India Pesticides Limited is launching an IPO totalling to Rs 800 crore – with fresh issue of shares worth Rs 100 crore and an offer for sale worth Rs 700 crore by the promoter group. At the upper end of the price band of Rs 290-296 the post-issue market cap of the stock on listing would be Rs3,400 crore and the post-issue price earnings ratio would be 25 times. The offer closes on June 25. The proceeds from fresh issues are planned to be utilised towards working capital requirement and other corporate purposes.

Post issue, promoter group will own 60%.

The Business

India Pesticides Limited (IPL) is an agro-chemical manufacturer which makes both technicals and formulations catering to both export and domestic market. It is a family-owned business that is trying to build scale in the global agro-chemicals supplies space. Technicals or active ingredients contribute to ~80% of the sales and are primarily exported while formulations contribute to the remaining and find application in the domestic market. It exports to over 25 countries including Australia and countries in Europe, North and South America, Africa, and Asia. For FY21, exports contributed to ~57% of its total sales of Rs.684 crore. Exports have contributed between 50% and 62% of revenues in the last three years.

While most Indian players are focussed on insecticides which is the biggest agrochem segment in the domestic market, India Pesticides Limited is focussed on herbicides and fungicides, which apart from offering higher growth potential, offer better export prospects as well. India Pesticides Limited’s technical product portfolio includes: Folpet, used to manufacture fungicides that control fungal growth at vineyards, cereals, crops and biocide in paints; and Cymoxanil, used to manufacture fungicides that control downy mildews of grapes, potatoes, vegetables and several other crops. Among herbicides, its technical products include Thiocarbamate herbicides that have application in field crops, such as wheat and rice, and are used globally. In addition, the company manufactures and sells 30 formulations of insecticides, fungicides, and herbicides in the Indian market under brand names such as Takatvar, IPL Ziram-27, IPL Difen, IPL Dollar, IPL Soldier and IPL Guru.

The company has two manufacturing facilities located at UPSIDC Industrial Area at Dewa Road, Lucknow and Sandila, Hardoi in Uttar Pradesh.

Positives

#1 Global agrochem opportunity

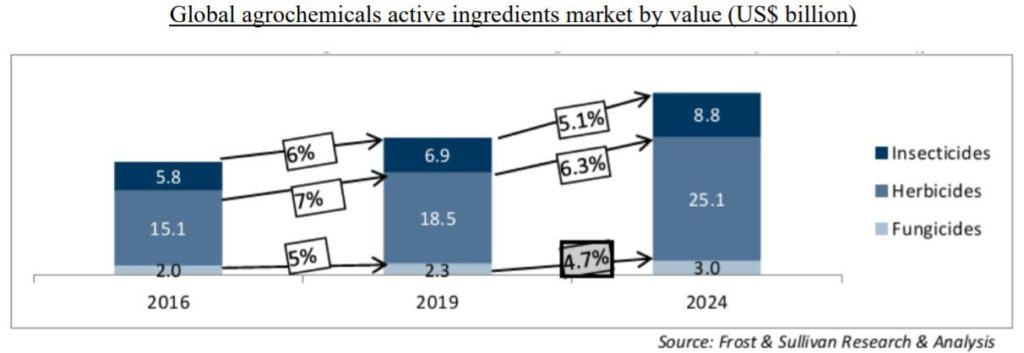

The global agro-chemicals market is projected to grow from US$ 62.5 billion in 2019 to US$ 86 billion by the end of 2024. India has been ranked fourth globally in the production of agrochemicals (crop protection/ pesticides) after the USA, Japan and China. With a complicated approval process and environmental headwinds, new product development in the global agrochem space is a long-winded process, with a new molecule taking upto 12 years to hit the market. This has opened up the playing field for low-cost manufacturing destinations like India which churn out a wide variety of off-patent technicals.

Approximately 19 active ingredients are expected to go off-patent between 2019 and 2026 and an opportunity size of over US$ 4.2 billion is expected due to this by 2026. Some of the key products include: Bixafen, Chlorantraniliprole, Cyantranilipore, Fluopyram, Fluxapyroxad, Sedaxane, Fenpyrazamine and Fluopicolide. These are expected to provide a huge opportunity for generic manufacturers in India. (Source: F&S Reports). India crop protection chemicals exports are projected to grow to ~55% of total production in 2024, in terms of value to US $ 3.1 billion

After the supply disruptions last year, some multinational companies are taking proactive steps to reduce dependence on China for their manufacturing operations and looking at India as an alternative option. Indian players being low-cost manufacturers of technical grade products, the ‘China plus one’ strategy is playing out in favour of India, enabling scaling of exports for players.

Fungicides and herbicides are more prominent globally compared to the Asia Pacific region and are expected to record higher growth internationally. Herbicide growth in particular is driven by the global shortage of farm labour and rising labour costs. This gives players like India Pesticides Limited, which are present in herbicides and fungicides, a firm foothold in global markets.

Source : RHP

The domestic crop protection chemicals market is valued at US$ 2.1 billion which is anticipated to grow at 4% in the next five years to US$ 2.6 billion by 2024. (Source: F&S Reports). India has one of the lowest per capita consumptions of crop protection chemicals per hectare, which suggests scope for growth in the domestic market.

#2 Accelerated growth, margins with exports

While export markets offer opportunity, establishing a toehold in new geographies is not easy for Indian players as each new product has to go through a registration, regulatory approval and licensing process. This results in significant entry barriers.

Present both in the domestic agrochem market via formulations and the export market through technicals, India Pesticides Limited after moderate growth until FY18 has seen a strong scale up in revenues in the last three years, driven mainly by exports. The development of processes for less toxic products and commercialization of three new active ingredients increased their sales contribution from ~12% of revenue in FY19 to ~42% in FY21. This was accompanied by improving export revenues.

The company derives almost 57% of its revenues from its top 10 clients and almost 20% from its top clients. There is client concentration risk in terms of large contributions from a single client. However, rising exports have aided margin expansion in the last 3 years, with EBITDA margins scaling up from 20% to over 29% in FY21 – now ahead of many larger industry players. The company is in the process of developing two new products each in fungicides, herbicides, insecticides, and intermediates. Export products are registered either by its customers or the company itself directly in the country of sale.

The company’s customer base includes crop protection multinational companies such as, Syngenta Asia Pacific Pte. Ltd, UPL Limited, ASCENZA AGRO, S.A., Conquest Crop Protection Pty and Stotras Pty Ltd. . In the domestic market, Rallis India and Sharda Cropchem are its customers apart from UPL. The company also claims to have strong relationships with many of its customers for over 10 years

#3 Capex with thrust on quality

The company has two manufacturing facilities at Dewa Road, Lucknow and Sandila, Hardoi in Uttar Pradesh with aggregate installed capacity for agro-chemical technicals of 19,500 MT and formulations of 6,500 MTand are spread across over 25 acres. At present, the company is running at 75% capacity at its major agro-chemicals plant at Sandila, It has obtained permission from the MoEF(ministry of environment) to expand manufacturing capacity at Sandila to up to 30,000 MT and has commenced construction of two manufacturing units that are proposed to be used for herbicide technicals.

Quality and compliance of manufacturing facilities are important in exports. The plants will be subject to an audit and review process by customers on various processes and the finished products are also subject to laboratory validation by certain customers. The company is also investing in automation, modern technology, and equipment to continually improve the processes to address changing customer preferences in the export market.

#4 Internally funded expansion

Despite the business being both working capital and fixed capital intensive, India Pesticides Limited has managed its significant scaling of operations and new product development over the years, through internal accruals alone. This conservative strategy has contributed to high Return on Equity and Capital Employed which compare favourably even to industry leaders, despite IPL being a much smaller contender.

The company started operations in 1984 and has been around for 37 years in the agro-chemical business. The company has seen hardly any fresh issues of equity in the last twenty years though it has made multiple bonus issues. At the end of FY20, the paid-up equity capital of the company was only Rs. 3.18 crore comprising 3,18,325 shares of face value Rs.100 each while it had accumulated reserves of Rs. 257 crore. The company has also stayed very conservative on taking on long-term leverage with negligible long-term debt and manageable short-term borrowings. Pre-IPO, promoters and promoter groups (including family trusts) own 96% of the equity. Conservative capitalization policies may lead to good wealth creation for public shareholders if the company manages to sustain its recent growth and margin trajectory.

Risks

#1 Price competition

A newly listed agrochemical stock such as India Pesticides Limited is unlikely to command much of a scarcity premium given that over a dozen listed players, some with a far larger scale of operations and more established brands, already operate in the agrochemical space. The Indian agrochemical industry is highly fragmented with over 150 active ingredient makers, 1000 formulation makers and 2 lakh distributors fighting for the relatively slow-growing pie. Affordability rather than efficacy or safety influences the farmer’s purchase decision.

The Indian agrochem market therefore continues to be dominated by very traditional, outmoded as well as off-patent products with significant price competition. The market has also been traditionally dominated by lower-margin insecticide products rather than herbicides or fungicides which are the mainstay globally. Imported products and counterfeit products also threaten organized players. In the domestic market, a pan-India distribution network and an ability to build national brands gives players with scale such as UPL, Rallis or Coromandel a significant edge over smaller players like India Pesticides Limited. Globally too, given that Indian players are present mainly in off patent generics, competitive pricing holds the key to higher volumes and market share.

#2 Procurement risks

Indian manufacturers of pesticides often rely significantly on raw material or intermediate chemicals sourced from overseas suppliers without long-term supply arrangements, which subjects them both to supply chain disruption and foreign exchange related risks. Smaller players like India Pesticides Limited with high raw material to sales ratios (50% plus) are also likely to be price-takers with limited negotiating power with their global suppliers as well as buyers. In FY21, India Pesticides Limited imported 38% of its raw material requirements.

#3 Regulatory risks

Growing water and land pollution concerns surrounding the use of agrochemicals has led to the Ministry of Agriculture periodically banning select lists of products. This poses a regulatory threat to most Indian pesticide makers who are reliant on more affordable but old-fashioned off-patent products for the bulk of their revenues. In 2018, two formulations made by India Pesticides Limited – Divax 76% and Triazophos were impacted by a ban on the manufacture, import, formulation and trade in 18 pesticides but these accounted for less than 2% of revenues. Presently, a notification to ban domestic sales of 27 widely used insecticides is under consideration. Captan and Ziram, two formulations on this list contributed Rs 114 crore of the company’s domestic revenues in FY21.

While Indian pesticide makers have shown themselves to be able to flexibly alter their product profiles to get around such bans in the past, sudden regulatory disruptions can cause temporary dents to both revenue and profitability, not to mention de-rating the stock. In recent times, the NDA regime has initiated a policy push towards ‘zero budget’ farming which minimises the use of chemicals, which could eventually curtail agrochemical offtake.

#4 Working capital intensity

Off-take of agrochemicals in the domestic market tends to suffer from high seasonality as well as cyclicality. Sales performance of individual players may depend not just on the spatial and temporal spread of monsoons in their specific markets, but also on the pest build-up in a particular growing season. Unlike fertilizers which are applied during sowing, agrochemicals are used in the pre and post-harvesting stage when any weather-related damage to the standing crop or swings in prices can impact offtake. Agrochemical products unlike fertilizers are also not supported by any government subsidy, making offtake more vulnerable to swings in market realizations for target crops and general farm incomes.

This dependence on farm and crop fortunes makes the business working capital intensive as receivables days can stretch on in years where weather conditions during harvest or market realizations for a target crop are not conducive. The unusual trend of two consecutive years of good South West monsoon has led to relatively steady revenue growth with a positive change in working capital cycle for Indian agrochem makers in the last couple of years. But whether this run of good luck will last through an indifferent monsoon year or other adverse weather events remains to be seen. India Pesticides Limited’s trade receivables to sales have dropped from over 51% to 32% in the three years to FY21.

#5 Limited fresh issue

Both the growth profile of India Pesticides Limited and it’s the nature of business indicate high capital requirements, yet the current IPO seeks to raise very limited funds for expansion with most of the proceeds going to the promoters by way of offer for sale. The company’s sales and PAT have grown at 27% and 36% CAGR over the last 4 years, with sales accelerating to 38% growth in the last 2 years. The business is capital intensive and the operating cash flow to EBITDA conversion has been, on an average, 40% in the last 5 years. The company extends 30 days to 180 days credit to its customers. The company has on-going capex plans as well as its existing agro-chemical plant is running at 75% capacity. Considering these factors, the company could have aimed at raising a higher amount through fresh issue than offer for sale.

Valuation

At the upper end of the price band, the stock is offered at 25 times FY21 earnings. This appears moderate on a relative valuation basis when compared to current valuations of agrochem companies listed in India. But it needs to be kept in mind that the agrochem sector itself has been a beneficiary of a sharp re-rating in valuations in recent times with investors taking a fancy to chemical/specialty chemical players who are seen to take advantage of global supply chain diversification out of China. Recent jumps in profit and revenue performance from players such as India Pesticides Limited have aided this re-rating. But whether the China story will play out as bullish investors expect remains to be seen and even if it does, it may be unrealistic to expect all Indian technical agrochem players to equally benefit.

In the Indian context two consecutive seasons of good monsoons and a booming rural economy have worked wonders on agri input players in the last couple of years. But these trends may prove an exception rather than the rule in a cyclical business.

In IPL’s own case, there has been a near doubling of FY21 EPS over FY20 and so the IPO valuation of 25 times is on a very high base that allows limited margin for earnings disappointments or a growth slowdown. Post issue, the stock is also being valued at a steep 5 times on a market cap to sales basis. Future returns for IPO investors will depend on growth from this high base.

The company has split the face value of shares from Rs. 100 to Re 1 and issued bonus shares in the ratio of 5:2 in FY21 to make the pricing attractive in IPO. The company has also allotted 3,71,830 equity shares at Rs. 33.70 per share to relatives of one of the non-executive directors in January 2021.

An upbeat primary market and buoyant sentiment towards the chemical sector is enabling the company to come up with an offer for sale led IPO at a valuation that would have been considered quite rich even a couple of years ago. While India Pesticides Limited’s high shareholder returns make a case for owning it, inherent cyclicality in the business and the rich valuations peg up risks.

Please note that this review does not take into consideration the possibility of listing gains.

11 thoughts on “IPO Review: India Pesticides Limited”

My understanding is that for a long-term investor investing in IPO never makes sense. So unless anyone is looking for quick listing gains, there is no value in looking at IPOs. Is my understanding correct? What are the other reasons for investors to study IPOs?

Thanks for your query sir

It is not exactly so. IPOs provide a good case for investment in Cos that are sector first/leaders in their sector Or the business is niche/unique

So, in last 5 Yrs itself you might have seen Cos like D Mart, Dixon, CDSL, IEX, IRCTC, etc giving humongous returns and few others also following up with decent returns like HDFC Life, Galaxy Surf, sheela foam, etc

But, when the overall IPO space is over-crowded in bull market and there is nothing to point out about a Company as a sector first/leader Or a niche/unique biz, there is no merit in investing when offered at expensive valuations

Thank you for response, this makes sense. As your team mentions, stock analysis is hard, to me personally, IPO stocks seems super hard to analyze. BTW thanks for all the good work PI team is doing!!

Thanks! Vidya

Thanks for your detailed outlook ,need more caution ahead.

You should also give indicative price going on in the grey market

Thanks for your query sir

That is NOT a metric that any investor should look in to as it is not a legal price discovery mechanism

Business, valuation, governance and risks are the key factors that should decide whether to apply or not for an IPO

So is this a risky bet?

Yes, thanks for your query sir

EXCELLENT REVIEW ;WORTH OF TIME

Thank you sir

Comments are closed.