The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

In the prior updates on the Nifty 50, we have maintained that there is nothing bearish in the technical outlook for the index. The level of 21,700 was mentioned as a bearish trigger level and this level still remains intact. Though there was an intra-day breach on June 4, the close was well above this level. The subsequent break above the positive trigger level of 22,900 has imparted positive undertone to the index.

With this, let us try to decipher what is in store for the Nifty 50 index in the near term and which sector / index to focus in present market environment.

Nifty 50 short-term outlook

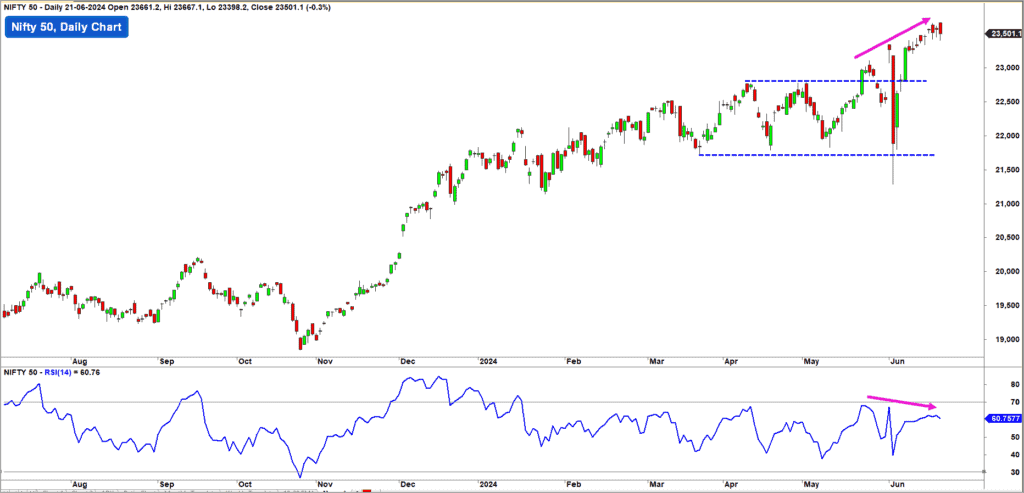

Here is the daily chart of the Nifty 50 index. The price managed to break out of the prior range which is sign of strength. After the move above 22,900, the Nifty 50 index has inched its way higher and has reached within the striking distance of the 24,000-target mentioned earlier this year.

While there is nothing bearish in the charts yet, there are a few red flags that one needs to take note of:

- One, as highlighted in the above chart, there is a clear negative divergence between the price action and the 14-day Relative Strength Index (RSI) indicator. The price has been making higher highs while the RSI has been making lower highs, suggesting waning momentum.

- Two, looking at the negative divergence and the short-term breadth, there is a possibility of a brief downside move in the near term. A quick pull-back to 23,200 appears likely. A breach of 23,200 could trigger a much deeper cut extending up to 22,600-22,700. However, as observed in the prior updates, the trend would turn bearish only if the Nifty 50 index closes below 21,700.

For now, it is time to be cautious as there is ample evidence of lack of momentum to the upside. Considering the recent spike in volatility, there is a strong case for a cool off volatility in the near term. Expect the index to probably be confined to a narrow range. This apart, the price action is getting increasingly stock specific. Hence focus on the outperforming stocks / themes but keep the position size relatively small.

Now, let us shift our focus to few sectors and market segments.

Nifty SmallCap 250

To begin with, let us get started with the Nifty SmallCap 250 index.

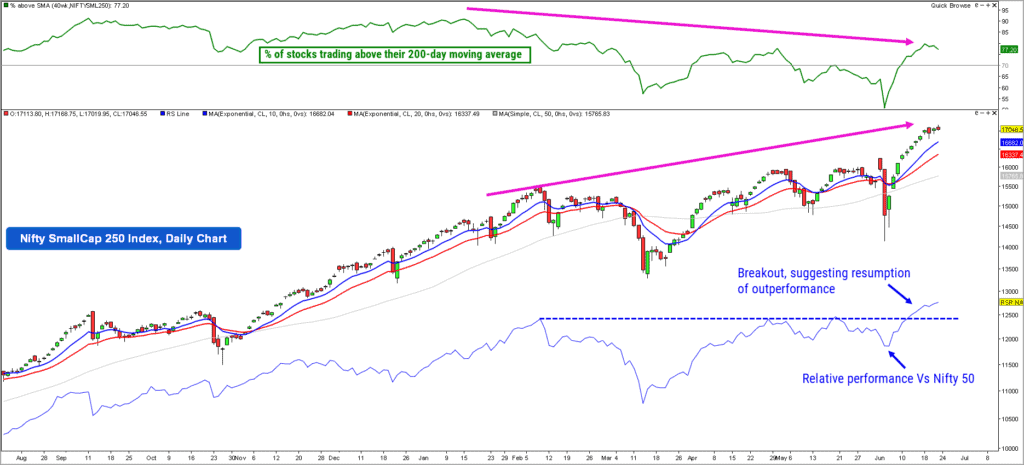

As highlighted in prior updates, there was a clear underperformance of this segment in the past few months. The recent rally suggests that the small cap segment is back in focus. The relative outperformance has resumed which is a healthy sign. However, the problem is the thinning of participation in the smallcap universe.

As highlighted in the chart above, the index has resumed its relative outperformance against the Nifty 50 index – but the percentage of stocks trading above their 200-day moving average is nowhere near the highs recorded in December-January period. Though this indicator has recovered from the recent lows, the recovery in not strong enough to push the indicator to prior highs. This is a sign that not all stocks from the group are participating in the rally.

Focus on the right stocks and enjoy the ride. A fall below 16,500 would be an early sign of weakness and would warrant caution. As long as the price sustains above 16,500, expect range bound to grinding move up, kind of price action to persist.

Nifty Non Cyclical Consumer Index

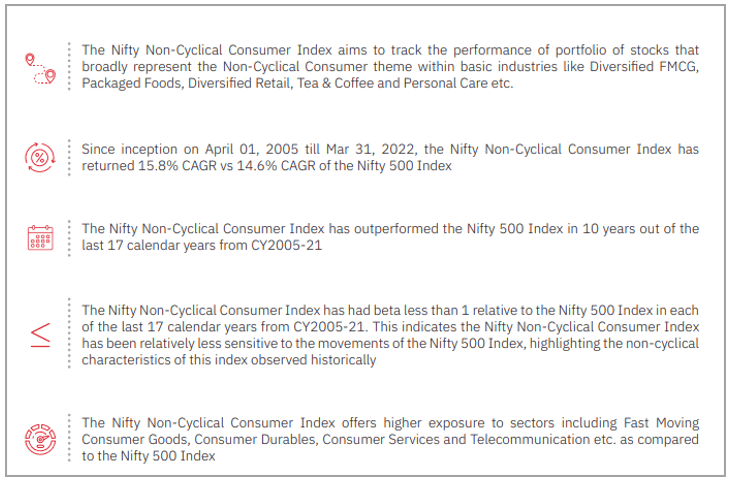

This is an interesting index having some unique characteristics. Here are a few key features of this index which is available at www.nseindices.com.

This index can act as a defensive bet when there is a spike in volatility in broader markets. Considering the relatively low beta, this index can offer some protection in the event of a market correction. Besides, this index has outperformed the broader markets in 10 out of the last 17 years suggesting that this index has a unique blend of outperformance and low beta.

The technical outlook for this index is bullish and a rally to 16,600-16,700 appears likely. In the event of a deeper pull back in the Nifty 50 index, it would be prudent to park some money in this index as a defensive bet; however, note that there is only one index fund on this index at present.

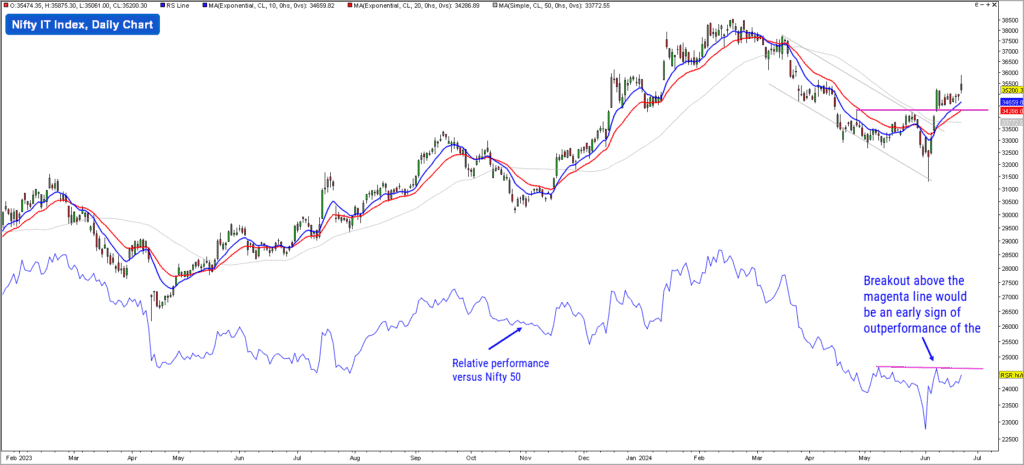

Nifty IT Index

We have been bearish on this index for a while now and this index has been a rank underperformer for several years. The recent price action, however, suggests that things could turn around for the large cap IT stocks. Even so, while there are early signs of strength, it would be better to wait for clear signs of outperformance before committing a big allocation to this sector.

As highlighted in the chart above, the price is displaying early signs of bullishness. The breakout above prior swing high suggests that the bearish sequence of lower highs is negated. What is pending is some signal of outperformance versus Nifty 50. A breakout above the trendline in the relative strength line in the above chart, would be an early sign of outperformance.

Keep this index on your watchlist. We are heading towards the quarterly earnings season and IT companies would be among the early ones to announce their earnings. The short-term trend would be bullish as long as the index sustains above 34,000. A breach of this level would warrant a reassessment of the early signs of bullishness.

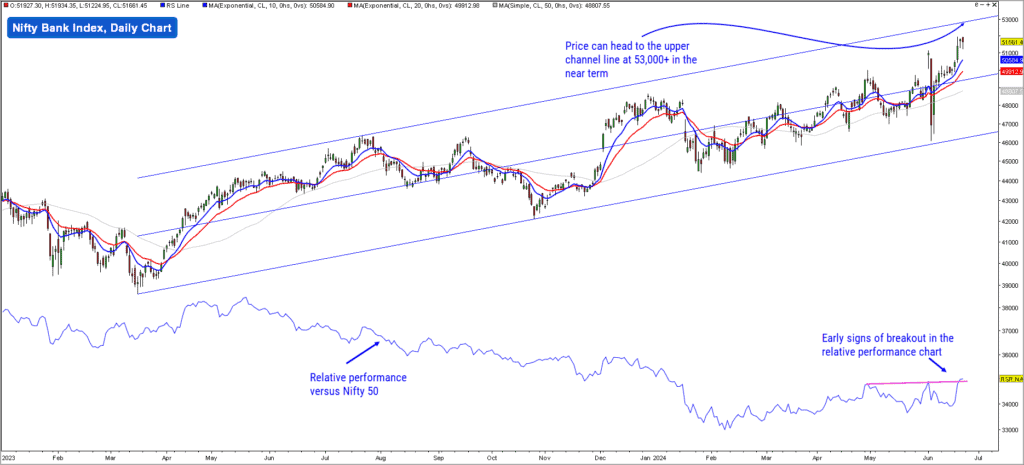

Nifty Bank Index

Similar to Nifty IT, the Nifty Bank index too has been a relative underperformer. But there are signs of improvement in the price action as well as relative performance.

It is evident from the above chart that there are early signs of outperformance of this index. As mentioned in the chart, the immediate target for the Nifty Bank index is 53,000 and thereabouts. Keep an eye on this index as it could spring a surprise, provided the price sustains above 46,900 level.

A breakout above 53,000 could open up much juicier targets for this index. But let us not get too excited and end up being prematurely bullish on this index! We will keep you informed with relevant updates based on the unfolding price action.

Other sector indices

The Nifty Auto Index has been a strong outperformer recently. But the recent rally has pushed the price into an overbought zone. So, exercise caution in terms of allocating fresh funds into this sector. Remain invested and focus on your exit criteria.

Similar to the Nifty IT & Nifty Bank, the Nifty Pharma index is displaying signs of bullishness with respect to the price action. But the relative performance is not impressive against Nifty 50. Wait for some momentum to manifest and then consider exposures here. For now, along with IT & banks, pharma too would warrant a closer attention but not an outright investment immediately.

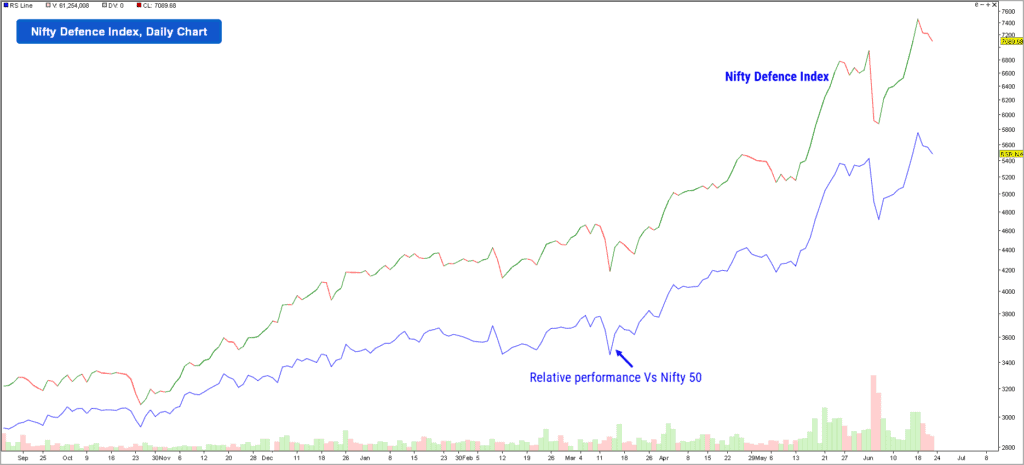

The railway-related stocks continue to display momentum. Look for strategic swing trading bets here. The defence sector stocks too have been on a roll for several months now. We have a dedicated index for this sector. Here is the chart of this index.

It is apparent from the above chart that the price is in a strong uptrend and the relative performance with Nifty 50 (captured by the thin blue line) is also in a strong uptrend, suggesting outperformance. The trend would be bullish for the Nifty Defence index as long as the price sustains above 5,870.

The National Stock Exchange has been busy launching several new indices recently. Interesting among them are the Nifty Defence Index, Nifty Tourism Index, Nifty EV & New Age Automotive and the Nifty 500 Momentum 50 index. All these are interesting launches. It would be interesting if ETFs and/or mutual funds tracking these indices are launched; a few such as defence & EV are already up or are slated to do so.

To sum up, the trend for the Nifty 50 index remains bullish though there is a possibility of a brief pull back. Be cautious as there are signs of thinning out of participation in the broader markets. Look for stock / sector specific opportunities and take strategic short to medium term bets.

3 thoughts on “Technical outlook: Caution in the short-term for the Nifty 50?”

As always, excellent analysis from a technical perspective. Can you please share the chart for the Consumer Index you mentioned in the article and analyse it?

Hello:

Appreciate your feedback. We will share the chart of the Nifty Non Cyclical Consumer Index in the next update. I am manually maintaining the chart as most software providers do not provide data for a few indices which are not updated on live basis. This index is among the few which is updated only on end of the day basis by NSE.

B.Krishnakumar

Very useful as usual. Please keep writing more on PI.

Comments are closed.