Manufacturing is back in favour in the stock market, largely driven by cyclicals such as auto, auto components, industrials and capital goods. In this report, we discuss in detail the prospects for the manufacturing space and how to play it through a thematic fund that we added a month ago in Prime Funds.

The triggers

A revival in the manufacturing space was driven early on by commodities. Post this, there have been more sectors participating in the revival. The broadening recovery can be attributed to the following:

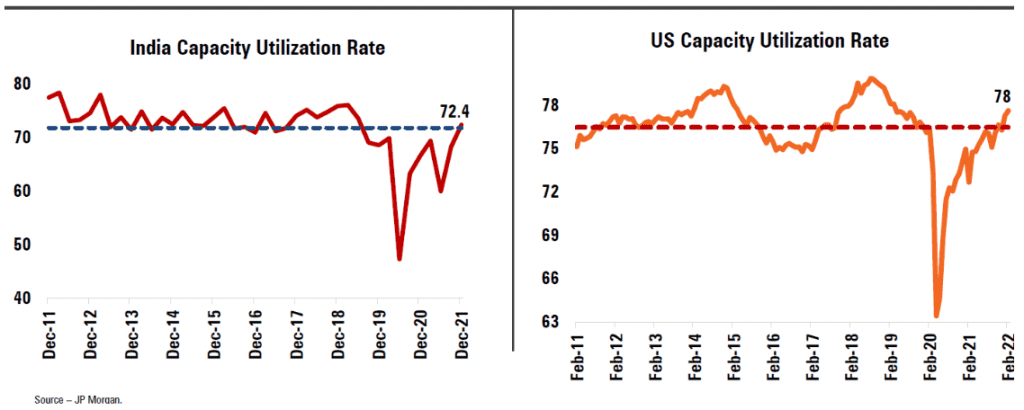

#1 Improving capacity utilisation

India’s capacity utilisation rate that has been stuck for long at well under 70% is now seeing a revival. The graph below will tell you that while in countries such as the US this figure has been healthy, in India it is still at a very early stage, spurred only by more recent demand revival post Covid.

The data below on the index for industrial production’s (IIP) growth compared with year ago numbers will give ample evidence of the spurt in manufacturing activity in the economy. As can be seen, transportation, electrical equipment, textiles, machinery, metals and chemicals are some of the sectors with high growth in production.

(According to MOSPI, the IIP is a composite indicator that measures the short-term changes in the volume of production of a basket of industrial products during a given period with respect to that in a chosen base period).

When capacity utilisation touches 75-80%, it is typically the point of capacity additions for companies. However, this process has been advanced ahead of such a critical point, thanks to the PLI (production linked incentive) scheme by the government.

#2 Production linked incentive (PLI)

PLI, a fiscal response by the Government to India’s rising import burden, aims to boost the manufacturing sector through incentives, taking the sector’s contribution to GDP from about 15% at present to 25%. With a massive outlay under 15 schemes, the focus is on three categories:

- One, sunrise sectors such as semiconductors, advanced automobiles, AVV batteries and drones.

- Two, import substitution that covers sectors such as telecom, IT hardware, pharma, APIs, medical devices and specialty steel.

- Three, export focus covering sectors such as electronics, white goods, textiles, food processing and pharma. This once again has already driven many sectors including auto and auto parts to invest in additional capacities, since the investment recoverable from the incentives can range from 48% to as high as 348%.

This scheme has likely advanced the capex activity in some sectors, ahead of their hitting their maximum capacity utilisation.

#3 Corporate and government spending

Both the private corporate spending and household investment in real estate in India traditionally provided a chunk of the ‘gross fixed capital formation’ in the country. This dipped from as high as 59% in FY-12 to 40% in FY-21. Favourable demand scenarios and availability of credit have both lifted this number now.

According to reports, aggregate capex by the private listed space has increased from Rs 5.5 trillion in FY-21 to Rs 6.6 trillion in FY-22. Both Central and State government capex have further added strength to this with Rs 11.1 trillion spent in FY-22 and is expected to cross Rs 14 trillion by FY-23. This spending, spurred by demand, has led to addition of capacities in key sectors, beginning with metals and now moving to auto and auto parts and industrial goods.

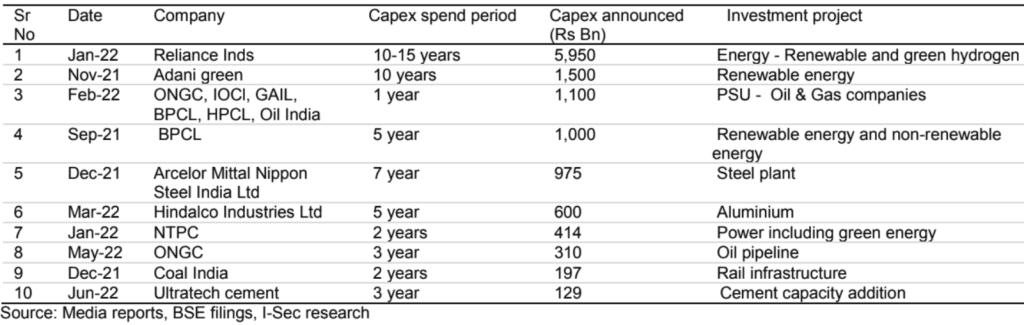

Below, we give some data sourced from reports on the top 10 capex spends announced in the past 6 months. The quantum of the same will give you an idea of the ripple effect it can have on related industries.

Gaining from transformation

Apart from the traditional triggers of spends and fiscal incentives explained above, the manufacturing space is, in pockets, also undergoing a re-rating due to a transformation that is happening in select sectors. A brief on this is given below:

- Traditional players are seeking to provide higher value addition and retention of customers through more post-sales services. This is visible in sectors such as auto as well as automation and power.

- There is also a simultaneous effort by large and new players to tap new opportunities be it EV, solar, waste energy management or digitisation of industrial operations (which started with Covid). This has opened up newer business opportunities and has also helped many companies diversify their revenue stream. Many MNCs, such as ABB or Siemens in the industrials space or Mahindra or Ashok Leyland in the auto space have resorted to one or more of these measures to grow and sustain growth.

- Consolidation measures (mostly through acquisition) to add products or geographies to their baskets (Bharat Forge in auto or Carborundum Universal in the capital goods space, select pharma and chemical companies, for example) promise to yield rich dividends and possibly result in re-rating of such stocks.

- In manufacturing segments such as pharma, too, although out of favour in the market, transformation is quietly visible. Companies have been reframing their US strategy and are now incurring more serious research and development cost to build a differentiated pipeline of complex products. Outsourcing of higher-end work (from drug discovery to manufacturing, also called CDMO) is also now gaining pace in India. This, together with increased preference for complex/specialty generics (generic versions of speciality drugs once they go off patent) makes currently less favoured sectors such as pharma attractive (in pockets) from a medium to long-term perspective.

We believe that the fiscal stimulus together with the transformation happening in certain segments of manufacturing provides ripe opportunities in this space.

How we are playing this opportunity

At PrimeInvestor, we have been playing this cycle from its onset through pockets of opportunities as they opened up. We did this as follows:

- Typically, a commodity super cycle can be an indication of a more broad-based recovery in the manufacturing/cyclical space. We kickstarted our calls in this space with a commodity fund in late March 2021 (we gave a book profit in June 2022).

- We then saw trends of a broader recovery in the infrastructure space and an early sign of recovery in the capital goods space. We added an infrastructure fund in early July 2021. Remember, infrastructure spending can trigger activity in a lot of capital goods, engineering and industrial segments.

- In our September 2021 quarterly review, we added a strategy-based fund that played special situations and opportunities. This fund helped catch some of the sectors that were turning around.

- In early June 2022, when the auto sector turnaround was underway, we added a fund focussed on the same.

You can check all of these funds under the Thematic/Strategy section of Prime Funds. Now, in early July 2022, as we see a more broad-based recovery underway – especially in capital goods and industrials - we added Kotak Manufacture in India (Kotak Manufacture) to play this overall manufacturing revival. This is the fund which can specifically play the manufacturing theme as outlined above.

The fund

Kotak Manufacture in India is a relatively new fund launched only in February 2022 and benchmarked against the Nifty Manufacturing index TRI. While we usually look for funds with a track record, in themes such as these, the portfolio potential scores over performance record. There are 4 other manufacturing funds – from ABSL, Bank of India, DSP and ICICI Pru AMCs. Besides, there is an upcoming index fund from Navi AMC.

Our preference for Kotak Manufacture over the other active funds at this point is primarily on account of the fund’s overweight position in auto and auto components (at close to 22%) compared with its peers. This is followed by capital goods and a more contrarian exposure to healthcare and consumer durables.

This makes the Kotak Manufacture a diversified fund, giving exposure to various pockets of manufacturing opportunities. While the index fund from Navi may come close to this (with the weights), the fact that it is free float market cap weighted means restricting the size of exposure to smaller players. Active funds have more leeway in this aspect.

There is not much of a performance record to speak of for the fund. However, it is evident that there is a clear pick-up in performance in the manufacturing segment.

Suitability

- This fund is suitable only for high-risk investors and should not account for over 5% of your portfolio.

- As with cyclical themes, this theme can go into deep down cycles too. While we will be issuing alerts, it is important for you to know that significant commodity prices and geopolitical uncertainties can impact this space.

- If you hold our infrastructure fund and you wish to add Kotak Manufacturing, then ensure that your overall exposure in both funds is at a maximum of 10%.

- Similarly, if you hold the transportation fund, you can add this fund if you’re interested in a broader theme. Here again, cap exposure at 10% for both funds.

- Given that the fund has run up over 9% since our call, invest a proportion now and wait for some correction opportunities. We don’t recommend long-term SIPs. At best spread out over 3 months if you cannot time corrections.

PS: If you’re a Prime Growth investor, we will be gradually issuing stock calls in the cyclical manufacturing space.

3 thoughts on “Prime Recommendation: How to play the cyclical space now”

Thanks for the Reco. Just one question: Size of AUM is small Vs other . Does small AUM Size makes the funds more volatile ? I have long term view i.e. 3 to 5 years and i beleive this fund can do good – only concern is size of the AUM.

What is your opinion.

The AUM size is not very small – it is about Rs 800 crore. In any case, it is not a worrying factor; the fund can well manage on this AUM – thanks, Bhavana

Thanks Bhavana.. Well noted.

Comments are closed.