International funds from the US, specifically technology-backed ones have become a favourite investment option for many of you, given the fancied returns that the segment delivered in the past few years and the increasing options from domestic AMCs on this front.

But with the US Federal Reserve providing a clear signal on rate hikes, US stocks in general and technology stocks in particular, have been tumbling their way down this month. The Nasdaq 100 for instance, may have seen a correction of only about 15% but individual stocks in the index are already down over 25% from their respective 52-week highs, on an average. And there are stocks that are down 60-70% as well in this established index!

This has triggered concerns and doubts in many of you, going by your queries. Your questions range from whether the technology cycle was over, to whether this is to be a Y2K bubble to whether the rate hike would mean a permanent depression in valuations of this fancied sector.

It is at this juncture, that DSP AMC has chosen to launch an NFO – the DSP Global Innovation Fund of Fund. And we think this NFO is trying to partly answer the above questions you have.

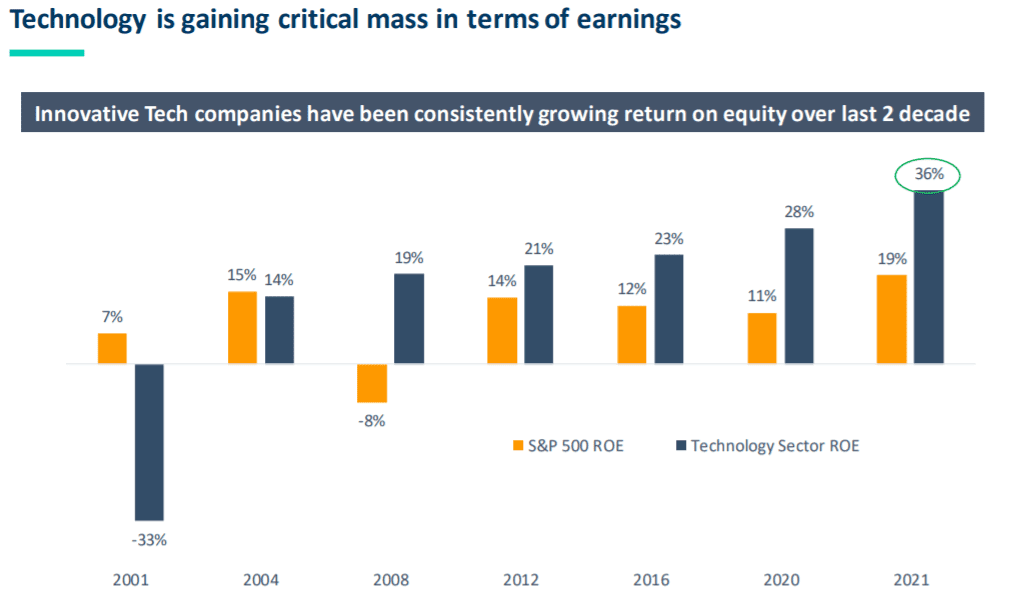

Source: company presentation, Bloomberg data

- One, the technology cycle itself may be far from over if the continuing strong earnings growth and high ROE in many innovative tech companies are any indication (see graph above). But in the aftermath of a meaningful correction, there can be a new wave of companies that are picked by the market (we will explain this shift a bit later). You may not know where to find the fresh catch even if you are aware that money has traditionally chased innovation and disruption. This may be the time to look for those, even as the US market gives you the shivers with its brutal corrections.

- Two, a rate hike that is now imminent in the US will not only remove the froth in the valuations of quality stocks, but also permanently depress valuations afforded to companies with poor growth, poor earnings and cash flow visibility or low ability to pay back debt. At a higher interest rate, DCF models would no longer throw meteoric price levels for these stocks anymore. That means a correction triggered by a rate hike can separate the wheat from the chaff.

Simply put:

One, there is no need to be concerned about the fall in global tech stocks if you’re holding them through funds such as the Nasdaq 100 ETF or FoF. You need to be concerned only if you hold high-risk individual stocks of companies with no profitability or path to operating cash flows, in the US market. If you hold funds that invest in the Nasdaq 100, continue to hold them. We may come up with calls on averaging the index. Look out for them.

Two, we do think it may be a good time to start scouting for companies that will benefit from a new wave. In the absence of expertise on our part (and not easy for you as well) in identifying such themes – or even stocks – in international markets, funds that invest in innovation and disruption are worth a look, if you have the risk appetite for adventure and discovery.

The shift

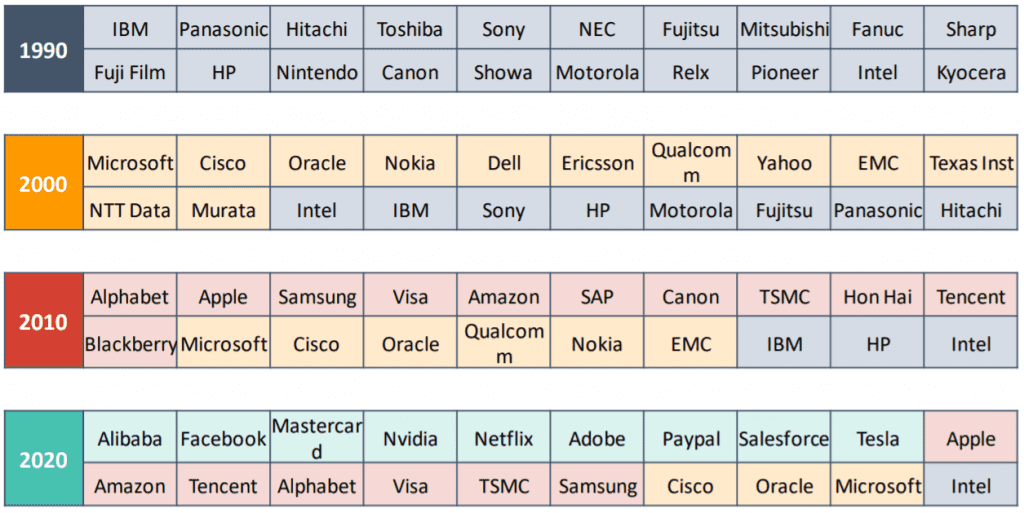

Different industries have driven a new wave of growth across different centuries. Steam engines, the telephone, automobiles or micro computers are all examples of such innovations. But even within industries, trends change fast. Technology has seen a significant shift. Pharma and life sciences have moved from innovating simple drugs to genome technology. Automobiles are moving to clean mobility.

For example, the image below tells you the churn in the top stocks in the tech space alone, driven by disruptive innovation and shifting consumer preferences and industry needs.

So, to ensure you do not lose out, identifying the shifting trends early on becomes imperative. Global portfolio manager Cathie Wood of ARK Invest came up with the idea of focusing on disruptive innovation and capitalizing on the investment opportunities it creates. According to ARK’s ‘saddle adoption curve of innovation’, there is often a gap between early adopters embracing an idea and mass market acceptance.

It appears that the DSP Global Innovation Fund of Fund is trying to extend this idea into a full-fledged, balanced portfolio. But why are we emphasizing a ‘balanced portfolio’ here?

It is not an easy call now to invest in super high-growth companies, some with limited or no record of profitability, at a time when US inflation is at a multi-decade high and a rate hike is imminent. It defeats the point that we made earlier that such companies could be permanently depressed when a rate hike happens and a correction removes some of these companies entirely out of the radar. So, it is important to go in search of the new without losing sight of what provides stability.

DSP appears to have taken a few initiatives to achieve this balancing act in its DSP Global Innovation Fund of Fund.

The DSP Global Innovation Fund Of Fund’s offering

DSP Global Innovation Fund of Fund (DSP Innovation FoF) is a fund of fund that will invest in a basket of ETFs and active funds. They are presently as follows:

You will see two passive funds (ETFs) one on the semiconductor sector and the other on the Nasdaq. The remaining are active funds. The Morgan Stanley US Insight fund aims to invest in established and emerging companies in the United States, where it sees competitive advantages with above-average business visibility. This has a mix of large and midcaps.

The BGF World Tech Fund invests in global companies with at least 70% of its assets in companies involved in technology. Nikko AM ARK is run by influential fund manager Cathie Wood and aims to invest in disruptive innovation. Bluebox, run by William De Gale, seeks to invest in suppliers of software, hardware, semiconductors and services that enable such disruption and thereby get a share of a disruptor’s profits.

Getting the balance right

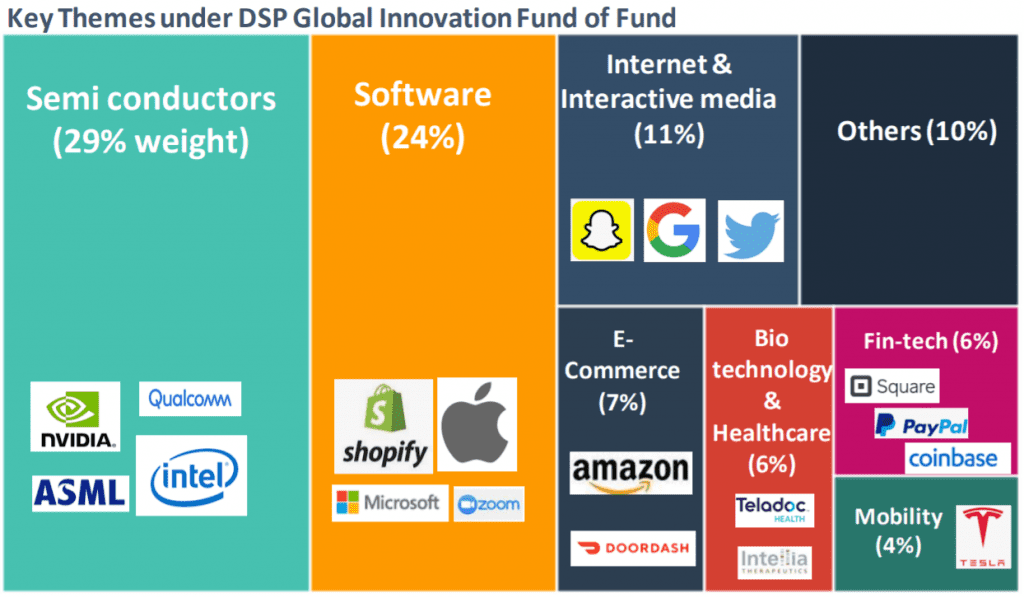

We mentioned earlier that a chase for innovative uber-growth companies can be a high risk in the current rate environment and DSP may be trying to do a balancing act here. This is how we think it is doing it. First, DSP has defined a basket of themes that it thinks will hold promise in innovation and disruption. This diversification can help reduce concentration to sectors. The image below will tell you that software is just a fourth of its theme. Semiconductors (please read our call on this here), internet and interactive media and bio technology among others, have also been identified as those where disruption is happening.

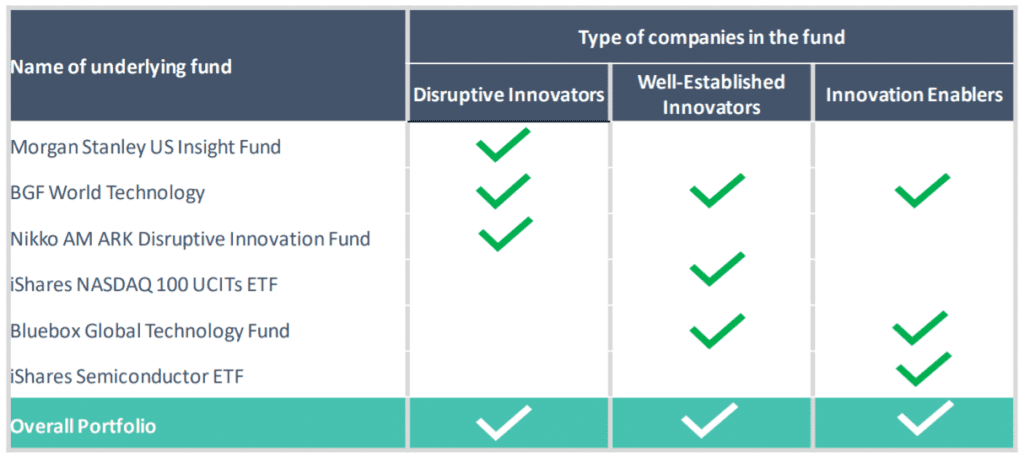

Second, instead of chasing only the emerging uber-growth companies (the risks of which we mentioned earlier in high-rate scenario), it has mixed its choice of funds between:

- The more established innovators

- Those that are or are expect to disrupt or innovate now

- The enablers of such disruption

The DSP Global Innovation Fund of Fund has classified its underlying funds as having exposure in the following manner:

Source: AMC documents

Third, the fund plans to monitor, rebalance, add or exit funds in this basket. That means it might remove a fund with poor performance or add a theme or ETF that holds a new promise. Thus, it tries to reduce the risk of failed themes and seeks to course-correct. So, there is an element of active management here in terms of monitoring and rebalancing these themes.

Portfolio and performance

For a basket of six funds, DSP Global Innovation Fund of Fund surprisingly does not have much overlap in the stocks held. This may be largely due to the mix of themes it has gone with. According to data from the AMC (below), the only significant overlap is in the Bluebox’s enablers portfolio with a maximum of a third overlap with 3 other funds. Cathie Wood’s fund has some overlap with the Morgan Stanley US Insight fund. We think this is still acceptable, considering that the exposure to individual stocks in these portfolios are not high even if all of them are put together (based on data as of September 2021).

Needless to say, barring the last 1-year’s underperformance due to the recent correction, the basket of underlying funds has beaten the MSCI All Country World index (benchmark) across time frames as seen from data below.

However, there is a higher probability of the fund falling more than the benchmark given that it is a high-growth and high-risk basket. For example, the worst 5-year return (on a rolling return basis) for the basket was -8.5% while it was just -3.5% for the benchmark. Hence, this offering from DSP can be expected to be highly volatile.

Is it for you?

DSP Global Innovation Fund of Fund is not for everyone. You need a high level of risk appetite to own this fund and you need a large corpus where this can be part of your thematic holding, if you have such an allocation. There are stocks in this basket of funds that you would never bet on individually. Rather quite a few of them are stocks for venture capitalists and private equity investors to bet on. To this extent, taking the fund route can reduce your risk.

We do think this is an interesting fund to take exposure to, even if you hold funds such as the Nasdaq 100 or the S&P 500, provided your exposure to Nasdaq 100 is not already high. If Nasdaq 100 accounts for over 10 % of your portfolio, cut back there if you wish to hold this fund.

SIPs would be the recommended route for two reasons: one, the present current correction (which may continue) is best handled by deploying money in a phased manner. Two, like many other international funds (read this), DSP Global Innovation Fund of Fund is also dealing with the issue of a cap by RBI on mutual funds to invest overseas. While this issue has been taken up by SEBI and a resolution is awaited soon, DSP can at present invest only in the underlying ETFs and will await clarity to deploy in the other funds. Our suggestion would be that you start a SIP post with such clarity.

Expect a decline in your investments soon after you invest, as it is evident that the tech space is cracking a bit and will settle with more realistic valuations.

As an active fund, expense ratio will be capped at 2.25% (including that of underlying funds). Use the direct plan route if you decide to invest. The FoF will be managed by Jay Kothari and Kedar Karnik. The NFO closes on February 7. You can wait for it to reopen and enter after clarity on the overseas investment limit. As an international fund, DSP Global Innovation Fund of Fund will be taxed like a debt fund.

22 thoughts on “NFO Review: DSP Global Innovation Fund of Fund”

This NAV is around 20% down from the launch NAV.

Is it right time to start exposure in this tech heavy fund ?

Please advice

SIPs are fine. Not lumpsum.

Very good article gave good clarity on opportunities and Risks.

can you come out with an article on comparing funds dealing in overseas investments via FOF ,

clarifying on risks , rewards so far etc.

Balasubramanian.N

Very insightful article. Given the digital age we are living in, disruptive innovation theme should yield positive outcome in the long term.

I have a query regarding the suggestion to limit the allocation if one is already invested i>10% in NASDAQ or S&P, why is that so? Thematic strategy can play parallelly to other diversification in the same portfolio, isn’t it?

We meant for Nasdaq alone – since it is part of this fund. Thanks, Vidya

ok, so you meant to avoid the overlap between NASDAQ 100 & this fund. Thanks.

Expense ratio will be capped at 2.25%, that looks high, when would we know the exact expense ratio, and upto what limit ican it be a safe bet !

We will know after they come out. 2.25% is the SEBI cap. Thanks, Vidya

Very good review of NFO, seems to be good option for diversified portfolio within the international tech basket. The intended funds have minimal overlap. Expecting a follow up update from PI once the RBI restrictions are eased out.

Hello Vidya

Excellent and very timely article. I was thinking of investing in this fund after seeing the DSP MF webniar and your write up reinforced my belief. You have mentioned in the article that DSP can invest in the 2 ETF and not in the 3 other active MF’s? Is the ETF’s exempt from the RBI foreign currency cap?

The limit is not hit there yet is our understanding. thanks, Vidya

One clarification as your reply is not clear. The article seems to indicate the DSP can only invest in 2 ETF and not the other funds, which is a big handicap. But your reply above mentions that the limit is not yet hit, so, can you clarify whether DSP will be able to invest in all the funds as advertised in their NFO?

No it will not be able to. All AMCs are awaiting clarification. Vidya

How is it different from Edelweiss US Technology fund? If someone is already invested in US Tech fund, would be wise to switch to the fund?

Thanks

Yogesh

Edelweiss is a regulate tech fund with top holdings in AMD, Tesla, Alphabet and the likes. This is not a tech fund, it is an innovation fund, across sectors. Whether to switch or not would depend on your take on holding a high risk innovation theme or a portfolio of jsut established tech theme. Vidya

This is a very timely article. You have detailed the pros and cons very well. Is it likely that most of the underlying funds will give high performance at the same time frame? Is it not more likely that the under-performers will pull down the overall return?

The theme is common, so naturally when they fall – they all fall down 🙂 Only the extent of fall will vary as the established ones can be expected to hold forte better than the disruptor ones. thanks, Vidya

Thanks for a such an insightful analysis of this NFO. Of late multiple AMCs have been coming up international funds catering to multiple themes/overseas regions giving rise to plenty of choices. Each AMC’s marketing material attempts to prove why they think their fund is a good investment candidate against some benchmark that is hardly heard of before and by not investing in that fund, I get into FOMO. Would be great if you could come up with an article on the whole platter of international funds available, which ones among them can be taken as part of one’s core portfolio and which ones can be given a miss. This would greatly help. Thank you.

This article https://staging.primeinvestor.in/how-to-choose-international-funds/ will cover it and newer funds since will under one of those categories we mentioned. So we will not have a new take here. thanks, Vidya

Thanks a lot Vidya.

I completely echo your views unlike some of the experts calling it as a mess because it has chosen 6 funds to invest. I do not like hefty concentration of FAANG in NASDAQ-100 (that’s a personnel dislike) while this fund will be overdiversified with > 200 stocks. Individual Stock Performance will not make much difference to Fund Performance unlike NASDAQ-100 where Top 10 Stocks are more or less driving the Index. Last 50 stocks of NASDAQ-100 do not have any significant role in Index performance whatsoever up or down. This is typically a pitfall pf Free Float basis Index. This DSP Fund’s performance may depend meaningfully on how underlying sectors as a whole perform rather than bunch of stocks.

I was wondering what would be expected TER for this FoF. Basis weighted avg TER of underlying scheme and if this FoF charges 0.5% just for feeding into Global Funds, final TER for Direct Plan seems to be somewhere around 1.5%

Though I liked underlying concept, back tested results are not much impressive and probably make sense to allocate to goals which are > 10 years away as a Satellite Portion only.

This fund may definitely be a better choice than Indian Thematic Technology Funds which are enjoying stellar long term chart buste track record of 15-20 years. In fact NASDAQ-100 may be better choice if one wants to get Tech Giants than just owning Infosys n TCS holding funds.

Thanks a lot for giving me confidence on what I was thinking about the fund.

Will you please publish a follow up information when SEBI removes the hurdle for the global limit?

Regards

Keyur

Hello Sir, Thanks. And thanks for your views. We will mail our subscribers on removal of restriction. Vidya

Thanks

Comments are closed.