At a time when the revenue models for many fintech startups are ambiguous, PB Fintech – the company that houses Policybazaar and Paisabazaar – stands out. It has a clear revenue model driven by scalability that will likely pave the path to profits! But here’s the hard part: for the clarity it affords, it asks an IPO price that is head and shoulders above the likes of other tech platforms like Zomato or Nykaa that came to market recently. That’s what makes the IPO of PB Fintech a tough one to assess. Read our take on it.

PB Fintech’s IPO is open from November 1-3. The company plans to raise fresh money to the tune of Rs 3750 crore and also has an offer for sale for about Rs 1900 crore, primarily led by SVF Python II (a unit of SoftBank). The company has raised Rs 2,569 crore through 155 anchor investors ahead of the IPO opening. At the higher end of the offer price band of Rs 940-980, the company’s market capitalization will be about Rs 44,000 crore.

About the company

PB Fintech is the parent company of Policybazaar, an online insurance distribution platform launched in 2008. PB Fintech also houses Paisabazaar, an online financial products marketplace (launched in 2014) for personal loans, home loans, credit cards, loan against property and business loans from large banks and NBFCs. Policy Bazaar has been funded by private equity through multiple rounds between 2008-21.

Policybazaar is the primary growth driver for PB Fintech. The former accounted for 69% of consolidated operating revenue of PB Fintech in FY-21. Paisabazaar contributed 20% to the revenue for last fiscal while the remaining 11% revenue came from the standalone PB Fintech entity’s support services to partners. Until FY-21, Policybazaar was an insurance web aggregator, which meant it generated revenue through leads, outsourcing services and commissions. But it could not gain any renewal income on life policies in this model.

Recently, in June 2021, the company clinched a license from IRDA to be an insurance broker. This will not only help Policybazaar earn income on life policy renewals but also helps go offline – setup offices and build a point-of-sale presence (POSP) network. The company plans to spend Rs 375 crore of the IPO proceeds towards offline expansion.

Policy Bazaar expanded its revenue at 40% CAGR over FY-19 -21 while Paisabazaar expanded by 11%, the latter being more hit by the pandemic in FY-21. The consolidated entity’s disclosed numbers are given below. At a net level, PB Fintech was a loss-making company as of FY-21.

PB Fintech has many positives and strengths in its favour that has helped it achieve scale and build a moat. These strengths will likely remain in future. Let us look at some of these.

Positives

#1 Clear model with a lucrative business

These are times when a number of fintech players (including the big boy Paytm, whose offer will soon follow) are adding many ‘free services’ in order to bolster their top of the funnel ‘user’ numbers and transactions (ostensibly, to keep the PE funding community happy), or are still figuring their revenue model. On the other hand, PB Fintech’s revenue model as a web aggregator for insurance policies and as a marketplace for loans has been clear from the beginning.

What adds to this positive is the fact that the insurance intermediary business is among the more lucrative ones in the financial savings space. With stock broking becoming commoditized with even ‘zero’ brokerages and mutual funds seeing a steady decline in distribution fees, the insurance distribution business has remained the primary, if not the only, margin accretive option for intermediaries (so much so that the other FinTech intermediaries have often ventured into insurance to add or create meaningful revenues). Commissions of 15-18% on the premium on a blended basis on new and renewal business (premium) is quite remarkable.

PB Fintech’s other subsidiary, Paisabazaar, on the other hand may not boast of a high growth or high margin business, with revenue of about 2-3% of total loan disbursals. However, the company appears to have a tight cost structure driven by a large customer base that it need not spend every time to acquire. 2.15 crore customers had accessed its free credit score in FY-21 alone. This suggests that it can build a huge directory of potential customers.

More interestingly, 67% of the loan disbursals in FY-21 were made to existing customers. That means the cost of acquiring over two-thirds of the customers was nil. If we go and look at numbers over the past 3 years, this number is lower, but still at a healthy 40%. This does provide comfort that this business can be run with less spending. This is primarily the reason why Paisabazaar managed to break even in FY-21 despite a fall in disbursals due to the pandemic.

A lucrative insurance business and a credit marketplace with a tight cost structure gives clear signals on the viability of the business – as measured by contribution margin (or unit economics as the modern term goes).

Dejargonizer

Contribution margin: Contribution margin in the base for any break-even analysis. It is the profit (as a percentage of revenue) arrived after deducting all the direct variable costs that can be attributed to sales. A business that has enough to cover its direct variable costs can typically be scaled up and made fully viable to meet other common costs. Typically, businesses that are more labour intensive have lower contribution margin while those with higher fixed costs have a higher contribution margin. A business that is not viable at a contribution level poses serious risk on the pricing/strategy front and can question the going-concern assumption.

The data below will tell you that the contribution margin has steadily been increasing despite a relatively weak show in FY-21. The graph below the table also indicates how the steadily falling operating expenses, specifically advertisement and promotional costs have helped with rising contribution margin.

While the company will see an increase in operating costs post IPO – driven both by increase in advertising as well as costs related to setting up offline channels – it may at best delay its path to profitability and is unlikely to deny it.

#2 Stickiness

We mentioned earlier that Paisabazaar has successfully managed ‘repeat’ loan disbursals to a chunk of its customers, suggesting high stickiness. The insurance business of PB Fintech also boasts of stickiness in several metrics.

Renewal premium as a proportion of total premium was 42% in FY-21 as opposed to 26% in FY-19. While this mix rose partly due to slower pace of new business premium (due to pandemic), renewal premium, by its own merit, expanded at a scorching 81% between FY-19 and FY-21.

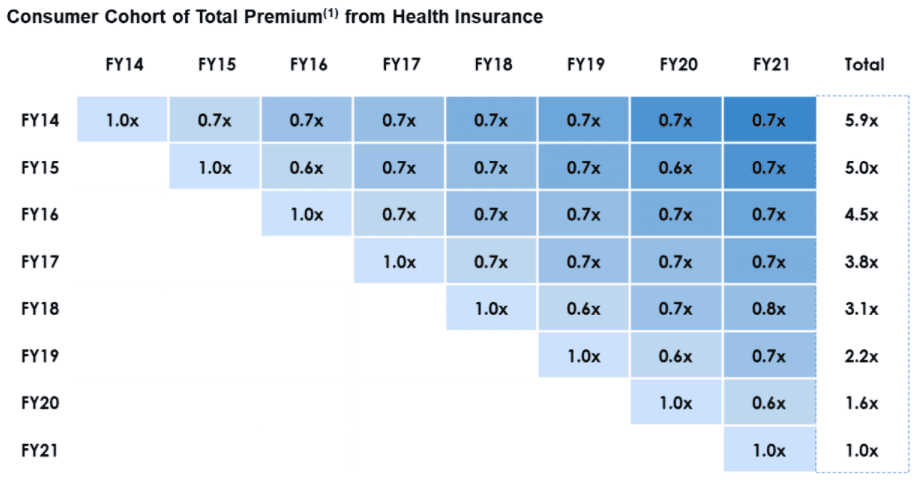

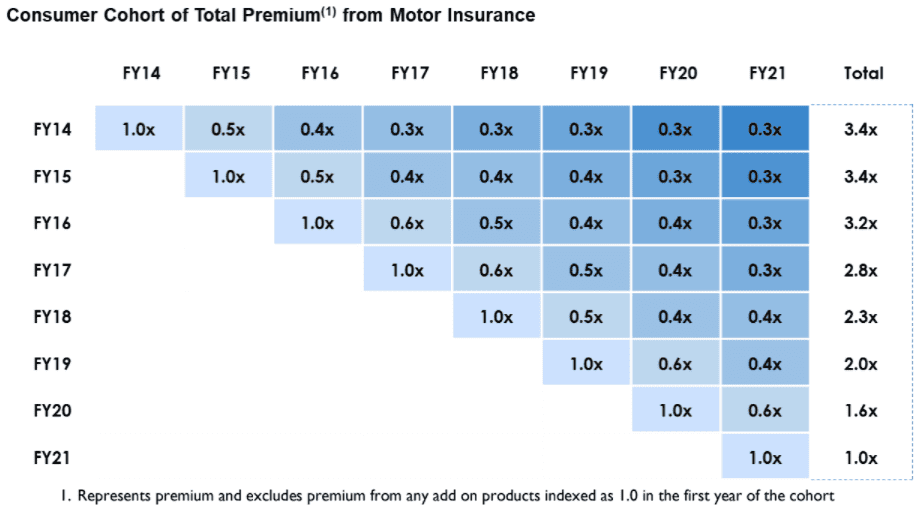

Policybazaar also has a high retention, if we go by the Cohorts it has disclosed on ‘consumer retention’ and premium multiple.

To explain the above data, the company has managed to retain 70% of health insurance customers who entered in FY-14 up to even FY-21 (that is, 70% of these customers are continuing to pay their annual premium on policies purchased). And more interestingly, their premium went up by 5.9 times – likely due to an increase in premium, or moving to higher cost policies or adding more policies. In other words, both customer retention and wallet share remained high. In motor insurance, while the retention does not appear high at about 30-40%, the wallet share from such customers adequately makes up for any drop in customers.

We think this stickiness is important for two reasons: one, commissions from renewal premium will keep the revenue stream a lot more stable and less susceptible to slowdowns – building some annuity cash flow. Two, even if the industry slows down in penetration, the company will still have a large enough customer base to tap into – to ensure it is growing at a higher rate than the industry.

#3 Achieved scale & moat

Policybazaar’s share of premium in the industry, at just 0.6% (life and non-life for FY-21) may still seem tiny. However, the company has made significant progress in the pie that is available for it.

- One, according to an industry report in its RHP, it had a 94% market share as of FY-20 in the online distribution space (based on number of policies sold). If you take a wider universe of digital policy sales (including directly by the insurance companies), Policy Bazaar still had a dominant 65% market share.

- Two, growth in premium was a blistering 42% CAGR between FY-19 to FY-21 even as it stood at 9.2% for the industry.

- Three, within the relatively small pie in the digital space, it has achieved significant scale and garnered a massive user base it can sell to. The company has 5 crore registered users, 1 crore transacting customers and 2 crore policies sold from its inception till June 2021.

The penetration and scale achieved by Policybazaar, as an early mover, is likely to ensure that it remains the dominant player. Its revenue has reached significant size, compared with the likes of Coverfox, TurtleMint or InsuranceDekho. Besides, regulatory hurdles do not make it easy for players to get an insurance broker license. And the complexity of the product requires operational depth that can be achieved only with a mix of human and technology-driven service. If the numbers are to be believed, Policybazaar boasts of a whopping 80% of new policy sales (FY-21) with minimal human assistance.

#4 Avoiding saturation

An already-high market share in the digital space, slow transformation of the insurance industry into digital model and the continuing complexity of the product may all have necessitated Policy Bazaar to expand through the offline mode. It plans to add (already started) 200 stores by March 2024 and also incur Rs 75 crore per year for the next 3 years to build a network of point of sales persons (POSP).

We think the POSP model can be a promising model as it not only provides a ready army of agents who are familiar with the product and customer but also help penetrate to regions which neither physical offices nor digital modes can. For an agent, the large bouquet of products that Policybazaar offers together with a likely lucrative commission will make for a ready case to move to a marketplace model.

LIC’s success model is proof that in India, direct selling and agent models have worked well and helped penetrate micro markets.

Limitations and risks

An attractive business notwithstanding, the growth potential of PB Fintech will be limited to that of the insurance industry and to a smaller extent dependent on credit growth (for Paisabazaar). Unlike other fintech giants like Paytm, which can tap the entire retail populace as consumers with its universally relevant product offerings (everyone shops at retail outlets, everyone transfers money etc), PB Fintech’s universe is narrow and this poses some challenges and risks.

#1 Low penetration or limited market size?

While industry reports and broker reports talk of an underpenetrated market, we think this highlight may be overdone for few reasons:

- First, data suggests that life insurance funds, as part of the flow of household financial assets, accounted for just 1.7% of GDP in FY-20 and this is a number that is often highlighted. However, it is noteworthy that household financial asset additions themselves were just 8% (8.2% for 3 quarters ending Dec 20) of total GDP. That means financial savings is not high per se and has seen a slow climb with periods of dip based on economic conditions. Within additions to financial savings - for the 3 quarters ending December 2021 - life insurance funds has overtaken provident funds with a share of 19% of the flow into financial savings. This makes insurance the second highest parking ground for fresh household financial savings, next to deposits (which has seen a dip in share compared with FY-20). The question therefore is whether insurance is really an underpenetrated market with very high growth opportunities as is widely touted or merely one that offers steady growth with awareness and rising income levels.

- Second, while the premium growth in the insurance space is in double digits, the addition of new policies is not all that inspiring; that too in the life policy segment. The number of new life policies sold in the last 3 years ending FY-21 has grown by a mere 1.13% CAGR – stagnating at around 2.8 crore policies. Even a 5-year period shows a similar growth. So, the industry growth appears to come from fancily priced policies and higher sums assured than penetrating new markets. On this count, the non-life policy segment has seen a healthier growth of 16% in the last 3 years. But remember that non-life accounts for just a fourth of the industry by premium value. For Policy Bazaar, over 60% of premium is from the life segment. Unless there is innovation or ease of buying policy by leaps, the pace of new penetration and growth in the industry may be less glamorous. Today, life insurance remains inaccessible for many below a certain income threshold.

#2 Risk of self-sufficient manufacturers

Any intermediary is at the mercy of product manufacturers to give it products to sell, and PolicyBazaar is no exception. LIC’s life policies are not available for sale on PolicyBazaar’s platform, limiting PB to 50% of the overall market. On the general insurance side, ICICI Lombard and recently, HDFC Ergo, have also pulled their products from the shelf (although their life insurance counterparts still have their products listed in PolicyBazaar). HDFC Ergo accounted for 12% of commission income for Policy Bazaar in the non-life policy segment. This could be a worrying trend for PB Fintech.

Also, the high growth area of non-life policies is now witnessing manufacturers going fully digital. Online and direct-to-customer players like Digit and Acko are reported to have about 2-3.5% market share in total general insurance/motor premiums.

Such trends and large exits not only pose risk to revenue but also raise the question of serious competition from the manufacturers directly.

On the potentially positive side, PB’s expansion into offline channels may prompt some of these players to come back – either fully or in a restricted capacity (like offering their products only for offline sales).

#3 Problem of plenty

PB Fintech has cut down on advertisement costs and also saw reduced employee costs as a proportion of revenue. In private equity language, it is not burning enough! It has Rs 1,886 crore or 60% of the total funds it has raised (pre-IPO), lying either in deposits, mutual funds or other cash equivalents. This raises the question of why it needs to raise an IPO for Rs 3,750 crore, when it is not spending enough.

Here, it must be pointed out that there is a difference between some other fintech players and PB Fintech. Companies such as Paytm or Phonepe can offer discounts, gifts, cashbacks and a variety of other financial incentives to acquire and retain customers, or increase usage of their app. PB Fintech, on the other hand, is prohibited by regulations to do any of these. Essentially, PB Fintech has neither pricing power on products it sells or ability to lure customers with cash. Which means that the large scale spending has to be on sales and marketing. Until now, it has been on TV advertising and online marketing – both of which have their ceiling in terms of efficient spending. Going forward however, the offline rollout will likely take a significant portion of the overall acquisition spend.

Like many other IPOs, the company issued a largesse in the form of bonus shares of 499 shares for every share held in June 2021 (apart from conversion of preference shares to equity in the same month). High cash, expanded equity base and no profits are not recipes for high return on equity for the near term.

#4 Valuation

PB Fintech cannot be measured by traditional metrics without profits. On an enterprise to sales value (EV/Sales), it trades at 48.5 times FY-21 sales at the upper end of the price band post IPO. This is nowhere near the 20-23 times multiple of recent tech IPOs such as Zomato or Nykaa or anywhere near the low single-digit valuation of insurance manufacturers. At an aggressive revenue growth of about 41% CAGR between FY-21 to FY-25, EV/Sales would be about estimated 12 times.

If we try to do a discounted cash flow valuation for the next 10 years at varying growth rates that average at about 30% for the consolidated entity, we still find the asking price at least 50% more! But then, bull case scenarios such as LIC entering the digital marketplace, or resounding success in offline channels and ability to retain high margins can make the valuation seem even fair. We do not wish to discount those positives now.

The high valuation with a kitty that is already brimming with funds suggests that the company is simply raising money when it can, at a price that a bull market will accept.

The business prospects of PB Fintech make a sound case for investing at a price that only a bull market investor will pay. If you buy, make sure you deploy only a part of the sum you wish to allocate, waiting for correction opportunities. For the others, this is a good company to hold on the watchlist, with evaluation and re-evaluation at different price points and based on unfolding events. Please note that this review does not take into consideration the possibility of listing gains.