When stock markets are volatile and there’s uncertainty all around, you need an option that can navigate across markets, that’s steady in strategy, and that is large-cap based. Kotak Flexicap fund fits all three. This flexicap fund is part of our Prime Funds recommendation list. Kotak Flexicap fund suits any investor with a timeframe of 4 years and above. Here’s why the fund makes a good investment.

#1 It beats the market and peers across timeframes

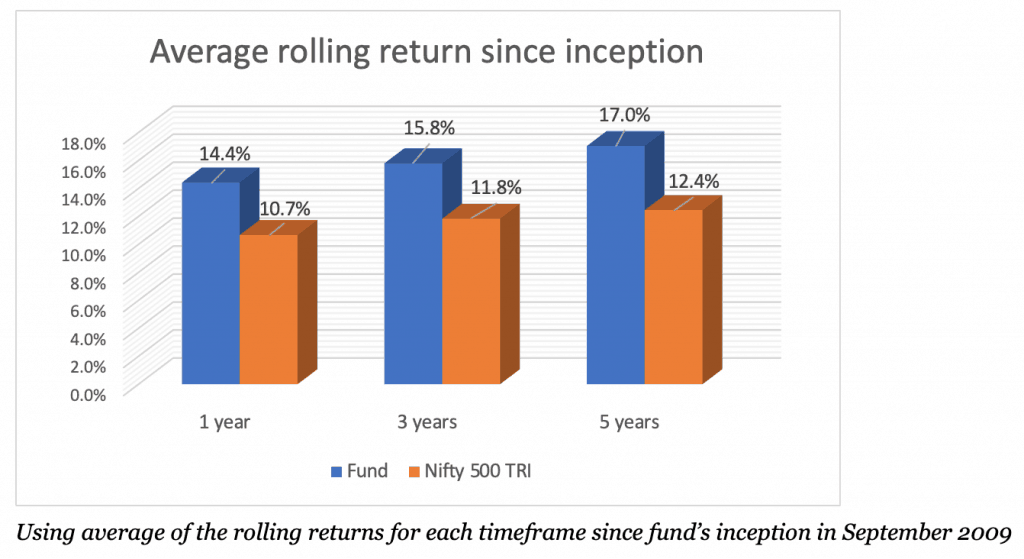

Consistency in a fund’s returns is the one metric that provides comfort about a fund’s ability to deliver in future as well. Consistency means that a fund has beaten the market and peers across different timeframes and in different markets.

On this count, Kotak Flexicap fund (Kotak Flexi) fares very well. Rolling the fund’s 3-year and 5-year returns since inception in September 2009 has it beating the Nifty 500 TRI all the time. The Nifty 500 represents the broad market and is a useful gauge for mutli-cap funds; the fund’s stated benchmark is the Nifty 200.

Against other funds that can invest across market capitalisations, Kotak Flexicap fund beats the average all the time too, when 3-year returns are rolled for a 6-year period. The average margin of such outperformance is 2.5 percentage points. However, in 1-year periods, the fund can and has lagged the index.

Kotak Flexicap Fund is also able to keep return volatility lower than many peers in both the shorter-term 1-year periods and longer 3-year timeframes. Contained volatility over the long term is preferable as it does not require big market rallies to make up for losses. On downside containment, Kotak Flexicap Fund does not score as well as others such as Parag Parikh Long Term Equity, Canara Robeco Equity Diversified, or UTI Equity. However, as Kotak Flexicap Fund is able to control overall volatility and catch market upsides, it still manages to perform well. The fund’s risk-adjusted has steadily held above the category average.

#2 Kotak Flexicap fund has a clear, stable strategy

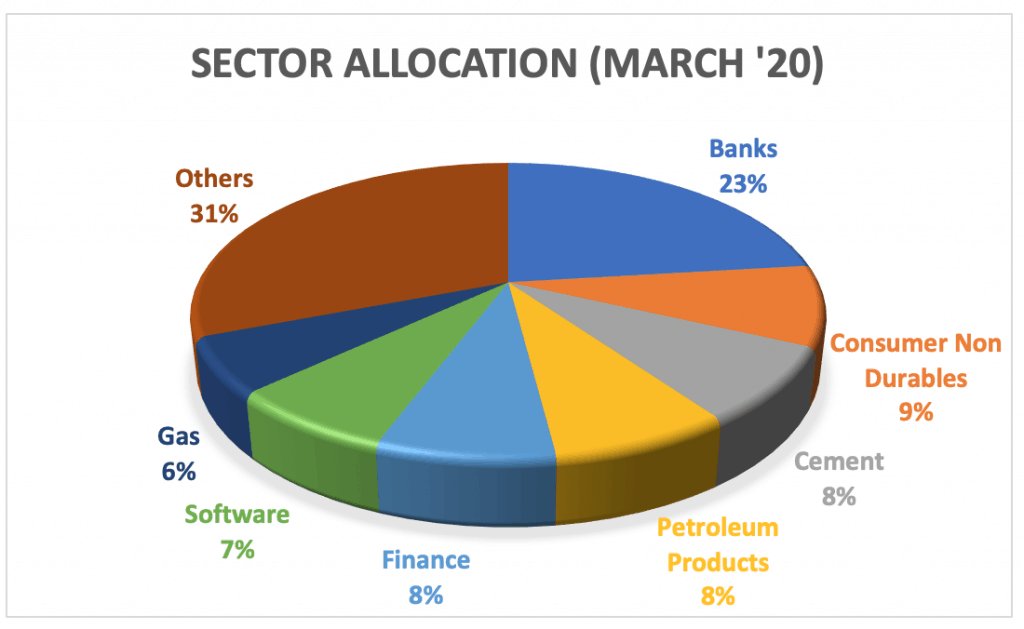

Kotak Flexicap Fund adopts a top-down strategy. That is, it looks for sectors that can deliver returns in the coming cycle and assigns heavy weights to these sectors. Within this sector allocation, it diffuses holdings across stocks. The fund does not sport a value portfolio but has a value-based approach to picking stocks.

So why give the fund now, with the cloud over the economy and cyclical sectors? For one, the fund hasn’t suffered the same performance declines as value funds. While looking at valuations, the fund does not adopt a deep value stance – it is usually a trade-off between sector prospects and valuations. This allows it to invest in attractive sectors and not only in the down-and-out.

For example, the fund is overweight currently on cement with an 8.3% allocation to the sector, featuring stocks such as Shree Cement, Ultra Tech Cement, and Ramco Cement. It is overweight on the infrastructure segment, capital goods, and oil & gas. But the fund has also upped holding in consumer non-durables to 8.8% of the portfolio now against the 5.2% it had been in September 2019. The fund has bought into stocks such as Hindustan Unilever and Britannia Industries, moved out of ITC and bought into other mass-consumer stocks such as Page Industries and Bata India.

Two, while it can look at the overall sector from a valuation perspective, it can pick higher-valued stocks within this. For instance, the fund is overweight on banks with the sector forming 23% of the portfolio. But it has a good allocation to HDFC Bank, in addition to those such as ICICI Bank and Axis Bank. Funds such as ICICI Pru Value Discovery or Franklin Equity have had very low allocations to the stock, causing them to miss the rally. Reliance Industries is another example.

Three, within each sector, the fund picks strong players with sound fundamentals; it also holds multiple stocks which spreads out the risk. Larsen & Toubro, for instance, would be far better placed to ride a recovery in infrastructure and construction compared to the more niche or smaller players. Kotak Flexicap Fund also often invests in the Nifty 50 index itself, makes some use of derivatives, and moves up to 10% in cash if needed.

So while growth-based funds may seem like a good option in a period of economic and financial uncertainty, Kotak Flexicap does that without doing a ‘growth at any price’. Given that a portfolio also needs to have a style mix, Kotak Flexicap can provide a value-style that delivers.

#3 It is a good large-cap equity fund substitute

Kotak Flexicap Fund is categorised a multi-cap fund. The share of large-cap stocks in its portfolio, though, has been in the range of 70-80% for several years now. This large-cap orientation makes it less risky and more stable than a fund that dynamically moves across market caps. The fund is also unlikely to hike mid-cap/small-cap allocations by much even if opportunities arise given its large size. It therefore works well as the large-cap component that every long-term portfolio must have.

At the same time, the measured exposure to mid-cap stocks allows it to explore stocks outside the large cap equity fund basket. This places it in a better return position than pure large-cap stocks, almost all of which are unable to beat the Nifty 100 TRI.

Kotak Flexicap Fund is managed by Harsha Upadhyaya. It has an AUM of Rs 22,871 crore.

How to use this fund

If you wish to know how to use Kotak Flexicap fund in your portfolio, please visit our Prime Funds page. We have explained (in the ‘why this fund’ section) what style of funds you should be mixing this strategy with, for your portfolio to work optimally. You can also check out our time-frame based portfolios, where we use this fund to build portfolios that mix and match styles. This will give you cues on how to build your own portfolio with this fund and funds with other strategies.

At PrimeInvestor, we don’t just pick funds based on performance and portfolio. We look for funds with clear strategies. Identifying such strategies helps us to provide you with the right set of funds to complement your portfolios – with a mix of styles that ensures you are diversified across strategies for different market conditions. Subscribe to PrimeInvestor today to enjoy our suite of products across mutual funds, ETFs, deposits and soon to come stocks!

12 thoughts on “Kotak Flexicap fund: A Prime Review”

Kotak Flexicap has become a laggard in the category. It is almost a large cap due to sheer size of the fund. Does it still fit in the Best Mutual funds recommendation

Please check Prime Funds for the current recommendation list. We have discussed the fund here: https://staging.primeinvestor.in/quarterly-review-changes-in-prime-funds/ – thanks, Bhavana

Hello, Given that this fund has grown mammoth in size and unable to beat the index – BSE 500 & NIFTY 100. Moreover, 72% of the portfolio is Large cap companies, does this fund still fit the remit and can qualify for the best mutual funds. Any update on this fund will be helpful

We have discussed the question of fund size here: https://staging.primeinvestor.in/does-aum-size-impact-fund-performance/. We will let you know if we change any call on our recommendations. – thanks, Bhavana

Hello Bhavana, what should be our call on this fund post the latest Multicap regulation issued by SEBI?

Hello Sir, We’ll definitely let investors know once SEBI receives feedback from AMCs and AMCs decide what to do. thanks Vidya

Bhavana ji, amazingly well articulated article. On a candid note, the research team of PrimeInvestor can also take lessons on how to convert thoughts into words so beautifully – Guess, I will subscribe for it 🙂

Thanks, sir 🙂

Regards,

Bhavana

Dear Team, Do you think its size would be an issue going forward. Also, does it matter that it was previously listed along with the large-cap funds (Kotak Select Focus)?

Hello sir,

Size is not a big issue here as the fund is large-cap dominated. Kotak Select Focus was renamed to Kotak Standard Multicap in the recategorisation exercise. It was a multi-cap fund earlier, too. Both then and now, the fund was primarily large-cap with some amount of mid-cap and small-cap. The fund hasn’t changed what it does; its large-cap orientation is why we’re comfortable putting this fund as a large-cap substitute.

Thanks,

Bhavana

“while growth-based funds may seem like a good option in a period of economic and financial uncertainty” – Any multicap fund which use such strategy, which is complement of value based multicap and kotak multicap too, as you said kotak is not also completely growth one.

Hello Bhavana, When this fund was called as Kotak Select Focus, they used to have some limitation with regard to the number of sectors they will invest in. Does it still hold good? Or the number of sectors cap in the fund has been removed?

Comments are closed.