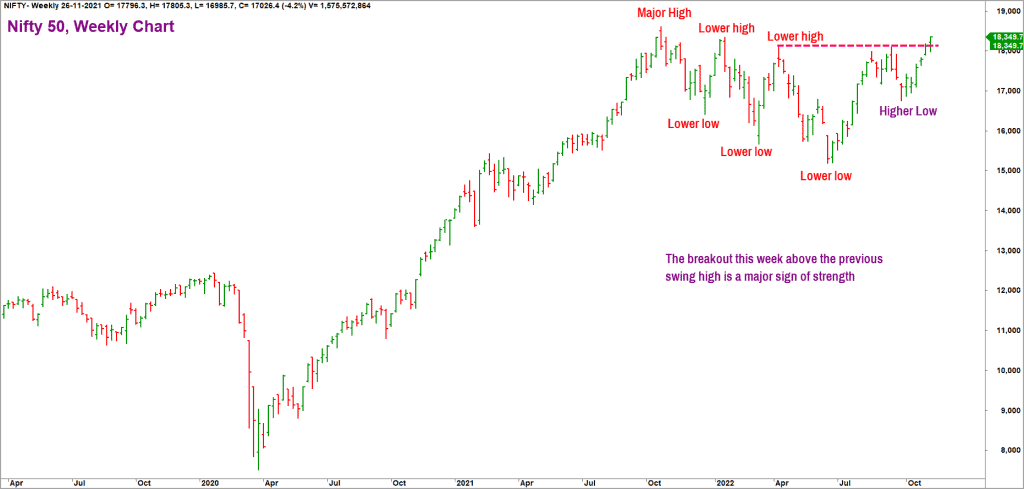

In the previous update on the outlook for the Nifty 50, we had mentioned the possibility of the Nifty 50 index stabilising for a while before resuming its uptrend as one of the possible scenarios. This scenario has played out. The breakout above the positive trigger level of 17,500 confirmed the bullish case scenario as well. The third point worth highlighting is that the Nifty 50 index did not breach the bearish trigger level of 16,400 mentioned in the previous posts.

Short-term perspective

The key question now is what is next for Nifty 50. As always, we will address this question using the familiar tools. Let us get started with the weekly bar chart of the Nifty 50 Index.

As highlighted in the chart above, the price action this week has helped the Nifty 50 index trace out a bullish sequence of higher highs and higher lows. More importantly, the price has managed to close above the previous swing high at 18,115 which breaks the bearish sequence of lower highs and lower lows.

From a short-term perspective, the trend remains positive and the Nifty 50 index is likely to reach the immediate target of 18,640-18,700 range. The rally can spill over and extend even up to 19,100. The short-term positive outlook would be under threat if the index closes below the recent swing low of 17,900.

Until 17,900 breaks, it would be reasonable to operate on the premise that Nifty 50 could head to the target of 19,100. While the targets may sound appealing, there are a few red flags which is worth highlighting.

#1 Overbought Breadth

As always, we will stick to the PF-X% indicator as a tool to assess market breadth. This indicator captures the percentage of stocks that are in a bullish swing in the Point & Figure chart.

To study the short-term breadth indicator, we use the 1% box size chart. The PF-X% in the short-term time frame is in the neutral territory, suggesting scope for further upside in the Nifty 50 index. The indicator is currently at 60% and well below the overbought reading of 75%.

In the 3% box size (capturing medium term breadth), the indicator is at 74%, just short of getting into the overbought zone. And in 5% box size (capturing long term breadth), the indicator is at 78%, suggesting overbought condition.

Therefore, while the price action is supportive of continuation of the recent uptrend, the breadth in the bigger time frame is either overbought or on the brink of getting into the overbought zone. Do note that breadth getting into an overbought zone is just a red flag or a sign of caution and does not necessarily mean an immediate reversal in price.

The breadth can cool off from an overbought zone either via a price correction or by volatile consolidation. Which scenario will play out and when is not something that we can make a call right now. We will address it in subsequent posts.

For now, the short-term trend is bullish. However, do not go overboard with fresh equity exposures as the breadth is signalling caution. If you have an exit plan, then stick to it. If you do not have an exit plan, this is probably the right time to create one. I have been saying this in prior posts and repeating it here – that Nifty 50 is unlikely to revisit the June 2022 lows anytime soon. This is based on the analysis of the price action till date. Obviously, I will revisit this opinion if the subsequent price action suggests otherwise.

Now, let us take a quick look at two key sectors that are in focus for opposite reasons – the Nifty IT index and the Nifty Bank Index.

Nifty IT Index

The Nifty IT index has been in a downtrend since January 2022. The index has been in consolidation since June 2022. While the Nifty 50 index has recovered off the June lows and is perched to challenge its all-time highs, the Nifty IT Index has been lagging behind.

The Nifty IT Index has been consistently underperforming the Nifty 50 index since January and there are still no signs of a reversal of this underperformance. I would, personally, wait for a clear improvement and breakout in the ratio chart to suggest that the Nifty IT index is outperforming the Nifty 50 index. Until then, this sector is not something I will look closely at. While there are signs of an improvement in the price action and relative performance in the past few days, I would wait for a breakout above 30,600 in the Nifty IT index.

After this breakout happens, it would be prudent to check the ratio chart or the relative performance of the index versus Nifty 50 to check if the breakout in price has led to a relative outperformance. Until then, keep this index on your watchlist and hold back fresh exposures to the IT sector.

We will update our thoughts on this index as and when there are signs of improvement in price action and relative strength.

Nifty Bank Index

I have highlighted in prior posts that this index plays a pivotal role in influencing the momentum in the Nifty 50 index. Banking stocks account for almost 30% of the Nifty 50 weightage while the banking and financial services sector accounts for about 37% of the weightage. Besides, the banking sector is often viewed as a proxy for economic health and progress. For more reasons than one, the Nifty Bank index is a key index to monitor.

Interestingly, the Nifty Bank index has edged to a fresh all-time high, a major sign of strength, while the Nifty 50 index is yet to do so. From a short-term perspective, this index could head to 45,000-45,400 and the rally may extend up to 46,500-47,000. This view would be invalidated if the price drops below 38,600.

While the price action is positive, I would wait for signs of outperformance of the banking sector against Nifty 50. Until then, this sector would be on my watchlist, but I would not enhance exposures. In this context, it would not be out of place to highlight that the Nifty PSU Bank index has displayed strong outperformance versus the Nifty 50 index. This is the sector that I would continue to focus on while the IT and private banks would be on my watchlist, awaiting signs of outperformance against the Nifty 50.

9 thoughts on “Technical outlook: Where the Nifty 50 & key sector indices are headed”

Hello Srikanth,

It is true that the broader markets aka small and mid-cap stocks have not performed quite as well as the Nifty 50 index in the past few months. The Nifty MidSmallCap 400 Index has been underperforming Nifty 50 for a while now. So, wait for the outperformance to manifest before committing funds to this space.

B.Krishnakumar

If Nifty IT is underperforming, wouldn’t it be a good time to start accumulating via SIP ? coz eventualy it should spring back right ?

Hello:

Why would you want to lock up the capital in a sector that is under performing. You may invest in the benchmark index instead. And, we cannot second guess how long this relative under-performance might persist. The current under-performance of the IT sector started in January 2022 and it has been a good 10-months. Let us wait for evidence of out performance and then consider exposures in IT.

If you have a strategy of doing SIPs in the IT sector for whatever reason, then you can continue with it. But I would wait for signs of out-performance first.

B.Krishnakumar

Hi Krishnakumar,

Thanks for your views. I am already having active SIPs in the prime fund’s passive portfolio. I am bullish about IT sector in the long run. The reason why I thought of starting a SIP now is to try and accumulate more units as the NAV falls.

Any Technical Levels for PSU Banks, understand it is multi year breakout.

Hello:

The Nifty PSU Bank Index is overbought from a short-term perspective. A cool off to 3,400-3,500 is a possibility. I would personally prefer to add to my PSU Bank exposure once this cool off happens. I presume you have an exit plan, just in case the tide turns against you.

Best wishes

B.Krishnakumar

Thanks, would like to also know about updates on BSE Capital Goods Index (think you had previously mentioned it) technically

Hello:

BSE capital goods is still bullish but undergoing some correction. Trend will remain positive if the index sustains above 29,500. in terms of relative performance, the sector has been performing in sync with the Nifty 50 index in the past few weeks. We will have to wait and watch if the sector turns an under-performer or not. In any case, a drop below 29,500 in the index would make me turn cautious and trim exposures to this sector.

Hope this helps

B.Krishnakumar

Thanks so much

Lots of buzz going on that Small Cap indices have not faired with Major Main Stream indices, is it time to have some exposure nw?

Comments are closed.