In these reviews, we pick stocks that have rallied, or where businesses are interesting or changing, or where companies may be relatively unknown and so on. We present an analysis of these stocks, covering what has driven them, business prospects, threats and more. These reviews are meant to give you an understanding of a stock. They are not our recommendations.

One set of financial stocks that haven’t participated in the recent bull market are old private sector bank stocks. Traditional industrial lending has gone through a rough patch in recent years and regional banks that have catered to specific communities or regional niches while staying true to old-world lending have faced a lot of challenges.

While three banks in this space have floundered (Nedungadi Bank, Lord Krishna Bank and Lakshmi Vilas Bank) and seven have survived, only City Union Bank (CUB) has created meaningful shareholder value in the last decade through a laser focus on asset quality and conservative lending. Federal Bank is charting a different course with a significant thrust on technology, digital adoption and diversification into new retail segments in the last five years.

The business

Federal Bank is an old private sector bank with 100% public ownership and professional management. The bank’s business mix has remained largely the same over a decade with corporate, agriculture, SME and conventional retail loans like home, vehicle and gold loans. In recent years, the cost-to-income ratio has spiked above 50% and that has led to poor Return on Equity (RoE) since FY16. Apart from a branch expansion spree, traditional work culture and resistance to change dragged the bank from pursuing cross selling opportunities.

But there are bright spots emerging. The bank has put its branch expansions on hold since FY16. It has been investing significantly in technology in the last five years and the benefits are becoming visible in terms of the scale of digital transactions, loan originations, enhanced utilization of credit in e-commerce and merchant purchases and ability to quickly partner with fintech start-ups. With RoE improving in the last two years and a likely rebound in economic activity, the bank appears to have multiple tail-winds to return to growth with better RoE going forward.

Federal Bank has a 74% NBFC subsidiary Fedbank Financial Services focused on gold loans, small and medium ticket loan against property (LAP) and small business loans. The subsidiary ended Q1FY22 with a book size of Rs.4,712 crore and net profit of Rs. 15 crore. Asset quality deteriorated sharply in Q1FY22 with gross and net NPAs rising to 3.21% and 2.68%, respectively. Capital adequacy is however strong at 26.9%,

The bank also has 26% stake in Ageas Federal Life Insurance which was earlier IDBI Federal Life Insurance. Belgian insurer Ageas Insurance International bought a 23% stake from IDBI and the entity has been re-named. IDBI Bank still holds 25% stake in the life insurer, while Ageas holds 49%. There is scope for further acquisition of shares by the foreign partner pursuant to approval of 74% FDI in life insurance. Federal Bank also holds a 19.90% stake in Equirus Capital which operates in the areas of investment banking, wealth management and insurance broking. The subsidiaries and associates of the bank are at early stages in their growth cycles and so do not meaningfully contribute to valuation at this point of time.

The bank’s positives are as follows.

#1 Pegged to the economic cycle

Economic growth is the strongest tail-wind for traditional banks like Federal Bank given that loan growth in the corporate and Small & Medium Enterprise (SME) segments is directly linked to GDP expansion. Federal Bank had a loan mix of 54:46 on corporate and retail loans in Q1 FY22. In the last decade, credit growth for Indian banks has decelerated from ~20% to ~5% as the capex boom petered out and nominal GDP growth slowed. The global financial crisis and domestic scams which led to stuck infrastructure projects, set off de-leveraging by industrial sectors and triggered a shakeout among India’s traditional industrial groups.

Here’s how bank loan growth panned out in India in the last 10 years

Federal Bank had its own share of woes. After a massive branch expansion spree between FY12 to FY16 which doubled its network, the bank had an elevated cost-to-income ratio that brought down its RoE. But it has put branch expansion plans on the hold for the last four years , with 1272 branches at the end of FY21, not much higher than in FY16. The bank has also gone through significant asset quality challenges during this period. The stressed assets book of the bank was at 4.3% in the beginning of FY16 and continuously came down to 1% in Q2FY21, before rising past 2% in Q1FY22 in the aftermath of the pandemic. Covid has aggravated corporate risk aversion and consequently, credit growth both towards project and working capital lending has slipped further.

But post Covid, prospects are bright for both working capital and project lending to revive. Ultra-low interest rates, low corporate tax rates and production linked incentives (PLI) for capex, not to talk of the recent revival in the commodity cycle and governments globally focusing more on infrastructure building as stimulus, could prove a turning point for industrial lending and banks engaged in it. Federal Bank, even though it managed to grow its advances at 8% in FY21 saw corporate advances de-grow by 4%. A revival in industrial activity and a resumption of the capex cycle and resultant credit demand will trigger a growth cycle for traditional banks such as Federal Bank.

Following is the segment wise break-up of advances of the bank

#2 Technology, collaboration

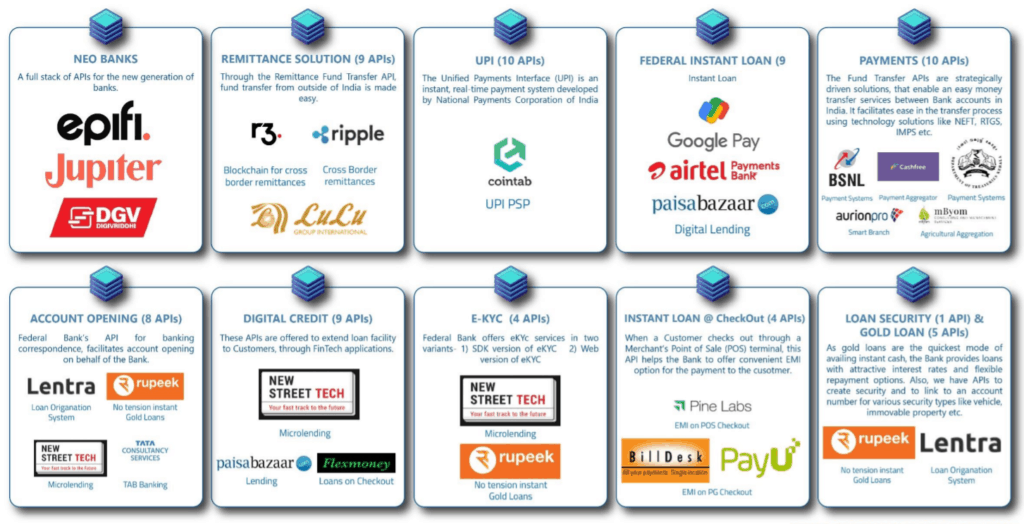

The key strength of traditional banks such as Federal Bank is a loyal and large customer base, but unlike leading private sector banks missed the bus on cross-selling and stayed away from the high yielding retail lending business. With the downturn in industrial lending, their RoAs and RoEs have drifted down. But Federal Bank has been ahead of its counterparts in making timely investments in digital technologies, with good collaborations. The bank was quite early to flag off innovations such as the Selfie Account and mobile banking. It started investing in open banking from 2017 and is recognized as a strong player with more than 83 APIs and 13 API bundles and 100+ partners connected to the platform.

Below is a list of tie-ups Federal Bank has forged with various Fin-tech players in open banking

Source: Federal Bank Q4FY21 Presentation

The bank has also become the top partner for Bharat Pe, processing 1.5 million transactions a day and serving 3.7 million merchants on its platform. The bank’s own mobile platform in digital personal loans has succeeded and it has capitalised on debit card spends in e-commerce and POS terminals, with an EMI option. Transactions in its omni-channel platform for corporates crossed Rs 10,000 crore in Q4FY21. This will be a key space to watch out for as the efforts of the last many years are coming to fruition.

#3 New high yielding segments to aid returns

Federal Bank has a strong deposit franchise with Current & Savings (CASA) at 34.81% by Q1FY22. It has identified credit cards, commercial vehicle (CV) finance and microfinance as the new segments for future growth. It kick-started the CV finance segment last year and closed FY21 with total book size of Rs. 912 crore registering a growth of 58% with a mix of new and used CVs. Micro-finance segment is still small with a book size of Rs.300 crore and is looking to expand both organically and in-organically. Federal Bank has rolled out cards for its employees on a pilot basis, but the MasterCard issue may delay the roll out by a few months. The bank is initially targeting up to 10% of its own customer base of 1.1 crore customers for credit cards.

To put this in perspective, RBL Bank with a book size of Rs. 58,000 crore has a credit card base of 2.96 million contributing to 21% of its advances while for IndusInd, the micro-finance portfolio is around 13% of its advances. IndusInd Bank’s blended yield was 11.78% in FY21 with the corporate segment at 8.42% and consumer segments including CV loans and microfinance at 14.27%.

The management has maintained that it will move slowly and steadily in these new segments in the aftermath of COVID and scale up in the next 2-3 years. Federal Bank has enough headroom to grow in the new segments and improve its return ratios.

#4 Asset quality, no negative surprises

Federal Bank closed FY21 on a decent note despite asset quality deterioration which was within the management guided limits. Gross and Net NPA were at 3.41% and 1.19% respectively while the re-structured book due to Covid was at 1.04%. The bank maintained provision coverage at 65% at the end of FY21 and the stressed assets book was at 1.76% at the end of FY21 contributed by Covid related restructuring. The stressed assets book of the bank had been continuously declining from the peak of 4.3% in FY16 to 1.3% at the end of FY20 before Covid. RoA has moved past 1% in Q4FY21 and RoE has topped the 12% mark.

The bank has started FY22 with some increase in restructured loans to 2.24% in Q1FY22 from 1.76% at the end of FY21, while Covid specific re-structuring increased to 1.82%. There was Rs.200 crore of re-structuring from the gold loan portfolio as well while the Loan to value (LTV) ratio stands at 74%. This book may be susceptible to more NPAs in Q2 from incremental loans given out in FY21.

Gross and Net NPAs have inched up marginally to 3.5% and 1.23% respectively while provision coverage has been maintained at 65%. It has used treasury windfalls and loan recoveries to boost provisions, which increased 89% compared to the previous quarter.

Peer comparison

While Federal Bank is still seen as a mid-sized old private sector bank, its technology initiatives distinguish it and it has been regarded as one among the top private sector banks in this area. The bank has also attained significant business size to be categorized among top private banks. But it still lags in some core areas affecting valuations. Yield on advances and lower cost-to-income ratio are the key areas on which the bank needs to deliver to enhance RoA and RoE.

Below is a comparison of the bank with old regional private banks as well as some new private banks.

Key risks

#1 Dependence on NRI deposits

Federal Bank has high dependence on NRI deposits that make up ~40% of its total deposits and form a significant source of low-cost funds. Current and savings account deposits (CASA) stood at 34.8% at the end of Q1FY21 Vs 33.8% in FY21 while the ratio was at 30.5% in FY20. The churn in the Middle Eastern economies recently has resulted in a returning immigrant flow and World bank predictions indicate a reduction in inbound remittances. While remittances remained strong in CY20 with a drop of just 0.2% over CY19, the trend in CY21 needs to be closely watched for any clear picture. Any disruption in this source of Federal Bank’s CASA could have an impact on cost of funds which will in-turn impact the RoA and RoE trajectory. The bank’s share in remittances stood at 18.2% in Q1FY22 Vs 16.5% at the end of FY21.

#2 Low CAR, though adequate

Federal bank’s capital adequacy ratio (CAR) stood at 14.64% at the end of Q1FY22 with Tier 1 at 13.87%. The board has also allotted 10.48 crore shares to IFC at Rs. 87.39 per share on July 23, 2021. This could boost its CAR to 15.5%. Tier 2 capital stands at 0.77%. But still the bank seems to have a low CAR compared to many of its peers. If asset quality deteriorates further, CAR will need further shoring up. The bank is still looking to boost its capital structure further in FY22 through equity and debt issuances and can expect a further 5% equity dilution later.

#3 Dependence on management

Unlike other old private sector banks which have seen management ousters and disputes, Federal Bank has been a beneficiary of stable management. The present CEO Mr. Shyam Srinivasan has been at the helm for 11 years and his tenure has been extended recently by RBI until September 2024. The bank has appointed Ms Shalini Warrier as Executive Director in January 2020 with succession in mind. Any disruption to this transition can create uncertainties about the bank’s return to growth and go-to-market strategy.

#4 Asset quality risk

High yielding loan segments come with commensurate risk. The post Covid period may be a dicey time for any traditional lender to expand its footprint into higher yielding retail or unsecured segments that carry higher default risks. Recent financials from lenders in these segments suggest a spike in NPAs in vehicle and unsecured retail loans. Building strong under-writing skills remains the key in areas like CVs, credit cards and micro-finance. Federal Bank’s ability to make headway in these segments without asset quality slippages needs to be closely watched.

#5 Fintech threat

New-age fintech firms making forays into peer-to-peer lending, payments and mobile wallets are feared to cause disruption to traditional banks, as the former can scale up without significant investments in branch banking or personnel. While universal banks do have limited scope for micro-segmenting customers, fintech players are more likely to emerge as collaborators rather than disruptors for banks. Federal Bank has made significant progress on technology adoption in corporate banking with full solutions for payment processing, pay-roll processing, supply chain management, trade finance, and receivables & payment management.

So far in India, the fintech revolution has focused more on payments until now and has not made a big dent in the banking business. Payments as a business is also not making money for most players. On the other hand, banking is a commoditized money-making machine when the assets and liabilities are well-managed.

While neo-banks are looking to change the way banking is done, they are not standalone banks and operate by plugging into existing bank APIs. Therefore, banks may remain as the trusted source of finance while fintech firms may be their collaborators rather than disruptors. Collaborations look to be the way forward with a significant thrust on API /open banking. Federal Bank has had a head start on this strategy.

Valuation

At Rs. 87, the Federal Bank stock is trading at about ~1 time its FY21 book value. The stock has mostly traded in the 1 to 1.5 times price to book value band in the last 10 years primarily due to its sub-par RoE. Now, the bank seems to be moving in the right direction by diversifying into high yield lending and partnering with fin-tech. While resumption of the economic growth cycle will itself act as a key tail-wind for traditional banks, the ability to enter into and succeed in high yielding lending areas will determine the extent of valuation re-rating. With RoA crossing 1% mark in Q4 FY21 and RoE moving to 12%, whether the bank gets back to its own peak RoA and RoE levels of 1.4 -1.5% and 14 -15% respectively in the next few years, will be the key factors to watch for a re-rating.

1 thought on “Stock Review : Federal Bank – An old private bank learning new tricks”

its a fantastic stock to invest in, incl rare enterprises, Lulu group invested

Comments are closed.