if rally continues won’t feel left out 🙂

Comments are closed.