At a time when investing overseas is gathering more interest as are passive options, HDFC AMC is jumping on the train with its latest NFO. This is the HDFC Developed World Indexes FOF, a fund that aims to track the MSCI World index. What’s this index, how does the fund plan to track it, and does it fit a portfolio? Let’s dig in.

The MSCI World Index

MSCI is a world-dominant market leader in index building. MSCI’s indices span geographies, strategies, themes, and asset classes. Its indices are used by ETFs and benchmarks across the world; it has about $14.5 trillion in assets benchmarked to its indices and over 1300 ETFs tracking its various indices.

So, it’s safe to say that MSCI indices are robust and adept at capturing and measuring market movement. The MSCI World index represents large and mid-caps across 23 developed markets and houses about 1557 stocks. Obviously, though, the US market accounts for the lion’s share of the index’s weight at 67.95% currently. The country and sector break-ups, as of August, are as below.

Now, for this index to be a useful addition to your portfolio, it needs to provide a different risk-return profile compared to our own domestic markets. From this aspect, the MSCI World index is a good diversifier.

- One, the correlation between the MSCI World and the Nifty 50 is low. In other words, the MSCI World index and the Nifty 50 move differently from each other and performance of the two indices is not closely related. The correlation between the two indices in the past 15 years is relatively low at 0.45. Considering the Nifty 50 USD (the Nifty 50 index in dollar terms for a more even comparison), the correlation is even lower. Slicing and dicing this into different time buckets shows similar low correlation.

- Two, the MSCI World is lower-volatile than the Nifty 50/ Nifty 50 USD. The deviation in 1-year returns rolled daily over the past 15 years for the Nifty 50 is 23.7%. It’s even higher for the Nifty 50 USD at 30.7%. The MSCI World, on the other hand, is by far more stable with 17.2% return deviation.

- Three, the lower volatility also means that the MSCI World tends to fall to a smaller extent than our own markets. For instance, the average 1-year loss over the same 15-year period for the MSCI World was 12.6% against the Nifty 50’s 15.2% and the Nifty 50 USD’s 16.6%. The trend holds even considering a shorter 10-year timeframe.

On pure returns, though, the MSCI World index tends to average lower than the Nifty 50 over longer-term periods. See the table below. It shows average returns, plus downsides and deviations of the MSCI World index in INR across time frames from 2001, which the NFO has provided in its presentation. We’ve added the Nifty 50 returns for the same period (not the TRI, because TRI data doesn’t go as far back).

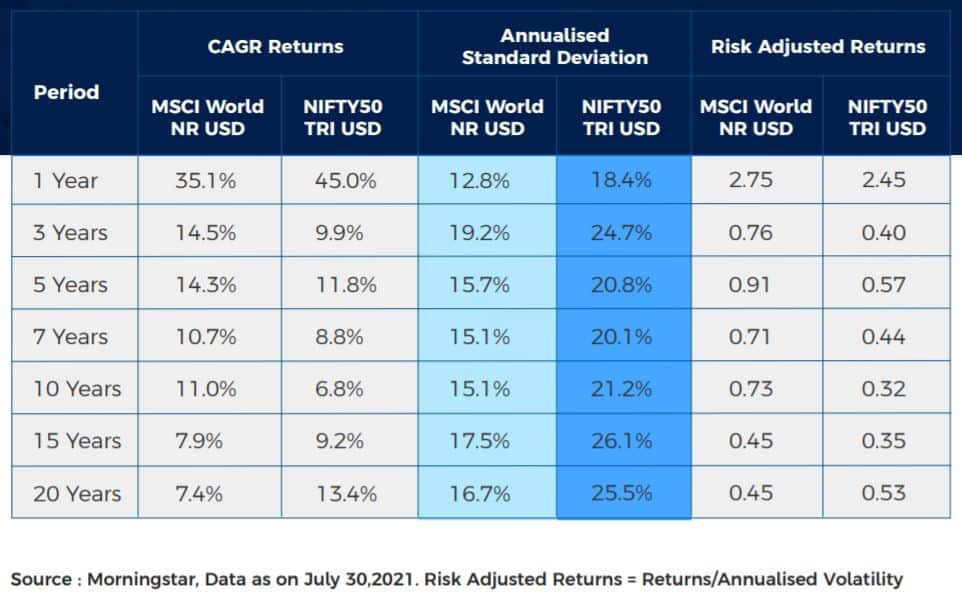

The takeaway here is simple – the MSCI World and our domestic markets behave differently from each other. The MSCI World index is lower returning over time, compared to our markets, but then it is also lower volatile. Therefore, in terms of returns adjusted for volatility, the MSCI World index offers a good option.

This aspect is captured in yet another table that the NFO presentation shares (note that the returns below are point-to-point returns and not rolling returns).

The HDFC Developed World Indexes FOF

For a variety of reasons, such as transaction costs, currencies, taxation, and others, the HDFC Developed World Indexes FOF is structured a little differently. The fund will track the MSCI World Index using a suite of ETFs and index funds of Credit Suisse Asset Management, domiciled in Ireland and Luxembourg. Each ETF/index fund represents a particular market.

The HDFC fund will mix allocations to these different ETFs/funds to mimic the allocations of the MSCI World index. At this time, the allocations and underlying funds are as below.

The total expense ratio, obviously, will be known only after the fund is operational. As per SEBI rules, the maximum allowable TER is capped at 1% (plus some permissible additional expenses, such as collections from specific cities).

The more important aspect that will be clear only over time is how well the HDFC Developed World Indexes FOF actually tracks the MSCI World index. Tracking error, for global index funds, are already tricky due to exchange rates, costs, and cross-country taxes on dividends or gains. The additional layer for the HDFC fund is the mix between the underlying ETFs and funds, and how efficient the fund is in reflecting the correct allocations.

Without this clarity, and with the fund’s unique structure, it’s best to be cautious on the fund and phase out any investments until there’s more understanding on how the fund works.

Suitability

Quite apart from tracking error, it’s important to compare available opportunities when looking to invest globally. We have covered how to look at international funds separately, where we also explained why the US offers the best bet, among the options there are.

The MSCI World index, as explained above, derives the chunk of its exposure from the US markets. The index and US markets, therefore, are very closely correlated. Using both the MSCI US index and the US S&P 500 as comparisons, the correlation works out to around 0.9 – meaning that the MSCI World and the US move in tandem.

The HDFC Developed World Indexes FOF will, however, be a low-cost fund given its passive nature and its structure. So, to this extent, it adds to the passive options that we currently have in the Nasdaq 100 and the S&P 500.

Given that this is an NFO, we do not have a ‘buy’ recommendation on this fund. We will prefer to watch tracking error, cost and performance before adding it to our list.

But if you wish to hold the HDFC Developed World Indexes FOF, then follow these points:

- If you already own about 10-15% in US-based funds, skip the HDFC Developed World Indexes FOF. The new fund will not add diversification and will simply increase the number of funds you hold.

- If you have a very large portfolio, the HDFC Developed World Indexes FOF can be an option to add. This is even if you already have US exposure, if your individual fund concentration is high at say 6-8% of your portfolio or more. The new fund will be a good option especially if you hold passive US funds; it helps spread out the tracking error impact somewhat.

- For those holding only high-cost active funds (US or otherwise), the HDFC fund is a good add-on or can even partly substitute the exposure. Several active funds have expense ratios of above 1%, whether they are investing in emerging markets, markets such as Japan, the US or across geographies. If you hold a clutch of active funds in different markets, this new fund could be a way to cut down on expenses and number of funds (and the need to track fund performance), and yet maintain a reasonable global exposure. Consider making additional investments in the HDFC fund, instead of your active fund.

- This fund is not suitable if you have a holding period of less than 5 years. Remember that in terms of asset class, it is still equity and it is still volatile.

- Avoid deploying your entire intended surplus in this fund at one go. Given that the fund’s ability to mimic the MSCI World Index will emerge only over the course of several months, it is best to invest gradually after there’s more data to go by.

Of course, as with all international funds, note that taxation will be similar to that of debt funds. The NFO is open until September 28, and will reopen post that.

8 thoughts on “NFO Review: HDFC Developed World Indexes FOF”

Well explained. Thank you for this piece. Could you please elaborate on what constitutes a large portfolio? Are there certain rules of thumb one can use to understand the scales used?

Hi Bhavana & Team

Are you aware if any of Indian MF AMC is coming up with:

1. Global Smart Beta/ Multi Factor Index Options for Indian Investors?

2. Option for participating in Silver ETFs?

Regards

Keyur

No, not that we’re aware of. Funds will need to file for SEBI approval, so if you’re keen on tracking it, check here: https://www.sebi.gov.in/sebiweb/home/HomeAction.do?doListing=yes&sid=3&ssid=39&smid=37 thanks, Bhavana

Hi

It appears that none of AMCs in India have so far NOT explored the possibility to introduce FoF in connection with 2 important and beneficial US Stock Market “INDEX”es i.e. (1) NASDAQ Composite Index > ONEQ is the ticker symbol of the ETF which tracks it. (2) Russell 1000 Index > VONE [Blend] is the ticker symbol of the ETF which tracks it. (VONG =Growth) & (VONV = Value) are the options / variables available in the same. These ETFs have given satisfactory annualized ‘returns’ {in terms of USD} to the investors since their inception till date (1) ONEQ = 13.07% (2) VONE = 15.10% (3) VONG = 18.08% & (4) VONV= 11.83% . Let us hope we get something relevant over here in India.

Hi

Let me have a pleasure to throw more light in connection with the NFO “HDFC Developed World Indexes FoF”. >>>>> There is one ETF in USA which tracks ‘MSCI World Index’ the ticker symbol is [URTH]. The name of the ETF is > “iShares MSCI World ETF” which falls under ‘World Large Stock – Blend’ category . The inception date of the said ETF is January 10, 2012 and since February 29, 2012 till date the annualized returns are 11.67% (in USD). The ETF comprises of about / approx. 1300 Stocks spread in to various countries like USA (65%) and remaining 35% together in Japan, Britain, Switzerland, Canada, France, Germany, Australia, Netherlands & Ireland etc. The nearest / closest competitor ETF to URTH is QWLD (SPDR MSCI World StrategicFactors ETF) wherein ‘Overlap by Weight’ is about 63%. However, URTH has a record of better performance over QWLD over various time frames. On this background it will be interesting to observe the performance on the NFO vis -a-vis performance of URTH going forward. HAPPY INVESTING.

By/- Prakash Joshi, Retired Sr. Banker, Mumbai.

E-Mail : [email protected]

Good stuff. very insightful.

Excellent, Quality writing.

Thanks! – Regards, Bhavana

Comments are closed.