Beginning now, we will be issuing recommendations on opportunities arising in primary government bond issues to Growth subscribers. These recommendations will be both central govt bonds (called G-Secs) and state development loans (SDLs) and if opportunities are attractive – treasury bills as well.

As we explained in our post budget analysis you will need to have an RBI Retail Direct account to buy these bonds. Some of them will be available with brokerages such as Zerodha who make such auctions open. But our observation is that not all issuances that are on the RBI Retail Direct platform are available on these brokerages.

Today, we are issuing recommendations on two SDL issues.

Key points on the issues

First, do note the following:

- There is a coupon rate (the interest you will earn) mentioned at times when you bid. And there is always an indicative yield that is mentioned. The actual yield you will get on allotment will be the ‘effective interest rate’ for you based on the price at which the issue is allotted to you. Yield is nothing but the interest income dividend by the purchase price.

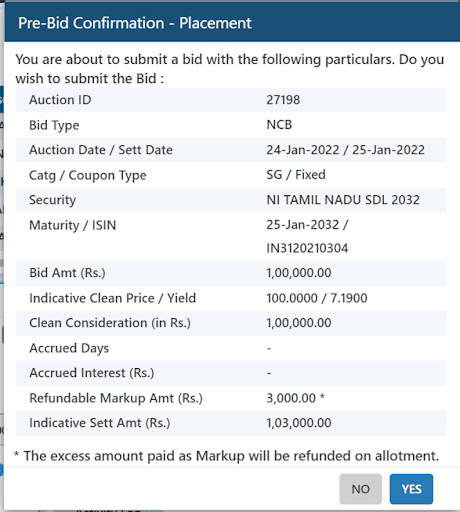

- The yield will be known only after the auction closes. Therefore, you may be sometimes asked to pay a little more than the amount you bid for, as a mark-up. The same will be refunded based on what the final yield is. See the image below to know how it works:

- Interest payments on these instruments are credited half-yearly. There is NO cumulative option.

- We will mention the bidding opening and closing dates, and the last dates for UPI and netbanking transfers. Please note that the netbanking closes a day or two within auction open date. So, you need to put in your investment very quickly before the window closes. You can use UPI as well, which closes later, but note that the UPI limit is Rs 2 lakh only. Make sure the bank account linked to UPI is the same as the bank details you give when you open the RBI account.

- In general, the window for these auctions is very short. You have to keep tabs of our mail alerts on these recommendations and act fast.

- The bonds you buy through RBI retail Direct will NOT get into your demat account. It will be credited and held in Retail Direct Gilt (RDG) account. You can sell them through the RBI Retail Direct Secondary market account, for which you will have access when you open a RBI Direct Gilt account. Please read everything about this account and the operational issues on this here: Everything about RBI Retail Direct Account.

- Very importantly, we have nothing to do with the operational aspects of these bond issues. Kindly DO NOT WRITE TO US with queries on your allotment or bidding status. Our job would only be to alert you on timely opportunities. Write to [email protected] for any queries or call their customer support. We have tried this over the past month and have found them to be responsive. As the RBI Retail Direct Platform is a new one, the support team is also trying to get their act together and smoothen things. So do keep that in mind 😊

- Please make it a point to read this FAQ from RBI Retail Direct to know about bond issue price and yields.

The present opportunity

Our recommendation today are two primary SDL issuances as below. Very importantly, please note that both these recommendations are meant for buy and hold only – that means, our call is for you to invest in the bond and hold till maturity. The minimum investment bid size for both the bonds is Rs 10,000.

To know the basics on SDLs, you can refer to this article.

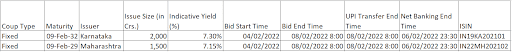

#1 Feb 2032 Karnataka SDL

The fixed-coupon SDL from Karnataka matures in 10 years. The indicative yield at 7.3% is 0.43 basis points higher than the current G-Sec 10-year rate of 6.87%.

Karnataka is among the states with relatively lower gross fiscal deficit to gross state domestic product (GFD/GSDP) of 3.3% based on 2021-22 budgeted estimate. This ranks better than the other southern states of Telangana, Andhra Pradesh, Tamil Nadu and Kerala. Hence, the spread cannot be expected to be too high.

#2 Feb 2029 Maharashtra SDL

The SDL issuance from Maharashtra has a maturity of 7 years and an indicative yield of 7.15%. At GFD/GSDP of 2.2% Maharashtra has among the better managed state finances.

Issue details

- The issue size of both these bonds are large enough to have decent liquidity in case they need to be sold in the secondary market. You can choose either of these based on your timeframe.

- There may be mark-to-market loss as SDLs trade and will see price fluctuations based on rate movements. A longer maturity bond’s price will be more sensitive to rate movements. For example, a 10-year SDL can have higher mark to market losses than a 7-year SDL when rates move up. The reverse is also true when rates fall. So, if you invest in these bonds, you need to be prepared to see price dips and you need to hold through these dips and not worry.

Suitability

- G-Sec and SDL bonds are only interest generating. Coupon is paid out half-yearly. As noted earlier, there is no cumulative option. Interest is fully taxable at your slab rate.

- These options are especially suited for those who wish to establish a predictable income stream. The extreme safety of SDLs are an additional attraction. These bonds are far better substitutes at this time for bank FDs or insurance policy annuity products, both of which are also taxable.

- Those who prefer guaranteed products in their debt portfolio can also find a special use in SDLs.

- These are not suitable if you are seeking tax efficiency in your debt products or investments.

Other important points to note

- Given the current rate scenario, you will definitely have mark to market losses on these SDLs. Holding them till maturity will get your full capital back. Note that the bonds carry implicit sovereign guarantees, so your investment is safe. To reiterate, our call on these two issues is for buy-and-hold only, and for you to earn from the interest payments.

- If you try to sell the bonds during rate hike scenarios, you will convert MTM or notional losses to real losses. So do not do this unless you need the proceeds to meet an emergency. However, if rates fall, you may have capital appreciation. In any case, SDLs may or may not have liquidity. So, it is best that you buy them with an idea of holding until maturity.

- Capital gains tax, if you sell before maturity, will be taxed at your tax slab for holdings less than a year and at 10% (without indexation) for holdings greater than a year.

18 thoughts on “GSec/SDL Recommendation: Two SDL bond opportunities to lock into RIGHT NOW”

I would request you to also start recommendation on bonds which can be bought from RBI Retail Direct Secondary market.

Thanks for the recommendations last week. No recommendation this week?

How is Feb 2032 Gujarat SDL – Maturity of 10 years and indicative yield of 7.11?

Regards,

Pranav

None this week. We look for max return with some quality on sovereign risk. Vidya

Are these still available? Cant seem to find them on the site.

No, these are open only for a few days – the start and end dates are given in the table in the article, and we will be giving the close dates for every such recommendation we make in the future as well. – thanks, Bhavana

Thanks for the excellent article.

i have invested in both of these bonds and got allotted.

one query i like to add.

multiple bidding is not possible like gold Bond.

i can bid for only one time in 1 SG bond. Is there is any reason.

need your comment.

Some bonds allow multiple. You would need to check only with the RBI team. thanks, Vidya

Thank you so much for very timely recommendations. If we are looking at regular income for 10+ years, does it make sense to wait for few more months/quarters for yields to inch up more before locking?

Yes…that is why we suggest adding in tranches if you have surplus now. hard to catch the peak but can start allocating slowly. thanks, Vidya

RBI a floating rate savings bond offers similar interest spreads. Is my understanding correct. How are these better options than the RBI abounds ?

You cannot sell RBI in the secondary market. You can sell these. That’s the only difference. Vidya

Thanks for the recommendations. Very Useful and well explained.

My Query -do Interest payouts attract TDS?

Thanks.

S.Swaminathan

No, there will be no TDS deducted. However, the interest is fully taxable. thanks, Vidya

Thanks for the recommendations. Two quick queries :

1. Is there any difference- safety & mode of interest/ principal payments-between Central & State GSecs? The yields are similar.

2. In what mode will the securities be held? Will it reflect in the BLA account, if one already has such account?

Thanks.

Thanks …& Sorry to come back with another doubt. If one is opting this investment in lieu of Annuity, can we look at longer dated securities? For instance, the longest available is AP SDL @ 7.49% indicative yield maturing in 2042.

Is there anything else to be considered, other than what you have mentioned in your article?

Is there any list / place where we can check the GFD/GSDP ratio of the respective State Govts ?

Thanks

Longer dated securities will lend themselves to more volatility and mark to market loss as rates move up. it is better to lock into them at the peak of rate cycle to be hurt less. Also, it is not a matter of just picking one state with high maturity. There are quirks in spreads between states. So kindly tread them carefully. State fiscal deficit data, look at Ch II here: https://rbi.org.in/Scripts/AnnualPublications.aspx?head=State%20Finances%20:%20A%20Study%20of%20Budgets thanks, Vidya

There is an excellent paper released by RBI on SDL bonds. The paper is titled States’ Fiscal Performance and Yield Spreads on Market Borrowings in India’ authored by Ramesh Jangili et al. The paper covers how the pricing of SDL bonds have worked and how to compare each of the SDL bonds with each other for an investor.

Hello sir, thanks for sharing about it here. We have gone through it. For those who wish to, here’s the link: https://rbi.org.in/Scripts/PublicationsView.aspx?id=20995 regards, Vidya

Comments are closed.