Last week, we made a quick note about SEBI’s consultation paper on mutual funds in the PrimeInvestor Community. A consultation paper solicits opinion from the public on proposals mooted by the regulator, along with rationale for such proposals. Do note that these are proposals and have not been implemented.

But since the proposals mooted in this paper can change the industry’s landscape and impact your own investments, we wanted to discuss these to let you know what could have a bearing for you. For the sake of easy indexing, I have classified our observations under the following heads (you can click to go to the respective sections). You’re free to skip to the section that captures your interest, but we do think every one of them is important – especially if you’re a regular plan investor!

- The profitable business of AMC: The industry landscape and SEBI’s primary trigger for proposal on rationalising costs. It essentially talks about the profitability of AMCs and their reluctance to pass their economies of scale to investors.

- Cost rationalisation: Reducing the total expense ratio (TER) and cutting off the additional expenses that were being charged over and above the TER.

- Performance-based TER: Linking the total expense charged on schemes to performance. Lower TER for failing benchmark/hurdle rate and higher TER for crossing the same.

- No more benefit from switches: Curbing the practice of scheme switches by distributors (to higher cost plans), by imposing lower commissions.

- Other AMC games: Sorry, hard to summarise this in a line but entirely my conjecture on why some of these proposals have been mooted and their impact, if any.

The profitable business of AMC

I would first like to place our house view on this business of profitability, before I discuss the powerful data that SEBI has provided:

- We are not fans of anything that restricts a free market economy.

- A business is run as a business to make profits.

- How much profit it makes is entirely dependent on the supply-demand scenario, under normal circumstances.

- Hence, we don’t quite tune in with the view that AMCs need to lower profits.

- But if AMCs do gain from any unfair trade practices, then SEBI’s proposals are most welcome!

Having said that, we love SEBI for bringing this data to the public. It helps investors make informed decisions about AMCs, their motives, and their ability (and unwillingness) to lower the cost of their offerings

In the paper, SEBI has classified the 42 AMCS as being large, medium, and small as follows:

- Large AMCs (8 of them) having more than 5% share of the industry AUM.

- Medium AMCs (10 of them) having industry AUM share of 1-5%

- Small AMCs (24 in number) with industry AUM share of up to 1%.

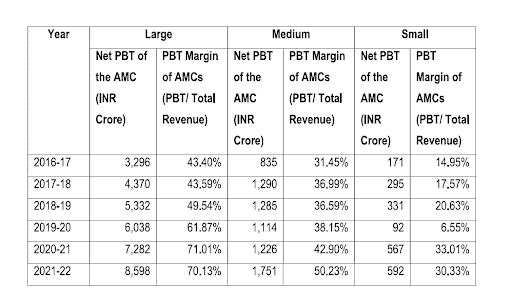

Here is the data from SEBI on the profitability of each of the above categories of AMCs.

- The profit before tax (PBT) margin was 70% for large AMCs and 50% for medium AMCs.

- All large and medium AMCs were profitable as of FY-22 and 10 out of the 24 small AMCs were in losses as of FY-22.

What comes out starkly is the high profit margin that this business enjoys. Why? Having tracked AMCs, it is easy for us to answer that an AMC is a highly scalable business with very limited fixed cost. You largely need the same number of fund managers and analysts and infrastructure at Rs 1,000 crore and at Rs 10,000 crore.

In effect, it is a super-profitable business if an AMC has built its brand and network (for example those AMCs with a bank network). To put this in perspective, the table below shows large AMCs with super PBT margins of 70%. The data should not surprise you. Clearly, the largest three all have a banking network, backed by your friendly Relationship Manager

The paper does not directly target this profitability. It takes note of an increase of 173% and 93.25% in the profits made by large AMCs and medium AMCs respectively, during the period between FY 2016-17 and FY 2021-22. It simply presents the data and wishes to bring the accrual of benefits of economies of scale to investors as well

There are also a few other interesting data points:

- The number of mutual fund investors in the country has gone from 1.28 crore in 2017 to 3.77 crore in 2023 (both ending March). That’s almost tripling of investors in 3 years!

- The share of AUM of individual investors has overtaken the share of corporate investments. As of March 2023, 60.06% of AUM is held by individual investors (both retail and HNI) - no doubt due to high equity participation by individual investors and the sharp climb in the market.

With this background discussion, SEBI has mooted the various proposals in the paper.

Cost rationalisation

I am not going to get into the present TER structure under SEBI. You can refer pages 2 and 3 of the Consultation paper for that. But we wish to draw attention to this piece of data and SEBI’s observation on that:

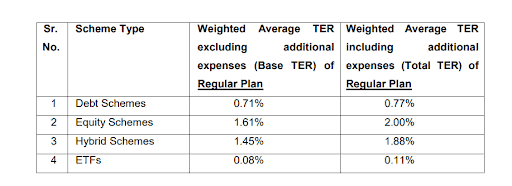

“Despite presence of various mutual funds with significantly large AUMs in schemes which are oriented towards retail investors i.e., Equity and Hybrid schemes, the TER charged is mostly close to the prescribed regulatory limits. However, in case of Debt schemes, with investors being mostly corporates/institutional investors having bargaining power, the TER is much lower than the prescribed limit. Therefore, the benefit of economies of scale accruing in the debt schemes appears to be passed on to the investors but not so in the Equity and Hybrid schemes.”

What the extract above means is that the retail-oriented schemes of equity and hybrid are charged to the hilt in terms of TER. But the corporate-dominated debt schemes have TER much lower than the SEBI-prescribed limit.

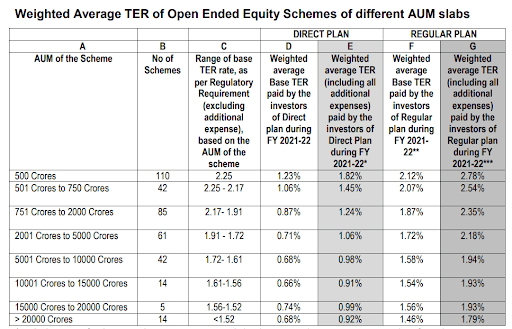

So let us get into the TER you pay on equity schemes. Focus on Column E and Column G below. For a scheme with Rs 5000-10,000 crore AUM the difference in regular and direct is as high as 1 percentage point! (Needless to say, it may be higher for smaller AUM schemes as commission paid to market them will be higher).

*Includes TER of column D plus expenses towards brokerage and transaction cost, 5 bps for schemes having provision of exit load and GST on Management Fees.

**Difference between base expense of Direct plan (Column D) and regular plan (Column F) is due to distribution commission charged to regular plans.

***Includes TER of column F plus expenses towards B-30, brokerage, and transaction cost, 5 bps for schemes having provision of exit load and GST on Management Fees.

If the above data is confusing – know this:

#1 BASE TER (column D and column F) is the expense allowed for each scheme with the difference between regular and direct being the distribution commission (technically).

#2 Total expense charged to you are in column E and G. This is higher than base TER because there are 4 additional expenses that AMCs are allowed to charge you, over and above TER. They are as follows:

- Brokerage and transaction costs for execution of trades

- Expenses up to 0.3% of daily net assets towards inflows from B-30 cities

- Additional expense (capped at 0.05% of daily net assets) for schemes with provision for exit load

- GST on investment and advisory fee (management fee)

Now SEBI has found that AMCs/distributors either follow poor practices in claiming these additional expenses or there is little case now for allowing these additional expenses.

For example, it found that AMCs executed trades with brokers outside of the top brokers at costs higher than other empanelled brokers. As it observes -

“From the data shared by AMCs, it is observed that spending of some schemes towards brokerage and transaction cost is more than even the maximum TER limits prescribed”.

Similarly, the wrong practices arising from charging B-30 additional expense has been highlighted in the paper. Without getting into the details of each of these, suffice to say that SEBI proposes including all these costs under TER with very limited leeway to pay commission only for the first investment from a PAN from B-30 cities, again subject to limit.

Outcome for you: Your total cost will not be way off the base TER that is typically showcased to you. In other words, there will be less hidden costs. It is a progressive step towards bringing all costs under a broad TER structure and giving less room outside the TER. To accommodate these additional costs that are brought into TER fold, SEBI’s proposal has marginally revised the TER slab upwards (as discussed below).

It is not just a revision of the slabs, either. SEBI has proposed an overhaul of the way TER is charged at a scheme level. Here’s the change:

- TER limit will be PER CATEGORY, PER AMC and not at a scheme level. Category here means - one, equity and equity-oriented schemes and two, the rest that fall under other than equity-oriented schemes. So, for example, the total AUM of ALL equity schemes of an AMC will determine the TER slab of every equity scheme of the AMC. A proliferation of new schemes with higher TER to garner inflows cannot happen if this proposal is implemented. It also means that a fund house cannot charge a low AUM equity scheme with high TER. It can charge only based on its weighted average equity AUM.

- The slab itself is proposed to undergo a change (two slabs for equity and equity-oriented schemes and then the other schemes). You can look at the slabs in pages 22 and 23 of the paper. As we see, compared with the present slabs, debt funds will have a lower TER slab while that of equity doesn’t significantly change. Still, point 1 will ensure that cost of some equity schemes in the AMC comes down – especially in the large AMCs.

Outcome for you: Based on SEBI’s illustrative example, for an equity scheme, this proposal may result in lower TER. How much it lowers will depend on the size of the AMC’s AUM; it can be low by just a few single-digit basis points or double digits. Hence, this may not be significant enough for you at a portfolio return level, although at a scheme level you may benefit in some schemes. When it comes to cost rationalization - it should either reduce your cost or at least reduce the divergence between regular and direct plans. On this aspect, we don’t think this specific proposal will meaningfully reduce the yawning gap between Direct and Regular plan.

For the industry itself, based on FY-22 expenses, SEBI’s paper puts out just a 4.55% reduction in value of expenses charged under the new slab rates. So yes, it is unlikely to dent the AMCs either.

Performance-based TER

This is the one proposal that has caught everyone’s attention

- charging a BASE TER allowed for passive products and then charge the additional fee if there is outperformance at the time of redemption.

- charging the scheme TER and then refunding appropriate fee for underperformance, if any.

SEBI provides the data below to make the case for performance-based TER. But to us, the data shows another, very important observation.

To us, the data indicates two things:

- Mutual funds’ underperformance of benchmarks is quite telling – whether regular or direct. We can give some leeway for debt schemes’ inability to beat theoretical benchmarks (the data above includes all funds). But even allowing this, we know from our own data (check this with Prime Mutual fund screener) that the proportion of outperformance of equity schemes over key indices is indeed shrinking.

- But what is even more telling is how the distribution fee eats into performance. After all, that is the primary difference between regular and direct plan of the same scheme. And as your return compounds so does this fee cost. Hence, you see (in the table above) that over a ten-year period, there is a big difference in the % of schemes underperforming between direct and regular plan compared to other periods. Over 10-year period, one in 3 schemes underperform under direct plan while 2 in 3 underperform in the regular plan. It also means that the return difference actually goes up between direct and regular over time. To us, the above data is primarily a key alert for people to relook at their regular plan channel.

Now let’s shift to the performance-based TER - we are a bit skeptical about it for the following reasons:

First, active mutual funds have been struggling to beat their benchmarks since the advent of two changes: one, using the Total Return Index (TRI) of each benchmark instead of regular benchmark. Two, new SEBI categories that necessitated schemes to bucket themselves within categories and invest within the universe mandated.

In addition, the nature of stock moves in market-cap weighted indices and the limitation of funds in mimicking such stock weights has also contributed to underperformance of funds over benchmarks.

In other words, what is happening today is a structural issue in terms of scheme performance.

We don’t think this can be solved through a carrot-and-stick approach to charging variable management fee.

Second, with an open-ended product like mutual funds, we think investor behaviour takes care of fund flows. Money chases performance. A fund that performs poorly cannot garner inflows. This, to some extent, acts as a self-correcting mechanism eventually to remove excesses in terms of charging high TER when funds cannot showcase performance.

The present direction of the MF industry, both in terms of moving to lower cost and passive products, fills the gap created by the structural changes mentioned above. A performance-linked fee only adds another layer of complexity to this natural progression and at best serves as a marketing tool for AMCs trying to differentiate themselves in some way.(We had shared our above views in this ET Wealth article and it is partly reproduced above)

Outcome for you: We are neutral to skeptical on this. We would rather you focus on lower cost passive products when active funds don’t perform.

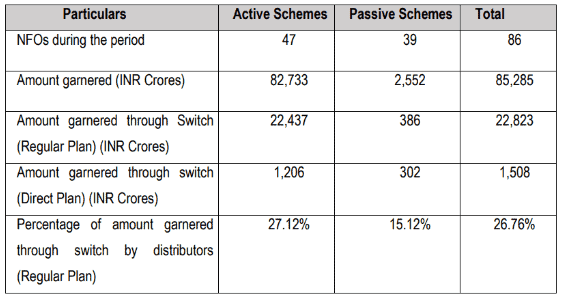

No more benefit (for distributors) from switches

There are other smaller but significant proposals that SEBI makes on observing poor industry practices. One of these is the practice of switching investors’ money to NFOs or from schemes earning lower commissions to those with higher commissions. SEBI argues that 27% of amounts raised through active fund NFOs come from scheme switches in the case of regular plans. That means your distributor is asking you to move to an NFO from an existing fund a good number of times.

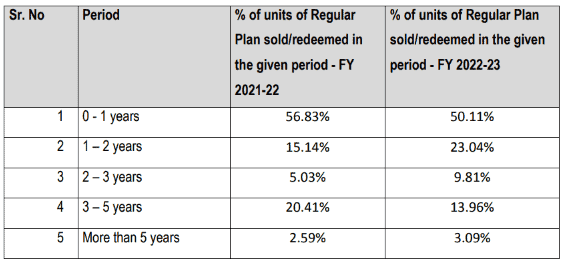

It further provides data (see image below) on how schemes under regular plans are churned within a year of investment.

To discourage MF distributors from churning portfolio by switching from a lower TER scheme to a (newer) higher TER scheme, SEBI proposes that when such a switch occurs, the previous commission structure will continue. In other words, the lower commission structure of the two will be the one that is paid out. This move is significant as it not only helps curb the practice of churning but also ensures the investor does not suffer from the higher cost from such mis-selling, even as he/she makes the mistake of making such a switch lured by his/her distributor.

We have been talking about such practices in the industry but when data comes from the regulator, you definitely need to sit up and take notice if you are a regular plan investor – especially dependent on your banks to provide investment advice.

Outcome for you: Very positive as you will now be lured with fewer NFO choices by your distributor

Other AMC games

The paper takes note of many undesirable practices by AMCs – whether it is about charging high brokerage and transaction charge or not uniformly charging the B-30 expenses where the intention is to keep the TER of some schemes low, churning of B-30 investors and so on. But there is one peculiar point that caught our eye towards the end of the paper, and it is about the TER charge on Direct and Regular plans. While this has been in the grapevine for several years, we’re hearing it from the regulator now.

SEBI makes the following observation:

“It is understood that the TER charged to investors is based on estimations and actual expense may be higher or lower than the estimated cost. Consequently, if higher investment and advisory fees are charged to regular plan as compared to direct plan, for the same service, it may not be in the interest of investors of regular plan. The issue of difference in actual and estimated cost charged to investors can be addressed by increasing the frequency of reconciliation of TER and crediting back the difference of accrued cost vs actual cost, if any, to the respective plan at the end of the financial year/fixed frequency e.g., weekly/monthly.

In view of the above, it is proposed that there should be uniformity in charging of each and every expense to the investor of regular plan and direct plan and the only difference between the TER of regular plan and direct plan should be the expenses towards distribution commission.”

A general reading may make us conclude that there have been more charges on Regular Plan than direct plan. But read closely and you will see SEBI specifically mentions investment and advisory fee (fund management fee) here. Why? Why would an AMC want to charge a higher management fee on regular plan AUM than direct plan AUM? Perhaps because 80% of the AUM sits in regular plan and a higher fee on 80% of your AUM is what earns an AMC a higher revenue? You get the point that I am speculating? We will leave it at that

There are a few other proposals that I would rant about (like additional incentive for women investors, where there is nothing more than lending the woman’s name) but overall, we think this is a paper where SEBI’s intention seems to be to bring to light – with data – the somewhat unfair practices happening in the industry. While thus far we have often blamed the distributor community (rather the ones with muscle power backed by bank network), this time around data suggests that AMCs have more say than meets the eye in many of such practices.

For you, this paper should be an eye opener on two things:

- If you want lower cost, DIY is the only way with Direct plans (and of course with a platform like PrimeInvestor)

- Rather than betting on regulatory complexities on TER rationalization and performance-based schemes, focus on fund performance and keep it simple with a good dose of passive products where all this argument need not even arise.

6 thoughts on “SEBI sees through AMCs’ games – How the new MF proposals will impact you”

SEBI is indeed playing the role of an active watch dog. Kudos to SEBI. Havent seen such a slew of regulations from SEBI in such a short time – one after the next whether on MF side or on FnO side. I feel all of them are about improving the capital market structure in India. Kudos to Ms Buch.

And a great article as always Vidya. Very well summerized. By when are these likely to take effect post consultation?

Would PrimeInvestor write about investing in AMC companies? Is there a place and time to be a contrarian here?

Hello Sir, We do watch AMC stocks. They make for good dividend earners as of now unless we see better growth. High margins do not necessarily mean high growth. Vidya

will the expense ratio of passive index fund increase if all equity scheme expenses come under one umbrella?

No. the paper specifically says no change for passive funds and ETFs. Vidya

I have one query. Is there a way to switch from a regular to direct plan without selling the regular plans and buying the direct plans on a platform like Kuvera and Groww.

Also, are the platforms mentioned above the right way to buy direct mutual funds.

Every switch is unfortunately treated as a sale. So there will be tax impact although such switches are possible in many platforms. You can also use platforms like MFCentral if smooth UX is not a big deal for you (CAMS and Karvy’s venture).

Comments are closed.