With interest rates on fixed income options hitting rock-bottom in recent years, debt investors have been starved for reasonable yields. This is perhaps why the issue of Non-Convertible Debentures (NCDs) from National Highways Infra Trust (NHIT NCD), offering a yield which is a tad over 8%, is seeing such enthusiastic reception from investors, bond platforms and some advisors too.

But after analysing the terms of this NHIT NCD offer, we believe that individual investors can skip this offer. The structure of the principal and coupon repayments on this NHIT NCD will make for irregular income. With market yields moving up, an 8.05% yield on a non-sovereign 25-year instrument is not a mouth-watering return either.

Background

The issue

NHIT or National Highways Infra Trust is making a public issue of secured NCDs (non-convertible debentures) to raise Rs 750 crore with a green-shoe option to keep excess subscription of another Rs 750 crore. The minimum application size is Rs 10,000 with multiples of Rs 1000 allowed thereafter.

NHIT is a recently-registered Infrastructure Investment Trust (InvIT) which earns its income mainly from toll roads acquired from the National Highways Authority of India. The toll road assets are held through a project Special Purpose Vehicle (SPV). The InvIT is sponsored by NHAI. While NHAI is a fully government of India-owned entity, the InvIT is not backed by the government.

The NCDs are ranked as senior debt secured by first charge on NHIT’s immovable assets, hypothecated assets such as receivables and a corporate guarantee. But with NHIT being a relatively new entity, it is debt protection mechanisms such as the debt service reserve account (to meet each quarter’s debt repayments) and its comfortable liquidity position (due to recent fund raising), that provide protection to NCD investors. The NCDs have been rated AAA by CARE and India Ratings.

The business

NHIT holds an initial portfolio of five toll roads in Gujarat, Rajasthan, Telangana and Karnataka totalling 389 kilometres through a project Special Purpose Vehicle (SPV). It has recently added three toll roads in Telangana, Maharashtra, UP and MP totalling 246 kms, taking its total portfolio to 8 toll roads. Plans are for NHIT to eventually acquire 1500 kms of toll roads over the next three years from its sponsor.

The project SPV has signed concession agreements with NHAI for the right to collect tolls over 20 or 30 years. The concessions are based on a TOT model where NHIT is expected to collect toll, but incur expenses relating to the maintenance of assets. The existing portfolio of assets have been acquired using an initial capital of Rs 6,011 crore raised from InVit unitholders and a bridge loan of Rs 1,500 crore which is proposed to be repaid from this NCD offer.

NHIT has term loan sanctions aggregating to Rs 2,000 crore from banks and has recently raised over Rs 1400 crore through a private placement of units with institutions. This positions it well for now to fund its road acquisitions.

InvITs tend to need a constant infusion of debt or equity to expand their portfolio of operating assets and generate cash for their lenders and unitholders. Therefore, SEBI caps their aggregate borrowings at 49% of their enterprise value, with a relaxation to 70% based on certain conditions. Rating agencies peg NHIT’s aggregate debt to EV at 37-41%.

Compared to InvITs based on power transmission assets (like Indigrid or Powergrid InvITs), those that rely on toll collections are riskier. Toll collections can be subject to ups and downs based on economic activity which in turn impacts traffic volumes and toll collections. Regulatory interventions to ‘waive’ toll are also a risk.

But NHIT’s geographically diversified portfolio, and the vintage of its toll roads lend some comfort. While the initial set of 5 toll roads have a 12-18 year record of toll collections, the latter set of 3 have also been existence for 5-13 years. CARE’s rating report states that the initial five projects collected toll of Rs 139 crore during FY22, with the collections jumping to Rs 142 crore in the first quarter of 2023. Potential collections from the second set of 3 roads are not captured in these numbers as they are set to contribute to NHIT’s income from October 2022 only.

Why it’s better to skip

#1 Unfriendly structure

In our view, the main call that you have to take on this NHIT NCD relates to its peculiar structure. NHIT’s underlying business in secondary. To this end, there are a few points to note:

One, a key difference between this NHIT NCD and others is that the principal repayment will not come to one lumpsum at maturity of the bond. Instead, it will be staggered between the 8th and 25th year of holding.

The NHIT NCDs have a face value of Rs 1000 each, broken up into three parts termed as STRPPs – Separately Transferable and Redeemable Principal Parts. STRRP A is worth Rs 300, STRRP B is worth Rs 300 and STRRP C is worth Rs 400. The principal portion on each STRRP is proposed to be paid back to you in full, after the 8th, 13th and 18th years respectively from the date of allotment.

Two, the individual STRRPs are not being redeemed at one go at their face values. Instead, they will be redeemed in installments of Rs 50 each. This makes the principal repayment schedule for this NCD appear as follows:

The return of principal right from the 8th year lifts up the yield of the instrument, because you get back the bulk of your principal sooner than 25 years. However, you need to remain invested in this NCD till the 25th year to get to that 8.05% yield.

From a portfolio perspective, the principal payouts in small dribbles are sub-optimal for you, as tracking and reinvesting them will be a tough task. Moreover, with the principal being returned to you in small doses, the interest you earn from this NCD will decline over time.

#2 Irregular returns

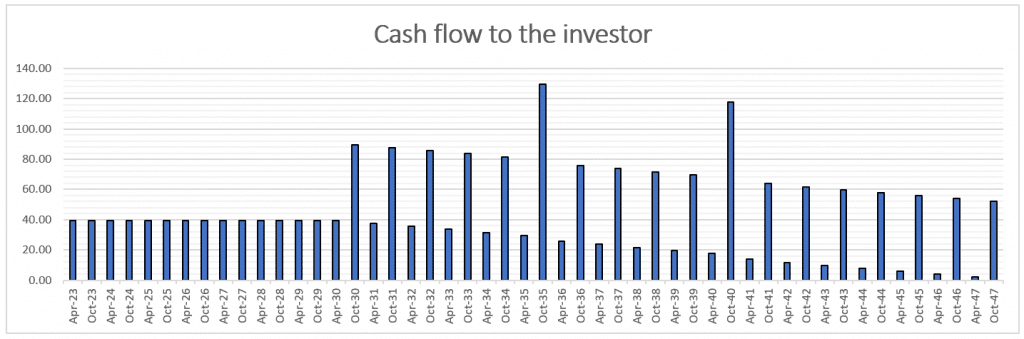

Investors and advisors who are recommending this offer are going mainly by the effective yield of 8.05% that they have worked out based on the bond’s cash flows over 25 years. But if you invest in this NCD, you will need to prepare for sharply fluctuating coupon payments and cash flows, very unlike any other fixed return instrument. Here’s why.

The NHIT NCD will pay out a coupon of 7.9% pa on a half-yearly basis. But you need to be aware that the interest is calculated on the outstanding principal. As the principal outstanding on this bond (owing to STRRPs being gradually retired) falls from the 8th year, as explained above, your interest receipts will begin to dip too.

See the Excel sheet above. It captures how your interest payments, principal return and final cash flows from this NHIT NCD will pan out over the next 25 years (on one single NCD). As you will see, your highest cash flow from the bond is likely to be Rs 129 in 2035. The lowest will be less than Rs 2 in 2047.

Such variability will make this NHIT NCD an irregular income source for regular cash flow seeking investors. The graph below shows the fluctuating cash flows you will receive from each NCD, after the first 8 years.

On paper, with the STRRPs being separately tradeable in the secondary market, you may think of exiting some of them post-offer. But given the falling face value and coupons of the STRRPs you cannot be sure whether it will be priced like bonds with similar maturity or whether you will get a higher yield or a lower one if you sell. There is also a risk of poor liquidity in these new instruments. So, if you want to get the 8.05% yield, you will necessarily have to hold on for the full 25 years.

In our view, the irregular returns and long lock-in period makes it difficult to find a use-case for this NHIT NCD. It may not fit seniors or others seeking steady income because of its irregular cash flows that are front-ended. It further loses charm with central and state government bonds offering good yields even on long tenors. It may not suit investors looking for debt allocations for their long-term portfolios either, because of the long 25 year lock-in, which enhances duration risk, and the difficulty of reinvesting its piecemeal periodic payouts.

Limited financials

InvITs are vehicles where the unitholders (or shareholders) expect regular distributions just like bondholders. The claims of debt and NCD holders in InvITs rank ahead of the unitholders. But to assess an InvIT’s ability to distribute healthy cash flows to its lenders and investors, it is useful to have a reasonable track record of operations and history of revenues and cash flows.

NHIT lacks such a track record, as the InvIT itself is of recent origin. The prospectus of NHIT states that, as its existing assets are available only from November 2021, it has sought special exemption from SEBI to present a limited snapshot of financials. These go back just over a year to March 2021.

But these financials do not capture income or profitability potential of NHIT’s full toll road portfolio. Nor do they capture a full picture of its debt or equity (which would increase post NCD and private placement). This makes the debt service coverage and interest service coverage ratios calculated in the prospectus for March 2022 (at 4.6-4.7 times) irrelevant to investors in this NCD.

However, rating agencies CARE and India Ratings, after assessing the debt parameters of NHIT just before this offer, have relied on its low consolidated debt to EV (37-41%), debt service coverage ratio of over 2 times and funding from recent private placements and term loans to assign AAA ratings.

Not sovereign

The common perception seems to be that because NHAI is the sponsor of this InvIT, NHIT is a sovereign entity backed by the government of India. This is incorrect. Just like other listed InvITs, NHIT is majority-owned by public shareholders and institutions.

The shareholding pattern of NHIT (based on prospectus) shows the sponsor NHAI holding 16.06% of the unit capital, with the public holding at 83.94%. Institutions and corporate bodies, led by Ontario and CPP Investment Board hold a 69.9% stake in the unit capital while non-institutions hold the remaining stake.

Given this ownership pattern, investors in NHIT need to view it just like any other listed InvIT backed by private investors. In fact, NHIT has been created as a part of the GOI’s plan to transition quasi-sovereign entities such as NHAI into self-financing institutions that don’t rely on the central Budget for funds. The hive-off of NHAI assets into this InvIT is, in fact, meant to monetise NHAI assets and distance them from GOI finances. Given its non-sovereign status, the returns on NHIT’s NCD issue need to be evaluated against other AAA-rated issuers, rather than government securities.

Duration risk

After the recent rise in India’s g-sec yields, 1 year treasury bills offer yields as high as 7%, central g-secs maturing in 4-5 years are offering 7.3%, 10 year g-secs are at 7.52%. SDLs, which are also sovereign instruments, offer yields close to 7.8%-7.9% for 10 year tenures.

Compared to these sovereign options, the 8.05% yield on the NHIT NCDs isn’t that attractive. Given the high probability of a further rise in market yields, investing in a 25-year instrument at this yield can expose you to duration risks, eroding your capital if you seek exit before maturity.

To sum up…

We don’t think the NHIT NCDs are attractive for retail investors because:

- Their STRRP structure and principal repayments make for irregular cash flows for regular income seeking investors. For investors looking for debt allocations towards long term goals like retirement or wealth creation, the duration risk, lack of cumulative option and the irregular payouts make this bond sub-optimal.

- NHIT has very limited history and financials on the basis of which to judge its fundamentals over the long run.

- The yield of 8.05% is not attractive given the 25-year tenor and the non-sovereign nature of the bond.

- Market yields are quite likely to rise further, with the result that you may find sovereign instruments offering almost similar yields with far lower duration.

16 thoughts on “Should you invest in NHIT’s NCD offer?”

Vanakkam Aarati Ma’am,

I discovered PrimeInvestor yesterday and subscribed to the site today. Cannot express enough gratitude for such high quality in-depth coverage on personal finance topics!!

So far I have found the coverage to be ROCC Solid [Reliable, Objective, Comprehensive, and Comprehendible] 🙂

For couple of year now, I have been observing that Uttar Pradesh Power Corporation Ltd. ‘s bonds are available at coupon and yield of ~ 10%. They are guaranteed by the Uttar Pradesh State Govt. If they meet your reviewing criteria then please have a look at them and publish about them.

Thanking you

Warm Regards

Thank you! Shall cover.

Thanks a lot Aarti Madam for made it easier to understand. Very clear.

Its need of hour to write about State government guaranteed company bonds ( power bonds and AP bonds etc)!. Hope you cover it soon.

Yes shall look into them

Shall cover them.

Thanks a lot Aarti

I did not go in details of this NCD Issue with just a plain fact… If something is too good to be true, it is indeed fishy.

And now your detailed analysis confirms those doubts. I already own Powergrid InvIT and pretty happy with its performance apart fm major chunk in Short Term Debt Bond Funds. But this NHAI Issue looked indeed fishy.

Thanks a lot for this detailed review and also keeping it open access for all. Layman Investors/ Limited Knowledge DIY Investors like most of us need to be extremely mindful about Debt Instruments and be very clear that Debt is for Safety, Liquidity and fairly Predictable Returns. All risks should be shifted to Equity from Debt.

I am going to share this Article in my Group for awareness. Probably, many have already subscribed the issue.

Thanks once again.

Regards

Keyur

Thank you!

I hurriedly looked at “To Sum up…”. The third point is enough to take a decision to invest or not for a retired person like me who look for regular income backed by GoI. One need not go through the entire article, as the points are well written in Sum up. The highlighting of first sentence in second para is very attractive and sets the side of the argument and rest of it is the proof. It is clearly brought out what is GoI, NHAI and NHIT. Interest rate is attractive, but the article suggests, one should see the duration 25 years, the principle is paid in bits for such a long duration and the important point is the interest is keep falling as the principle is getting reduced over a long period of time. Thanks for timely, well researched and informative article.

Thank you..do understand your point about long articles.

Reasoned recommendation. Thanks

Good one Aarati,

As you have rightly pointed out, SDLs with a simpler structure and the RBI backing seems a way better alternative to this. Perhaps you should write an article on SDLs, covering the aspect of the RBI mechanism as to how it is safe, even if the underlying State may not be a strong one. This may dispel a lot of doubts on SDLs. Further, you could highlight the difference between SDLs and State Guaranteed bonds. Lately, there seems to be a lot of interest in bonds of State Power Gen Cos etc.

As an add, if you could also talk a bit on Muni bonds (for those unfortunate ones who could not hear you at the Chennai conference !)

Thanks,

Ramesh

Oh thank you :-). Yes it would be a good idea to write about SDLs and I will take it up. The Chennai conference was a great learning for me too on Muni bonds.

This is precisely why I love the content from primeinvestor team! The devil is in the details and not one of the many other web sources I looked at really explained what implications this has on the cash flow (most harping about the yield). Thank you Aarati for the wonderful write-up.

Thanks!

Thanks Aarati! As usual, excellent review of this investment option. Crucial points overlooked by many have been nicely highlighted by you. I was also a little swayed by the coupon rate and NHAI brand that is tagged. Thanks to you, now I know better!

Good day.

Thank you!

Comments are closed.