Around this time last year, we had analysed the FMCG sector’s March 2022 quarter earnings. At the time, the sector was grappling with twin headwinds of a demand slump and rising input costs. Valuations were still expensive.

Most FMCG sector players have declared their results for the March 2023 quarter. The earnings numbers now show that the sector is at a turning point – cost pressures are abating, but volumes still remain under pressure. Urban demand has firmly recovered, but rural demand is only just emerging. Valuations are off their peak, but are still not ‘cheap’. Meanwhile, the FMCG index is rallying and institutional investors are increasing allocations to the FMCG sector, among others.

So, the FMCG sector is positioned at an interesting crossroad. While a reversal in the global interest rate cycle will enable them to sustain their rich valuations, volume growth recovery is expected to aid earnings growth. If these two don’t play out together, it’s consolidation ahead, not gains.

Let’s now discuss in detail on the numbers, the key challenge going into FY24 and valuations.

Note: In this sector analysis, we have not considered ITC as the company still derives the bulk of its business from cigarettes, making aggregate comparisons with pure FMCG sector players difficult.

Turning around

The March 2023 quarter saw most FMCG companies put up a good show, on two fronts – net profits and gross margins. This has come by even as volume growth remains subdued. With most of FY23 seeing severe input cost pressures, FMCG players have taken on significant price increases to shore up margins and earnings. In a year where volume growth for the sector was at negative 4%, the profit growth has largely come on the back of price increases.

Nestle, for example, delivered one of its best quarters in many years helped by healthy growth in its chocolates segment. Players like Britannia led the recovery by taking sharp price increases even though volume growth took a hit while Godrej Consumer managed on both. Dabur India was among the outliers, posting a poor set of numbers.

Barring Dabur, healthy Q4 numbers helped pull up overall FY23 performance for the FMCG sector. Performance even caught markets by surprise, with several stocks such as Nestle, Britannia, Godrej and Marico all seeing a price uptick. The table below shows the Q4 revenue and PAT growth, along with the results for FY 23 and 3-year average for comparison.

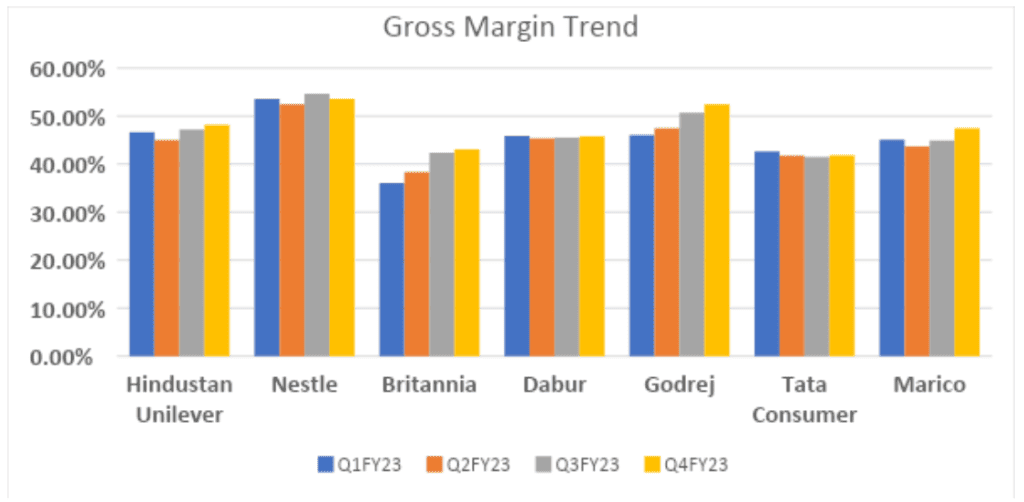

What is also a key positive in the March 2023 performance is that several FMCG companies have seen an improvement in their gross margins. Along with the price hikes undertaken earlier, the cool-off in input cost prices such as edible oil, crude oil derivatives, wheat, packing materials, etc helped. Though gross margins are yet to go back to pre-Covid levels for most companies, they successfully navigated persistent and significant cost pressures between FY21 and FY23 and protected margins hold them in good stead now. With both wholesale and retail inflation now ticking down, margin recovery can kick off.

The graph below shows the gross margins over the last 4 quarters for FMCG majors. The bottoming-out of margins happened by Q2FY23 for most, and the past two quarters have seen a gradual recovery. Consequently, most FMCG companies have guided for further recovery in margins in FY24. Those with significant rural exposure such as HUL and Dabur are a bit less optimistic, pitching for a slow recovery.

FMCG sector companies used other levers to cut other costs to prevent sharp erosion in EBITDA margins as well. Adspend, for example, is a key cost head that companies juggle with when faced with input pressures. Cost controls on this and other costs have helped FMCG companies keep up EBITDA margins. Barring Dabur, the margin contraction is not significant for FMCG companies as they end FY23.

HUL, in fact, managed a good show through cost saving measures as well as a balanced mix of price and volume growth despite 40% of its business coming from rural India. It managed with 2% contraction in margin between FY21 and FY23 even at its gigantic size. The EBIDTA margin contraction seems to have fully played out for the sector in FY23 and no player is expecting any contraction in FY24.

Volume growth- the key challenge in FY24

The third potential turnaround from here comes from rural demand, and its impact on volumes. With the sharp price hikes that FMCG companies took on, volume growth in general took a hit across companies. A prolonged volume slump is challenging as price growth alone cannot sustain revenues. For the full year of FY23, volume growth for the domestic FMCG market declined and growth was largely price-led. Britannia, for example, showcased poor volume growth despite strong pricing-led earnings growth. Dabur struggled with volume growth during FY23 as it had dealt with de-growth in health supplements as demand faded away post Covid.

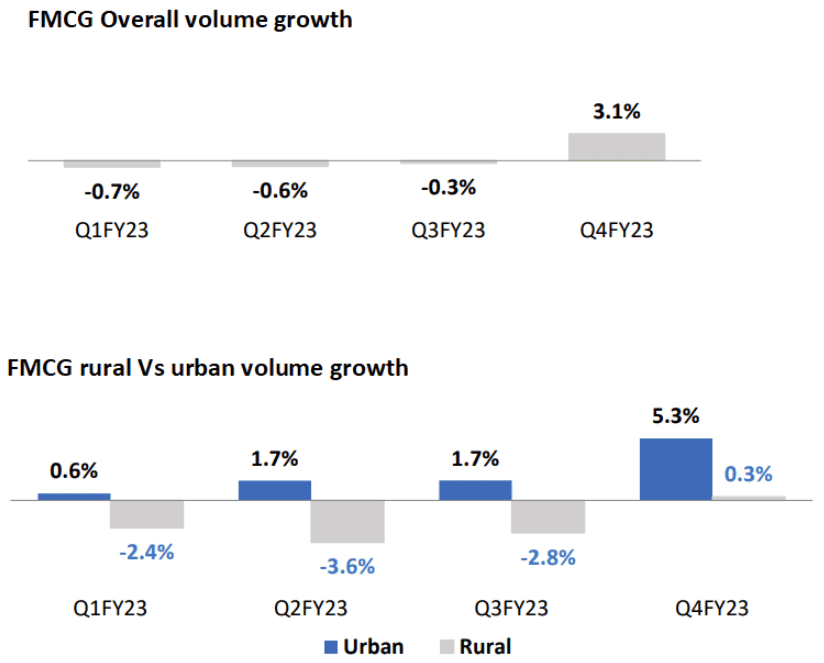

However, FMCG demand splits into the rural and urban segments, and trends here have differed. The pull-down in volumes has been led by the rural segment. Urban demand recovered earlier and faster than the rural segment, possibly contributing to the ability of FMCG sector companies pushing through product price hikes. The data below shows volume growth for the Home & Personal care and Foods segments for the FMCG sector, broken down into rural and urban segments.

Source: Marico Q4, FY23, Corporate presentation, Nielsen IQ data

(For separate volume growth data on home & personal care and foods, refer to the presentation)

This was also reflected in reported volume growth of companies. Urban-focused players such as Nestle, Godrej and Marico put up a good show. Those with a higher rural focus such as Dabur and HUL struggled and are less optimistic about quick rebounds. In this context, HUL’s volume growth of 5% for FY23 looks commendable given the 40% share of rural business.

The bright spot going into FY24 is that overall volume growth has inched into positive territory in the Jan-March quarter, at 3.1%, with rural volume growth turning positive to 0.3%. For volume growth to pick up strongly, that nascent recovery in the rural segment needs to build up. This apart, given that cost pressures have abated, growth for FMCG companies from here will have to be driven by volume recovery.

Data shows strong improvement in Q4 and the consensus among FMCG players now is that a cool-off in inflation and social spending before elections will keep the sentiment high in rural India in FY24. The negating factor here could be the impact of El Nino on monsoons and farm income.

Valuations moderate, but continue to stay expensive

The FMCG Index has delivered 53% absolute returns between January 2020 (pre-Covid) to date, matching the Nifty 50 returns. The bulk of this, 30%, has come in the last one year led by index heavyweight ITC with 67% returns. ITC’s weight in the FMCG index is at 33% and barring its outperformance, the price CAGR for others has been muted as can be seen from the table below.

Valuations for most FMCG players have not moderated much from their peak and current PE multiples are above 5-year averages as well. Going further back to cover the past 10-year period, most FMCG companies were trading in the 25-40 times PE ratio band at the beginning of the decade and ended in the 40-80 times PE band at the end of the decade, before the recent correction. Now, the valuations have moderated to a narrow band of 50-60 times for most players barring Nestle. Should companies clock a 10-15% earnings growth in F24, forward PE drops to around 50-55 times, a sharp contraction from their peak valuations of 72 times. That is still not really cheap, but a few factors suggest valuations are at an interesting juncture.

One, current PE multiples are already building in a more positive FY24, and have spiked following a sharp recovery post the results announcements. Given that cost pressures have let up and demand improvement is underway, the subdued earnings growth of earlier quarters that weighed on PE multiples can dissipate. Companies are also scouting for new growth avenues (explained in the next section).

Two, in the context of interest rates, the high interest rate environment that threw expensive PE levels for a loop now appears to be winding down. A lower or flat rate scenario can eventually support higher PE multiples, when coupled with growth.

In high spirits

While the growth in the FMCG sector has been subdued, even as valuations have been high, a point that indicates sector prospects are looking up is the acquisition activity. FMCG companies are making reasonably-sized acquisitions where they think they can scale up using their distribution muscle.

Companies across categories have gone shopping to drive consolidation and category expansion. Marico has set its eye on building and scaling up digital-first brands across categories. After acquiring men’s grooming brand BEARDO two years ago, it acquired breakfast cereal brand TRUE ELEMENTS in FY23. Marico has given an exit rate of Rs.400 crore for its digital first personal care brands in FY24, a reflection of scalability. Dabur acquired Badshah Masala to add a new category to its food portfolio with a large opportunity size.

Tata Consumer acquired breakfast cereal brand Soulful to add muscle to its food portfolio. Britannia converted its dairy subsidiary into a JV with French cheese maker Bel SA to scale up its cheese business under an MNC brand after fighting Amul head-on. The biggest among all is Godrej Consumer’s recent acquisition (though it would fall in FY24) of Park Avenue and Kamasutra brands from Raymond for a consideration of close to Rs.2,850 crore. Even big daddy HUL, while divesting its Annapoorna and Capitan Cook brands, still acquired stakes in two D2C brands in the health and wellness space.

What is in store for investors?

What can justify the higher valuations are a 14-15% earnings growth combined with a cut in global interest rates. Both these expectations are built in at this point of time. That places this sector at an interesting crossroads. If these two don’t play out together, its consolidation ahead for valuations to moderate further and NOT gains.

Combining this with the high spirits shown by many of these players in category expansions, mid-tier players at moderate valuations may be in a position to deliver on growth. It may be difficult for larger players to move the needle unless underlying volume growth picks up substantially, even acknowledging HUL’s FY23 performance in a tough year.

General disclosures & disclaimers

The securities quoted are for illustration purposes only and are not recommendatory.

5 thoughts on “FMCG sector: At the crossroads”

Thanks sir for clarity

How United Spirits, Patanjali , Adani wilmar performed in comparison of FMCG index?

Some insights in USL would help. Whether USL do buyback to increase promoter SH or create corpus for delisting or Dividend distribution ( now it is debt free truly).

Welcome your query sir

We don’t have these stocks under our radar for different reasons.

Specifically on USL, its the problem with growth and may arouse our interest if we see early signs of it.

Premium liquor market is almost a duopoly between USL and unlisted Pernod Ricard

Dividends & buybacks may be far away as it just turned net debt free. But, Growth only gives stock appreciation

Thank you

D: I may have personal interest in USL

Excellent article

Thanks sir

Appreciate if prime investor team can publish deep insights with respect to ITC stock along with its opinion as its large company and wishing to be more in FMCG space.

Welcome your query sir,

The up move in ITC stock always gives a feeling that it is the FMCG diversification that is leading it. But it is otherwise. The core cigarette biz is doing well and that is leading the rally

ITC will report its results today

Going by numbers until Q3, the FMCG segment result (EBIT) is still less than 1/10th of cigarette biz

(refer to slide 41 & 42 on Segment results in the Ppt or the published results)

https://www.bseindia.com/xml-data/corpfiling/AttachHis/fcf710b0-8cea-4618-b926-529b0b507173.pdf

FMCG is 10% EBIDTA margin while Cigarette is 70% EBIDTA margin

Definitely FMCG biz has gained size and the size is comparable (even a bit higher) to that of Britannia or Tata Consumer in sales. Another advantage being the higher valuation that FMCG biz gets in market Vs cigarette biz

Various brokerage estimates put Rs.110-120 for FMCG biz (25-30% of total ITC valuation) and it seems to be valued at par with Britannia or Tata Consumer. So, for 1/10th of EBIT, it gets 1/4th of valuation, inline with other FMCG Cos.

Market seems to be factoring that FMCG margins would eventually match that of food & beverage players in the range of 13-16%.

This is the picture on what FMCG biz is for ITC. The biz in drivers seat is still Cigarettes.

With its FMCG margin profile yet to mature and it being only 1/4th of valuation, it was better for us to keep ITC aside to capture the FMCG trend better.

Hope they will separate it some day

Thank You

Comments are closed.