The fallout of Yes Bank’s collapse brought one instrument to investors’ attention – the Additional Tier 1 bonds that banks issue. The complete write-off in Yes Bank’s perpetual bond was also a reality check in terms of risk materialising. Several mutual funds that held Yes Bank’s perpetual bond had to mark a loss, and this is a loss that can’t be recovered, as things stand. In this scenario, we’ve had many questions over the quantum of fund exposure to AT1 bonds. So here are the numbers.

What’s the risk

Before getting to the actual data, a word on how to interpret it. In general, perpetual bonds have a host of clauses that make them risky especially for a retail investor. Investing in them individually on your own is a tricky thing to do. Read our earlier article on this.

For funds, however, the advantage is that holding is diffused. The second point to note is that the presence of AT1 bonds in a fund’s portfolio does not automatically make it risky. A fund could have exposure to perpetual bonds and still be a quality fund that delivers above-average returns, and a fund could be highly risky and an exit even without such bonds

Also note that the perpetual bond holding comprises multiple banks. Close to half the perpetual bond holding is in SBI, Axis Bank, and ICICI Bank, with HDFC Bank, Punjab National Bank and Bank of Baroda making up another chunk. So do not panic just because a fund holds these bonds.

The data

So what we did was to bring credit risk into focus. To this end,

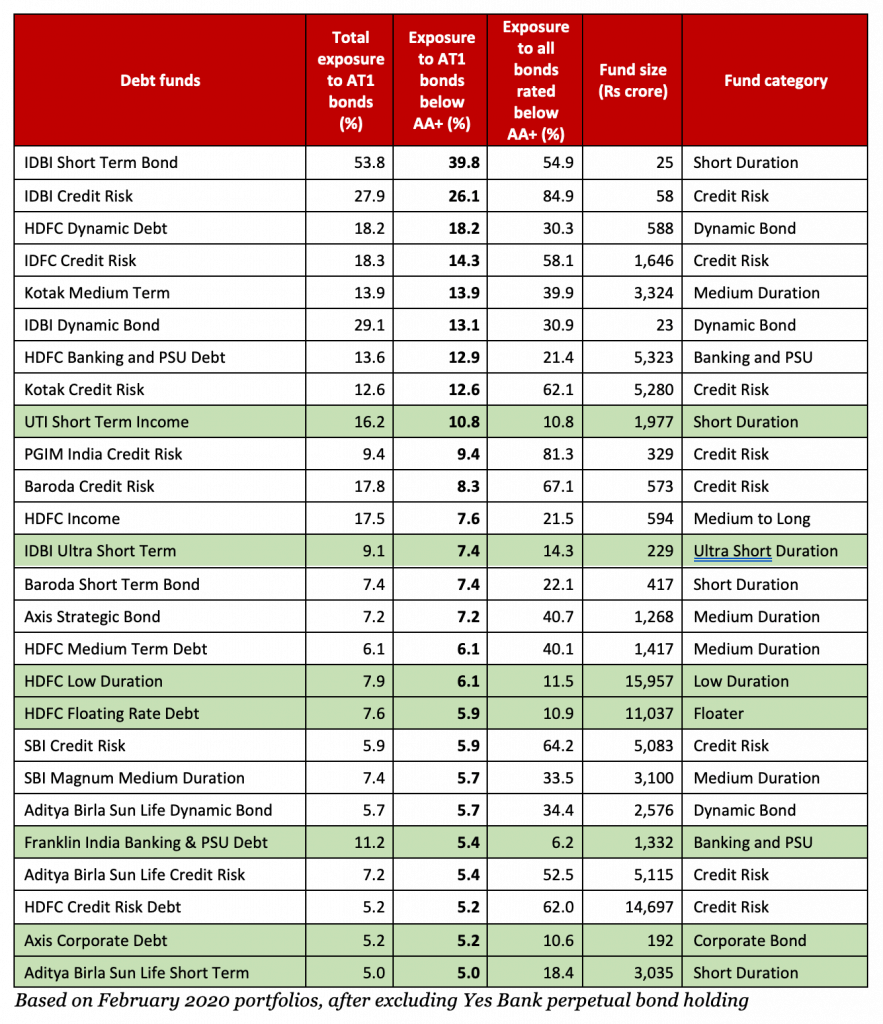

- Excluding exposure to Yes Bank bonds, we considered only those funds where total exposure to other AT1 perpetual bonds was higher than 5% in February. Lower exposures means that concentration risk is minimal and should there be an adverse situation in a bank’s perpetual bond, the write-off would not have a large impact.

- From this shortlist, we considered funds with exposure to bonds rated below AA+ and have put this in context of overall exposure to AA and below papers.

The total amount in AT1 bonds held by funds across debt and hybrid is around Rs 33,487 crore.

Debt funds with exposure to perpetual bonds

Based on the above criteria, here are the funds with high exposure to both AT1 bonds and their overall credit risk. As funds do not provide the precise nature of the instruments they hold, we have tried to deduce the data based on information available with portfolios (considering those instruments where there is no maturity date) and from stock exchanges. This data is therefore an approximation of exposure to perpetual bonds and is not a complete one.

So how should you read the data?

- One, look at the fund’s overall exposure to credit risk in addition to exposure to AT1 bonds. Funds highlighted in green are actually low on credit risk, i.e., total exposure to AA and below papers is less than 20%. In such cases, the presence of AT1 bonds are not reason enough to exit. This is not to say that the funds are quality performers; just that their credit risk through AT1 bonds or otherwise is low. You can check their overall performance using our review tool.

- Two, where funds already hold high credit risk, look at the AUM. Where such AUM is low – below Rs 100 crore – an exit may be warranted. A fund’s AUM could be low either because it has taken write-offs earlier on debt papers, seen redemptions, or because it is unable to get inflows.

- Three, where funds hold both high credit risk and high AT1 bonds and have large AUMs, dig a little deeper into the fund’s performance before deciding on what to do. Here again, our review tool will be of help.

- Four, if any of the funds listed above individually make up more than 10% of your portfolio, consider paring it down to that level. You could either exit these funds or deploy any fresh investments into other funds.

Of the top 20 funds holding high perpetual bond exposure, several are from the credit risk category. Because perpetual bonds were not seen as default risks, many credit funds held these bonds as they offered high yields and met the credit filter.

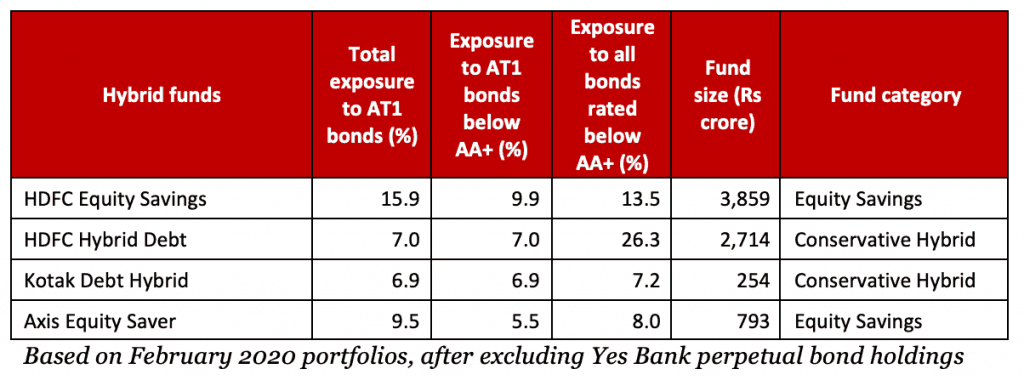

Hybrid funds with exposure to perpetual bonds

Across hybrid categories – equity savings, balanced advantage, conservative hybrid and so on – funds hold significant amount of perpetual bonds.

Though the quantum of perpetual bonds hybrid funds hold matches that of debt funds, each individual fund has low holdings. This is because debt is just one component of the total portfolio, especially for the equity-oriented funds. Hence, we are not calling out any risks in these, at this juncture. In general for hybrid funds too, perpetual bond exposure needs to be looked at in context of total credit risk. Use our review tool to assess their overall performance and risk.

Do note that this data simply provides a list of funds with high exposure to bank perpetual bonds. As stated earlier, use our guideline to look at this exposure along with overall credit risk and fund performance, and use our review tool to clean out poor performing/high risk options.

8 thoughts on “Prime Data Crunch: Mutual fund holdings in bank perpetual bonds”

Hi … How can I spot AT1 bond presence in portfolio of a debt fund? Are only those AT1 bond ranked below AA+ and with cummulative presence greater than 5% of total portfolio considered a risky proposition?

Regards .. JM

They will have no maturity. Vidya

How the ultra short fund can hold perpetual bond

Nothing prevented them from 🙂 A small exposure would not impact avg maturity. Btw please be aware this is an old article. We have just published the one on the lastest impact. Vidya

Bhavana

Superb analysis

To compile such a data and provide valuable insight is not easy !

Kudos to all of team members

Regards

Ravi

Thanks, sir!

Regards,

Bhavana

I bought two perpetual bonds, one from sbi and one from Canara bank. What should I do now if they are risky. In future should I go for RBI bonds

Hello,

Do read the article on what you should know about AT1 bonds that’s linked. If you hold these bonds, you will need to continue to hold them. But while these bonds are high-risk, all banks aren’t going to get into trouble the way Yes Bank has, and as long as you stick to top-tier banks it should be ok. You can avoid investing more in such bonds, more so because you already hold some. You can consider RBI bonds or other fixed-income options we have recommended here, or written about here.

Thanks,

Bhavana

Comments are closed.