Microfinance player Muthoot Microfin is coming out with a Rs 960-crore IPO – consisting of fresh issue of Rs.760 crore and an offer for sale of Rs.200 crore. The proceeds from fresh issue will go towards augmenting the capital base of the company. The issue is priced at Rs.277-291 per share of face value Rs.10/- the offer is open from December 18-20, 2023.

In the IPO, the Promoter group is selling shares worth Rs.150 crore while a PE fund is selling shares worth Rs 50 crore. After the IPO, Promoter NBFC – Muthoot Fincorp will continue to own 50% of shares of the company while PE Funds will own close to 23%.

We are proposing a ‘high-risk invest’ for those with a short to medium term view. We will likely reverse this call or retain it at best as a ‘tactical’ play for some time depending on how valuations move post listing.

The sharp growth in this segment in the last 3 years (specifically in the past year) makes us a bit uncomfortable and places some doubts in sustainability of such high growth. Besides, we foresee some fundamental risks (discussed later) to this sector over the medium to long term. If these risks pan out, a slowdown followed later by asset issues can crop up. For this reason, taking a long-term call on this sector is difficult. We are of the view that it may be these risks that are currently making some companies in this space look reasonably valued (providing room for upside gains in the short term).

This call is therefore not for those with long-term investment horizon. We would also not recommend investors taking high exposure to this stock.

About the Company

Muthoot Microfin is a Microfinance Institution (MFI) promoted by Muthoot Pappachan Group (known as blue Muthoot) and is one of the top 5 NBFC-MFIs in India with an AUM of Rs.10,867 crore. Muthoot Fincorp, the promoter of Muthoot Microfin, is one of the three largest NBFCs engaged primarily in the gold loans business in India with a network of close to 3650 branches across 24 states. The parent (Muthoot Fincorp) also enjoys a strong credit rating of AA-, a notch above that of its MFI subsidiary, but remains an unlisted entity.

MFI was a natural extension for the group as the gold loan business itself was a low-ticket business dealing with customers in rural and semi-urban areas. Muthoot Microfin has scaled up to become the 5th largest NBFC-MFIs and 3rd largest in the South with a network of 1340 branches spread across 339 districts in the country with Southern India contributing to half of its book.

Positives

#1 Industry is back to its hey days

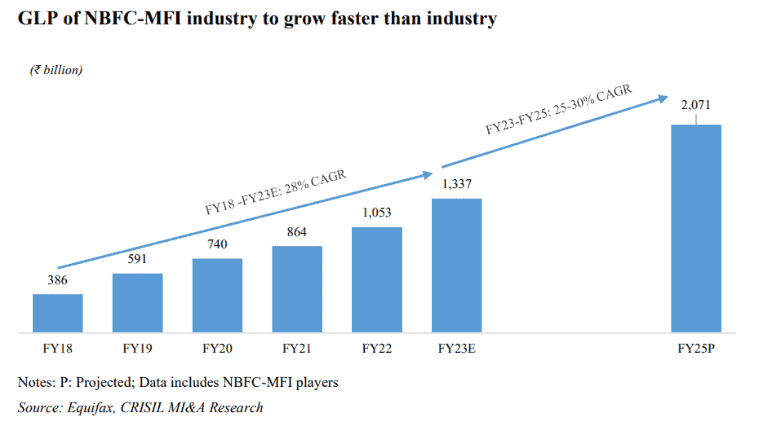

For the MFI industry, FY23 has been the best in the last 5 years with AUM growth hitting new highs. The top 5 players have grown their AUM by 47% in FY23 while the next 5 players have grown at 33.5%. Most of the top players also doubled their AUM between FY20 and FY23.

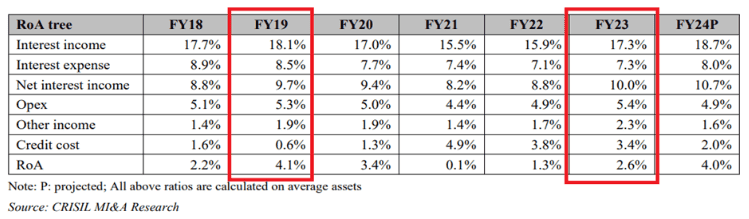

A combination of factors including pent-up demand, regulatory changes*, and higher ticket size has led to this humungous growth. At the same time, credit cost has fallen and has led to significant improvement in profitability. Consequently, CRISIL expects the RoA profile of the industry to converge to the 4% levels seen prior to Covid. The RoA convergence is mainly led by NIM expansion (post change in regulations) and moderating credit cost while operating expense(opex) remains the same. This augurs well for the companies to fetch good valuations in the market.

Source: Muthoot Microfin RHP

Muthoot Microfin scores in-line with industry on NIM while it has a higher opex at 6.53% (5.82% in H1FY24) compared to industry average. Credit cost was in line with industry at 3.16% in FY23 while it has fallen sharply in H1FY24 to 0.62% (annualised 1.24%). Falling credit cost combined with opex rationalisation could push RoA higher for Muthoot Microfin as well. Elevated opex for Muthoot Microfin is also due to network additions (30% increase in 1 year) and investments in technology. Overall, Muthoot Microfin’s numbers appear to be converging with industry trends on all these parameters and this augurs well for IPO investors.

#2 NBFC-MFIs on a strong growth wicket

The regulatory changes since 1st April 2022* has given a level playing field for NBFC-MFIs in line with SFBs. Further, SFBs have also shifted their focus to tilt their book towards secured lending from unsecured lending. Consequently, NBFC MFIs are expected to continue growing at 25% or more in the next two years despite a stellar growth in FY23.

Source: Muthoot Microfin RHP

Another noticeable thing is the consolidation of NBFC-MFIs among stronger players with 5 of the top 10 players promoted by NBFCs with strong lending operations in other areas. This include IIFL promoted IIFL Samasta, Manappuram promoted Aasirvad, Ananya Birla promoted Svatantra Microfin and Muthoot Finance (RED Muthoot) promoted Belstar Microfin apart from Muthoot Microfin. This has ensured timely capitalisation and market share gains for these players as well while surviving the Covid rout.

The IPO will boost Muthoot Microfin’s capital adequacy ratio (CAR) levels to grow in line with the industry. Muthoot Microfin has a Tier – 1 CAR of 20.46% as of 30th September 2023 and the proceeds of Rs.760 crore from fresh issue will augment its capital base by another 25% to take care of its growth.

*Regulatory changes effective 1st April, 2022:

RBI has proposed following changes to the regulatory framework for micro loans effective 1st April, 2022. Some of the important changes are as below;

1) Increase in annual household income cap for microfinance borrowers (to Rs.3,00,000 in both urban and rural areas from Rs.2,00,000 and Rs.1,60,000 earlier)

2) Removal of the two-lender per borrower norm for lending by NBFC-MFIs, and allowing NBFC-MFIs greater flexibility to offer non-MFI loans (MFI loans required to account for 75% of total assets for NBFC-MFIs, as per the new regulations)

3) Removal of cap in the lending rates based on cost of funds (10% spread gap) thereby allowing better risk based pricing

4) Maximum exposure limit based on the income level of households with repayment value restricted to 50% of the household income

Key risks

The humungous AUM growth for MFI players in FY23 has come on the back of regulatory changes leading to larger addressable market combined with higher ticket size. For all MFI players, client base has also shot up aggressively in FY23, after being stagnant for 3 years, while average ticket size has grown by 50-100% from FY20 levels. In other words, the sharp increase in average ticket size has come about in a short time.

This high base, sets challenges to sustained high growth in the next few years. Besides, this kind of growth may also catch the attention of regulator like it happened with other unsecured loans recently. Such a move can not only lead to a risk of lower growth but also a possible asset quality risk later.

The success of MFI model has its roots in the Joint Liability Model (JLM) of lending to women entrepreneurs. The recent regulatory changes have allowed MFIs to look at overall household income of the borrower and take credit decisions based on that. NBFC-MFIs may override the JLM model to lend more to those with higher household income, akin to other forms of income-assessment based unsecured lending models. Further, the leeway allowed to have 25% of book in non-MFI loans has allowed MFIs to lend individual loans to same borrowers which may further change the risk profile of the MFIs going forward.

Valuation

At the upper band of Rs.291, the valuation works out to 1.9 times the post issue book value. This compares with 5 times for CreditAccess, 2.4 times for fusion, 2.1 times for Spandana and 1.4 times for Satin in the listed space.

Muthoot Microfin is fairly valued at 1.9 times book that leaves some upside for IPO investors. Being a strong promoter backed MFI also adds to comfort.

CreditAccess has been an outlier on all key parameters and hence a comparison with its valuation may not be right (see comparison table below).

Please note that PE ratio would be a wrong metric to look at for this industry now, due to spike in profitability led by falling credit costs. All listed MFIs has reported robust numbers in FY23 as well as first two quarters of FY24.

Here’s how Muthoot Microfin compares with its peers on various parameters

Note: IIFL Samasta, Asirvad and Belstar are subsidiaries of listed companies IIFL Finance, Manappuram and Muthoot Finance (RED Muthoot) respectively.

Fusion Microfin and Spandana Spoorty are majority owned by PE investors.

As mentioned earlier, we do not recommend this company (or for that matter the MFI industry) with a long-term horizon for the following reasons:

- Sudden credit events leading to asset quality shocks once in few years with unknown magnitude and even possibility of Govt. interventions (State).

- Market extrapolating valuations of MFIs during good times and punishing hard during bad times leading to unmanageable volatility for investors.

Our call is more tactical based on the fact that this is a good time for the industry and valuation of this IPO is favourable, besides an additional comfort of a strong promoter backed MFI. Keep exposure limited even if you have a risk appetite.Note: We had recommended NCDs of Muthoot Microfin in July 2023 as it was available at a very attractive yield at a time the industry was recovering.

We also considered the strong promoter backing and fund raising through IPO as key factors. While debt servicing requires a different outlook altogether and we are not worried about such issues with this company in the medium term, even there we only stuck to under 3 year calls in MFIs and not more. The point we are trying to make is that with the MFI sector, long term outlook can be h

5 thoughts on “Muthoot Microfin IPO: Should you invest?”

This article seems incomplete please edit and post the full article

Hello Sir, It is complete. it is possible that you cannot view it if you are not a Growth subscriber.

You are absolutely right. IPO market is surely not a good hunting ground. More often than not the investors end up being the ‘prey’ in this hunting ground.

Thanks to the you all for segregating the chalk & cheese.

Thanks..

Thanks for the assessment NVC!

As you would be aware, there are quite a few IPOs lined up this week. Does picking this one up mean that others can be ignored or that others were not studied? Does the Team scan all the IPOs on offer and give a call on worthy ones?

Would be nice to understand the way it works.

Good day…

Welcome your query sir,

As you are aware, the IPO and listing have become the EXIT route for early investors and it turns hot when liquidity and valuations are hot

So, the construct of the IPO market itself doesn’t make it a good hunting ground for value seeking investors

We also may have limitation in studying large numbers of IPOs and come up with reco. Setting that aside, we are also wary of small sized Cos also in industries without size or long term value creation track record

Sectors with large size, strong promoter, history of value creation and finally IPO valuation dominate our selection criteria.

Hope this clarifies

Thank you

Comments are closed.