If there’s one NFO that’s trying to be a hop out of the regular, it is the HDFC Defence Fund. And with good reason – the defence space has been garnering increasing attention in stock markets with defence plays rallying. This open-ended thematic fund opens for subscription today.

HDFC Defence will be the only fund on the defence theme, making it differentiated from other sector offerings. There’s also no denying the scope in the defence sector, especially after key changes in defence capex spending which focuses on indigenous procurement. So, can this NFO make a good portfolio addition?

The defence opportunity

The interest in the defence space stems from two main opportunities.

- The first is our own defence spends, where there has been a marked shift with a clear focus on indigenization of procurement of equipment, defence systems, and ammunition and reduction in dependence on imports.

- The second comes from a potential rise in global defence spends, offering scope for domestic defence players to step up exports.

Local focus

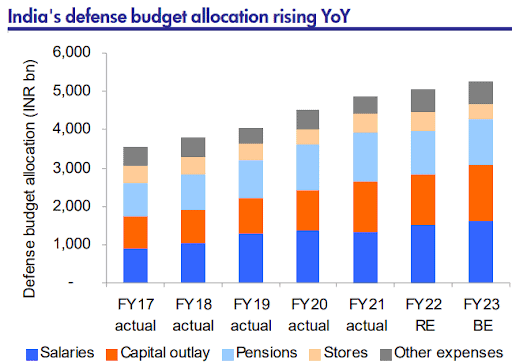

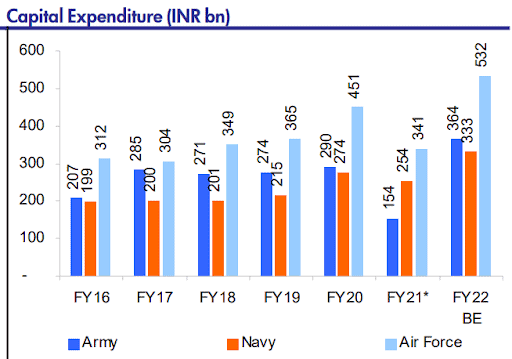

India has been among the biggest arms importers, accounting for 11% of the global arms trade. Capital expenditure on defence grew 9% annual between 2017 and 2022, and the share of capital outlay in total defence expenditure has also been increasing. Capex spending is what holds potential for defence companies to build their order books. According to news reports, India plans to spend a whopping $100 billion over the next 5-10 years to modernize its military. The graph below shows a gradual increase in defence capex over the years.

Source: Antique Stock Broking report

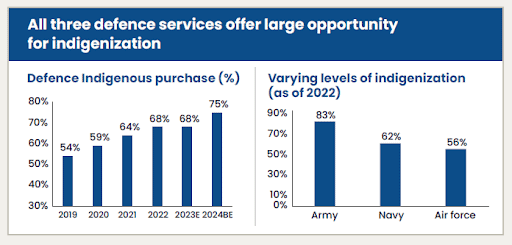

But what has markedly shifted attention on the potential in the defence sector is the Government’s procurement policy. There have been major policy tweaks to increase indigenization of defence procurement, introduce import embargo on specified equipment, reduce the import bill and build India into a defence manufacturing hub. Its Defence Acquisition Procedure 2020, for example, provides criteria in defence procurement contracts to prioritize Indian vendors, while also defining a 50-60% indigenous component depending on the nature of the vendor category. FDI in defence has also been upped.

These efforts have begun to show up in lower imports and higher domestic spending. According to data in the HDFC Defence fund presentation, indigenous defence purchase rose from 54% in 2019 and is projected to touch 75% by FY24.

Source: HDFC Defence Fund Presentation

In the listed space, order books have been robust. For example, Hindustan Aeronautics Limited’s order book has swelled from Rs.53,000 crore at the end of FY2020 to Rs.84,000 crore at the end of FY23 with Rs.55,000 crore of orders pending to be awarded. Revenue visibility increased from 2X to 3.5X. BEL has seen its order book balloon from Rs.48,000 crore in FY19 to Rs.60,000 crore in FY23 along with steady pace of execution while maintaining its order book to revenue ratio.

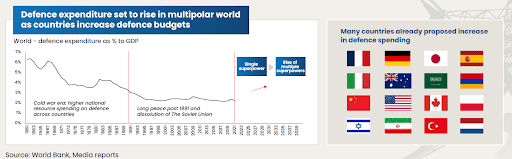

Export opportunity

The government has also been trying to stitch together more export opportunities as domestic manufacturing grows. Defence spends across the globe are set to grow, offering export opportunities. The extract below from the HDFC Defence Fund presentation points to a phase of rising expenditure in the face of a changing geopolitical climate.

Source: HDFC Defence Fund presentation

The data also shows Indian defence exports growing significantly higher since 2019. As a share of global trade, it is fairly negligible at less than 2%. Still, if domestic capacities were to grow and if government efforts to push exports do pay off, growth can still unfold even as share as such remains low.

Limits in the listed space

But there is a firm growth opportunity in the defence sector, there are caveats to the opportunity in the listed space.

- One, the stock universe HDFC Defence fund has defined is small at 21 stocks at present. This is even as a defence stock is defined (by both the fund and the Nifty India Defence Index) as one with at least 10% of revenue from defence or those specified in the Society of Indian Defence Manufacturers list, or those in the relevant AMFI classification.

- Two, while there have been IPOs in this space in the past few years, depending on these alone to expand the universe for more opportunities is not prudent. That leaves performance dependent primarily on the major large-cap players, especially PSUs – and more on that in the next section.

- Three, higher indigenous spending does not necessarily have to translate into order uptick for listed companies. The range of equipment, systems, etc that are procured is vast and MSMEs can snap up opportunities. According to reports, the Ministry of Defence has doubled its procurement from MSMEs in FY23, emerging as the top ministry in MSME procurement for 2022. Similarly, there are large unlisted players, especially in the private sector. Groups such as Tata, L&T, Mahindra, Godrej, Bharat Forge and Adani Defence are roping in global technology leaders as partners and building capabilities to tap not only Indian but also world markets.

High valuations with volatility

The HDFC Defence fund has a limited stock universe to begin with. The biggest of these are, of course, PSU majors – HAL, Bharat Dynamics, Cochin Shipyard, Mazagon Dock, Garden Reach Shipbuilders. The bulk of the universe is in PSU stocks – 78% by market capitalisation. these are thus likely to form the integral part of the portfolio.

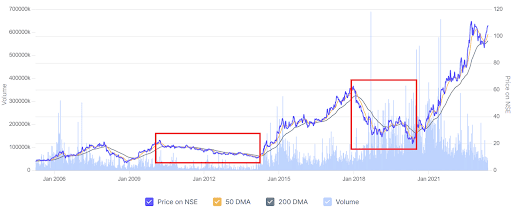

The PSU space is volatile by nature. Defence PSUs have corrected swiftly and steeply in the past. For example, HAL and BDL gave up 50% in stock prices between 2018 and 2020 after their IPO in 2018. The chart below, of BEL, shows how quickly prices can reverse in the event of any hiccup stemming from order inflows, payment cycles, or pace of execution. BEL’s first major correction correlates with policy paralysis period between 2010 and 2014. HAL suffered a payment crisis in 2019, soon after IPO in 2018.

The other part of the universe is private players – MTAR Tech, Paras Defence, Data Patterns, DCX Systems, Kaynes Technology, for example. Most of these are small-cap stocks, where valuations are already high and stocks have rallied.

The Nifty India Defence index is by far more volatile than the Nifty 50 based on 1-year rolling returns since the index’s inception in April 2018. The Defence index’s worst 1-year return was a 39% loss compared to the 33% for the Nifty 50. The Defence index has also been loss-making more often than the Nifty 50.

HDFC Defence Fund – timing holds the key

In our view, the HDFC Defence fund will have to balance two aspects – the current small investible universe that does offers only limited room for portfolio changes based on market movement, and the probable dependence on PSUs.

Therefore, the key in this sector is to get the timing and valuations right. On this front, valuations are not at comfortable levels at this time and leave limited margin of safety.

PSUs, for example, have already seen a tremendous 5x rally since 2020. The Nifty Defence index has shot up 56% in 1 year. The index PE at PE 28 times is above the 5-year average of 23.5 times, and the price-to-book ratio is currently at a peak as well. Individual stocks have seen valuations rise compared to earlier levels. The table below shows the changes in PE multiples of stocks from the Nifty Defence index.

Growing order books and market sentiment have propelled several stocks in the defence sector higher. Tradiotionally PSUs in this sector have faced the following risks that have often pulled stock performance. They are:

- Delay in execution of these orders and impact on translation into revenues

- Delayed payment cycles

- Continued order inflow.

Similarly, while expectations of increased exports are built in, translation of the opportunity into order books and actual growth for companies remains to be seen. A change in overall market sentiment, especially in the PSU pack, can also hurt.

Defence on its own is a strong long-term opportunity. The HDFC Defence fund also holds promise; it is a unique one with no comparable and will offer good differentiation in a portfolio. But the sharp rally in most stocks in the space, uncertainty over how growth will shape up now based on execution, and higher valuations make us uncomfortable. We will keep watch on this sector for better timing to invest in the HDFC Defence fund; given that volatility is fairly inherent in the stocks in this space, and the long-term potential in the sector, there will certainly be other opportunities to invest in the fund.

With inputs from NV Chandrachoodamani

4 thoughts on “NFO Review: HDFC Defence Fund”

Nice, timely article. Helpful collection of graphs and charts

Good review. I feel the FundHouse is just trying to garner retail money by capitalising on the “Flavour of the Day”. As rightly pointed out, two big minus points are a) Current elevated valuations b) Domination by PSUs whose history is only of inefficiency and non-performance.

Hi Bhavana

Just a thought there are other funds like Kotak manufacture fund which has a wider spread and also covers defence. Similar funds like this NFO have merged in the previous instance at a later date due to lack of spread and valuation.

Yes, indeed. But to some extent the fund may manage – it has given itself the leeway of 20% of its portfolio to invest outside defence stocks, which can help if the stock opportunities dry up…let’s see! Thanks, Bhavana

Comments are closed.