As the top two players in the oldest lending business in India, gold lending NBFCs Muthoot and Manappuram Finance don’t require much introduction to investors. Unlike other lending operations, gold lending still requires the physical presence of the customer and therefore fin-tech challengers are yet to figure out a way to crack this lucrative business. The adoption of digital technologies in gold lending is restricted to bank transactions and sales origination.

Muthoot is the larger among the two and in the last decade has stolen the lead in terms of market capitalisation. The market value of Muthoot at Rs 53,000 crore is today larger than the market value of the seven old private banks put together (Federal Bank, South Indian Bank, CSB, Dhanlaxmi Bank, Karur Vysya Bank, Karnataka Bank and City Union Bank). Both companies have delivered significant returns to shareholders during the last decade following a major re-rating post 2016.

As the lockdowns and income hits from the first wave of Covid unfolded followed by an RBI-granted loan moratorium, worries about rising defaults and a deteriorating credit culture battered most NBFC and bank stocks. Gold lending NBFCs remained resilient, given the nature of their collateral. But in the second wave and after, there has been a sharp divergence in the valuations and market performance of Muthoot and Manappuram with the former outperforming (See table). This analysis deep dives into the reasons for this divergence and what it may mean for future stock returns.

The gold loan business

Muthoot Finance and Manappuram Finance are the first and second largest players respectively in gold loans, with a pan-India physical presence. While Muthoot operated through a network of 5,490 branches, Manappuram had 3,524 at the end of December 2021.

A key factor which has made gold loans the most penetrated lending product in India is the easy availability of collateral. For low-income borrowers who generally don’t have access to bank credit and lack collateral in the form of land or financial securities, gold jewellery which can be held in units as small as a couple of grams, facilitates easy access to credit. While gold lending was long dominated by unregulated and unorganised street-corner pawn shops, NBFCs such as Muthoot and Manappuram have scaled their business while subjecting themselves to RBI’s regulatory oversight and adopting standardised and transparent lending practices.

Gold lenders typically contain their risks by extending only short-tenor loans of 3 to 12 months and calibrating their Loan-to-Value or LTV ratios, the loan value as a proportion of the underlying market value of gold they take as collateral. Seasoned players such as Muthoot and Manappuram generally cap their LTVs below 75% offering significant cushion. This makes recoveries easier in case of borrower defaults.

If a customer doesn’t pay his dues by the end of the term, then the underlying collateral is put up for public auction and the dues are realised. Save for exceptional circumstances such as sharp gold price fall (20% plus falls over short periods are quite unusual), this makes the business technically a low-NPA lending activity which still generates yields as high as 22-25%.

On the flip side though, the gold lending business does face three risks. One, as jewellery loans are typically sought by borrowers as a last resort, gold loans generally attract the riskier segment of borrowers who can be significantly buffeted by economic downturns or adverse events like lock-downs. Two, gold loans are generally given out as bullet repayment loans with the principal collected only at maturity. Rollover of these loans is a common practice and can lead to evergreening of doubtful debt and NPAs not showing up quickly in lenders’ books.

Three, the high yield and easily realisable collateral in this business has attracted hordes of new players, from banks to NBFCs. They are posing stiff competition to Muthoot and Manappuram by stretching the LTV and offering loans at far lower rates. Any attempt by the top two to match these offerings can escalate the riskiness of this business while trimming margins. Manappuram’s yields have moderated from 25% to 21% over time, with the management flagging rising competition.

Charting different growth trajectories

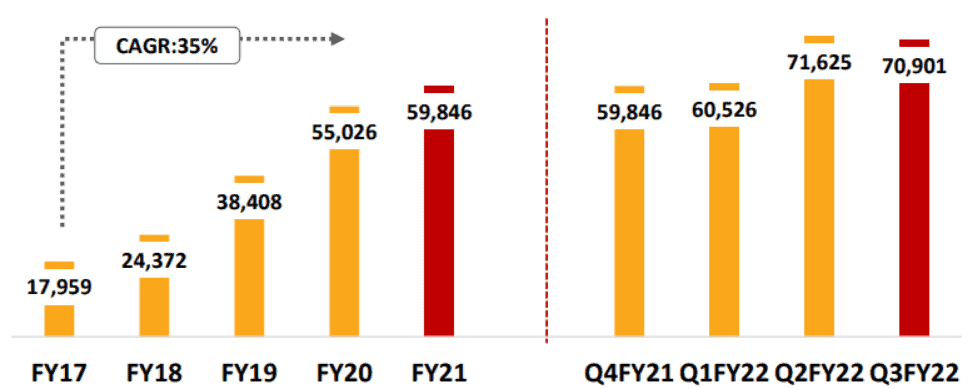

While both Muthoot and Manappuram have been good at underwriting risks in gold loans and have spearheaded their growth initiatives well, Muthoot has opted for the lower risk strategy. In its efforts to grow its loan book, it has mainly looked to tap into similar sets of customers operating within its existing catchment areas. Muthoot has also taken a conscious decision to slow down its diversification efforts post the pandemic. Gold loans therefore still make up 90% of its total AUM.

Manappuram, on the other hand, has aggressively branched out into microfinance ever since it acquired Chennai based Asirvad Micro Finance in 2015. It has grown the business over 4X between FY17 and FY21 with its AUM crossing Rs. 7,000 crore at the end of December 21. It is also the 3rd largest MFI in India with a network of over 1,400 branches with major presence in South, East and North. Microfinance loans which offer better yields than gold loans, are typically short-term, uncollateralised loans with few checks on the end-use. Customers are encouraged to repay on time through community checks and self-policing.

Below is a snapshot of the loan book composition of the two firms by December 2021.

Microfinance does present a logical diversification for gold loan companies considering that they cater to low income customers with deep penetration into semi-urban and small town areas. Pre-Covid, microfinance was also considered a high growth lending business that fetched rich valuations in the stock market. Bandhan Bank a MFI turned bank, listed in 2018 at 4X book value and traded at over 7X book value and enjoyed a Rs. 70,000 crore in market cap at its peak.

But as markets grew wary of all lenders during the pandemic, microfinance stocks were considered the riskiest of the lot with their unsecured, low-ticket lending. NPAs in the sector ballooned to as high as 10%, as incomes at the lower strata took a severe hit, self-employment opportunities faded and mobility restrictions made it tough for collection agents to physically visit borrowers.

This caused the market to sharply de-rate Manappuram with its larger microfinance exposure. Muthoot held steady on its core gold loan business which was still seen as a safe bet.

The valuation divergence

Both the stocks made new life-time highs in 2021 and were the sought-after companies in the NBFC space for a brief while after the first wave. Stocks of gold loan NBFCs have always moved in tandem with gold prices as gold price surges are seen to lift the value of their collateral/inventory. The 25% surge in gold prices after the first wave and expected higher demand for gold loans post the lock-downs thus buoyed these stocks.

But after a spike in 2020, muted/declining gold prices and flat gold holdings (tonnes) seem to have taken a toll on AUM growth too. NPAs also spiked up for these companies later on leading to higher gold auctions. While NPAs spiked for Manappuram in Q1FY22, they spiked only in Q3FY22 for Muthoot. The rise in NPAs at different periods seems to be a function of the tenure of their respective loans, which are shorter for Manappuram than Muthoot.

Their gold holdings (tonnes) have also flatlined due to higher auction of collateral by these companies in the last three quarters. While Manappuram carried out auctions worth Rs.1,500 crore in Q1FY22, Muthoot did Rs. 2,800 crore worth auctions in Q3, in line with the spike in its NPAs

While the Muthoot stock has not given up on its post-pandemic gains with a just 15% correction from its highs, Manappuram lost pace more sharply with the stock correcting almost 50% from its highs. This seems to have been triggered by three factors;

- Muted growth in gold loan business combined with declining yields

Yields have declined from the 25% it has maintained for the last five years to 21% for the December quarter of 2021 while gold holdings (tonnes) and AUM have been flat in December 2021 over December 2020.

- Asset quality issues in microfinance

As is to be expected post pandemic, the microfinance business comprising 23% of the loan book hasn’t performed well post-pandemic. Manappuram has made provisions of Rs. 271 crore for 9 months ended December 21 with GNPA at 2.8% (NNPA – Nil), while its contribution to profits has fallen to just Rs. 16 crore (2% of total profits).

- Management commentary

The market has taken note of the management commentary on rising challenges in the gold loan business growth due to aggressive lending by competition at rates as low as 17%

Declining growth in gold loans, a secured, high return, low NPA business with worries about stress getting worse in the microfinance business (which is unsecured, vulnerable and high NPA) have acted as a double whammy on Manappuram’s stock valuation, and triggered a sharper correction relative to Muthoot.

Consequently, a sharp divergence in valuation happened between the two in the last 6 months.

But it needs to be noted that Muthoot is not free from some of these risks, such as rising competition in gold loans. It has also seen a marginal decline in its gold loan AUM in the December 2021 quarter. Its management has also highlighted challenges to growth (toned down its guidance of 15% growth to 9-10%).

Tailwinds from gold prices

Historically gold loan companies have seen higher growth during periods of rising gold prices. Rising gold prices prompt borrowers to use this lending avenue more as they get better value for their jewellery. Companies to get leeway on their LTV to increase lending.

When gold prices rose at a 12% CAGR between 2017 and 2019, Muthoot and Manappuram managed a 6-18% CAGR in their loan books aided by 3-4% growth in gold holdings (tonnes) with the rest coming from prices. Their LTV (loan to value ratio) remained constant at about 65-67%

Below is a snapshot of their gold holdings (tonnes) and AUM growth in the last 5 years.

The brief spike in AUM in 2021 also coincided with rising gold prices post pandemic. While gold prices were muted for most part of 2021, they have been reviving recently on the back of rising inflation risks and geopolitical tensions. A sustained rise in gold prices has the potential to revive loan growth and add to the LTV cushion for both companies, which have seen flattish AUMs for the first three quarters of FY2022. Such a growth revival can help Manappuram recoup its valuations.

What’s ahead

After the recent declines, the Manappuram Finance stock trades at 1.25X its book value, for an underlying loan book that combines 65% gold loans and 25% microfinance loans. Muthoot Finance remains much more expensive at 3X its book value with a 90% gold loan focus.

Tailwinds from higher gold prices have the potential to lift loan book growth and thus valuations for both players. For Manappuram though there could be an additional tailwind from the microfinance business normalising as economic activities get back to usual levels post the third wave of the pandemic.

There’s already plenty of evidence that the third wave of Covid is rapidly receding across India. What’s more, with the fear factor surrounding the pandemic receding, the adverse impact on business and consumer sentiment is fading fast. Top microfinance players have seen AUM growth of 7-9% in Q3FY22 with returning new customer acquisitions while collections have normalised to 98-99% levels.

Manappuram has already provided for its NPAs so far in the microfinance business and a return to normalcy for this business could restore loan growth and help its battered valuations recover. Asirvad is already the 3rd largest MFI in India and post pandemic survivors are likely to emerge stronger.

If the tailwinds play out as expected, the steep valuation divergence between Muthoot and Manappuram could significantly narrow with the latter recouping returns and improving its valuations.

4 thoughts on “Muthoot and Manappuram – Explaining the valuation divergence”

Excellent article. A wonderfully detailed piece. Only feedback would be that it would have been nice to name one or two fintech gold loan firms that pose stiff competition.

Thank you sir

This business still require physical presence (gold holding, verification). So, no competition from fintech.

Ok. So the competition and margin pressure come from just the Kerala based old private banks?

Not all.

IIFL Fin is aggressive form the NBFC space. CSB Bank has been focusing mainly on gold loans.

Jut to point out those focusing more on this.

Availability of money at lower rates that has been pushing lending yields lower.

Makes diff. in high ticket size loans only, not in low ticket size loans.

Hope this clarifies.

Thank you sir

Comments are closed.