The stock of Tata Steel Long Products (TSLP) offers an interesting case study on how a commodity business in an unexciting category can acquire scale, a superior product mix and industry leadership through the inorganic route. Tata Sponge Iron, a sponge iron manufacturer, was incorporated in 1982 as a joint venture between Tata Steel and Industrial Promotion & Investment Corporation of Orissa Ltd, was fully acquired by the Tatas in 1991. An under-the-radar player in a commoditised business with an installed capacity of 0.45 million tonnes per annum, it had annual sales below Rs 1000 crore despite being the largest merchant sponge iron company in FY19. But with the Tata group using it as a vehicle for its long products acquisitions, it has acquired scale and transformed into a higher-end value-added steel player.

Up the value chain

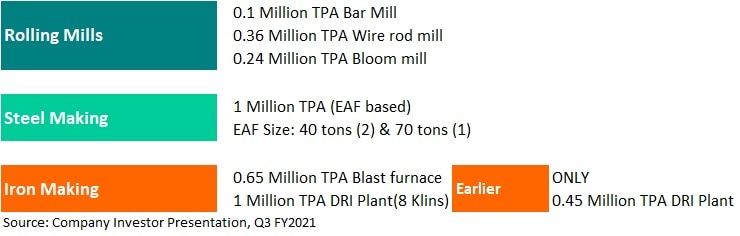

In April 2019, Tata Steel used Tata Sponge Iron as a vehicle to acquire the steel assets of Usha Martin for a total consideration of about Rs 4,700 cr. This brought a 1 million TPA plant in Jamshedpur which makes alloy-based long products, a functional iron ore mine, a coal mine under development and captive power plants into its fold. With this acquisition, the company was transformed from a small sponge iron manufacturer into a speciality steel manufacturer with significant size and scale. A name change to Tata Steel Long Products was undertaken in August 2019 to reflect this changed profile. With a capacity of 1 million TPA, it is now one of the largest integrated speciality steel plants in India in the long products segment. Below are its numbers pre and post-acquisition.

This has enhanced its steel-making capacity as follows:

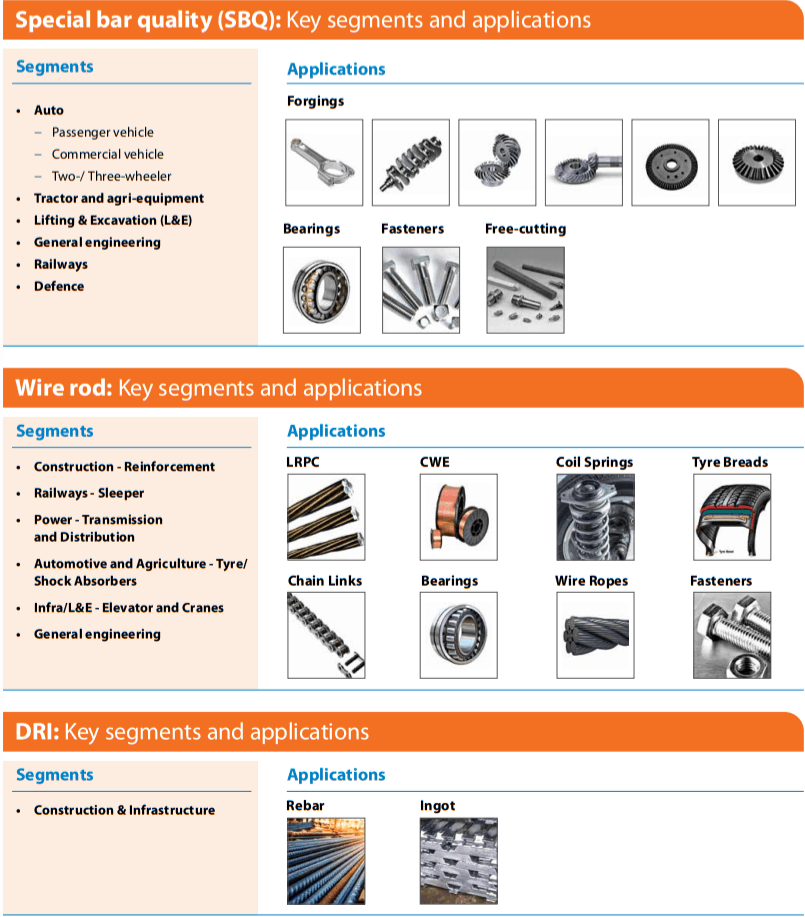

Its product mix has witnessed substantial change too. The company today produces high-carbon steel and alloy wire rods that find significant application in the automotive industry. As per Tata Steel Long Products earnings presentation FY21, the product mix consisted of 51% high-carbon steel and 49% alloy wire rods, from 63% and 37% respectively in FY20. It has increased market share in high-carbon steel to 15% in FY21 from 12% in FY20 with 38% market share in the commercial vehicles segment. It has also increased market share in the alloy wire rods segment to 20% in FY21 from 12% in FY20 supported by an increased share in the two-wheeler segment. The company developed 50 new products in FY21 against 34 in FY20 to enrich its product mix and expand its addressable market. Margins have expanded to its highest levels in the last 10 years aided by rich product mix and full utilisation of the rolling mill capacities.

A brief picture of key applications for the company’s products is given at the end of the report as an Annexure.

The re-orientation of strategy was accompanied by fund-raising. In July 2019, the company raised Rs. 1,650 crore at Rs. 500 per share to fund the Usha Martin’s steel plant acquisition, raising its equity base from Rs 15.4 crore to Rs 45.1 crore. Tata Steel, the promoter, subscribed to 87% of the shares in the rights issue worth Rs. 1,292 crore, taking its effective stake in the company to 75.91%. It also raised Rs. 2,650 crore in long term borrowings. In Q3 FY21, Tata Steel sold 1% to comply with SEBI regulations on minimum public shareholding.

Pre-merger of Tata Metaliks, Tata Steel Long Products featured institutions holding 27 lakh shares out of the 1.13 crore shares that make up its free float. Post merger, the free float will more than double to 2.63 crore shares or 30% of share capital of the company.

Strong business turn-around

The business expansion could not have come at a better time than this for Tata Steel Long Products, given the turnaround in the steel industry’s fortunes. Within a year of its acquisition of the integrated steel plant, thanks to an improving steel cycle and resulting EBIDTA margins, the company has been able to re-pay half of the debt taken for the acquisition and reach full production capacity in finished products. The data below captures its quick deleveraging. If steel prices sustain, the company will be able to re-pay its debt entirely in FY22.

Further consolidation

Even as its long products business has taken off, the company has initiated further inorganic moves to consolidate the long products businesses of the Tata group under one entity. In November 2020, the board of the company approved a proposal for merger of Tata Metaliks with it. Under this scheme of arrangement, every shareholder of Tata Metaliks will receive 12 shares of Tata Steel Long Products for every 10 shares held.

Tata Metaliks is a subsidiary of Tata Steel with a focus on pig iron and DI pipes, with an annual hot metal production capacity of 5 lakh TPA. Of this, 2 lakh TPA is converted into Ductile Iron (DI) pipes and 3 lakh TPA into pig iron. It is in the midst of an expansion plan to double its DI Pipe manufacturing capacity from 2 lakh TPA to 4 lakh TPA at an investment of Rs. 620 crore, which is expected to be completed by Q4FY22. The expansion is expected to increase the contribution of DI pipes to 70% of turnover from 55% at present. The demand for DI pipes is expected to grow at 10-12% over the next few years. The Government of India focuses on delivering piped drinking water to all rural homes by 2024, through its Jal Jeevan mission. The smart cities project and interlinking of rivers to redirect water to water-scarce regions and irrigation projects also point to sound demand prospects for DI pipes.

Below is the Tata Metaliks earnings for FY2021. The company carries low debt despite expansion plans.

An unlisted subsidiary of Tata Steel (95%) – India Steel Wire Products is also merging into Tata Steel Long Products in the ratio of 10 shares of Tata Steel Long Products for every 16 shares. Indian Steel Wire products is into alloy wire rods. The management expects a few synergies to play out post-merger of the two subsidiaries. It expects that combined sourcing of raw material and inventory management will lead to better operational efficiency. A common production process until the hot metal stage may lead to scale economies. After the mergers, Tata Steel Long Products is expected to have a good mix of value added products, which will be fully reflected from FY23 when Tata Metaliks’ new capacity goes into full production. The company is evaluating the option of further scaling up its speciality steel finished capacity from 0.7MT to 1MT which will further enrich the mix in favour of value-added products, which will account for ~70% of total production.

Post the scheme of arrangement, share capital of the company will increase to Rs 86.7 crores with the shareholding of Tata Steel at 69.60%. Having built a sizable and highly profitable domestic steel business focused on flat products, the Tata group now appears to be training its sights on long products via Tata Steel Long Products. India’s steel market comprises 50-55% of long products and balance 45-50% in flat products. While flat products are tuned to the automobile demand cycle, long products dominate during periods of boom in infrastructure and real estate construction.

Industry

The domestic steel industry has seen a significant revival of fortunes in the second half of FY21 on the back of higher global steel prices. As the developed world embarks on rebuilding economies battered by Covid, infrastructure building is taking centre-stage bolstering steel demand. A global housing revival is bolstering construction and housing, in turn supporting steel offtake. China too has turned an importer after a decade, withdrawn export rebates of 13% on 146 steel products and scrapped import duty on crude steel, pig iron and scrap. Global steel supplies are also tightening up on environmental pressures. Japanese Steel giant Nippon Steel is cutting capacities by 20% by 2025 on account of environmental pressure.

According to the World Steel Association’s latest update in April 2021, global steel demand will grow by 5.8% in 2021 and 2.7% in 2022. China, which recorded 9.1% growth in consumption in 2020, is expected to see 3% and 1% growth on the higher base in 2021 and 2022.

In India, after declining 13.7% in 2020, steel demand is expected to rebound by 19.8% in 2021. In 2020, India’s steel consumption was 88.5 million tonnes and is expected to recover back to 100 million tonnes by 2022. Infrastructure, construction, and real estate sectors hold the key to recovery in domestic demand for steel. International prices are at premiums to domestic prices, providing a buffer for price increases by Indian manufacturers and an opportunity for exports.

Valuation

Tata Steel Long Products is valued at 4.9X FY2021 EV/EBIDTA at the current market price. On PE and Price to Book basis, it is valued at 7.8 times and 1.7 times, respectively.

If metal prices continue to stay high, sales and EBIDTA could scale up significantly in FY22 and further in FY23 with additional DI Pipes capacity of Tata Metaliks coming on stream. If we look at the performance of metal companies, FY21 financials are under-stated owing to a very weak Q1 and a marginally better Q2, while the second half has yielded bumper results.

What to watch out for

No matter how good their product mix, commodity company earnings tend to be quite cyclical and a slave of the underlying price cycle. Here are some stumbling blocks to watch out for on Tata Steel Long Products.

#1 Steel price cycle

Irrespective of the quality of product portfolio and health of the balance sheet, a favourable steel price cycle is extremely important from an investor point of view to reap meaningful returns from these companies. Any sudden about-turn in Chinese imports or hiccups to global stimulus can adversely impact the price cycle, stopping the commodity bull market in its tracks.

#2 More expansion plans

Tata Steel Long Products is not done with its acquisitions. The management has confirmed that it is evaluating a bid for Neelachal Ispat Nigam which is undergoing privatisation. NINL has a 1.1 million TPA steel manufacturing unit (long products) which produces pig iron and billets. Such plans need to be closely watched as they can significantly change the financial position and product profile of a company. The Tata group has quite a mixed record in turning around and making a go of acquisitions.

#3 Possible merger with Tata Steel

Tata Steel Long Products is today nicely positioned with a robust value-added product portfolio, healthy balance sheet and has NO legacy issues. It also has a modern steel plant with reasonable size and scale. A quick turn-around in the steel cycle has enabled it to pay-off its debts quickly and put it in a good position to fund future expansion. But these advantages could be offset should the Tata group propose a merger of this company with Tata Steel. Tata Steel, though a solid player in the domestic context, has legacy issues arising out of its overseas acquisition binge.

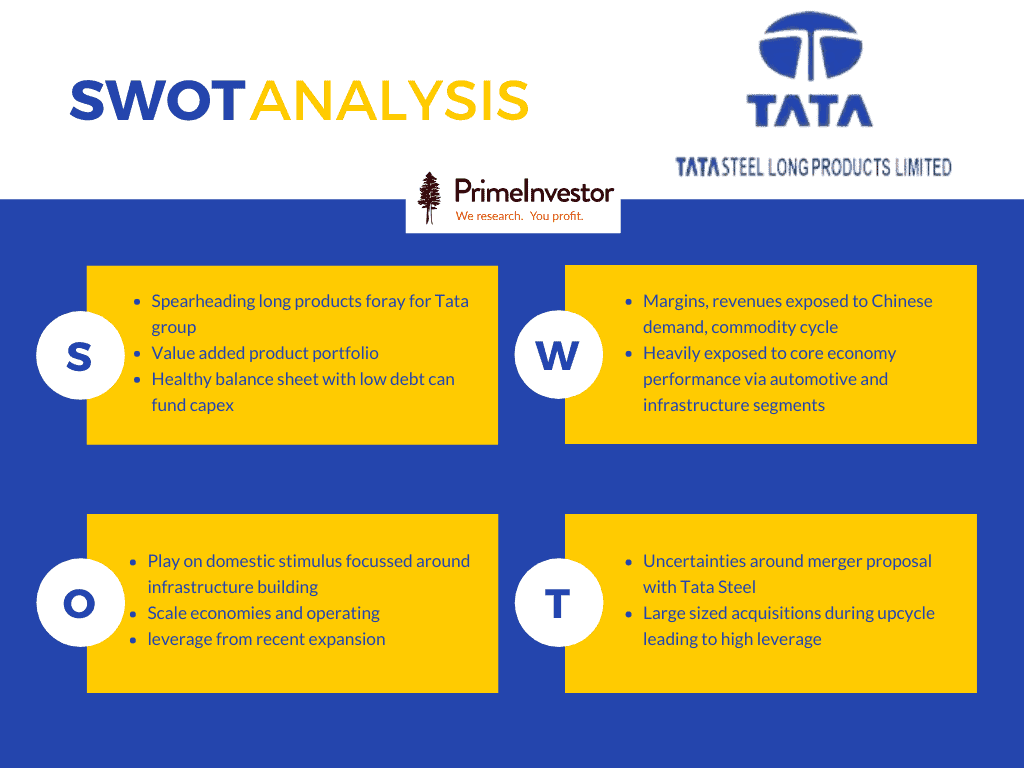

To summarise the above points, here’s Tata Steel Long Products’ SWOT analysis

Annexure

Key Product Applications

10 thoughts on “Stock Review: Tata Steel Long Products – A long shot on the steel cycle”

Good article and detailed analysis, gives more data to validate our decision, rather than just buy/sell calls.

Should also mention historical P/BV and EV/EBITDA ratios for steel industry, to judge the risk exposure at this stage

Thank you sir

For FY21, the ratios will appear a bit stretched or mis-leading as the turnaround happened for the sector in second half only. It will be more relevant in FY22 and we will be sending our updates on the stock based on how valuations pan out

Good review. I can see the synergies in the merger. With good management and growth, TSLP has good LT prospect. Keep it in your watchlist and enter at an opportune moment.

Thank you sir

Though reviews are in detail and interesting read , it adds less value to retails investors such as me. We expect from prime investor to help in decision making more concretely , like other things as stock recommendations , MFs recommendations etc.

With tata steel, commodities are already on high business cycle prices and may not be good option to invest now considering cyclical nature of it. So it just confuses users to invest or not. We expect than stock reviews more focus should be given to stock recommendations.

Hello Sir, I see your view point. However, there are multiple use cases. For those who just want recommendations, there are Prime Stocks. But there are many who want to undnerstand many under-the-radar companies and our review is an attempt to do that. Without this, an investor would have tos pend enormous time doing his/her own data/info gathering. Not every company that is covered needs to be a ‘buy’. At some point, these may be buys or enter our watchlist too but what is more important is for a long term investor to ‘understand’s companies and businesses before settling to invest. That is what these reviews seek to attempt.

thanks, Vidya

Still there should be recommendation to buy or hold.or watch.

That is the reason we took.paid membership.

Let’s make it simple.

Sir, thanks for your feedback. I understand your point. Our buy or watch are available in Prime stocks.https://www.primeinvestor.in/prime-stocks/

Just to clarify our service: We are not a brokerage we have no real need to keep giving calls to churn portfolios for brokerage 🙂 We are also nto a newsletter that promsies 1 stock call a week etc.

As a DIY research site we provide tools (screeners and rankings ) besides such analysis for DIY investors to help themselves. You will appreciate that there are many other people like to know about lesser known companies for their own analysis and shortlisting. They need analysis and tools..which is what we try to provide – espcially without bias or brokerage compulsion.

thanks, Vidya

Thanks for your honest reply and review. It should be the decision of the individual based on the data and research provided and buy calls supports our decision making.

thanks, Durgesh

Agree there . The reason i took prime investor is that there is no pressure on prime to publish 1 stock recommendation a week /month . The recommendation should be based on the when is the right time to start accumulate for the LT investors based on several factors Appreciate your unbiased work . Keep it up

Comments are closed.