After a dramatic comeback, gilt and dynamic bond funds swiftly lost the peak return they made post July 2019.

Credit risk funds drew a blank with defaults hurting NAVs like never before.

Liquid funds showed high stability but reduced returns due to rate cuts.

Last week we wrote about the performance of equity funds in 2019. This week we’ll discuss about the fund category that made the most number of headlines in pink papers – debt funds. The 2018 fallout of the IL&FS debacle carried itself into 2019, causing downgrades and defaults in several NBFCs, notably DHFL.

Last week we wrote about the performance of equity funds in 2019. This week we’ll discuss about the fund category that made the most number of headlines in pink papers – debt funds. The 2018 fallout of the IL&FS debacle carried itself into 2019, causing downgrades and defaults in several NBFCs, notably DHFL.

Complex webs, woven by corporate group holdings, also broke, with the Essel group (Zee group) entering into informal agreements with AMCs, requesting for their patience with the amount lent. That debt funds held instruments in telecom companies, which are in dire state for a different reason, further caused panic. Amidst all this turmoil, how did debt funds fare in 2019?

Here’s a summary of the year’s performance

- On a point to point basis, funds that follow a duration strategy (take interest rate calls) did well, as the series of rate cuts eased yields (causing bond prices to rise) providing gains to fund NAVs. Categories such as gilt and dynamic bond benefitted the most from this rally. Others such as corporate bond and short duration that held short to medium term bonds also marginally benefitted from the price rally in debt. You can see in the table below that these categories returned higher than the previous year.

| Returns (%)-YTD ending Dec 24, 2019 | Returns (%)- 2018 | |

|---|---|---|

| Liquid | 6.55 | 6.93 |

| Ultra-short | 5.95 | 6.64 |

| Short duration | 6.61 | 6.22 |

| Med duration & Corp. bond | 6.75 | 5.8 |

| Credit Risk | 0.44 | 5.17 |

| Dynamic Bond | 7.08 | 5.52 |

| Long dur. Gilt &constant maturity | 10.44 | 6.76 |

1.ultra-short includes floater, low duration and money market.

2. Short duration includes banking & PSU debt.

- With the rates cuts by RBI, the liquid and ultra-short category returns were lower compared to last year as near-term yields reduced over the year. For example, 1-year government bond yields came down from 6.8% to 5.5% year to date. Similarly, 3-month treasury bill rates fell from 6.67% to 5.02%. With this kind of fall, the returns you received from your liquid and ultra-short categories were not bad. The returns in the ultra-short category could have been better but for the credit fall-out in IL&FS and DHFL as a good number of funds held commercial papers or bonds of these companies.

- The credit risk category was most hit by defaults and downgrades followed by the ultra-short/low duration space.

- The dynamic bond space did not gain as much as gilt for 2 reasons: one, the average maturity of their underlying papers was not as high as the gilt space. Two, quite a few got hit when the credit events transpired.

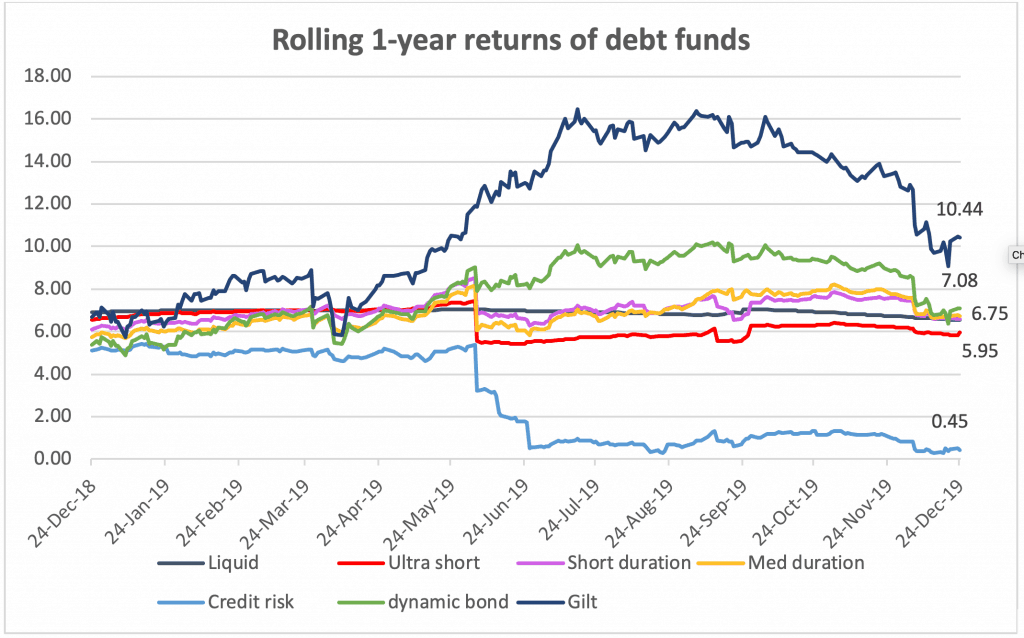

The rolling performance

The chart below will tell you that the gilt and dynamic bond categories went on a roll from April 2019. For those who exited these categories of funds because of the previous year-and-a-half to two years of underperformance, the opportunity loss would have been immense. On the other hand, investors who held on to decent returns in the credit risk category would have lost a significant portion of their returns. Let us suppose you were a long-term investor in December 2015 in a credit risk fund. Your 3-year annualised returns would have been a decent 7.4% (average returns of category) end 2018, even after the IL&FS event. However, your annualized return since then would have dwindled to 5.2% now, thanks to the harsh events that shook the debt space.

The data below will also tell you that liquid funds, as always have been the least volatile, followed by short duration funds. Categories such as dynamic bond and gilt, although ending the year with handsome returns, has returns as low as 5-5.7% before they made a mark.

Rolling 1-year return statistics

| Liquid | Ultra-short | Short duration | Med duration | Credit risk | dynamic bond | Gilt | |

|---|---|---|---|---|---|---|---|

| Minimum | 6.55 | 5.42 | 6.09 | 5.68 | 0.28 | 4.9 | 5.73 |

| Maximum | 7.07 | 7.43 | 8.52 | 8.2 | 5.42 | 10.18 | 16.44 |

| Average | 6.93 | 6.37 | 7.01 | 6.86 | 2.79 | 7.87 | 11.41 |

| Std.Dev | 0.12 | 0.59 | 0.48 | 0.7 | 2.05 | 1.54 | 3.4 |

Takeaways for debt investors

2019 perhaps had the most lessons to teach debt fund investors and they are as follows:

- When you take credit risk, there is no such thing as ‘all will be well in the long term’. It is a zero or one game. Whether you want to use debt to diversify and hedge (and use equity for risks) or are willing to take risks in debt should determine which categories of funds to avoid.

- A low duration or ultra-short category does not automatically mean that your risks are low. The higher volatility (Standard deviation) in the ultra-short space (table above) will tell you that this segment was hit by risky events. Since the regulator does not define credit risk in these categories, choosing funds that consciously stay away from credit is important. Higher returns in this segment is not possible without higher risks. At PrimeInvestor we take cognisance of such risks in this category when rating and recommending funds.

- If you decide to pick a fund based on the duration strategy (dynamic bond and gilt), patience is key. The year would have taught you that the duration game can take off very swiftly after prolonged dip or inactivity. It can also lose quickly. The graph above will show you gilt’s 1-year returns sliding from over 16% in July 2019 to about 10.44% now. Hence it is important not to expect high returns to last. Either some active profit booking or setting reasonable expectations of FD-plus returns would be prudent. Read our earlier take on what returns you should expect from debt funds here: https://staging.primeinvestor.in/2019/12/16/what-returns-should-you-expect-from-your-debt-funds/

2020 will be an interesting year for debt for two reasons: one, the long-term yields are again inching up and that means you can’t be sure if the current gilt fund and dynamic bond fund returns you have will last. However, you may yet see some activity with the government’s trial with an operation twist to ease long-term yields (to ensure log-term lending isn’t expensive).

Stay tuned for our subscriber-only outlook on debt in January 2020, once we launch our research platform. As a subscriber you will have access to timely strategies on debt that we call out.