Union Budget 2024-25, the first Budget after Elections, has taken a slightly different tack after a long time. The focus on personal taxes is back – whether it is to give or take. While we admit there is probably a little more taking than giving, the simplification of tax, accompanied by more money in the hands of people through the New Tax Regime, together with sustained capex will still likely keep the economic growth engine chugging, along with the comfort of a fiscal deficit that is largely in control.

- Budget 2024 Impact on Personal taxes

- Budget 2024 – Impact on investments

- Budget 2024 – Impact on sectors and markets

Budget 2024 Impact on Personal taxes

#1 Changes in income tax rates

Continuing with the objective of incentivizing more people to join the simplified new tax regime, there were announcements to sweeten the new tax regime in this budget as well. While the overall number of slabs remains the same, there are some changes in the first three slabs, allowing less tax outgo. See the slabs in the new tax regime.

Additionally, the standard deduction under the new tax regime has been increased to Rs. 75,000 from Rs. 50,000 earlier, making another Rs. 25,000 tax-free.

We have created a new spreadsheet to help you assess whether you’re better off with the new or old tax regime after these recent changes. Please find it below.

#2 Increased deduction under section 80CCD

Under Section 80CCD, for non-government employees, contributions to a pension plan like NPS from their employer were tax-deductible up to 10% of salary. This limit has now been increased to 14% under the new tax regime. Do note that the maximum employer contribution allowed under PF and NPS combined is Rs.7.5 lakh per year and there is no mention of revising this in the budget memorandum. This change is with effect from the assessment year 2025-2026 (FY 24-25).

Employers offering NPS as part of the salary package might tweak the salary structure to benefit from this change. Although section 80CCD is available under both the old and new tax regimes, the increase in exemption to pension contributions has been given only to the new tax regime. This is yet another evidence of making the new tax regime more attractive.

#3 Reducing the burden of TDS on salary if you have TCS

Chapter XVII of the Income Tax act deals with the collection and recovery of tax. Under this chapter, portion B deals with tax deduction at source (TDS) and BB deals with tax collection at source (on sale of certain items for instance where the seller will collect tax from the buyer at specified rates and remit the same to the Government).

Section 192 that falls under Chapter XVII B covers TDS on salaries whereby an employer is liable to deduct tax on salary before paying the same out. This section also lays out how the amount of tax to be deducted is to be computed – taking into account all the income of the employee and not just the salary income, TDS and loss on income from house property. TCS was not taken into consideration.

If it turns out that too much tax was deducted on the salary, after taking into consideration all of the income, TDS and TCS of the assessee, he / she had to go through the hassle of claiming a refund. To make life simpler, this section, specifically sub-section 2B of this section, will be modified with effect from October 1, 2024 to state that in arriving at the tax to be deducted on salaries, the employer must take into account the following (subject of course to the employee submitting proof of the same):

1. any income chargeable under any other head of income

2. loss under ‘income from house property’

3. any tax deducted or collected at source

In other words, TCS is now allowed to be set off against TDS liability on their salaried income.

#4 Incentive for young job-seekers

If you are a young student and looking forward to your first job, Budget 2024 will give you some extra motivation. One of the focus areas of the Budget 2024 is ‘Employment and Skilling’ and three schemes have been announced under this. The ‘First Timers’ scheme or Scheme A, will certainly interest you! This promises one month’s wage to all new entrants in all formal sectors (based on EPFO registration). This will be paid in 3 instalments and will be capped at Rs. 15,000. The eligibility criteria for this benefit is a salary of up to Rs. 1 lakh per month.

Scheme B that is intended to incentivize job creation in the manufacturing sector too will interest you as it will provide a direct benefit to both the employer and you the new first-time employee on EPFO contributions for the first four years for specified scales.

Budget 2024 – Impact on investments

- There were two big ticket announcements through the Union Budget that could impact you positively and negatively – depending on which asset class you are interested in. They are: rationalization of capital gains tax and

- increase in securities transaction tax on futures and options segment.

The former (capital gains) is a HUGE change. Let us deal with it first.

#1 Changes in capital gains for almost all asset classes

In a move to simplify capital gains across asset classes there have been four broad changes:

- One, having only two holding period cut offs - 12 months or 24 months – to qualify for long term. All listed securities (read as listed equities and bonds) will be classified as long term if held for more than 1 year and all other asset classes will be classified as long term if held for more than 2 years.

- Two, short term capital gains on stocks, equity funds and units of business trust (InvIT and REIT) is proposed to be taxed at 20% as against 15% earlier. For other instruments, STCG is the same as it is now.

- Three, LTCG will be uniformly taxed at 12.5% for all classes of assets. How you define ‘Long Term’ will be based on point number 1 above.

- Four, there will be no indexation benefit for any asset class

However, as a consolation, the total long term capital gains exemption for shares and equity-oriented funds has been increased from Rs 1 lakh to Rs 1.25 lakh per year. Now let us look into what this means for different asset classes.

Listed stocks, equity mutual funds and listed bonds

In the table below, the changes are

- the STCG for shares and equity funds (from the present 15%),

- LTCG for all the 3 instruments (from 10% to 12.5%) and

- the holding period for REITs and InvITs that has changed from 36 months to 12 months.

The above changes are effective for sale made from July 23, 2024.

What it means for you: Your LTCG incidence will go up from 10% to 12.5%. So, on a say Rs 10,000 gain, if you paid Rs 1,000 as LTCG it would now be Rs 1,250 or a 25% increased tax outflow. In STCG, this is even worse as it moves from 15% to 20%. The impact here is a 33% increase in tax outflow. But you need to keep in mind that the exemption on capital gains has increased from Rs 1 lakh to Rs 1.25 lakh for LTCG. The other positive is recognition of REITs and InvITs as LTCG if held for 12 months. Overall negative, especially for STCG.

Unlisted bonds, debentures and shares

In the table below, the holding period has reduced from 36 to 24 months for all the instruments mentioned. STCG has remained the same and LTCG is proposed at 12.5% from the present 20% with indexation.

The above changes are effective for sale made from July 23, 2024.

What it means for you: Holding period reduction from 36 months to 24 months is a positive. The 12.5% taxation can largely be positive for unlisted shares and can go either way for unlisted bonds and debentures. Overall marginally positive.

Certain categories of mutual funds

As shown in the table below,

- For equity Funds: Tax on STCG and LTCG have increased (from 15% and 10% respectively).

- For debt-oriented and conservative hybrid funds: Nothing changes.

- For gold, international and fund of funds (with less than 65% in debt): The definition of specified mutual funds has changed. Therefore, these will no longer be taxed like debt.

The changes are effective ONLY FROM APRIL 1, 2025.

One class of product that we have not mentioned above is gold and silver ETFs and International ETFs. While the intent of the law appears to be to take them out of debt definition, it is unclear whether they will be considered as listed security for classifying as >12 month LTCG. One interpretation is that they will not fall under the debt category and are listed and should automatically be classified like equity for LTCG and STCG.

We think this may not be the case. In other words, for gold and International funds, holding period is likely >24 months for LTCG. STCG appears to be slab rate (as was the case before) and LTCG at a much better rate of 12.5% (slab rate at present). We will update this if the interpretation is otherwise.

The other contentious issue at present is whether debt funds will be taxed under 12.5% for their long term capital gains, considering that all assets other than the listed securities fall under 12.5%. Our understanding is that, this is not the case. A separate section 50AA was created last year only for the purpose of taxing debt funds separately. This section remains, albeit with a modified interpretation of what constitutes specified mutual funds.

What it means for you: For gold funds, international funds and FoF that are not into debt, the taxation makes these asset classes better than debt and hence a big positive.

Physical assets

The biggest change for the asset classes below is the removal of indexation benefit and change in taxation from 20% (with indexation) to 12.5% (without indexation). Please note that this move is does not impact the end-users who sell their existing house and reinvest in a new house. Those benefits remain.

While holding period hasn’t changed for property, it has changed from 36 months to 24 months for gold.

The above changes are effective for sale made from July 23, 2024. Awaiting clarity on how to value cost of property bought before April 1, 2001 (base year for the indexation) and any grandfathering of the same. According to reports, indexation for property bought before April 2001 might be available. This needs a written clarification from the government.

What it means for you: The removal of indexation benefit may be felt steeply in real estate depending on whether you made a lot of returns or otherwise. For those with poor returns, indexation would have helped even avoid tax. For those with very high returns (or very long holding period), this might turn out to be better tax treatment than the one with 20% indexation. For gold, the reduction of holding period from 36 to 24 is a plus. Mixed impact based on your gain!

#2 STT on futures and options

The budget proposed doubling the STT on both futures and options contracts.

Futures contract rates have increased from 0.0125% to 0.02% of the traded value. Options contracts rates have been Increased from 0.0625% to 0.1% of the option premium. This amounts to a 60% increase for both. But it is noteworthy that exchanges like the NSE had announced a reduction in exchange transaction charges effective April 2024, across cash and derivatives. So some parts of the market opine that the F&O STT hike is largely neutral. We do not yet have a view on this. However, what is clear is that the government (and also SEBI) is making moves to ensure that derivative trading is restricted to those with deep pockets.

The proposed changes come into effect on October 1, 2024.

#3 TDS on RBI Floating Rate bonds and G-Secs

Effective October 1, 2024, interest on your RBI Floating Rate Savings Bonds will be taxed if interest exceeds Rs 10,000 a year. Also, any G-Secs and State Development Loans (SDLs) notified in the Gazette will also be subject to such TDS. Interest on these instruments so far did not suffer TDS although they were taxed like any other interest income.

#4 TDS on immovable property

At present, TDS is deductible at 1% for sale of property exceeding Rs 50 lakh. The budget has provided clarification on TDS related to immovable property in situations with multiple buyers or sellers.

Previous interpretation: There was confusion about whether TDS applied when the total sale consideration (price) exceeded ₹50 lakh but each individual buyer or seller's share was less than ₹50 lakh.

Budget 2024 clarification and amendment: The budget clarifies that TDS at 1% applies if the aggregate consideration (total sale price for all buyers and sellers combined) exceeds ₹50 lakh. This applies regardless of the amount paid by each individual buyer or received by each individual seller.

Simply put, if you're selling a property with multiple sellers or buyers, you need to consider the total sale price, not just each person's individual share, to determine if TDS applies.

#5 Buyback of shares taxable in your hands

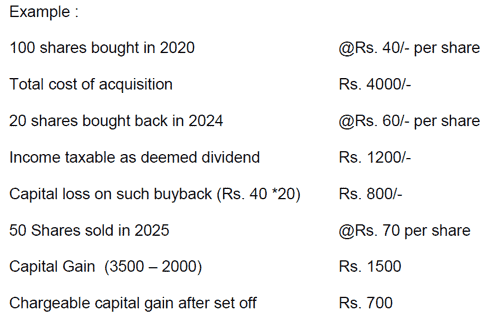

Any amount received by you from a buyback of listed shares initiated by a company will be treated like dividends (other income) and taxed at your slab rate. However, the cost of such shares that you received as buyback can be set off against any other gain on the same shares in future. Example is given below:

This change is effective from October 1, 2024.

What it means to you: After plugging the dividend distribution model used by promoters to take cash out, buybacks were a popular method to take out cash and distribute. With this proposal, such paybacks have been plugged. This means you might have fewer buybacks and you will need to assess whether it is attractive enough considering your tax outgo.

#6 Abolition of Angel tax

While this may not have a direct impact for you, the abolition of Angel tax can help entrepreneurs and the start-up ecosystem. Angel tax was the tax on investments received by startups from external investors. They were classified as income from other sources and taxed a rate of 30%, putting more burden on any young start-up. This change will be effective from April 1, 2025.

#7 NPS for minor children

The finance minister also unveiled a new scheme called NPS Vatsalya under the National Pension Scheme (NPS) for minors, which offers parents and guardians the opportunity to start pension planning for their children by making contributions that will be transferred to the standard NPS when they turn 18. It may be too early to comment on this move but this is likely to be a better scheme (in terms of higher risk-return pay offs) than options like PPF, considering that the former is market linked. The lock-in, withdrawal, rebalance features etc. will determine whether it is worthwhile.

Budget 2024 – Impact on sectors and markets

The lower-than-expected fiscal deficit target of 4.9% for FY25 and unchanged capital expenditure may not be something for markets to rejoice as it broods higher capital gains and STT on futures and options. Nevertheless, the allocations indicate fiscal prudence and would likely be appreciated by the bond market.

Will capital gain taxes hurt markets?

We discussed about capital gains and their impact on your investments. Coming to the implication of the same on the market, this change is happening at a time when returns from equities as an asset class has been moderating over the past few years (even while there are bumper years). So, will equities remain attractive on a post-tax basis, especially for institutional investors who drive the market?

For foreign investors, currency depreciation can make this equation even worse (which has been the case between 2009 and 2020). The new capital gain rates are also coming at a time when markets are priced to perfection. So, any negative impact of this tax increase can also come to haunt the markets when expectation of growth cools-off at some point.

Meanwhile, the budget has also passed on taxation of buybacks in the hands of recipient (as dividend), which will put companies on a back foot. They cannot no longer easily reward investors when markets behave poorly.

Fiscal consolidation – a bright spot

On the positive side, the cheer for the market comes from fiscal consolidation, as rating agencies, bond markets and corporates will take the right cues from the same. While the fiscal deficit for FY24 itself came 0.2% lower than expected at 5.6%, the number for FY25 is pegged at 4.9% Vs market expectation of 5.1%.

The government has used better than expected tax collections and RBI dividend bounty to accelerate fiscal consolidation than tinkering too much with allocation. Besides, that we will have the next budget in a space of 6 months may have also kept the government from tinkering much with allocations. The few areas that saw allocation (money and space) was clean energy transition, innovation and R&D. Rest went to social development projects.

Job creation – sector that can benefit

Another positive highlight in the budget was the government’s focus on employment creation with measures for employment and skilling the youth that would span over several years with a mammoth allocation of Rs 2 lakh crore. This includes incentive for employees and employers to absorb, skill and retain youth. This is something to be viewed as an initiative that would carry on in the coming years until it brings desired results. This also vindicates market’s assumption post the general election outcome that the government’s thrust could be changing towards employment creation, rural growth, etc.

Meanwhile, the FM has also tried to lure taxpayers to switch to “new tax scheme” by doling out higher standard deduction and lowering tax slab rates. What these would also result in is more money in the hands of people which can be positive for discretionary consumption. That is a sort of “trend” that developed post general election and would see it accelerating now.

Sector specific reaction

- It is the railway and defence pack from the PSU space that reacted most negatively to the budget. While the government’s capex commitment didn’t change vs. the interim budget at Rs.11.11 lakh crore, FM has specifically mentioned that the future allocation will be considering other priorities and fiscal consolidation as well. The fact that the Budget speech states the need for private sector to take over the mantle of capex forward is clearly communicative of this.

- Markets should take comfort that the capex is still maintained high at 3.4% of GDP, but it may be the higher expectations that was causing negative reaction, combined with irrational valuations in these segments.

- The stock of electronics manufacturing pioneer Dixon Tech fell after the Budget lowered duties on imported mobile phones and chargers from 20% to 15%. The government is perhaps of the view that the sector is approaching the desired scale and that it makes sense to lower the duty to where it was before the PLI incentives, where duty protection was given to help them scale.

- On the positive side, Gold retailers got a shot in the arm with 9% reduction in customs duty on gold from 15% to 6% and this could not have come at a better time, just ahead of the festival season. While this happened, Gold financiers witnessed a negative reaction as gold prices plunged, adversely affecting their loan to value (LTV) ratio.

- ITC led the gains from heavyweights as the Budget spared smokers this time. The broader consumer sector and the IT sector gained in a weak market.

- While these are but pockets of momentary market reaction, for us the accelerating trend in the consumption space, post elections, could have got a shot in the arm from the social measures in this Budget. Beyond that, there isn’t much to take home.

65 thoughts on “Budget 2024 – impact on your taxes, investments and markets”

Final very specific question

1. I have a debt fund bought in 2019 and i sell it today ( after budget) – will i be taxed at 12.5% or will I get indexation benefit.

2. I have international fund bought in 2018 and I sell it today – will i be taxed at 12.5% or will I get indexation benefit.

Thanks

You will get indexation benefit in both cases if sold before April 1, 2025.

For Fixed income funds bought before 2023 do we have the Indexation Lee way? SImilarly for dynamic funds holding >35% equity? Or is it simply as per slab?

Can LTCG from Fixed income funds be offset with Loss of Gain from RE or is this applicable only for Equity LTCG. Please clarify

If debt funds are bought before April 2023 and completed 3 years, and sold before April 1, 2025, indexation with 20% in applicable. Same applies to dynamic funds (if their equity is between 35-65%. for gross equity greater than 65% equity taxation applies..12.5%)

Yes any LTCG can be offset against any LTCL. Vidya

Further to clarification from MFs, there is no indexation available for any kind of units bought before April 1, 2023. Instead, it will be LTCG at 12.5% if held for over 2 years (for units of debt/intl. gold/fof etc bought before April 1, 2023)

Nicely explained.. one query I have is whether Intrrnational fof funds would have same treatment as pure domestic equity funds, i.e., 1.25 L exemption per yr & beyond that 12.5% LTCG?

Rates are the same but qualifies for LTCG after 2 years. Vidya

How does this impact LTCG for unlisted US equities, for example exercised ESOPs (unlisted) that are sold after 2 years? I think the earlier LTCG was 20%. Has that come down to 12.5% as well?

Not aware. Kindly check with a tax expert. Vidya

Hi there, I wanted to know about international funds ( Nasdaq funds ). Now you have mentioned that the benefit of LTCG after 24 months at 12% will be applicable from 1 April, 2025. Does it mean, if I buy these funds today and sell it after 2 years which is after 2025, I shall receive the benefit or only if I buy them after 1 April, 2025 & then hold for 2 years that I will get the benefit ?

Buying date is not relevant. Only selling date after April 1, 2025 is required for the new rates. Vidya

Thank You mam.

Hello Ma’am

All the LTCG & STCG tax changes have been made from immediate effect i.e 23rd July. So does the 1.25 lacs. LTCG exemption from equity investments also come from immediate effect or will it be from next financial year.

Thanks

Exemption will be immediate. thanks

Hello Vidya Ma’am,

In your article you are clearly saying ” For Debt funds and conservative hybrid funds – Nothing changes” i.e STCG at slab rates & LTCG at slab rates. And then in your replies to many queries on debt funds purchased before 1st April 2023 ( even I am holding debt funds which are more than 5 years old) you are saying that LTCG will be taxed at 12.5% if you have held for more than 2 years. Please clarify.

Thanks.

Yes, that leeway (funds bought before April 2023) was there earlier and continues to be there now. So there is no change. For those who spcifically asked it, I have pointed to the leeway given last year. thanks, Vidya

This is my 3rd or 4th year of continuous subscription. This article simply validates my decision to continue renewing. Thank you Vidya.

Any changes that could impact NRIs?

Sir, Many Thanks for your kind words and support regards, Vidya

Listed bonds have 12.5% LTCG? Then why those are not recommended over or in addition to debt mutual funds?

Can you suggest few bonds which offer cumulative options where I think difference between maturity value and principal will be taxed only at 12.5% (assuming interest is considered as capital gain in cumulative option)?

Unfortunately, bonds with good yields seldom have cumulative options. When we find good opportunities we will put them in Prime Bonds. If you hold a bond till maturity, the interest is typically taxed at slab rate on accrual basis (yearly). Vidya

Very nice article. This site is very useful , thanks

Comments are closed.